The AED to USD exchange rate remains one of the world’s most stable currency pairs.

For traders, businesses, and investors, understanding the forces behind the stability of AED to USD is essential for effective risk management and strategic planning.

This article explores the reasons behind the AED's unwavering link to the USD, its implications for the economy, and what traders should consider when dealing with this unique currency pair.

AED to USD: Why the Dirham Is So Stable

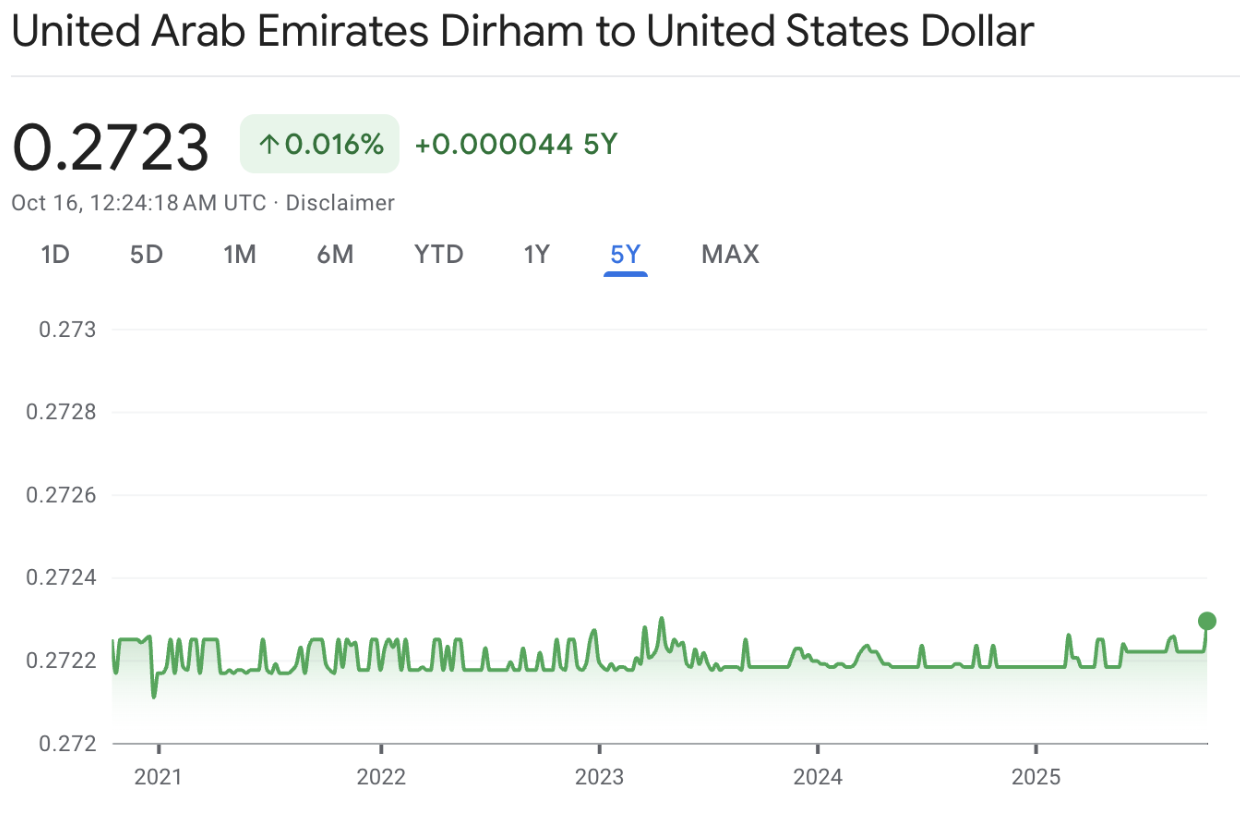

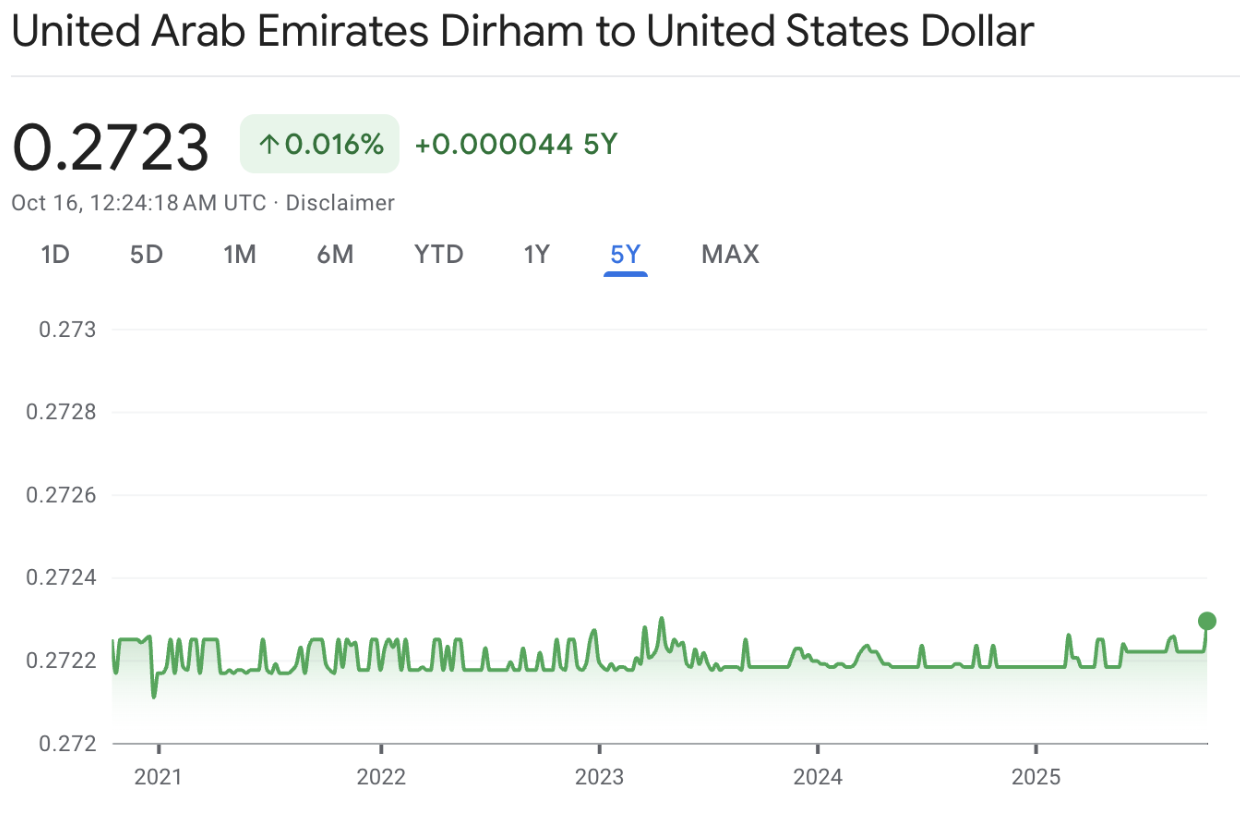

Before diving deeper, here’s a quick snapshot of the AED to USD exchange rate and key facts that define its long-standing stability.

| Aspect |

Details |

| Exchange Rate (Fixed) |

1 USD = 3.6725 AED |

| Peg Established |

1978 |

| Peg Type |

Fixed exchange rate to the US Dollar |

| Managing Authority |

Central Bank of the UAE |

| Average Daily Fluctuation |

< 0.01% |

| UAE Sovereign Credit Rating (S&P) |

AA (Stable) |

| Primary Currency Driver |

Oil trade priced in USD |

Since 1978 till now (2025), the UAE Dirham has been pegged to the US Dollar at a fixed rate of approximately 1 USD = 3.6725 AED. This peg is maintained and managed by the Central Bank of the UAE, ensuring that the exchange rate remains constant, with only negligible fluctuations, typically less than 0.01%.

For traders, this means that the value of one dirham is always around 0.2723 USD, regardless of global market conditions.

| Benefits of the AED-USD Peg |

Drawbacks / Limitations |

| Predictable, stable exchange rate |

Limited independent monetary control |

| Lower currency risk for trade and investment |

Exposure to U.S. policy shifts |

| Strong investor confidence |

Few opportunities for speculative trading |

| Supports UAE’s financial hub status |

Tied to U.S. economic cycles |

Why the UAE Chose the Dollar Peg

Several key factors underpin the UAE's decision to maintain a fixed exchange rate with the US Dollar:

Oil Exports: The UAE's economy is heavily reliant on oil exports, which are priced and traded in US Dollars. Pegging the dirham to the dollar simplifies these transactions and helps stabilise export revenues.

Trade and Investment Certainty: The US is a major trading partner for the UAE. A fixed exchange rate reduces uncertainty for businesses engaged in cross-border trade and investment, making it easier to forecast costs and revenues.

Financial Stability: The peg shields the UAE economy from regional volatility and speculative attacks on its currency, fostering a stable environment for both domestic and foreign investors.

