Gold hit its fresh record high in early Asian trade on Monday, buoyed by

likely safe-haven demand after Trump's plan to replace Powell could throw into

question the independence of the Fed.

Trump said Powell's termination "cannot come fast enough" as he called for

the Fed to cut interest rates. Trump's sweeping tariffs have added to

uncertainty around disinflation process.

The most recent consumer sentiment survey out of the University of Michigan

saw expectations of inflation one year from now to be the highest since 1981,

which barely underpins the view that rate cuts are needed.

Fed funds futures have priced in a more than 90% likelihood that the central

bank holds rates steady again at its policy meeting next month, according to

CME's FedWatch tool, draining Trump's patience.

Powell has said previously that he cannot be fired under law and intends to

serve through the end of his term as chair in May 2026. He also said Trump is

"likely to move us further away from our goals."

RBC BlueBay Asset Management has opened short positions on the dollar,

betting on the end of US exceptionalism. The fund long the dollar at the

beginning of the year but has now turned bearish.

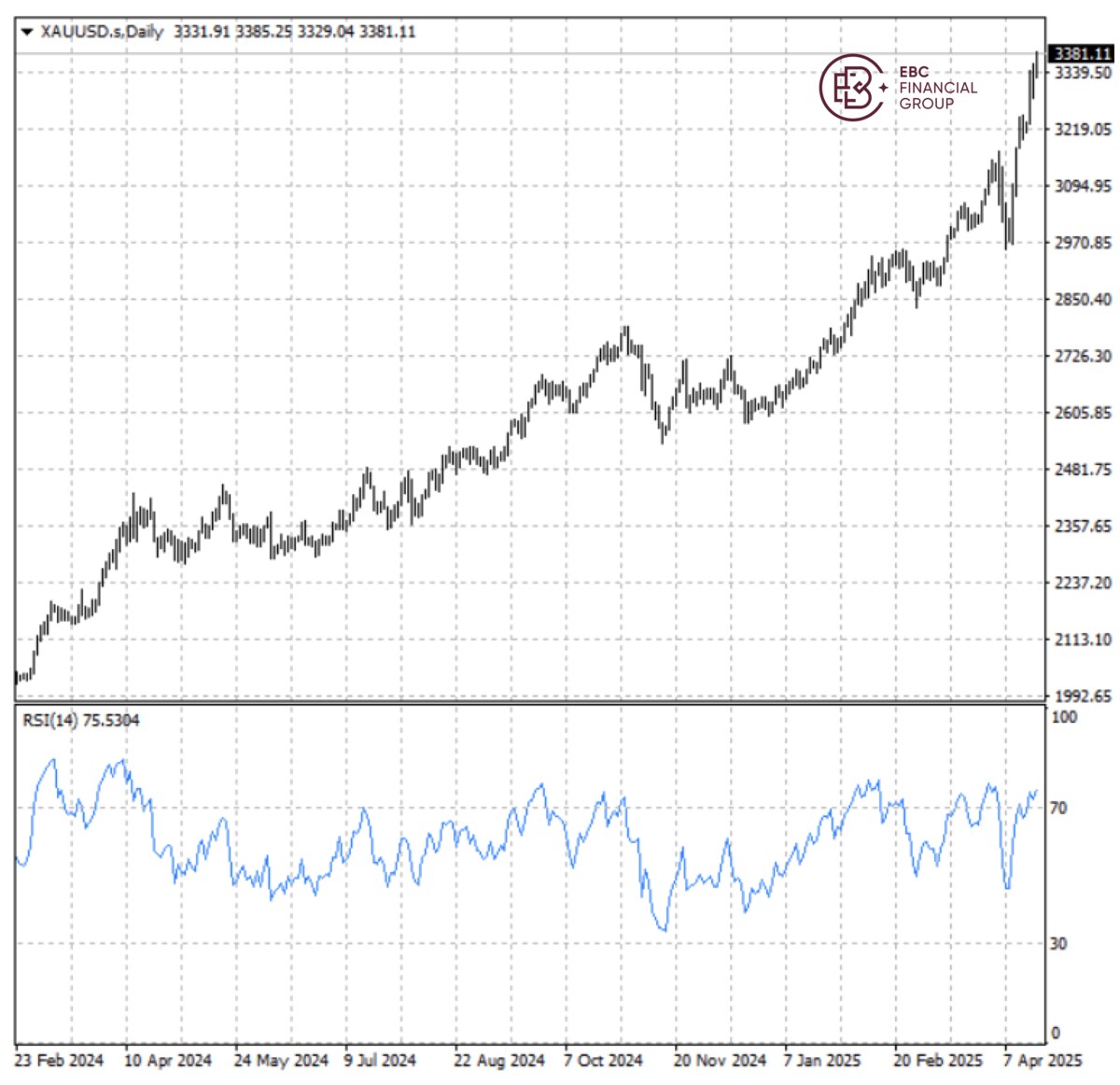

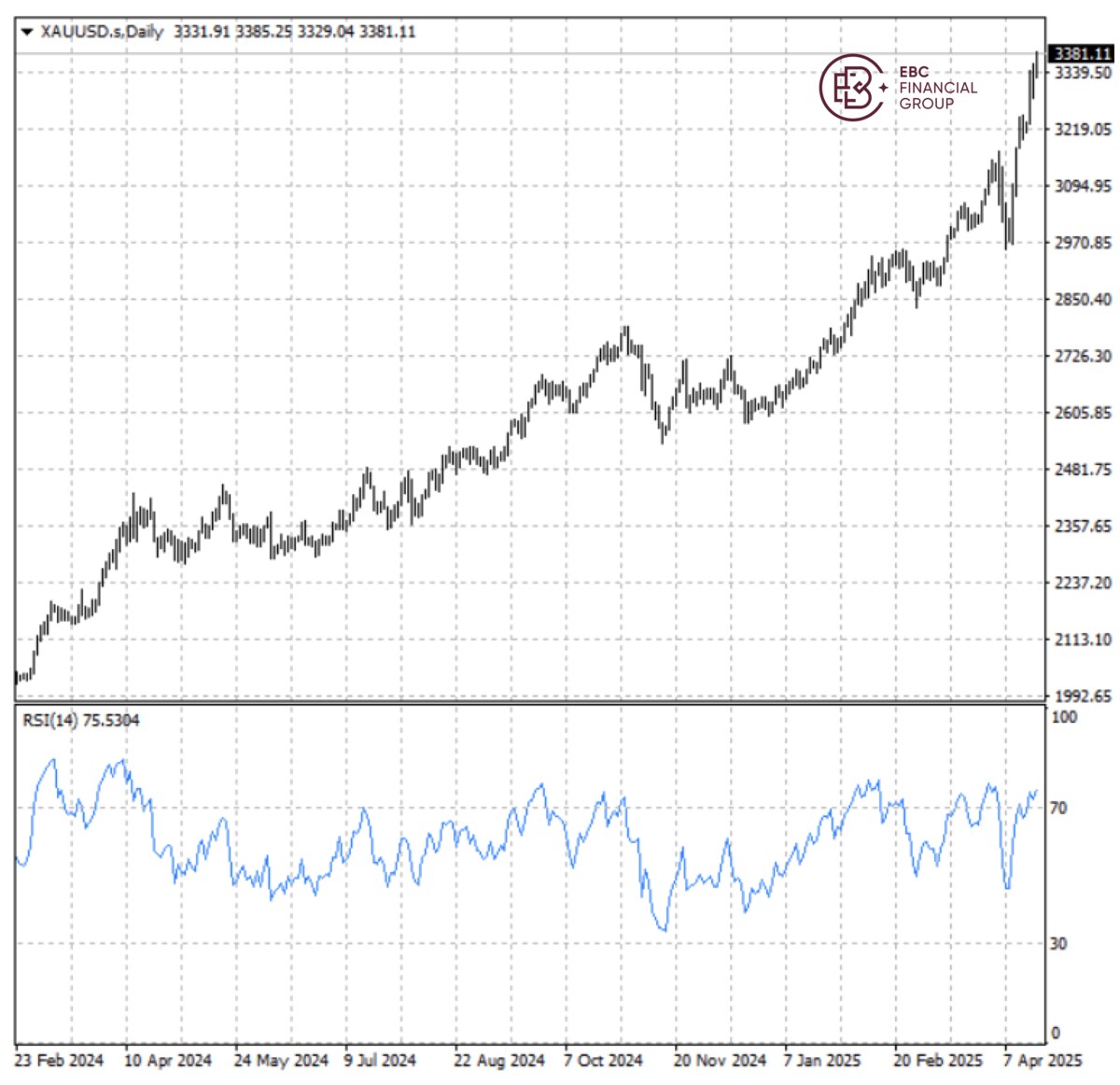

Bullion has been unstoppable and any dip proved to be a buying opportunity.

With RSI well above 70, it is less risky to wait for pullback to build long

positions rather than short at the point.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.