Oil was set to pare some gains on easing concerns over Middle East supply

risks, although prices rose on Friday as the summer driving season ramped up

fuel demand in the US.

Options markets suggest the probability of a disruption of oil flows through

the Strait of Hormuz is just 4% following the Iran-Israel ceasefire, Goldman

Sachs analysts said in a note on Thursday.

They also show a 60% chance that Brent will stay in the $60s in three months

and a 28% probability they would exceed $70, according to the bank. The

ceasefire deal appeared to be holding.

But Iranian authorities have carried out a wave of arrests and multiple

executions of people suspected of links to Israeli intelligence agencies, which

many fear is a way to silence dissent.

US crude oil and fuel inventories fell more expected last week as refining

activity and demand rose, according to the EIA. Adding to price support, the

dollar index was close to a three-year low.

Asia's crude oil imports surged in June to the highest level in two and a

half years. The rationale could be the low prices in April, when most of the

June arriving cargoes were sold to Asia.

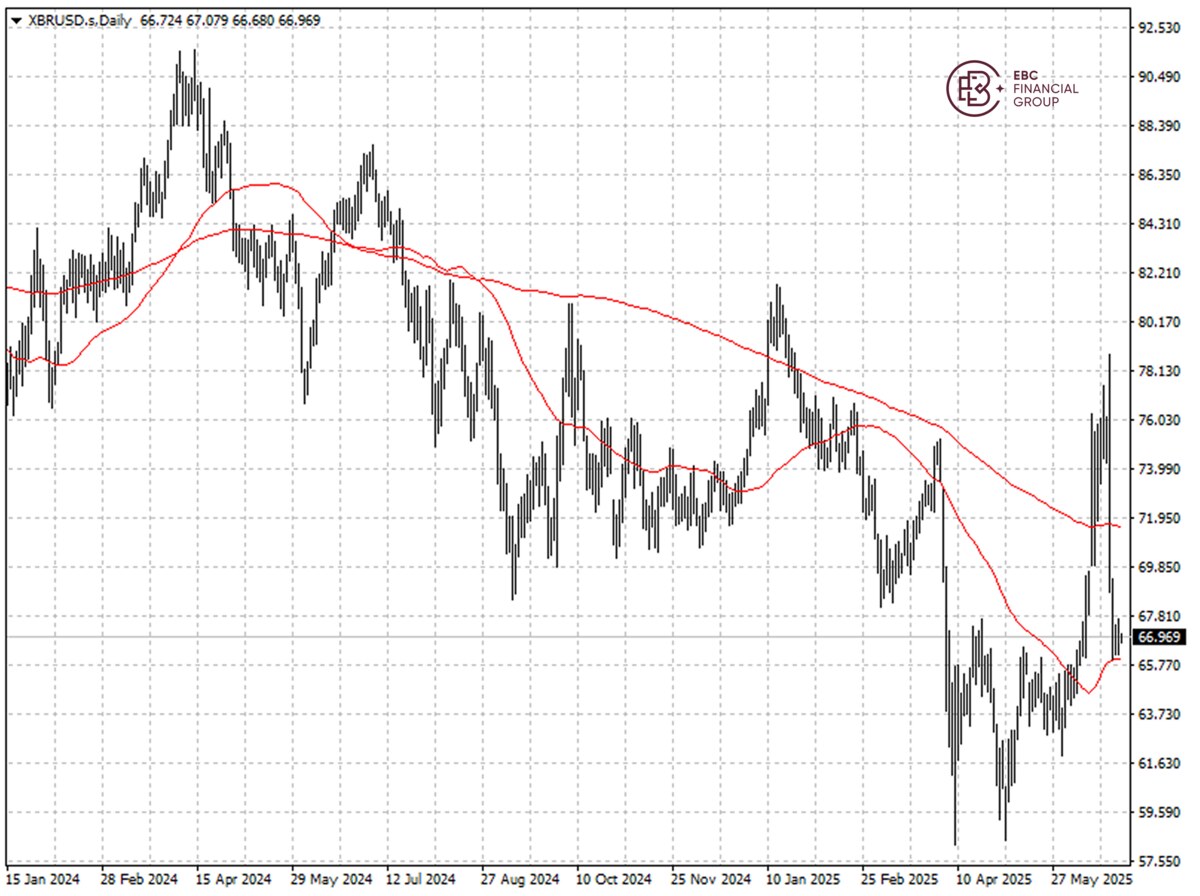

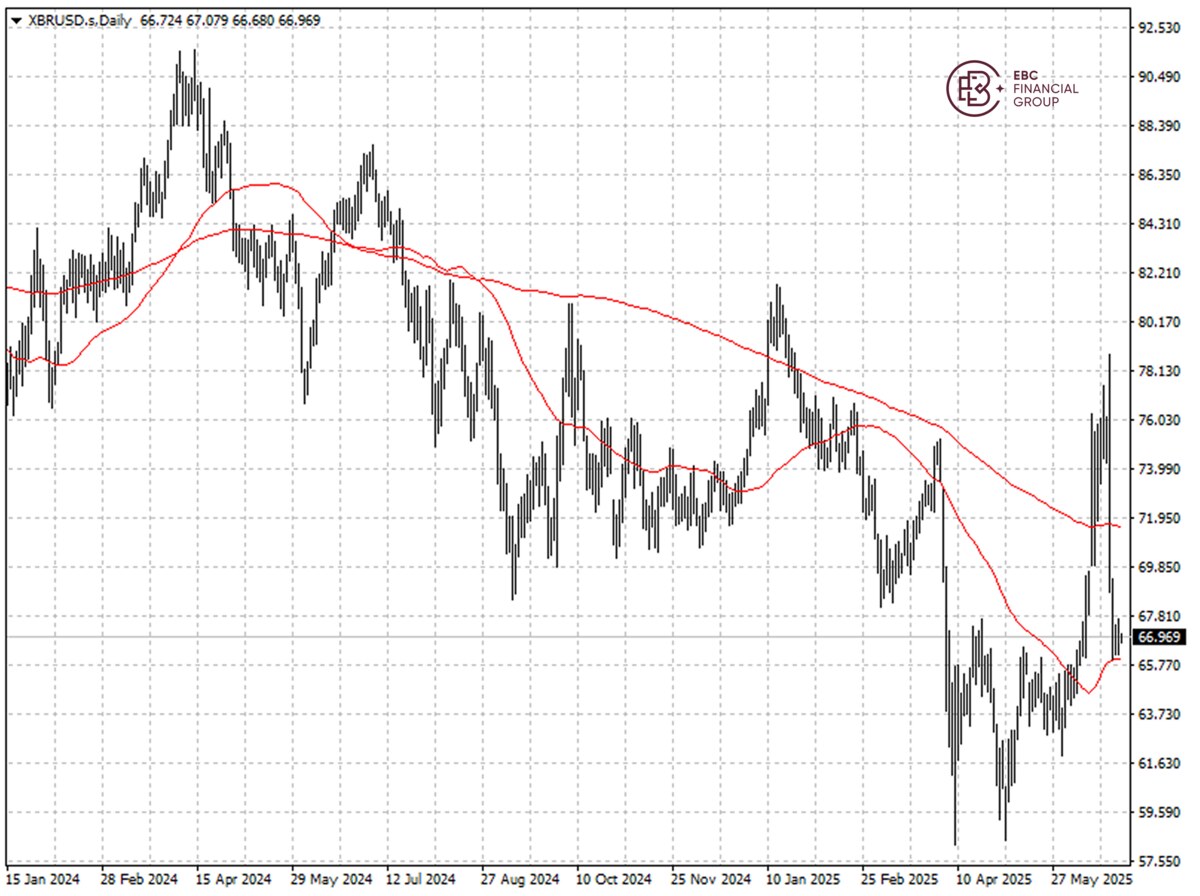

Brent crude has returned to the level before Israel attacked Iran, and 50 SMA

acts as a support. It will likely be bound by a tight range until more clarity

on trade talks, so it is recommended to sell the rally.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.