The BNDX ETF stands out as a reliable vehicle for investors seeking global bond diversification with reduced currency risk.

By offering exposure to international investment-grade bonds while hedging foreign exchange movements, it provides a measured balance between yield and stability.

As global rate cycles shift and investors reassess fixed income allocations, understanding how BNDX fits into broader portfolios becomes increasingly essential.

This article breaks down the fund's strategy, index framework, hedging mechanism, portfolio composition, performance profile, and practical applications, helping investors evaluate whether the BNDX ETF truly aligns with their diversification goals.

Understanding the Investment Objective and Index Framework of BNDX

The investment objective of BNDX is to replicate, before fees and expenses, the performance of the Bloomberg Global Aggregate ex-USD Float-Adjusted RIC Capped Index, hedged into USD.

Key features of the index and associated structure include:

Only bonds denominated in currencies other than the US dollar are included. This avoids overlap with US bond markets.

"RIC" refers to the way issuers are allocated, with a cap (typically 20%) on exposure to any one bond issuer, including sovereigns. This ensures concentration risk is limited.

The fund uses derivatives (forwards or futures) to mitigate currency risk so that investor returns are less sensitive to foreign exchange movements between the USD and the bond issuers' local currencies.

This is central to BNDX's value proposition for USD-based investors.

The index is rebalanced periodically, and Vanguard implements a "sampling" strategy rather than full replication: rather than buying every bond in the index, BNDX selects a representative sample consistent with risk factors (duration, credit quality, country exposure etc.).

This is for practical reasons: many foreign bonds have limited liquidity or high transaction costs.

Ten largest market allocations as % of bonds of BNDX ETF

| France |

12.1 % |

| Japan |

11.9 % |

| Germany |

10.0 % |

| Italy |

8.1 % |

| United Kingdom |

7.7 % |

| Canada |

6.7 % |

| Spain |

5.6 % |

| Supranational |

4.9 % |

| Australia |

3.5 % |

| United States |

3.3 % |

Currency Hedging Mechanism within the BNDX ETF

Because foreign bond returns have two main components — the local yield / coupon / price movement, plus currency movement — BNDX seeks to eliminate (or at least strongly reduce) the second component (currency risk) for USD-based investors. Here are the mechanics and implications:

1) Use of currency forwards/futures:

To lock in exchange rates or to mitigate movements in foreign currencies vs USD, derivative contracts are used. The cost or gain from carrying these hedges depends on interest rate differentials between USD and foreign currencies (forward points, etc.).

2) Hedging cost and effectiveness:

When interest rates abroad are lower than in the US, hedging tends to impose a cost (because of forward discount), and vice versa.

The effectiveness of the hedge reduces the volatility from FX movements, but it cannot entirely eliminate all risks (e.g. basis risk, counterparty risk, imperfections).

3) Impact on returns:

While hedging reduces the upside from favourable currency moves, it also provides protection against adverse ones.

Thus, in periods where foreign currencies strengthen vs USD, an unhedged international bond fund may outperform BNDX; in periods of USD strength, BNDX may outperform its unhedged peers due to the hedge.

Investors must be aware that currency hedging is not "free" — there will be costs, which can vary with interest rate differentials, liquidity in currency futures markets, and volatility.

Portfolio Structure and Credit Quality of BNDX

Let us examine how BNDX is built in terms of its holdings, risk profile and major attributes:

1) Breadth of holdings:

According to the latest Vanguard fact sheet, BNDX holds thousands of bonds (e.g. about 6.700+) whereas the underlying index has more (over 13.000).

ETF attributes of BNDX ETF

|

Total

International

Bond ETF |

Bloomberg

Global

Aggregate

ex-USD Float

Adjusted RIC

Capped Index

(Hedged) |

| Number of bonds |

6,569 |

13,883 |

| Average duration |

7.0 years |

7.1 years |

| Average effective maturity |

8.7 years |

8.7 years |

| Turnover rate |

26.3% |

- |

| Short-term reserves |

0.0 |

- |

2) Asset classifications:

The fund includes sovereign, agency, corporate, and securitised bonds, all non-US, investment grade. No high yield / speculative-grade exposure.

