European shares fell on Monday, as investors awaited further stimulus

measures from China to revive demand and eyed testimony from Fed Chair Jerome

Powell this week for more cues on the rate outlook.

Germany's DAX index dropped 1.0% after closing at a record high in the

previous session. Trading was thin on Monday with U.S. markets shut for a public

holiday.

The dollar edged higher and the UK pound was near a 14-month peak. Gold and

oil prices both moved lower in holiday-thinned trade.

Commodities

China is widely expected to cut its benchmark loan rates on Tuesday after a

similar reduction in medium-term policy loans last week to shore up a shaky

economic recovery.

‘Sentiment-wise in the Crude Oil market, traders are fairly bearish,’ said

Daniel Ghali, a commodity strategist at TD Bank.

‘But from a broader perspective, the analyst community is still looking for

pretty significant deficits in coming months.’

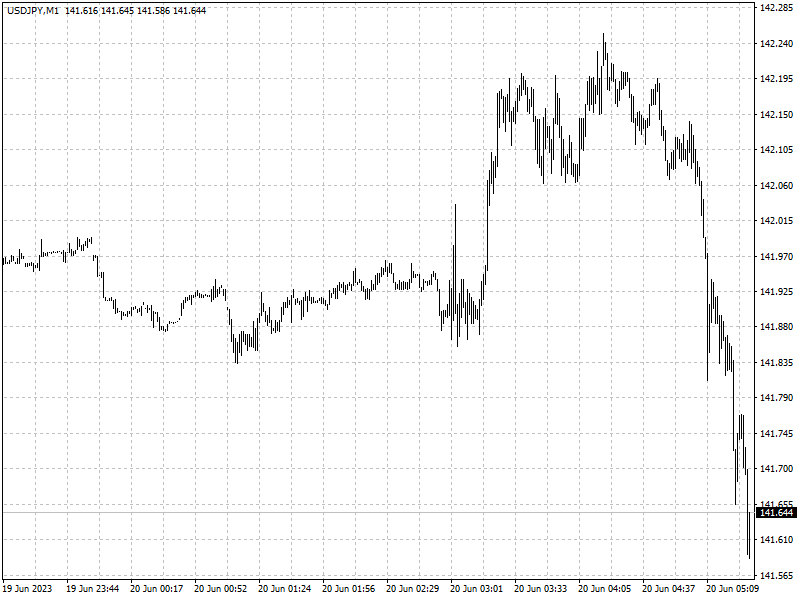

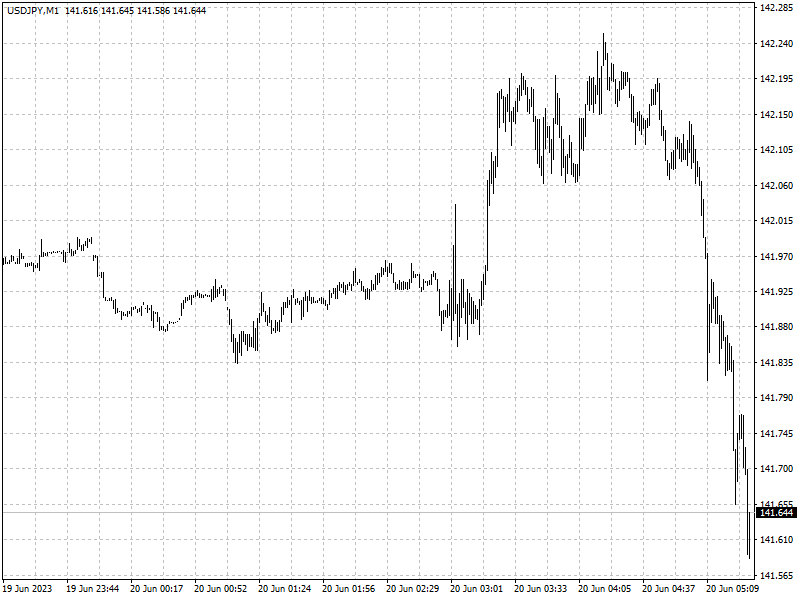

Forex

In a busy week for central banks last week, the ECB raised rates by 25 basis

points and left the door open to more hikes, while the BOJ's decision on Friday

to stick with its ultra-easy policy kept the yen fragile.

Currency analysts at MUFG said in a note that the testimony was one of the

important risk events for the dollar this week, but said they expected similar

messaging following the Fed decision last week.

Markets are pricing in a 72% probability of the Fed hiking by 25 basis points

next month, the CME FedWatch tool showed.