The iShares China Large-Cap ETF (FXI) is a leading choice for traders seeking exposure to China's biggest and most influential companies. With Chinese equities rallying in 2025, understanding FXI's sector composition and performance is key for active investors aiming to capitalise on Asia's dynamic markets.

FXI ETF Overview

FXI tracks the FTSE China 50 Index, comprising 50 of the largest Chinese companies listed on the Hong Kong Stock Exchange. With assets under management of $8.2 billion as of March 2025 and an expense ratio of 0.74%, FXI offers diversified access to China's economic growth without the complexities of trading individual mainland stocks.

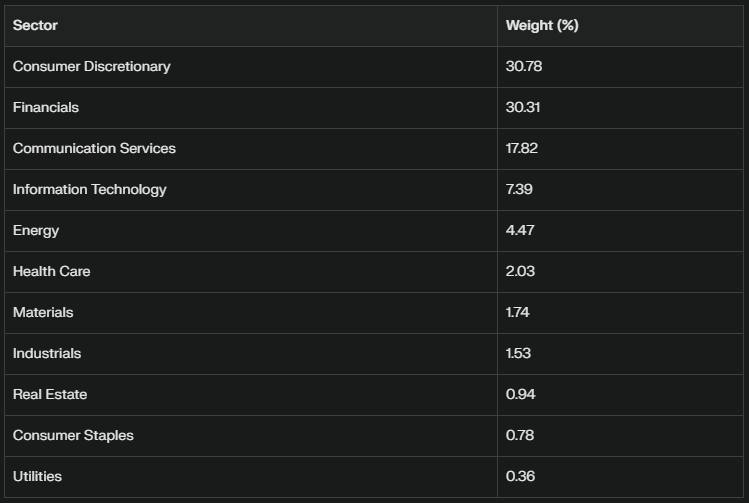

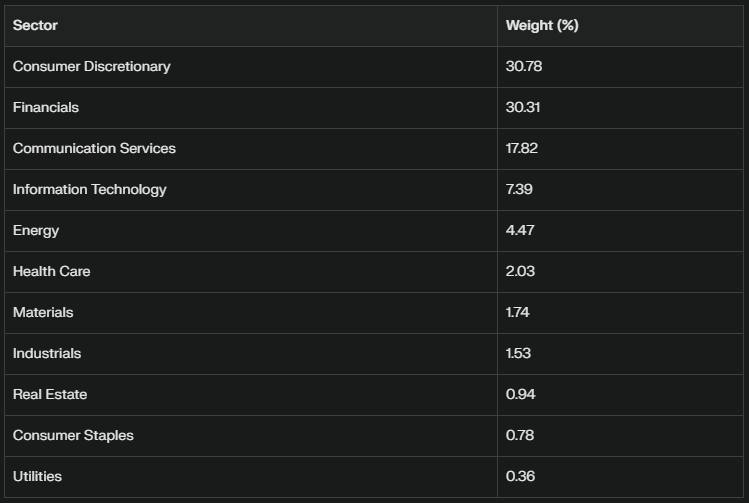

Sector Breakdown: Where FXI's Exposure Lies

As of June 2025, FXI's sector allocation is as follows:

FXI is heavily weighted toward consumer discretionary and financials, each making up over 30% of the portfolio. Communication services and information technology are also significant, reflecting China's tech and internet giants. This sector mix means FXI's performance is closely tied to consumer spending trends, financial sector health, and the outlook for China's digital economy.

Top Holdings: The Giants Driving Performance

FXI's top 10 holdings account for a large portion of its assets and include some of China's most recognisable names:

-

Tencent Holdings Ltd. (8.58%)

-

Meituan (7.99%)

-

China Construction Bank Corp. (5.95%)

-

Xiaomi Corp. (5.92%)

-

Industrial & Commercial Bank of China (4.85%)

-

JD.com Inc. (4.68%)

-

Bank of China Ltd. (4.14%)

-

Trip.com Group Ltd. (4.04%)

NetEase Inc. (3.81%)

These companies span e-commerce, fintech, social media, banking, and travel, providing broad exposure to China's economic engines.