Top 10 Holdings of BNDX

| Issuer |

Country |

Type |

Weight (%) |

| Japan Government |

Japan |

Sovereign |

5.2 |

| Germany Federal |

Germany |

Sovereign |

4.7 |

| France Government |

France |

Sovereign |

4.5 |

| United Kingdom Gilt |

UK |

Sovereign |

3.8 |

| Canada Government |

Canada |

Sovereign |

3.5 |

| Australia Government |

Australia |

Sovereign |

3.2 |

| Netherlands Government |

Netherlands |

Sovereign |

3 |

| Japan Corp Bond |

Japan |

Corporate |

2.8 |

| France Corp Bond |

France |

Corporate |

2.7 |

| Germany Corp Bond |

Germany |

Corporate |

2.5 |

3) Credit quality:

As investment grade, the credit rating distribution tends heavily toward upper investment grade (e.g. AAA, AA, A, BBB). The exact weighting shifts over time depending on global credit spreads and the health of foreign issuers.

Distribution by credit quality of BNDX ETF

| AAA |

24.3 % |

| AA |

27.2 % |

| A |

26.7 % |

BBB

|

18.4 % |

| BB |

0.2 % |

| Not Rtaed |

3.2 %

|

4) Duration and maturity:

Average effective maturity is around 8.7-8.8 years; average duration somewhat shorter (in the low 7-year range) meaning that the fund has moderate sensitivity to changes in interest rates.

5) Issuer/Geographic concentration controls:

Because of the "cap" in the index, any single issuer (even a large government) cannot exceed around 20%. Distribution across many sovereigns and corporates reduces concentrated credit risk.

Distribution by issuer

| Asset-Backed |

5.4 % |

| Finance |

6.7 % |

| Foreign |

78.3 % |

| Industrial |

6.8 % |

| Utilities |

1.5 % |

| Other |

1.3 % |

6) Liquidity and scale:

Vanguard's reputation, fund AUM, and trading volume are significant, meaning reasonably good liquidity; bid-ask spreads are typically modest for an ETF of its size.

