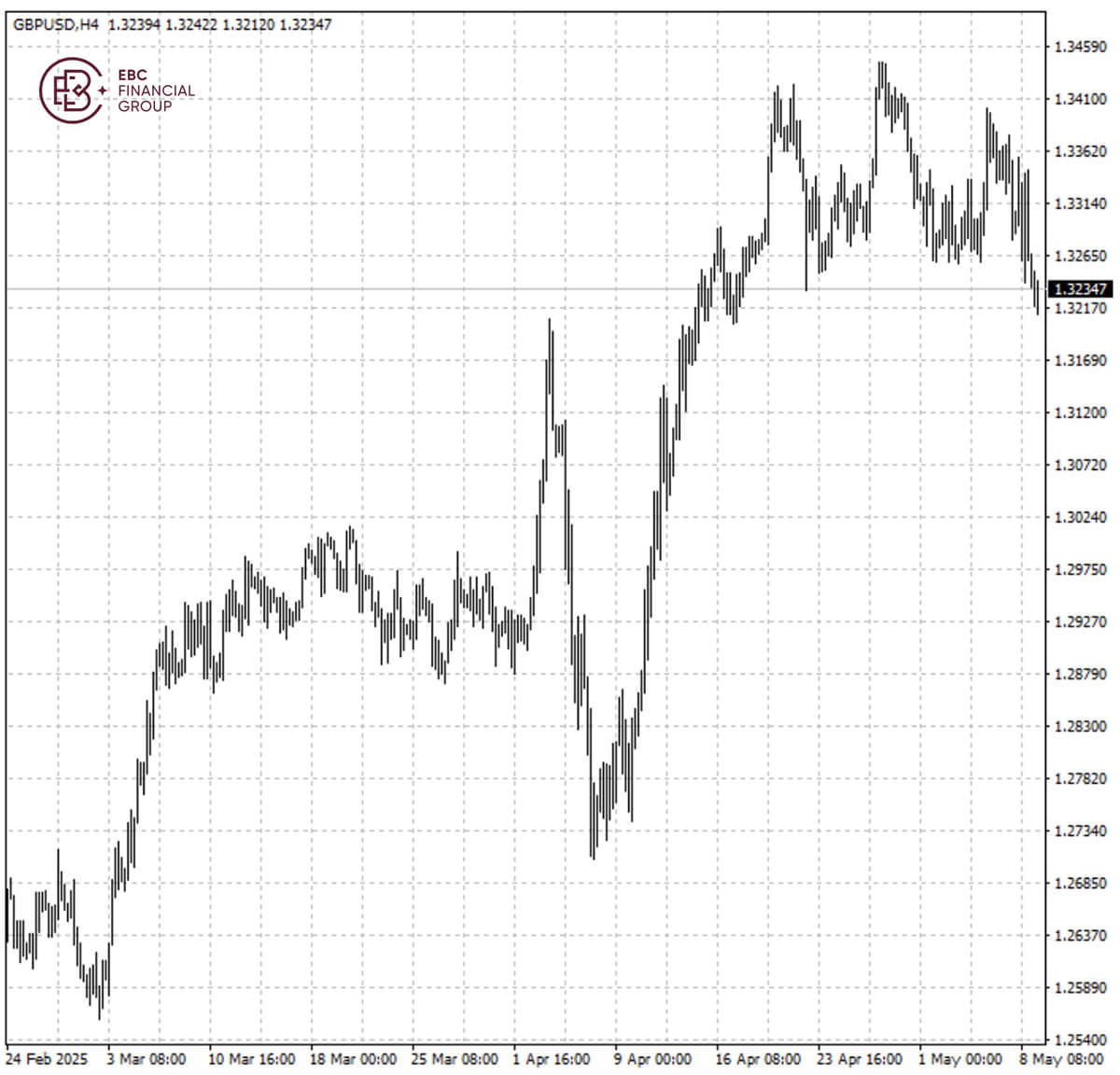

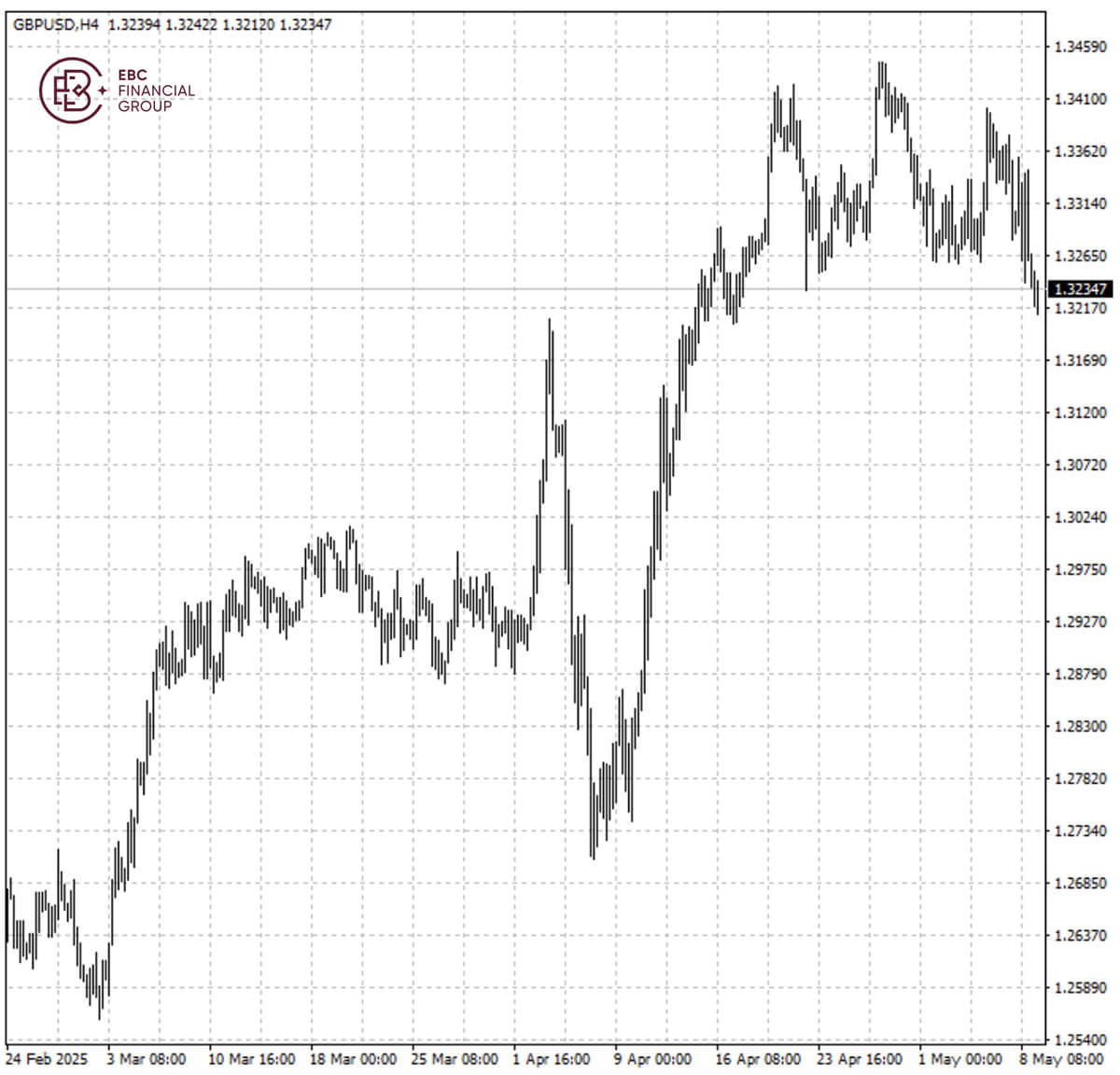

Sterling, which had rallied on news reports of an impending trade deal, gave

back gains when the agreement turned out to be pretty limited and struck a

three-week low of 1.3220 in early trade on Friday.

The US has agreed to reduce import taxes on a set number of British cars and

allow some steel and aluminium into the country tariff-free, while leaving a 10%

duty on most goods from the UK in place.

In exchange, the UK has reduced tariffs on US products including beef and

ethanol, which US commerce secretary Howard Lutnick said would create five

billion dollars in "opportunity for American exports".

The US president had previously described the deal as "full and

comprehensive", but analysts said it did not appear to meaningfully alter the

terms of trade between the countries.

The BOE cut interest rates by a quarter point to 4.25% to cushion the UK

economy against the impact of rising economic uncertainty. Financial markets

expect at least two further quarter-point cuts this year.

Rate setters said Reeves's £25bn increase in employer national insurance

contributions, which came into force last month, would affect employment, wages

and prices, though it remained unclear to what extent.

Sterling is heading lower towards the low around 1.3200 in mid-April. The

basic case scenario is that it will find robust support there, and resume its

uptrend.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.