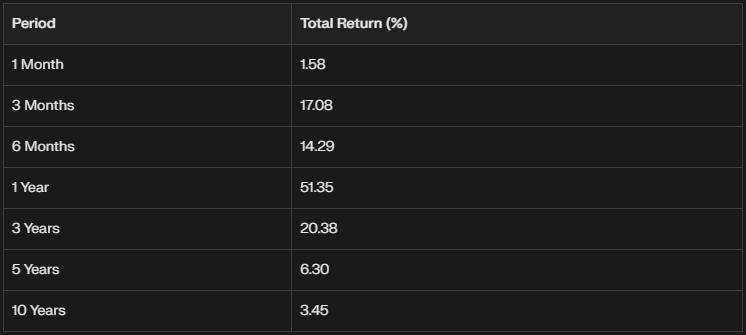

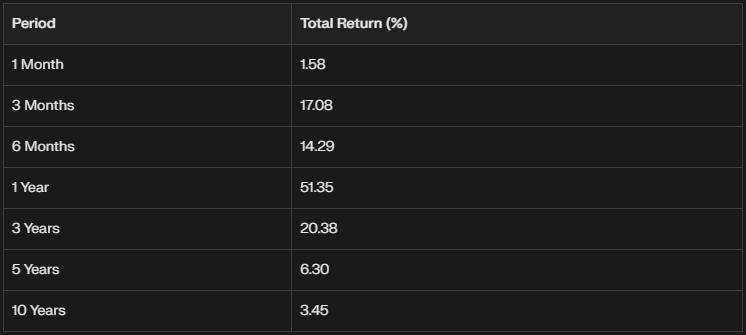

Performance Review: FXI in 2025

Recent Returns

FXI has staged a strong comeback in 2025. As of early June, the ETF is up over 26% year-to-date, significantly outperforming US equity benchmarks like the S&P 500, which is down more than 4% over the same period. The 1-year total return stands at 51.35%, with a 3-year annualised return of 6.38% and a 5-year annualised return of 1.23%.

Drivers of Outperformance

-

Tech Rally: Alibaba and Tencent have surged, with Alibaba up 70% and Tencent up 30% in 2025, buoyed by strong earnings and advancements in artificial intelligence.

-

Policy Support: The Chinese government's initiatives to boost consumption and support the tech sector have underpinned investor confidence.

Sector Rotation: Investors have shifted allocations from US to Chinese equities, seeking higher growth prospects amid US stagflation concerns.

FXI vs. Other Markets

FXI's 2025 outperformance stands in stark contrast to US-focused ETFs like the Vanguard S&P 500 ETF (VOO), which has lagged due to economic headwinds and trade tensions. The return differential between FXI and VOO is currently about 30%, highlighting China's recent market dominance.

Risks and Considerations

While FXI's recent surge is impressive, traders should be aware of key risks:

-

Regulatory Uncertainty: China's regulatory environment can change rapidly, impacting major sectors like tech and finance.

-

Geopolitical Tensions: US-China relations and trade policies can introduce volatility.

Currency Fluctuations: Movements in the Chinese yuan can affect returns for foreign investors.

FXI's concentrated sector exposure also means performance can be volatile, particularly if a few large holdings face headwinds.

Outlook for Traders

Looking ahead, FXI's prospects remain closely linked to China's economic policies, tech sector innovation, and consumer demand. The government's continued focus on technological advancement and domestic consumption is likely to support leading companies within the ETF.

However, traders should monitor global economic conditions and regulatory developments for potential shifts in momentum.

Conclusion

FXI ETF offers traders direct access to China's large-cap market, with a sector allocation that captures the country's key growth engines. Recent performance has been robust, driven by tech and financial giants, but risks remain. For active traders, FXI presents both opportunity and volatility—making sector awareness and risk management essential for success in 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.