Global stocks gained ground, hitting their highest level in more than a year

on Monday, while U.S. Treasury yields and the dollar were virtually

unchanged.

However, oil fell around 4% with Brent Crude futures closing at their lowest

level since December 2021 on concerns about weak demand and rising global

supplies, with rate uncertainty and inflation data added to worries.

Gold prices dipped as the dollar and bond yields firmed, while traders braced

for a busy week of key U.S. inflation prints and the Fed’s meeting.

Commodities

Goldman Sachs cut its oil price forecasts early on Sunday, citing

higher-than-expected supplies later this year and through 2024.

The bank's December crude price forecast now stands at $86 a barrel for

Brent, down from $95, and at $81 a barrel for WTI, down from $89.

The OPEC and the IEA will each release their monthly market updates on

Tuesday. China’s lackluster recovery is weighing on oil demand.

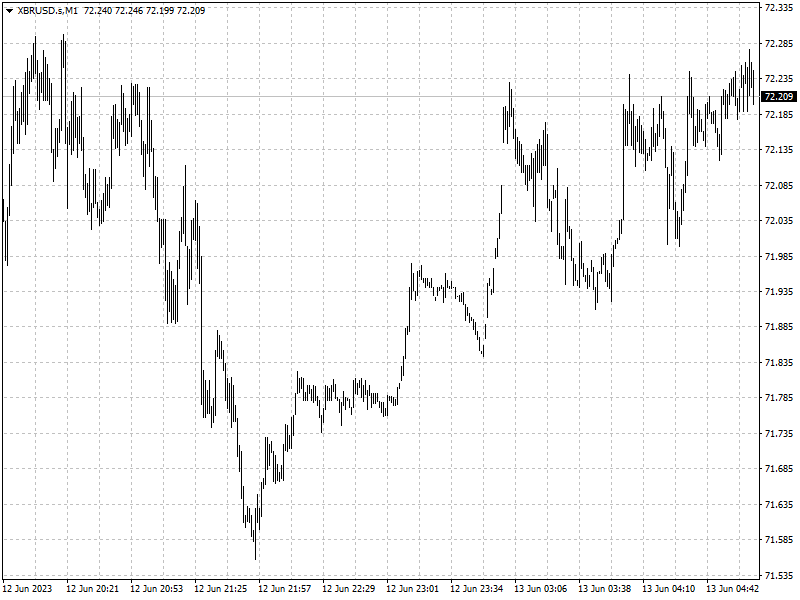

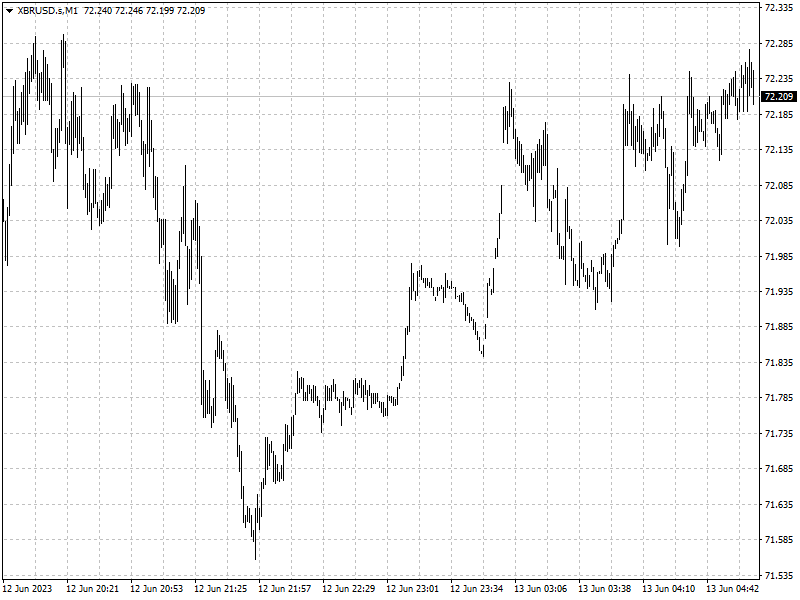

Forex

Traders are pricing in a roughly 75% chance of the Fed keeping rates steady,

and a 25% chance of a 25-basis-point rate hike, according to the CME FedWatch

tool.

Conversely, a clear majority of economists polled by Reuters expect the ECB

to hike its key rate by 25 basis points on Thursday and again in July, before

pausing for the rest of the year as inflation remains sticky.

The RBBZ last month signaled it was done tightening after raising rates to

the highest in more than 14 years at 5.5%, sending the kiwi tumbling 2.7% in

May.