With precious metals in the spotlight as economic uncertainty and inflation persist, investors are weighing the merits of gold versus silver for portfolio growth in 2025.

Both metals are traditional safe havens, but their price movements, industrial demand, and growth prospects can differ significantly. Here's an up-to-date comparison to help you decide which metal could offer more growth this year.

Gold in 2025: Stability and Steady Upside

Gold remains the cornerstone of precious metals investing. As of 2 May 2025, gold is trading at $3,250 per ounce. The metal has set new records this year, fuelled by persistent inflation, central bank buying (especially from China), and ongoing geopolitical tensions.

Analysts forecast gold could average $3,500 in 2025, with high-end targets reaching $3,800 per ounce.

Key Growth Drivers for Gold

Safe-Haven Appeal: Gold's reputation as a reliable store of value draws investors during times of crisis or market volatility.

Central Bank Accumulation: Central banks are buying gold at record rates, supporting prices and reducing market volatility.

ETF Inflows: Investment demand through gold-backed ETFs has surged, particularly during stock market corrections.

Inflation Hedge: Gold's traditional role as an inflation hedge remains intact, especially as global currencies face devaluation pressures.

Gold's Recent Performance

Price (May 2025): $3,250/oz

2025 Forecast Average: $3,500/oz

2025 Forecast High: $3,800/oz

Growth Profile: Consistent, with less volatility than silver, making it ideal for risk-averse investors.

Silver in 2025: Volatility with Higher Upside

Silver, while also a precious metal, has a dual role as both an investment asset and an industrial commodity. As of 2 May 2025, silver trades at $32.60 per ounce, having outperformed gold in percentage terms over the past year.

Analysts forecast an average price of $38 per ounce in 2025, with highs potentially reaching $42.

Key Growth Drivers for Silver

Industrial Demand: Over half of silver demand comes from industry, especially solar panels, electronics, and electric vehicles. The clean energy transition is a major tailwind.

Supply Constraints: Silver mine supply has not kept pace with rising demand, leading to inventory drawdowns and price support.

Volatility and Leverage: Silver tends to move more sharply than gold in both directions, offering higher upside in bull markets but also greater risk in downturns.

Affordability: Silver's lower price per ounce makes it accessible to a wider range of investors, increasing market participation.

Silver's Recent Performance

Price (May 2025): $35.50/oz

2025 Forecast Average: $38/oz

2025 Forecast High: $42/oz

Growth Profile: Higher potential returns than gold, but with increased volatility.

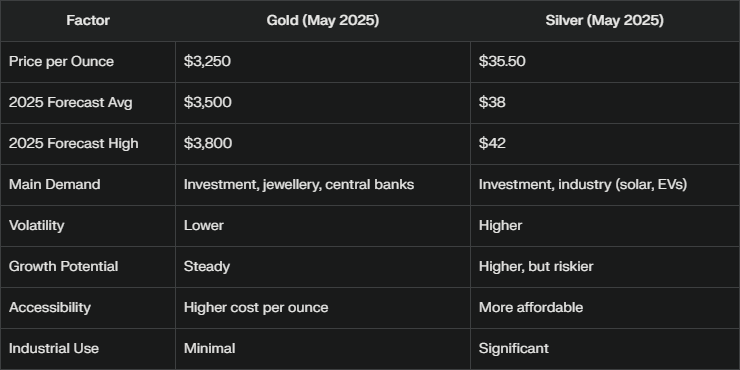

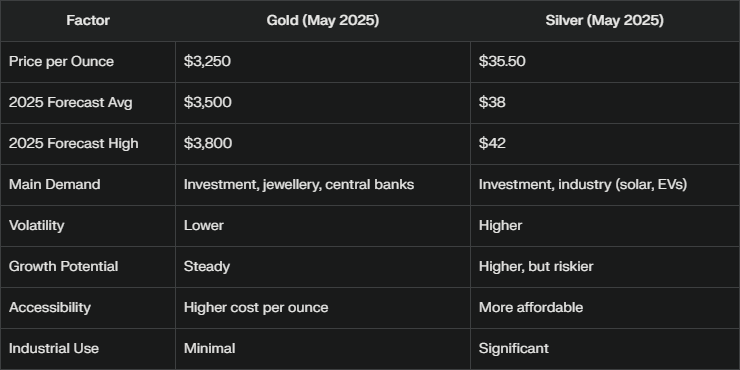

Gold vs Silver: Side-by-Side Comparison

Which Metal Offers More Growth in 2025?

Silver is expected to offer more percentage growth than gold in 2025. Its price is forecast to climb as much as 18% from current levels if it reaches the high-end target of $42 per ounce, compared to a potential 17% gain for gold if it hits $3,800. Silver's industrial demand, especially from solar and electronics, and ongoing supply constraints give it an edge for growth-focused investors.

However, gold remains the preferred choice for those prioritising stability and capital preservation. Its lower volatility and enduring safe-haven appeal make it a core holding for conservative portfolios, especially during periods of heightened uncertainty.

How Should Investors Approach Gold and Silver in 2025?

For Growth: Allocate a larger share to silver if you can tolerate higher price swings and want to capitalise on industrial trends.

For Stability: Make gold the foundation of your precious metals strategy for steady returns and crisis protection.

Balanced Portfolio: Many experts recommend holding both metals to benefit from gold's stability and silver's growth potential, adjusting allocations based on your risk appetite and market outlook.

Practical Tips for Investing

Monitor Market Trends: Keep an eye on industrial demand, especially for silver, and central bank activity for gold.

Diversify Holdings: Consider a mix of physical bullion, ETFs, and mining stocks for broader exposure.

Stay Informed: Regularly review price forecasts and market news to adjust your strategy as needed.

Conclusion

In the gold vs silver debate for 2025, silver stands out for its higher growth potential, driven by robust industrial demand and constrained supply. Gold, meanwhile, offers unmatched stability and remains the ultimate safe haven.

The best approach for most investors is a balanced allocation, leveraging the strengths of both metals to navigate an unpredictable economic landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.