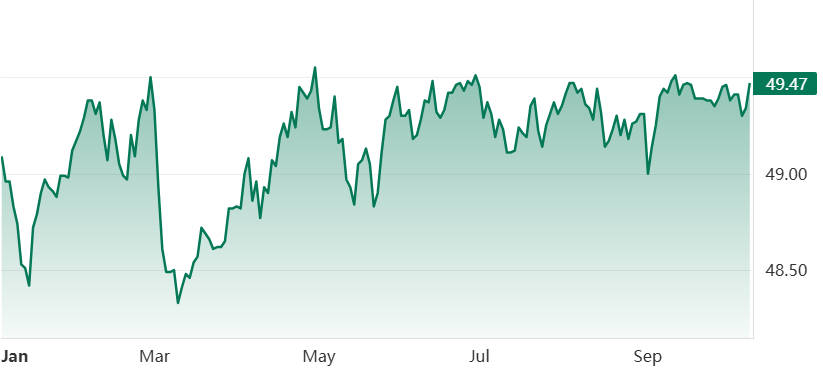

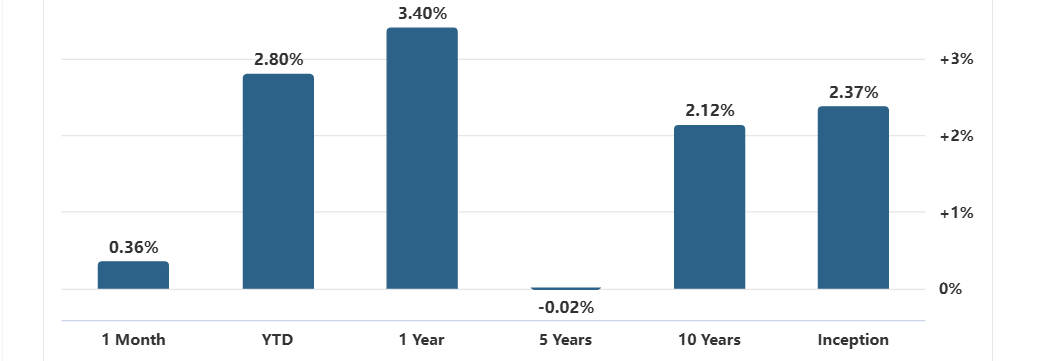

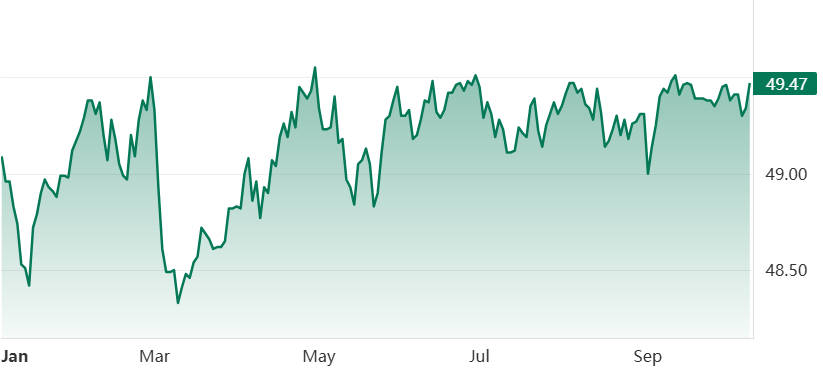

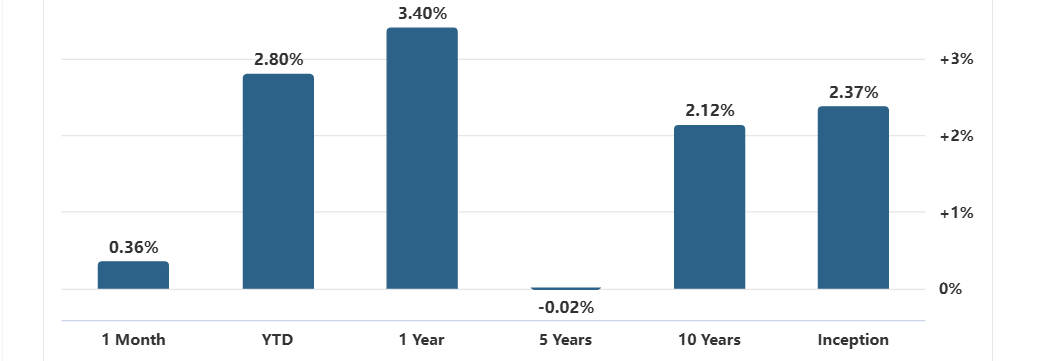

Key Performance Indicators and Historical Return Profile of BNDX

Analysing how BNDX has performed historically gives insight into what investors might expect, though past performance is no guarantee of future results.

Volatility and Drawdowns: Standard deviation over longer periods is moderate (several percentage points), maximum drawdowns have arisen during periods of rising global rates or credit stress. For example, simulated historical drawdowns (over more extended horizons) are material, sometimes exceeding double digit negative returns in adverse markets.

Risk-adjusted metrics: Because of its hedging, BNDX tends to have lower currency-driven volatility compared to unhedged international bond ETFs, which improves consistency of returns for USD investors. The Sharpe, Sortino or information ratios tend to reflect this stability (though exact recent values vary depending on timeframe).

