Australian consumer prices slowed more than expected in May, with core

measure hitting three-and-a-half-year lows. Swaps now imply a 92% probability

that the RBA would cut rates on July 8.

the economy barely grew in Q1 as consumers stayed stubbornly frugal, though

the labour market remained stable. The central bank has cut interest rates twice

since February to spur growth.

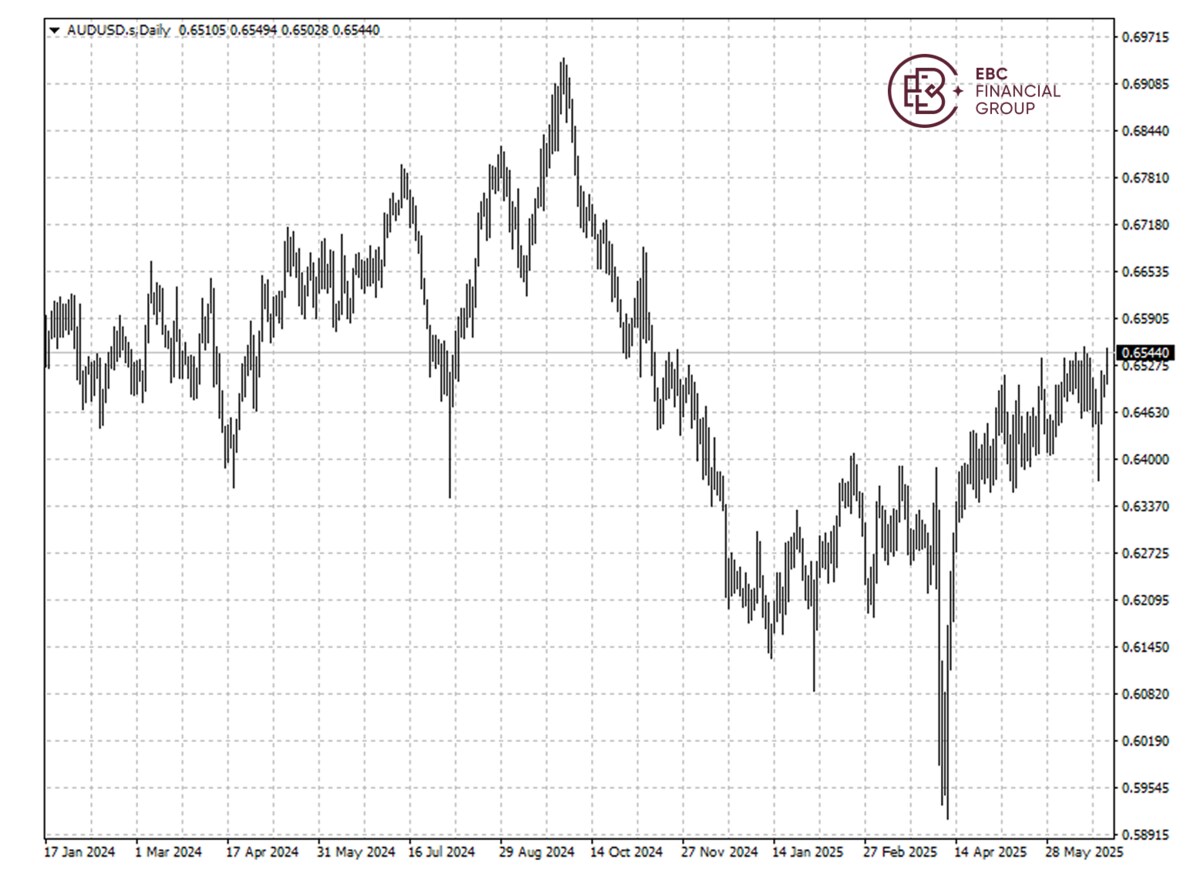

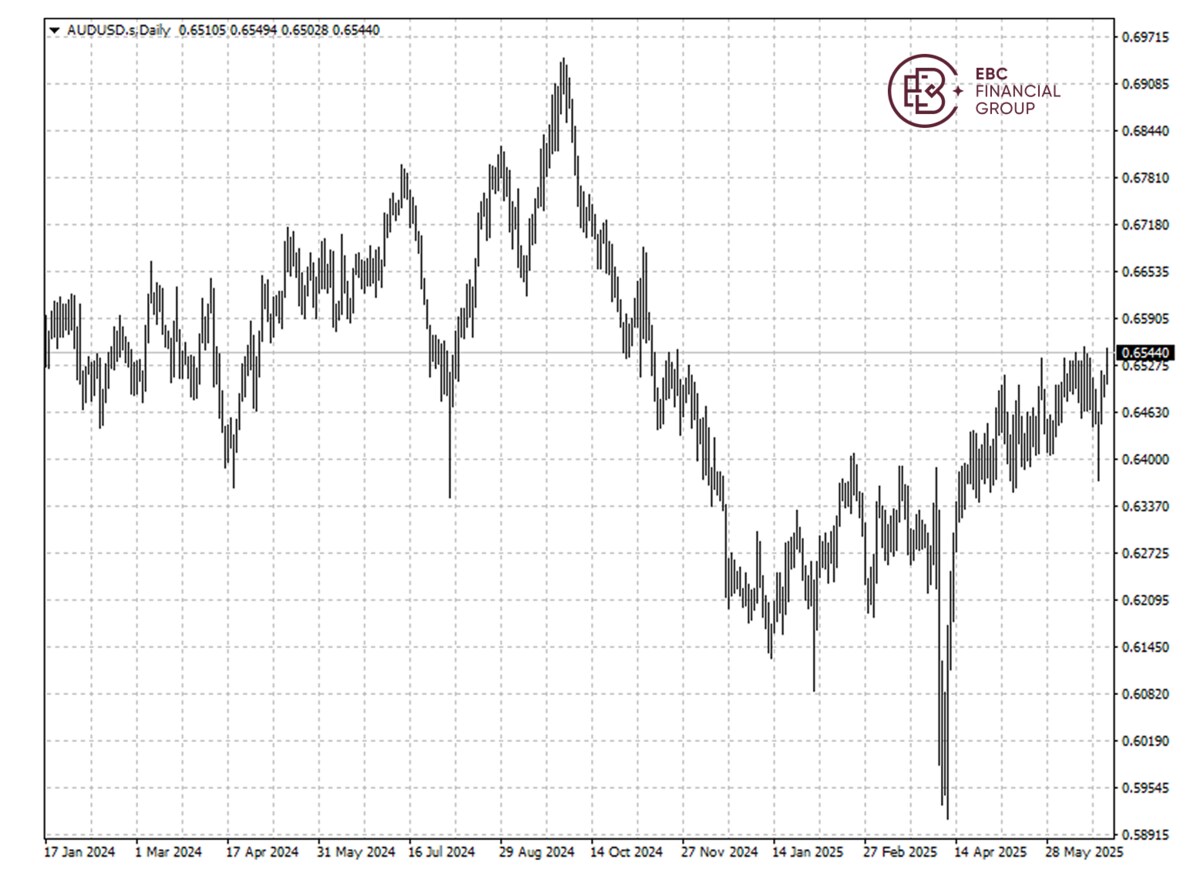

The Australian dollar has gained around 5% in 2025, reversing its weakness

over the previous year. It registered the biggest annual loss since 2018 back

then as upcoming MAGA 2.0 spooked traders.

The currency has been battered for three years in a row, partly due to peak

China housing. Iron ore, the raw material used to produce steel, has seen its

supercycle end with a whimper.

The pains seem to be drawn-out. Due to seasonal demand weakening and

expectations of production cuts by Chinese steel mills, the commodity are

approaching their lowest price levels since September.

Citigroup has reduced the three-month price forecast from $100 per ton to

$90, and lowered the 6-12 month target from $90 per ton to $85. That means the

downtrend will likely persist.

On the other hand, grain-fed beef exports to China have ballooned more than

40% year to date. Growing middle class and rising incomes are making beef a more

popular source of protein for the large population.

