Selling is a term used in the stock or Securities market to describe the

behavior and market supply of investors selling stocks or securities, also known

as selling out or selling square. The selling order represents the overall

quantity and selling pressure of the sold order.

When investors want to sell their stocks, they will hang the stocks on the

selling list and wait for the buyer to bid to buy them. The quantity and price

of the selling order will affect the supply and price trend of the stock. If the

number of selling orders is large, it means that more sellers are willing to

sell stocks, which may lead to a decrease in Stock Prices. On the contrary, if

the number of selling orders is small, it means that the supply is limited,

which may drive up stock prices.

Therefore, selling is considered a manifestation of the market's selling

power.

The formation of selling orders is usually related to multiple factors. This

may include market sentiment, economic data, corporate performance, and news

events. When investors are pessimistic about the market outlook, weak economic

growth expectations, or companies release bearish news, they may exhibit

stronger selling behavior. In addition, the selling decisions of seller

institutions, investment funds, and individual investors also directly affect

the formation of selling orders.

The opposite of selling is buying, which is used to describe investors'

behavior in purchasing stocks or securities and market demand, representing the

overall number of buying orders and buying pressure.

In the stock market, buying refers to the willingness and demand of investors

to purchase stocks at a certain price, also known as a buying order or buying

square. The buying price can be lower than the current price or higher than the

current price.

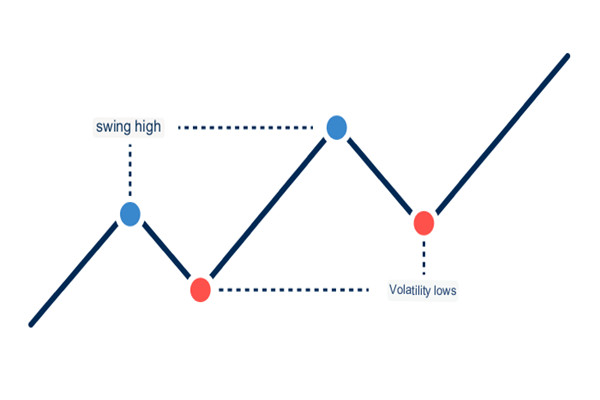

The gap and balance between selling and buying are important indicators of

market supply and demand. If the selling price exceeds the buying price, the

market shows a relatively strong seller trend, and stock prices may fall. On the

contrary, if buying exceeds selling, the market shows a relatively strong buyer

trend, and stock prices may rise.

Selling and Buying

|

Sell-side |

Buy-side |

| Definition |

Term used to describe the action of investors selling stocks or securities and the market supply. |

Term used to describe the action of investors buying stocks or securities and the market demand. |

| Synonyms |

Sell-off, sellers' side |

Buy-side, buyers' side |

| Represents |

Overall quantity of sell orders and selling pressure. |

Overall quantity of buy orders and buying pressure. |

| Influencing Factors |

Market sentiment, economic data, company performance, news events, etc. |

Market sentiment, economic data, etc. |

| Role |

Reflection of market selling pressure. |

Reflection of market buying pressure. |

For investors, it is very important to understand and analyze the situation

of buying and selling, as this knowledge can help them better grasp market

trends. In addition, changes in buying and selling not only depend on supply and

demand relationships but are also influenced by other factors. When conducting

transactions, investors must look and think before making decisions to minimize

risks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.