European markets delivered a mixed performance on Tuesday, 1 July 2025, with Germany's DAX experiencing its largest single-day decline since 19 June whilst the UK's FTSE 100 bucked the trend with modest gains.

The divergent performance across major European indices reflects ongoing uncertainty surrounding trade negotiations and monetary policy expectations as markets navigate the second half of 2025.

DAX Posts Largest Decline Since Mid-June in European Markets Today

Germany's DAX index fell 0.99% to close at 23,673.29 points, dropping 236.32 points in what marked the largest single-day point and percentage decline since Thursday, 19 June 2025. The index has now declined for two consecutive trading days, losing a total of 359.93 points or 1.50% over this period—representing the largest two-day decline since the same June reference point.

Despite Tuesday's setback, the DAX remains well above its 2025 lows, sitting 2.67% below its record close of 24,323.58 achieved on Thursday, 5 June 2025. Year-to-date, the German benchmark has gained 3,764.15 points or 18.91%, demonstrating the market's overall resilience despite recent volatility.

The decline was broad-based across German equities, with industrials and banks leading the losses. Defence-related companies were particularly hard hit, with major players including Rheinmetall falling more than 5% as investors reassessed geopolitical risk premiums and defence spending outlooks.

FTSE 100 Outperforms European Peers

In contrast to continental European markets, the UK's FTSE 100 gained 0.28%, adding 24.37 points to close at 8,785.33. This performance made the FTSE 100 a notable outlier among major European indices, demonstrating relative strength amid broader regional weakness.

The FTSE's resilience was supported by several factors, including expectations that the Bank of England may maintain a more hawkish stance compared to the European Central Bank. Recent UK inflation data showing a rise to 3.5% has prompted investors to scale back expectations for aggressive rate cuts from the BoE, providing support for sterling-denominated assets.

AstraZeneca emerged as a standout performer, climbing 2.8% after reports that CEO Pascal Soriot was considering moving the company's stock market listing to the United States. As the UK's largest company by market capitalisation, AstraZeneca's potential relisting has significant implications for the London market.

CAC 40 Remains Virtually Flat

France's CAC 40 ended the session virtually unchanged, declining a marginal 0.04% to close at 7,662.59 points, losing just 3.32 points. This minimal movement masked underlying volatility, as the index has now declined for two consecutive trading days and four of the past five sessions.

The CAC 40's performance reflects the broader uncertainty facing European markets, with the index sitting 6.63% below its 2025 closing high of 8,206.56 reached on Tuesday, 18 February. However, the French benchmark remains up 11.65% from its 2025 closing low and has gained 281.85 points or 3.82% year-to-date.

Broader European Market Context

The pan-European STOXX 600 index closed 0.21% lower at 540.25 points, coming off a more than 1% decline for June. The STOXX 50 fell 0.30% to 5,287 points, whilst the broader Euro Area index (EU50) gained 0.60% to 5,314 points, highlighting the mixed nature of regional performance.

Banking stocks were among the worst performers across the region, with the sector declining 1.3%. Deutsche Bank led the losses with a 3.6% fall, reflecting concerns about the economic outlook and potential impacts on lending margins. Industrial stocks also struggled, falling 1.7% as investors weighed the implications of ongoing trade uncertainties.

Trade and Policy Uncertainties Weigh on Sentiment

European markets are grappling with multiple headwinds as the July tariff deadline approaches. President Trump's 90-day tariff suspension is set to expire on 9 July, creating uncertainty about future trade relationships between the United States and its partners. This uncertainty has been particularly pronounced in industrial and export-oriented sectors.

The ongoing G7 finance ministers' meeting is being closely watched for any signals that could influence trade negotiations. Markets are particularly focused on whether a weaker US dollar—which has fallen to 3.5-year lows—could facilitate progress in trade discussions.