Asia resilience

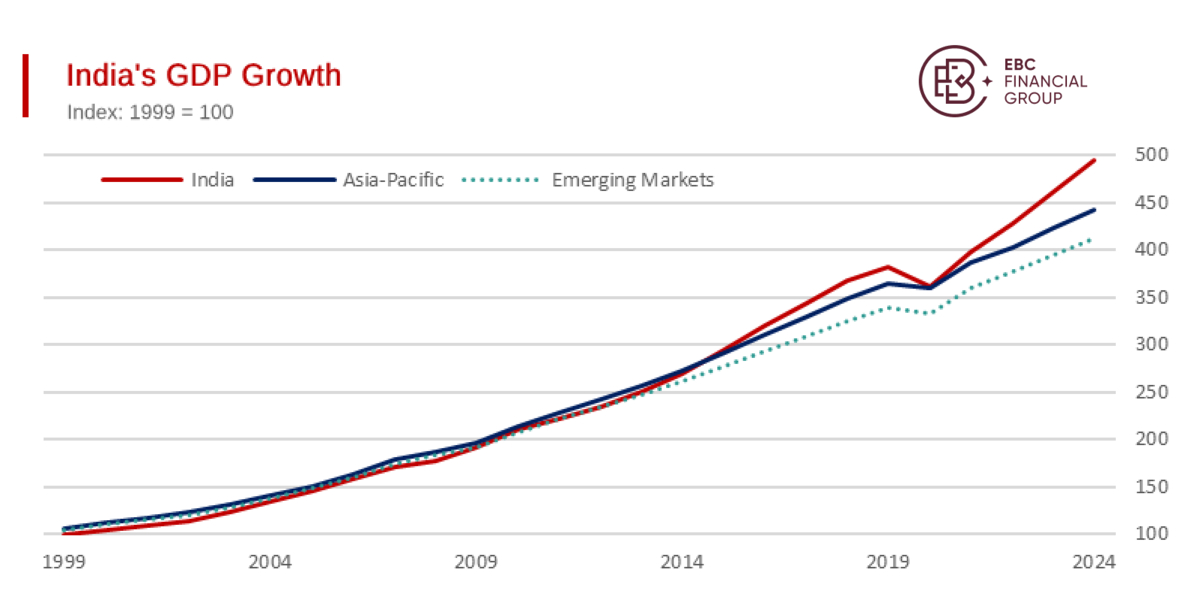

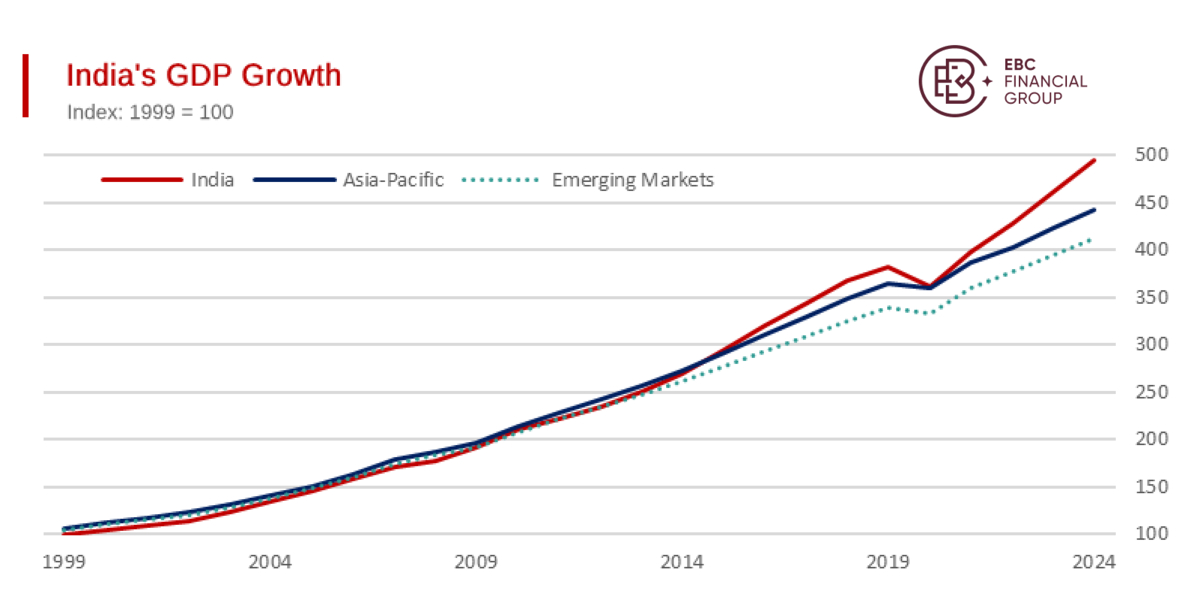

India's economy is projected to grow at 6.5%in the current fiscal year,

driven by strong domestic demand and potential monetary easing, according to a

report by S&P Global Ratings.

Falling food inflation, which slowed to the level last seen on October 2021

in May, has contributed to attempted disinflation in the country, giving

policymakers more leeway to be more dovish.

The report also observed that many Asia-Pacific economies began 2025 with

strong domestic demand. Several economies temporarily benefited from

front-loaded exports to the US ahead of tariff changes.

The agency projects GDP growth of 4.3%t for China in 2025. While it falls

short of official target, the report described them as "solid results" given the

current external challenges.

Nomura has lift the full-year growth projection for the worlds' second

largest economy to 3.7%, while waning of a double whammy due to the prolonged

housing slump and possibility of rising trade tensions.

The overall positive picture gratifies Australia whose export relies

increasingly heavily on the region following Trump's sweeping tariffs. It is one

of a long list of countries holding trade talks with Washington.

