In fast-moving markets, execution speed and leverage levels can make the difference between profit and missed opportunity.

EBC Financial Group is a full-tier broker overseen by FCA, ASIC, and CIMA, offering ultra-quick trade execution (below 20 ms), substantial liquidity, and leverage of up to 1:500.

This guide explores why EBC stands out in 2025 as the best forex broker of choice for traders who prioritise execution quality and high leverage.

EBC Financial Group at a Glance

Founded in London and backed by over 30 years of institutional experience, EBC operates under FCA (UK), ASIC (Australia), and CIMA (Cayman) licenses, plus Lloyd's of London insurance coverage.

It secured the "Best Fast Execution Broker for Day Traders" title in FXEmpire's 2025 review and ranks among the top FCA- and ASIC-regulated brokers.

With proprietary execution technology, EBC routes orders across interbank liquidity pools, resulting in over 85% of trades executed at better-than-quoted prices, minimal slippage, and market-leading reliability.

Why EBC Financial Group Is the Best Forex Broker?

1) Execution Speed and Order Quality

Precision execution is EBC's hallmark. Trading servers operate under 20 ms latency, allowing scalpers and high-frequency traders to capitalise on rapid price swings.

Its Black Box engine intelligently aggregates orders from 25+ top-tier liquidity providers, optimising quotes and minimising slippage. Reviewers consistently highlight "fast execution" and "impressive slippage control" on Trustpilot reviews.

2) Leverage Up to 1:500

EBC offers up to 1:500 leverage on forex, considerably higher than EU-regulated brokers (capped at 1:30). This enables traders to manage large positions with little capital, increasing both possible returns and risks.

Account types such as Standard, Pro, TRAD, and FCA offer flexible leverage choices, depending on your jurisdiction and risk profile.

While high leverage can increase losses, EBC offers negative balance protection and promotes responsible approaches. Its Smart Copy Trading feature also supports adaptive risk controls, ensuring replicators can manage exposure in volatile environments.