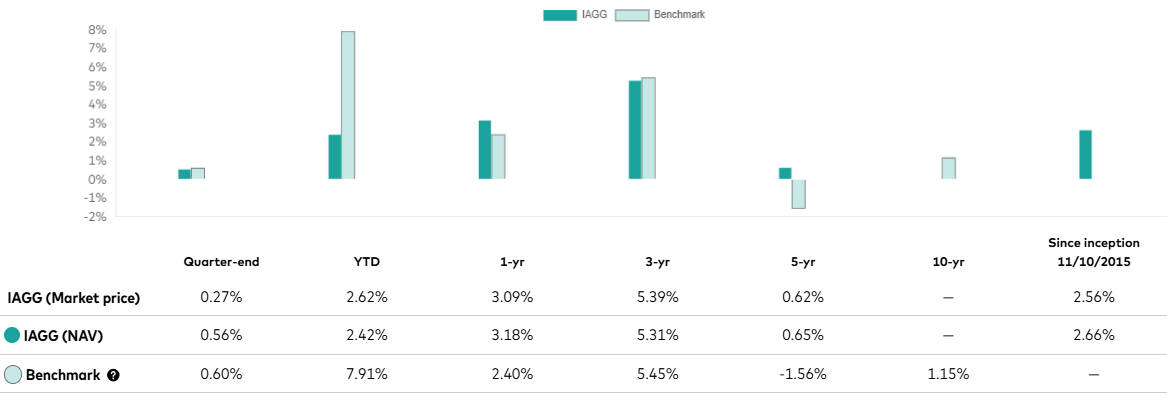

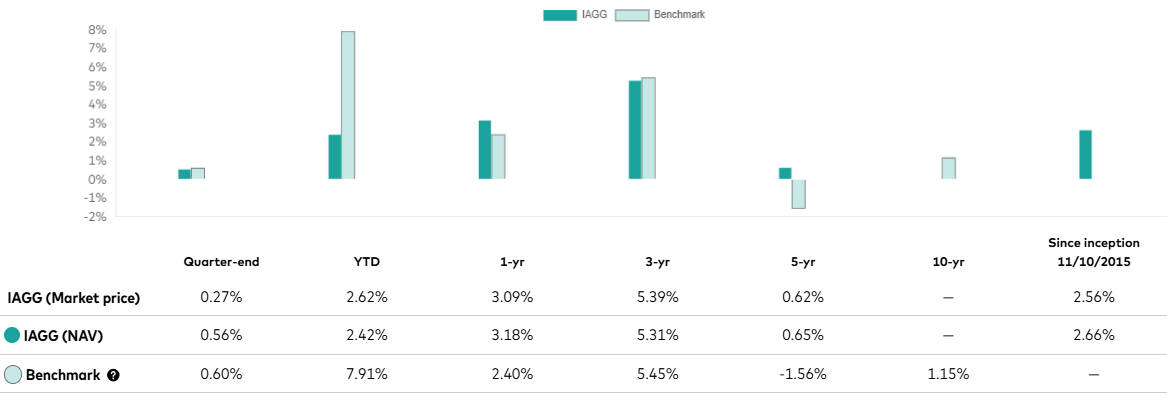

Comparison with peers: Peers include other large USD-hedged international bond ETFs, such as IAGG. There are periods where BNDX has underperformed IAGG and other unhedged or partially hedged funds, particularly when foreign currencies have appreciated. Conversely, when USD strengthens or when foreign currencies weaken / volatility is high, BNDX has an advantage.

Volatility Drivers and Risk Assessment of BNDX

Even though BNDX is designed to mitigate some sources of risk, it is vulnerable to others. Understanding these is essential for evaluating suitability.

Interest rate risk (duration risk): As with all bond funds, rising global interest rates reduce bond prices. Given its moderate duration (~7 years), BNDX will suffer in rising rate environments.

Credit spread risk: Fall in credit quality of issuers (corporate or sovereign) or widening of credit spreads will negatively affect corporate sectors in the fund. Global macro stress (recession fears, fiscal instability) can drive that.

Hedging risk: Imperfect hedging (basis risk), cost of hedging, rollover risk, and possible counterparty risk in derivatives. If the forward currency markets function poorly, costs can rise or hedges can underperform expectations.

Country/political/regulatory risk: Some non-US issuers are in countries with higher political risk, lower transparency, or weaker legal protections. While BNDX is investment grade, sovereign risks (e.g. policy, regulatory change, default risk) remain.

Liquidity risk: Certain foreign bonds are less liquid; during stress periods, selling under adverse prices may be difficult. Sampling strategies help but can lead to tracking error.

Currency risk via indirect channels: Even hedged funds are not immune to systemic currency crises or situations where hedging markets freeze or become very costly. Also, local inflation, sovereign bond yields, currency controls affect returns.