Australia and the EU have revived talks for a sweeping free trade agreement

this month. The main obstacle is some big meat-producing EU members have

reservations about opening the markets.

Restricted demographic bonus

Australia's population grew 1.7% last year to 27.4 million people, only next

to Canada among rich countries, which will result in more spending, more

housing, more demand for infrastructure.

Despite that, labour productivity – which is the key determinant of living

standards in the long run – has essentially stalled since 2016. Very few OECD

members have fared worse, according to McKinsey.

The lack of productivity growth means that on a good day, the best Australia

can hope to grow is 2% per year, according to HSBC chief economist Paul Bloxham.

The rate is presumably lower than the US's.

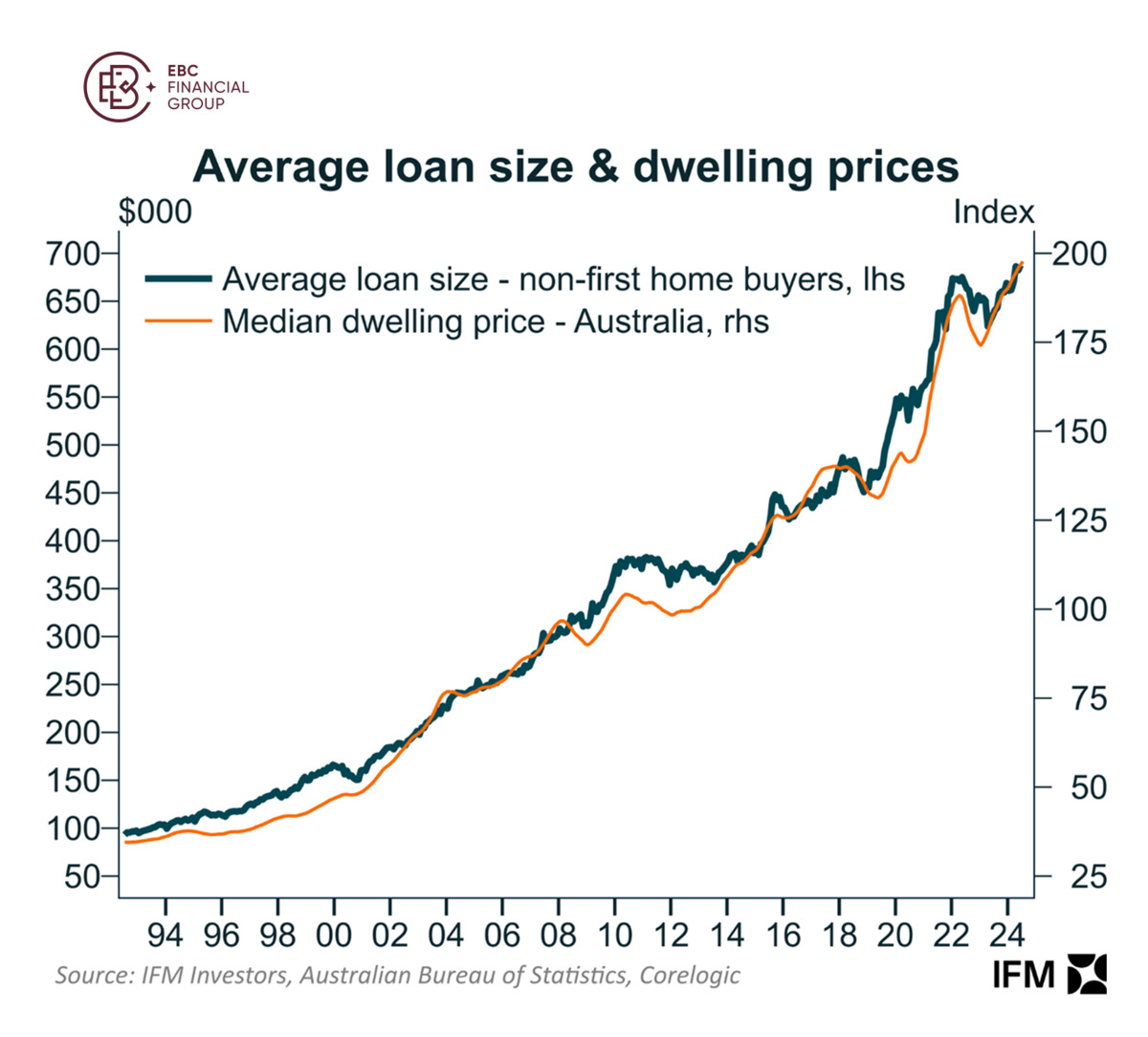

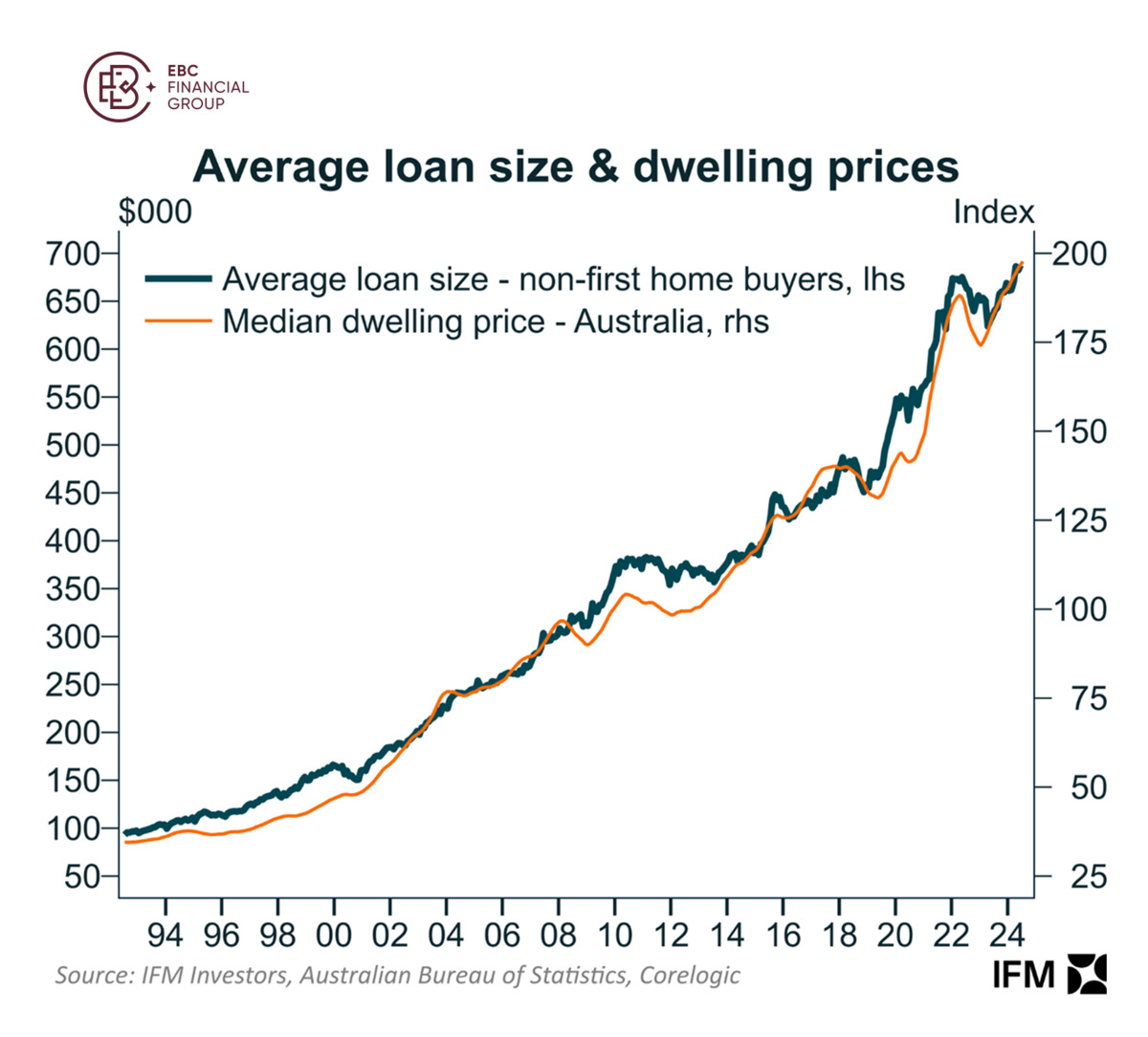

Some argued that the country's property obsession has diverted capital away

from the productive economy. Australians are drowning in debt, taking out

ever-larger mortgages to pay ever-higher home prices.

Once the envy of the developed world, the economy is growing at its slowest

pace since the early 1990s, excluding the COVID-19 pandemic, and lagging many of

its peers largely due to lacklustre consumption.

A Westpac survey showed consumers stuck in a holding pattern of cautious

pessimism in June. Commonwealth Bank senior economist Belinda Allen said it

could take multiple rate cuts for sentiment to improve.

Even exports could be only moderately affected by tariffs and a subdued iron

ore market, underwhelming investment and household spending point to limited

Aussie upside for the rest of the year.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.