Gold prices traded above $3,100 on Tuesday amid strong upside momentum, as

uncertainty around tariffs that would stoke inflation and hinder economic growth

lifted safe-haven demand.

The White House confirmed that Trump will impose new tariffs on Wednesday,

though it provided no details about the size and scope of trade barriers. Other

countries have threatened countermeasures.

Bullion has gained around 19% so far this year, after rising more than 27% in

2024, supported by a favourable monetary policy backdrop, robust central bank

buying and demand for ETF.

BofA has raised its gold period average forecasts for this year and next to

$3,063 and $3,350. It noted that central banks currently hold about 10% of their

reserves in gold, and could raise this figure to over 30%.

However, the bank added that US fiscal consolidation, reduced geopolitical

tensions, and a return to collaborative inter-governmental relations, including

more targeted tariffs, are key risks to bullion's rally.

Goldman Sachs also raised its forecast range to $3,250-$3,520 from

$3,100-$3,300 earlier, according to its research note. It expects large Asian

banks to continue aggressive gold purchases in the years ahead.

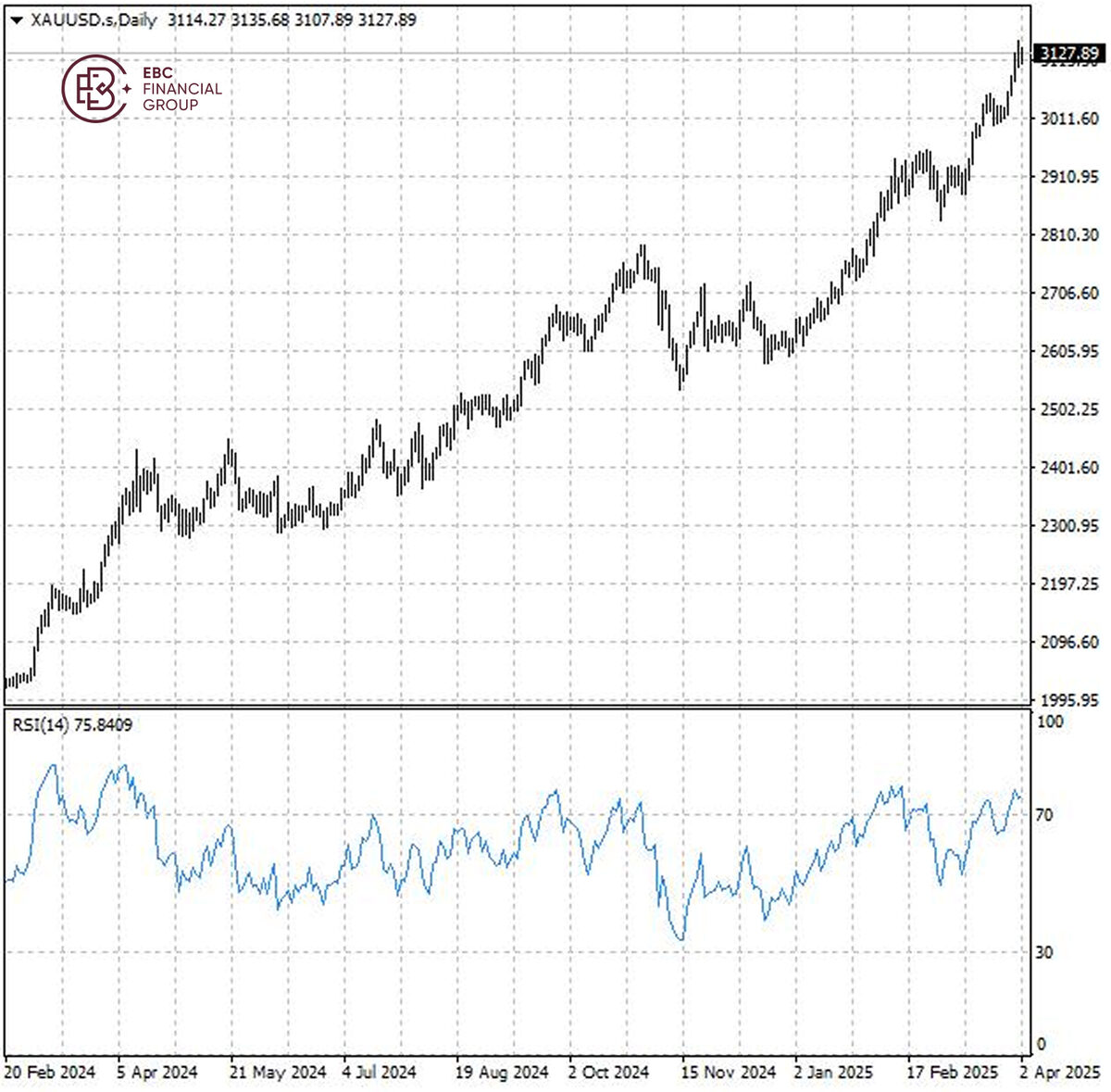

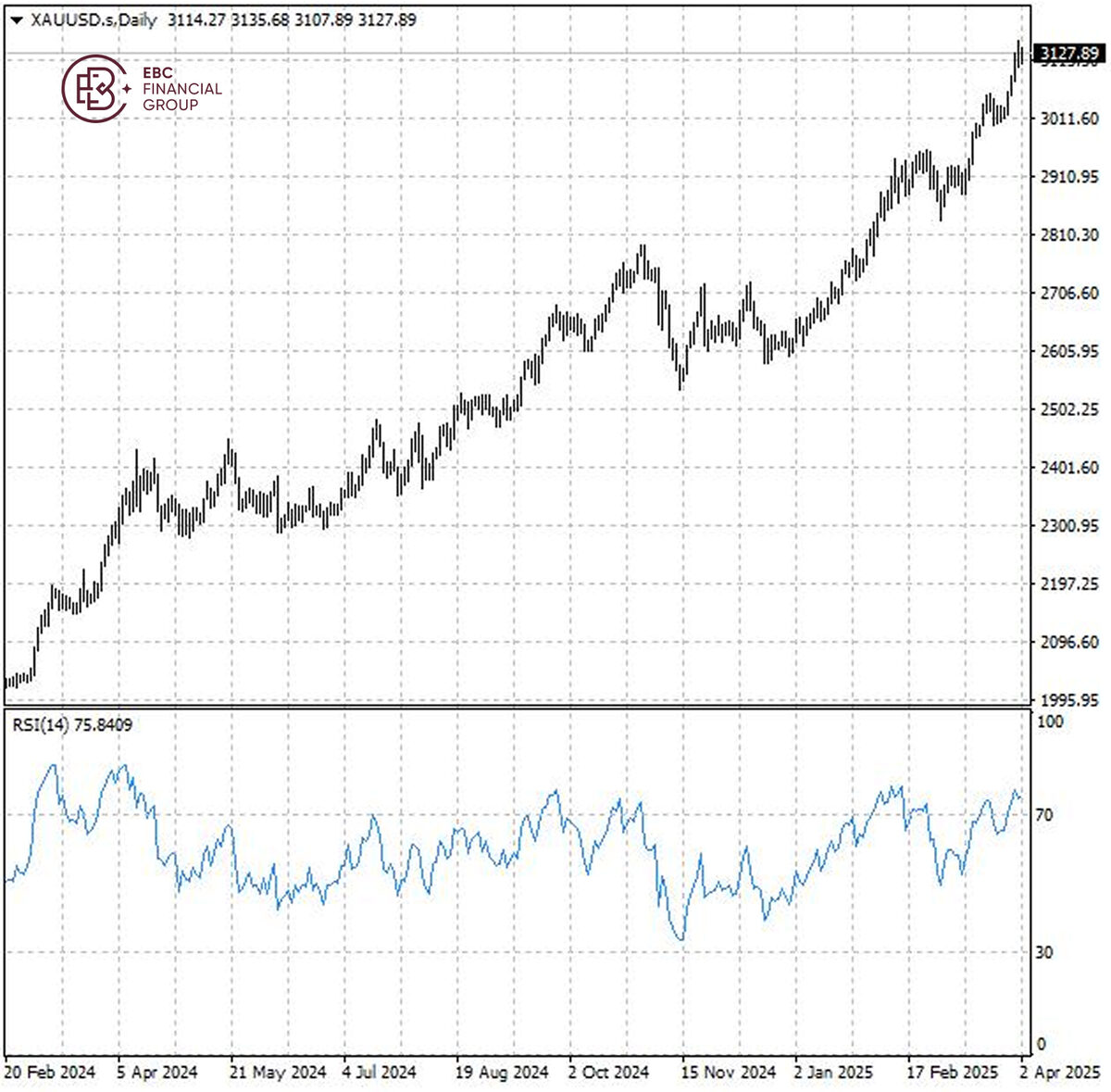

Bullion's RSI stands well above 70, indicating the market is overbought.

Therefore, it could retest $3,150 before a moderate pullback towards $3,100.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.