In every market, the ask price defines the true cost of entry. Learn how it works, why it changes, and what it means for your trades.

Introduction

The ask price, also known as the offer price, is the lowest price a seller is willing to accept for a financial asset. It matters because it defines the “selling side” of every trade, directly affecting how traders buy securities or currencies in the market.

Definition

Ask price (the seller’s price) is the quoted price at which a market participant or broker offers to sell an asset. It appears alongside the bid price (the buyer’s offer) in every trading platform.

In practice, the ask is always higher than the bid, and the difference forms the spread.

How Ask Price Works

The ask price represents the lowest price at which a seller is willing to sell an asset. It’s essentially the seller’s “offer” to the market, the amount they hope to receive when a buyer agrees to purchase.

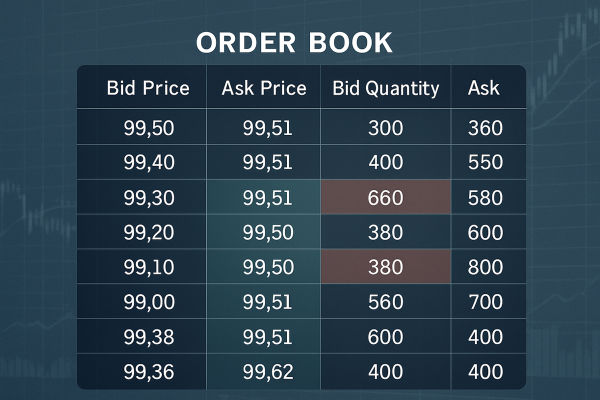

Sellers, brokers, or market makers list their offers in the market’s order book. The lowest available offer becomes the current ask price that buyers see. In simple terms, the ask is what you and everyone else are asking to sell which is the minimum you’re willing to accept.

For example, if you list a stock for $100, that becomes your ask price, and you’ll receive $100 when it sells.

The ask price moves constantly as sellers adjust their offers in response to demand, order flow, and market sentiment.

During periods of volatility or breaking news, sellers may raise or lower their asks to reflect perceived risk or opportunity.

In highly liquid markets such as large-cap stocks or major currency pairs, the ask price typically stays close to the bid due to heavy trading activity. In thin or uncertain markets, the gap widens, increasing costs for traders seeking immediate execution.

Example

As of 3 November 2025, Tesla Inc. (TSLA) is quoted on the NASDAQ at $220.00 / $220.05 (bid / ask).

$220.00 is the bid price which is the price where buyers are currently willing to buy. The second number, $220.05, is the ask price which is the lowest price sellers are currently willing to accept for one share of Tesla.

If an investor decides to buy Tesla shares immediately using a market order, the trade will execute at $220.05, because that is the price set by the sellers.

This ask price represents the minimum amount a seller is ready to receive and the immediate cost a buyer must pay to enter the trade.