Inflation Control: By pegging to the USD, the UAE effectively imports the monetary policy of the United States, helping to control inflation and maintain price stability.

Investor Confidence: The fixed rate reassures international investors, supports the UAE's role as a global financial hub, and encourages long-term investment.

Factors That Could Influence the Peg

The UAE’s dollar peg is strong, but several external forces could shape its long-term stability:

U.S. Federal Reserve Policy: When the Fed raises or cuts rates, the UAE typically follows suit to preserve the 3.6725 peg. A wide policy gap could pressure local liquidity.

Central Bank Reserves: Maintaining large U.S. dollar reserves gives the UAE the capacity to defend the peg and sustain investor confidence.

Oil Prices: High oil revenue strengthens the fiscal base supporting the dirham, while prolonged low prices could test that cushion.

-

Geopolitical Shocks: Regional tension or capital flight may disrupt liquidity flows, though the UAE’s stability record keeps risks low.

Market Dynamics And Impact On Traders

The AED/USD pair is among the most stable in global forex, offering near-zero volatility due to its fixed peg.

For traders, this means minimal price fluctuation and limited speculative opportunity, a stark contrast to free-floating pairs like EUR/USD or GBP/USD. Traditional technical setups, which rely on volatility, hold little relevance here.

For businesses and long-term investors, however, this consistency is a strategic advantage. The peg eliminates most currency risk in cross-border contracts and import/export pricing.

The dirham’s predictability also supports regional carry trade structures, where it serves as a funding or hedge currency against higher-yielding, more volatile assets.

During periods of geopolitical or financial stress in the Middle East, capital inflows often move toward the dirham as a regional safe-haven. This defensive demand reinforces its liquidity and underlines the credibility of the UAE’s commitment to the dollar peg.

Long-Term Outlook Of The AED Beyond 2030

Looking ahead, the peg is expected to remain the cornerstone of UAE monetary policy. Economic diversification under initiatives like UAE Vision 2031 aims to reduce dependence on oil revenues, but stability remains central to the nation’s strategy.

As the UAE develops stronger non-oil sectors and expands its role in global finance and technology, initiatives such as the digital dirham under the mBridge Project could modernize monetary tools, enabling faster cross-border payments and more efficient liquidity management, without disrupting the dollar peg.

Given the UAE’s substantial U.S. dollar reserves, robust fiscal position, and continued trade settlement in dollars, the peg is expected to endure well into the next decade.

For global markets, this makes the AED one of the few currencies whose stability can be treated as a policy constant rather than a market variable.

Practical Tips for Trading AED/USD

Monitor US Economic News: Since the AED is pegged to the dollar, US economic data and Federal Reserve announcements can indirectly impact UAE markets and interest rates.

Focus on Cross Pairs: For traders seeking more volatility, consider trading AED cross pairs such as EUR/AED or GBP/AED, which may exhibit greater price movement than AED/USD.

Understand Regional Risks: Stay informed about geopolitical developments in the Middle East, as these can affect market sentiment and liquidity.

Leverage UAE's Credit Strength: The UAE's high sovereign credit rating (AA by S&P) supports the AED's reputation as a stable store of value and a reliable currency for international transactions.

Frequently Asked Questions (FAQ)

1.Why is the UAE Dirham pegged to the US Dollar?

The peg ensures price stability, simplifies oil and trade transactions (which are dollar-denominated), and anchors investor confidence by linking the UAE’s monetary system to one of the world’s most stable currencies.

2.How long has the AED been pegged to the USD?

The Dirham has been pegged to the US Dollar since 1978 at a fixed rate of approximately 1 USD = 3.6725 AED, a system that remains firmly in place in 2025.

3.Can the UAE remove the dollar peg in the future?

While theoretically possible, it’s highly unlikely in the near term. The peg is deeply integrated into the UAE’s trade, investment, and fiscal structure. Any shift would be gradual and carefully managed to avoid market disruption.

4.Is the AED stronger than the USD?

No, the AED is worth less than the USD. One US Dollar equals roughly 3.67 Dirhams, a value deliberately maintained by the Central Bank of the UAE for stability.

Conclusion

The stability of the AED to USD exchange rate is a cornerstone of the UAE's economic success, providing certainty for traders, businesses, and investors. The long-standing peg to the US Dollar, supported by robust reserves, prudent fiscal management, and a diversified economy, ensures that the dirham remains one of the most reliable currencies in the world.

For traders, this means reduced currency risk but also limited speculative opportunities, making AED/USD a unique pair in the global forex market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.