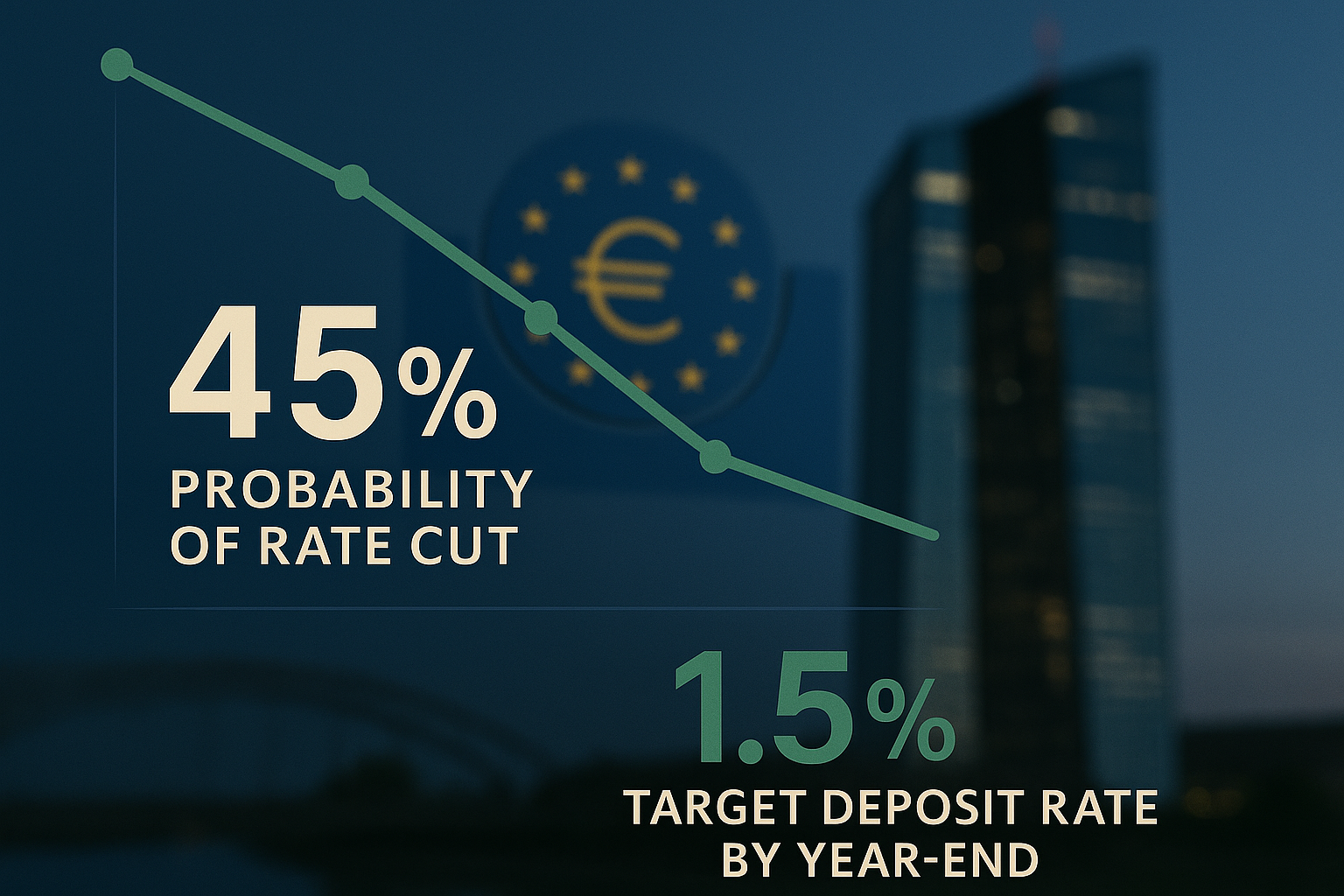

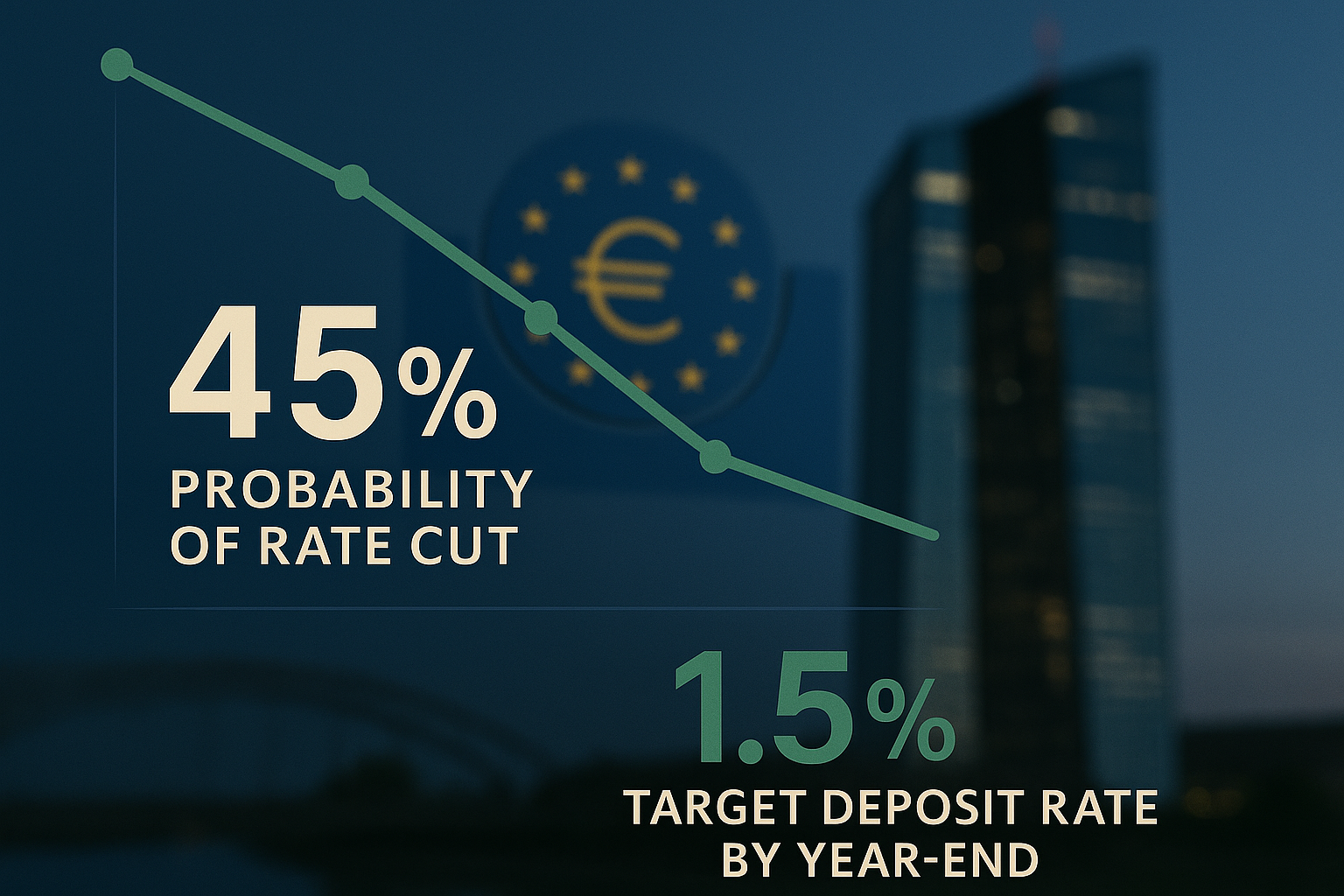

ECB Rate Cut Expectations Support Outlook

Despite Tuesday's mixed performance, European markets are positioned for potential gains as traders assess European Central Bank rate cut expectations. Current market pricing suggests approximately 45% odds of an ECB rate cut in the coming months, with the deposit rate expected to fall to 1.5% by year-end.

The divergence between ECB and Federal Reserve policy paths continues to influence currency and equity markets. Whilst the Fed faces uncertainty about its independence and future leadership, the ECB appears to have more clarity in its policy direction, potentially supporting European assets.

Sector Performance and Corporate Developments

Technology stocks showed resilience, with Infineon gaining 1.6% after announcing a collaboration with Nvidia to develop new power delivery architecture for AI data centres. This partnership highlights the ongoing importance of artificial intelligence infrastructure in driving corporate performance.

Conversely, retail stocks faced pressure, with JD Sports plunging over 7% after reporting a 2% drop in underlying sales. Marks & Spencer also declined more than 3% following revelations that a recent cyberattack could result in a £300 million hit to operating profit.

The mixed corporate earnings and guidance continue to create stock-specific volatility, with investors increasingly focused on company fundamentals rather than broad market trends.

Looking ahead, European markets face a complex backdrop of trade uncertainties, monetary policy divergence, and corporate earnings pressures as they navigate the remainder of 2025.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.