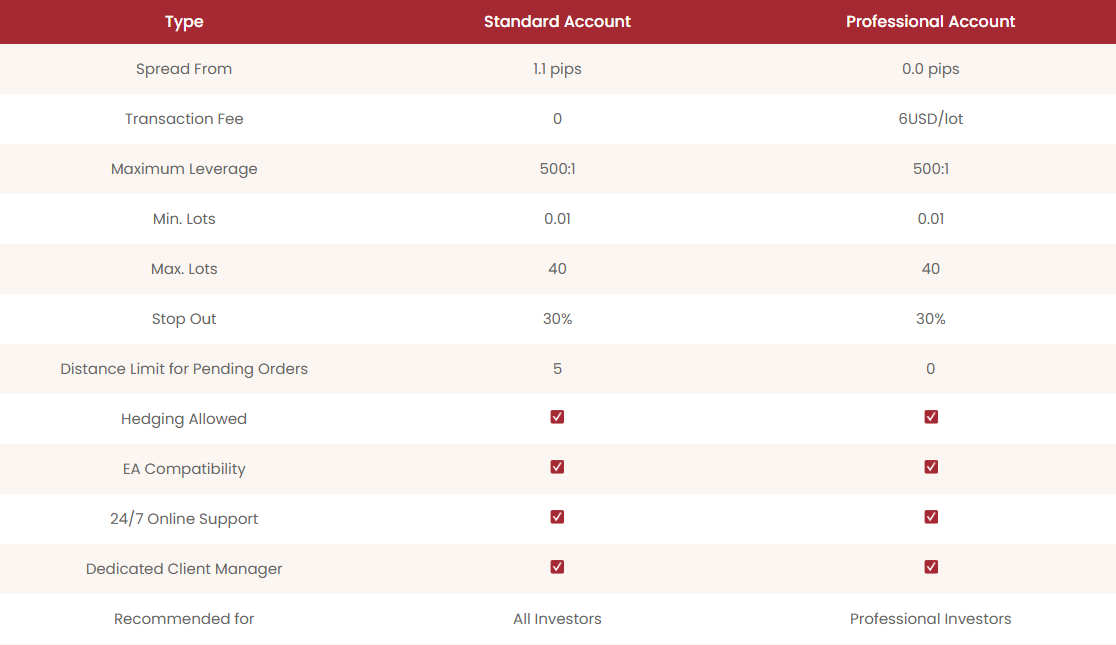

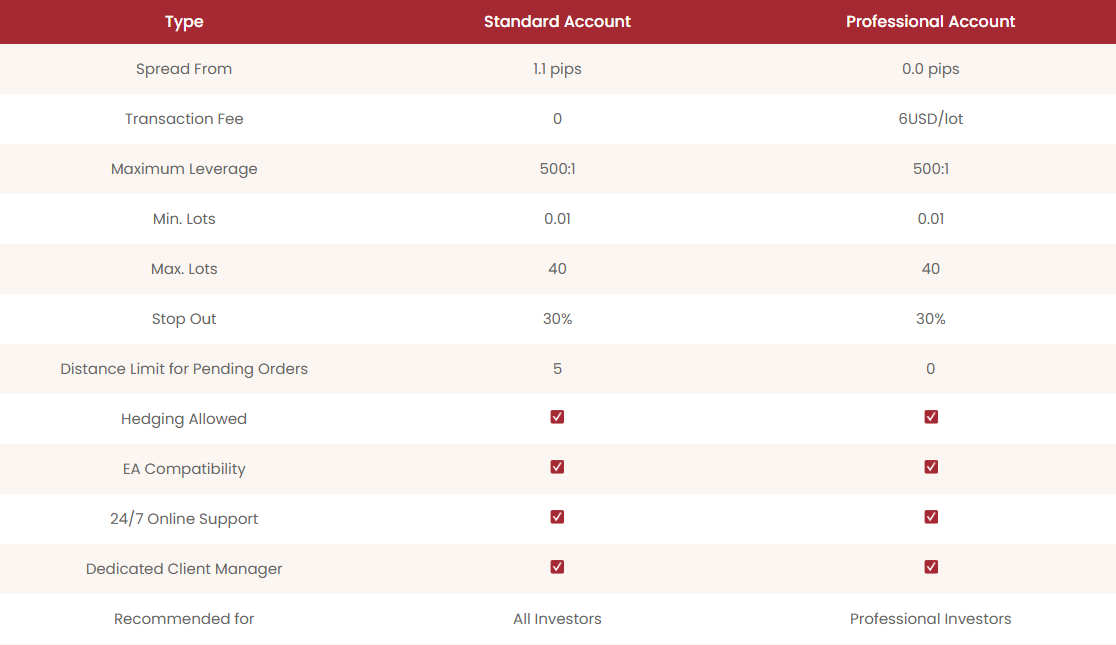

3) Tight Spreads and Competitive Fees

EBC offers spreads starting from 0.0 pips on its Pro account (with commission) and 1.1 pips on standard accounts. Payment and withdrawal options, such as cards and e-wallets, do not incur any fees. Inactivity charges will only apply after 12 months of inactivity. This control over cost is crucial for active strategy traders.

Accounts are customisable. For instance, the Pro account suits experienced traders looking for minimal spreads, while the Standard account is great for beginners with small deposit needs.