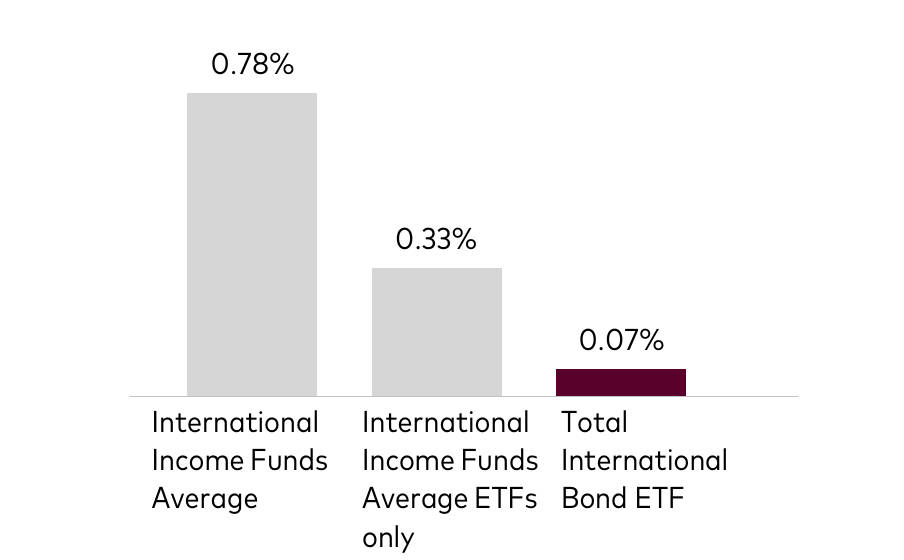

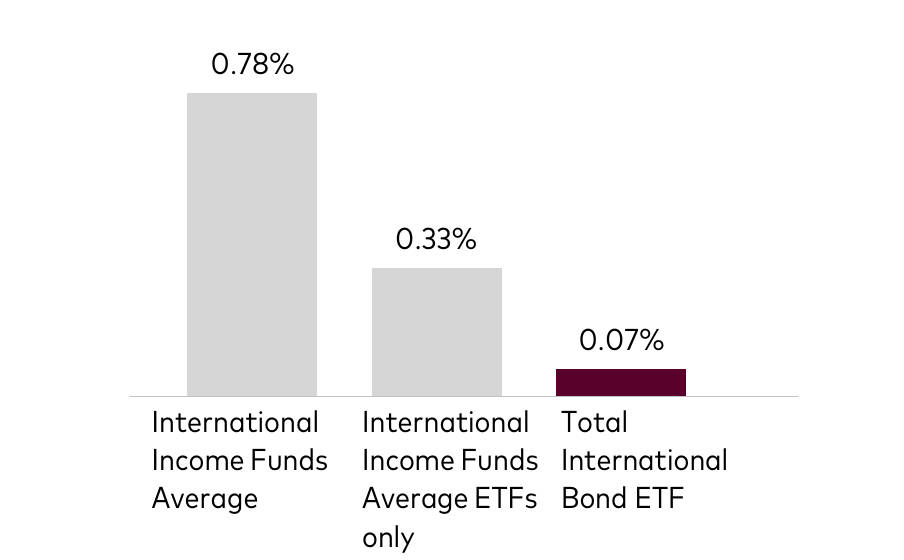

Cost Efficiency and Structural Advantages of BNDX

BNDX offers several structural advantages that make it appealing to many investors, especially when compared with non-hedged international bond exposure or actively managed funds.

Operational scale and liquidity: Large AUM, frequent trading in the ETF, reasonable bid-ask spreads; also dividends and distributions are regular.

Diversification returns: By being non-US, exposure to different macro cycles, yield curves, credit cycles. Currency hedging removes one big source of volatility, leaving performance more tied to bond fundamentals (yields, spreads, etc.).

Predictability and stability for USD-based investors: For those concerned about foreign exchange risk, BNDX offers a more stable fixed income income stream (adjusted for interest rate and credit risks) than unhedged international bond exposure.

Comparative Analysis of BNDX and Alternative International Bond ETFs

It is useful to see how BNDX stacks up against alternatives, paying attention to hedging, yield, duration, and diversification.

Unhedged international bond ETFs: These offer potential currency gains but also add currency risk. In periods where foreign currencies appreciate vs USD, they may outperform BNDX; but in reverse cases, BNDX will likely protect more.

Other USD-hedged ETFs: Peers like IAGG (or similar) may differ slightly in terms of index methodology, credit exposures, issuer caps, geographic breakdowns, liquidity, and cost. Sometimes peers may offer slightly higher yield or different corporate vs sovereign weightings.

Active global bond funds: These may chase yield or take active credit bets or duration bets; while potentially outperforming, they often come with higher fees and more risk, especially in volatile periods.

Non-bond alternatives or complements: For some investors, non-US fixed income exposure can be supplemented by emerging market local currency bonds, which may offer higher yields (though with substantially higher risk), or by global government bond allocations, inflation linked bonds, etc.

Comparison with Peer International Bond ETFs

| ETF |

Hedged |

Expense Ratio |

Duration |

3-Year Annualised Return (%) |

| BNDX |

Yes |

0.07% |

7.1 |

2.45 |

| IAGG |

Yes |

0.10% |

7 |

2.5 |

| IGOV |

No |

0.15% |

7.3 |

2.7 |

Strategic Applications of BNDX in Global Portfolios

How might an investor use BNDX in their fixed income / overall portfolio?

Tactical tilts: In times of expected USD strength, overweighting hedged international bonds (like BNDX) may help; when USD is expected to weaken, unhedged exposure might be preferable. Investors may alternate or hedge between the two.

Rebalancing anchor: During periods when US yields rise/fall, or when credit spreads widen globally, BNDX could serve as a stabiliser in global fixed income, especially versus more volatile allocations.

Conclusion

The BNDX ETF offers a disciplined path to global bond diversification, combining broad exposure with effective currency hedging. Its low cost, quality holdings, and stable performance make it a reliable core choice for investors seeking global reach without added currency risk.

It is suitable for investors who believe global interest rates and credit conditions will be relatively stable or improve, and who want international diversification but with limited exposure to currency risk.

Those who anticipate USD weakness might consider blending with unhedged international bond funds to capture currency appreciation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.