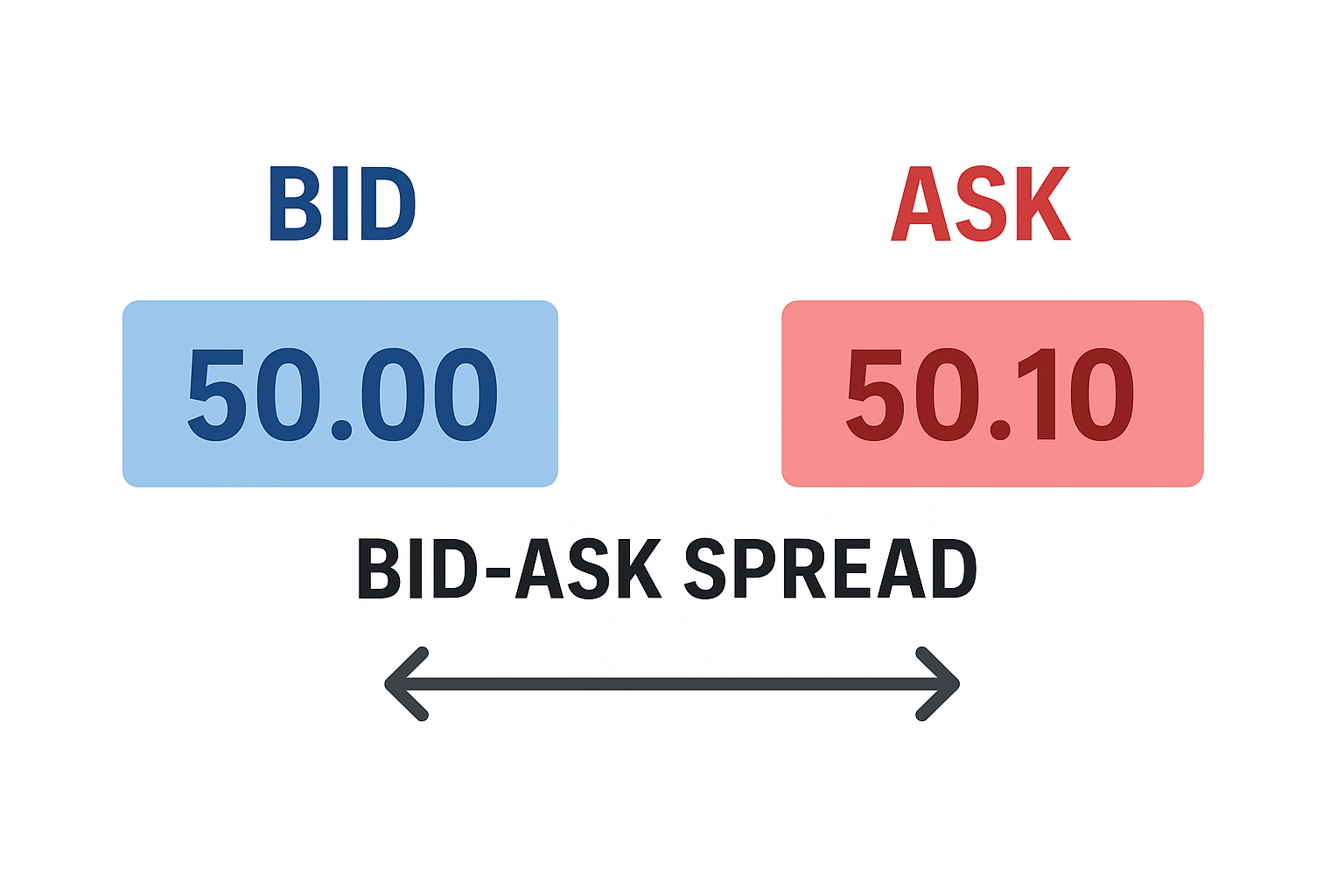

The small difference between the bid ($220.00) and the ask ($220.05) which is known as the bid-ask spread reflects the transaction cost built into every trade and compensates liquidity providers such as market makers for facilitating quick execution.

Related Terms

Bid Price: The highest price a buyer is willing to pay for an asset.

Bid-Ask Spread: The difference between bid and ask; a measure of liquidity and transaction cost.

Market Order: A trade executed immediately at the best available ask (for buyers) or bid (for sellers).

Frequently Asked Questions (FAQ)

1. Why is the ask price always higher than the bid price?

Because sellers aim to receive slightly more than buyers want to pay. The gap compensates for transaction costs and market risk.

2. Can the ask price change rapidly?

Yes. It fluctuates constantly with market activity, news, and order volume, especially in volatile or thinly traded markets.

3. How does the ask price affect my trade?

When you buy at market price, you pay the current ask. A wider spread means a higher entry cost, while a tight spread reduces slippage.

Summary

The ask price shows the lowest price a seller is willing to accept for an asset. It defines the cost for buyers who want to purchase immediately and moves constantly with market demand and liquidity.

Understanding the ask price helps traders manage entry costs and navigate market spreads more effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.