The australian dollar dived to five-year lows on Monday, slammed by fears

that a tit-for-tat global trade war would send the global economy into a

recession, which had some traders bet on outsized rate cuts Down Under.

China - Australia's largest trading partner – was the worst hit by Trump's

latest tariffs. The Antipodean country's three-year government bond yields

tumbled to the lowest since May 2023.

Markets see a 20% chance that the RBA could even deliver a big 50-bp rate cut

in May, having just held steady last week. The central bank is waiting for more

data to be sure inflation is heading in the right direction.

It did note that vulnerabilities could build if an easing in financial

conditions encourages households to take on excessive debt. Home prices rose to

record highs in March following the February rate cut.

Even before the tariff shock, government said mining and energy export

earnings could fall 6% in the financial year through June and "further modest

falls in earnings are likely over the five-year outlook."

Iron ore will remain the mainstay of Australia's commodity exports, but the

prices are increasingly vulnerable. The exports to China from Australia's Port

Hedland fell by 14.8% in February.

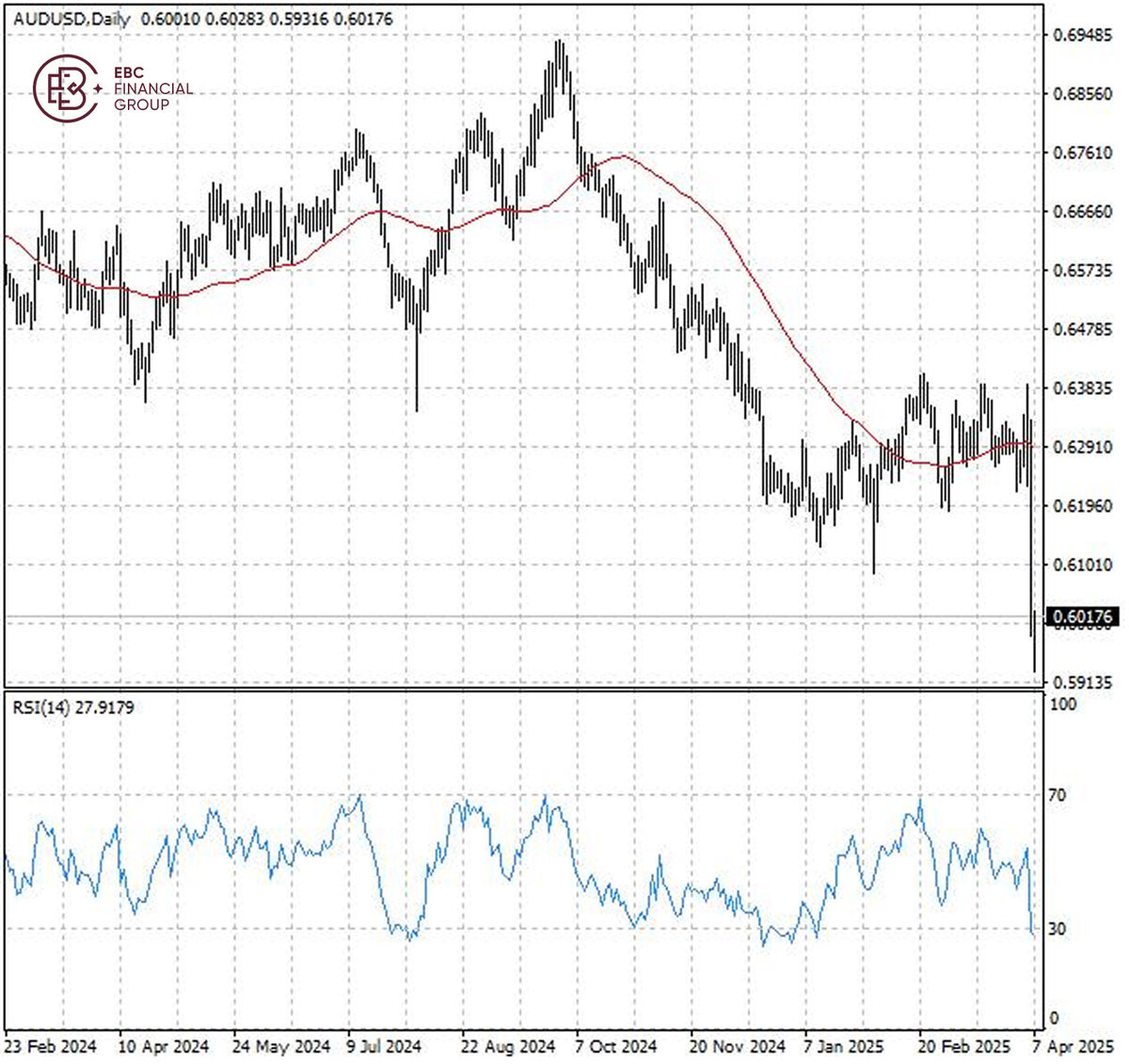

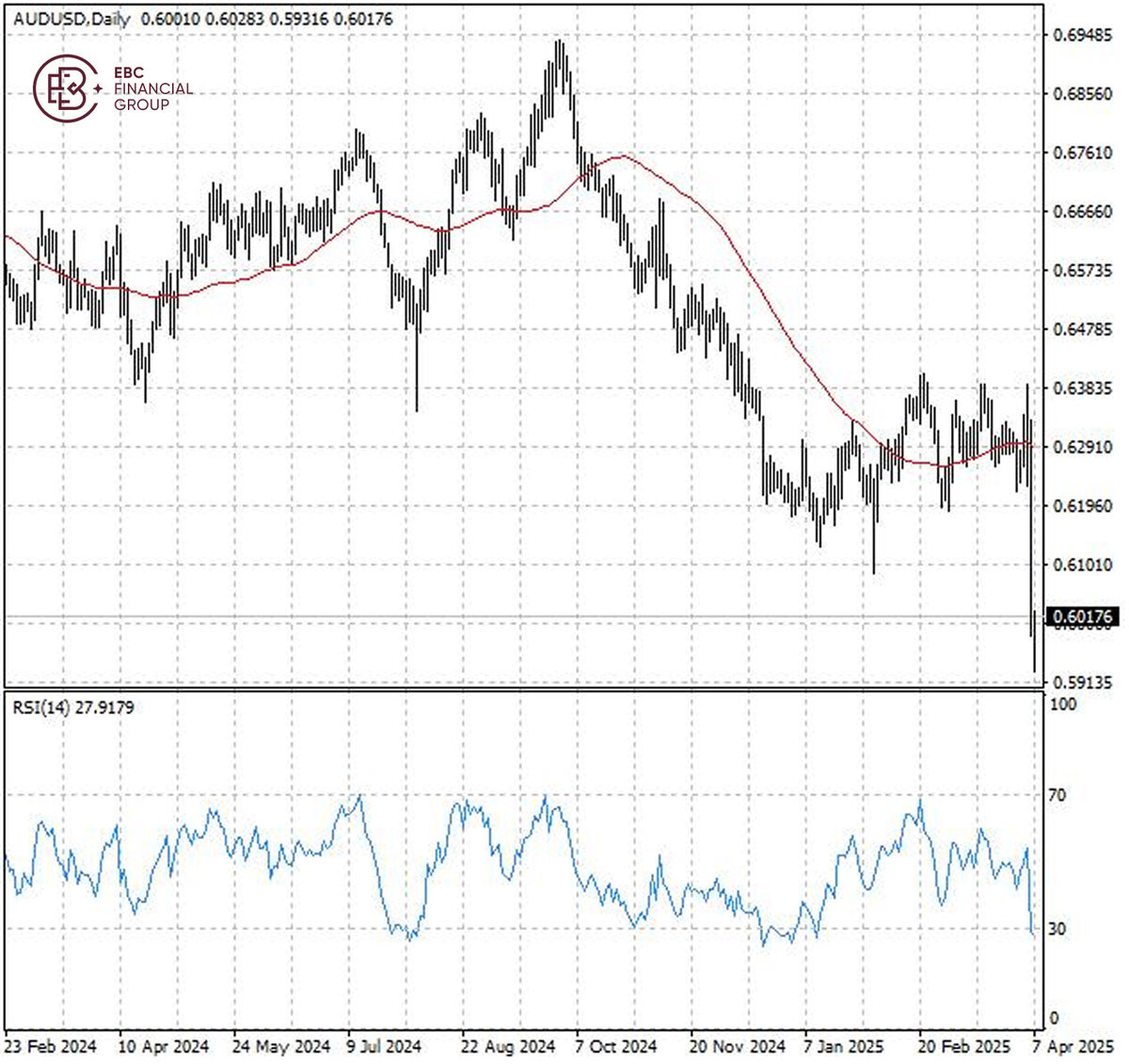

The Aussie dollar broke below 50 SMA decisively amid signs of oversold

condition. The next major level that may provide some support is seen at the low

around 0.5980 hit in March 2020.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.