4) Account Types and Platform Options

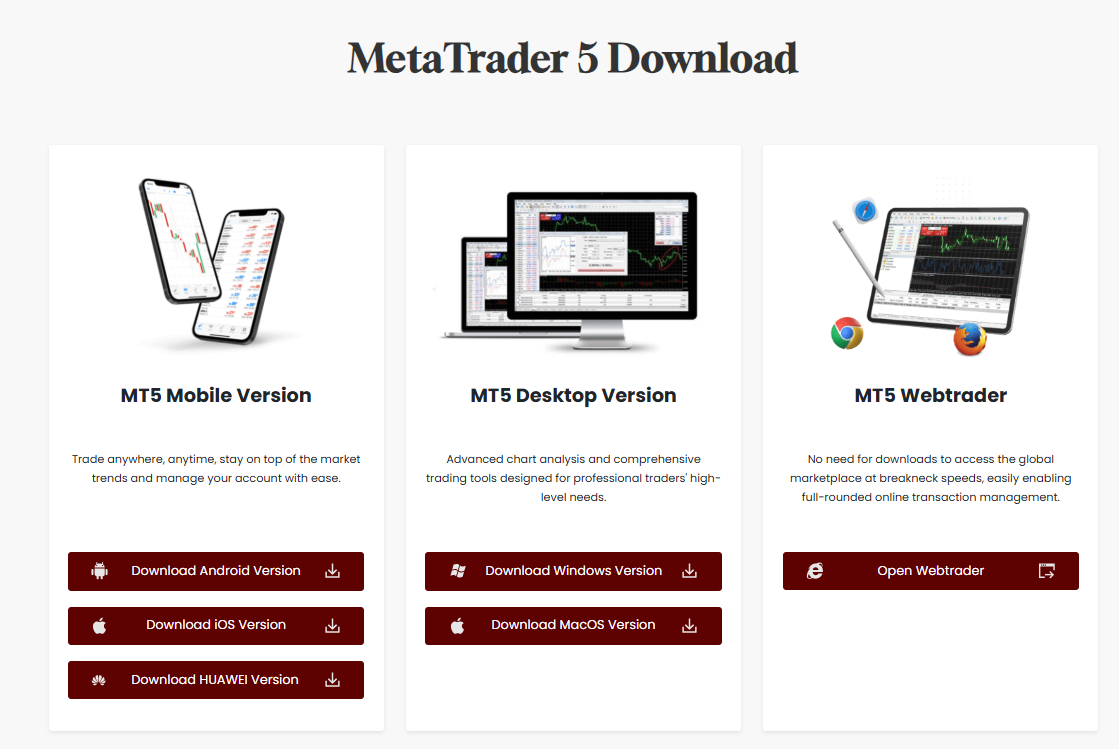

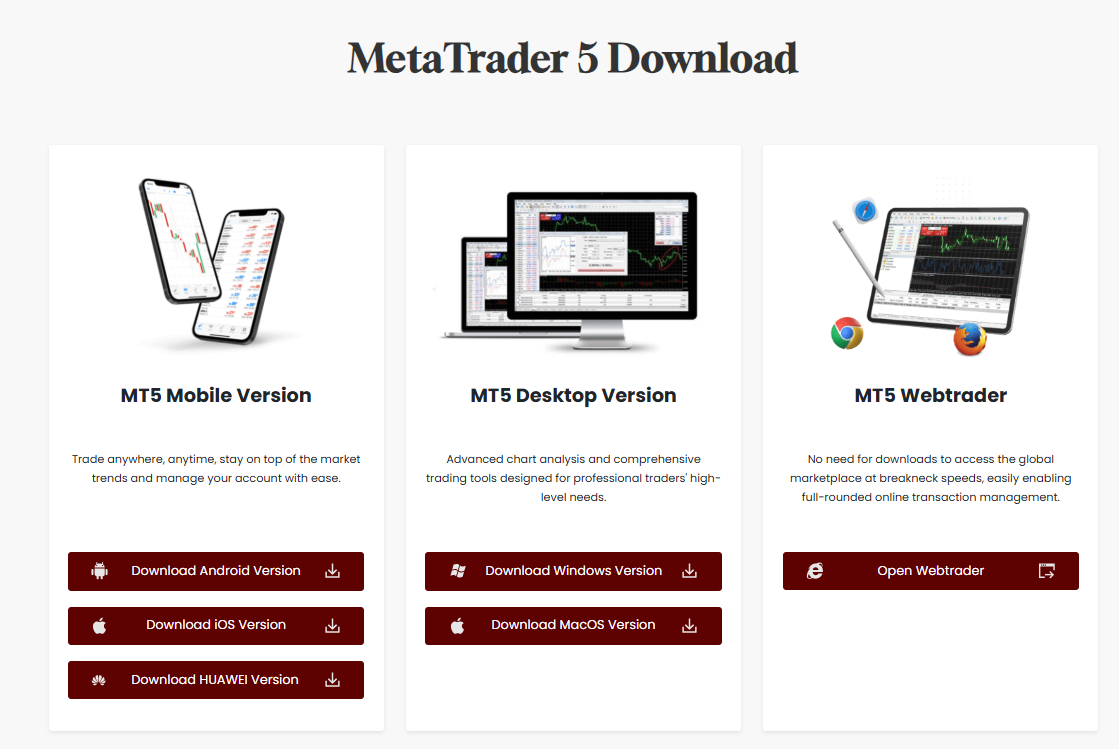

Speaking on accounts, EBC supports both MetaTrader 4 and MetaTrader 5, along with VPS hosting and AI-enhanced tools. Traders can use MT4/MT5 locally or via web/mobile apps across iOS and Android.

Features include automated trading, expert advisors (EAs), and order-flow analysis tools powered by CME data. Its copy-trading platform integrates AI-driven signals and community strategies ideal for both beginners and professionals.

Account offerings:

Standard Account: Min deposit $100, 1:500 leverage, 1.1 pip spread, commission-free.

Pro Account: Min deposit $500, spreads from 0.0 pip + commissions (~$6), full leverage, no pending order restrictions.

5) Regulation, Security & Reputation

EBC operates under full regulation from the FCA (UK), ASIC (AU), and CIMA (Cayman). It also participates in industry compensation schemes such as the Financial Commission fund. These measures ensure traders have legal protections and transparency.

Trustpilot ratings average 4.8/5, with 85% of reviews praising customer service, execution speed, and reliability. Investing.com also rates EBC highly for order execution and trading technology.

Ideal Trader Profiles for EBC

EBC's speed and leverage cater to a wide array of traders:

Scalpers and day traders who need instant order execution and minimal slippage.

Professional or pro-level accounts seeking commission-based pricing and tight spreads.

High-leverage strategies, including swing trading or institutional flows.

Social and manual traders use copy or algorithmic trading tools.

Global traders outside the U.S., as EBC does not accept U.S. clients.

Beginner traders can start conservatively with the Standard account, leverage education tools, and gradually scale up as strategy and confidence grow.

WHY EBC Financial Group Stands Out Among the Best Forex Brokers?

While other brokers may offer high leverage, EBC's edge lies in its regulated framework paired with fast execution. Numerous high-leverage brokers operate without regulation or from offshore locations, heightening counterparty risk.

Reddit discussions frequently note that high-leverage providers often lack oversight, but EBC's FCA and ASIC licenses mitigate this concern.

Additionally, its trading execution technology, which enhances performance across various liquidity sources, is rarely found among similarly leveraged brokers, many of which operate as bucket shops (B-book) and lack genuine interbank connections.

Conclusion

In conclusion, for traders who prioritise both fast execution and high leverage under strict regulation, EBC Financial Group offers an unmatched combination.

With ultra-low latency trading, deep liquidity access, flexible account options, and institutional-grade tools, it provides an edge especially suited to momentum traders and professionals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.