The yen to CAD (JPY/CAD) currency pair offers active traders a wealth of opportunities, thanks to its unique blend of safe-haven and commodity currency dynamics. With 2025 bringing renewed volatility and shifting central bank policies, mastering effective strategies is essential for those looking to profit from this forex pair.

Understanding the Yen to CAD Pair

The yen to Canadian dollar exchange rate reflects the comparative strength of Japan's yen—a traditional safe-haven currency—and Canada's dollar, which is closely tied to commodity prices, especially oil.

As of June 2025, the exchange rate has ranged between 0.0095 and 0.0098 CAD per yen, with notable swings driven by interest rate changes, economic data, and global risk sentiment.

Best Strategies for Active Traders Trading Yen to CAD

1. Carry Trade: Exploiting Interest Rate Differentials

One of the most popular strategies for the yen to CAD pair is the carry trade. Historically, the Japanese yen has been used as a funding currency due to its low or even negative interest rates. In contrast, the Canadian dollar often offers higher yields, making the pair attractive for carry traders.

How it works:

Traders borrow yen at low rates and invest in CAD-denominated assets with higher yields.

Profits are generated from the interest rate differential, in addition to any favourable currency moves.

2025 Outlook:

With the Bank of Japan considering policy tightening and the Bank of Canada maintaining relatively higher rates, traders need to monitor central bank decisions closely.

Rapid unwinding is a risk if the yen strengthens suddenly, so adaptive risk management is crucial.

2. Technical Analysis: Spotting Trends and Triggers

Technical analysis remains a cornerstone for active traders in the yen to CAD market. Popular tools include:

Moving Averages: Crossovers can signal trend changes; for example, a short-term average crossing above a long-term average may indicate a bullish move.

Relative Strength Index (RSI): Identifies overbought or oversold conditions.

Support and Resistance: Key price levels (e.g., recent highs/lows between 0.0091 and 0.0098) help traders set entry and exit points.

Candlestick Patterns: Reversal formations, such as head-and-shoulders or engulfing patterns, can provide early signals for market turns.

Tip: Combine multiple indicators for confirmation and use alerts to react quickly to technical triggers.

3. Fundamental Analysis: Watching Economic Drivers

Fundamental analysis is vital for understanding the broader forces behind yen to CAD moves:

Oil Prices: The Canadian dollar often tracks oil prices, so strong oil markets can boost CAD against the yen.

Economic Data: Key releases include GDP, employment, and inflation figures from both Japan and Canada.

Central Bank Announcements: Policy statements from the Bank of Japan and the Bank of Canada can trigger sharp moves.

Traders should follow the economic calendar and be prepared for volatility around major data releases.

4. Day Trading and Swing Trading

Day Trading: Involves making multiple trades within a single session, capitalising on intraday volatility. Watch for news events and technical breakouts.

Swing Trading: Positions are held for several days to weeks, aiming to capture larger price swings. This strategy works well when the pair is trending or range-bound.

Tip: Use stop-loss and take-profit orders to manage risk and lock in gains.

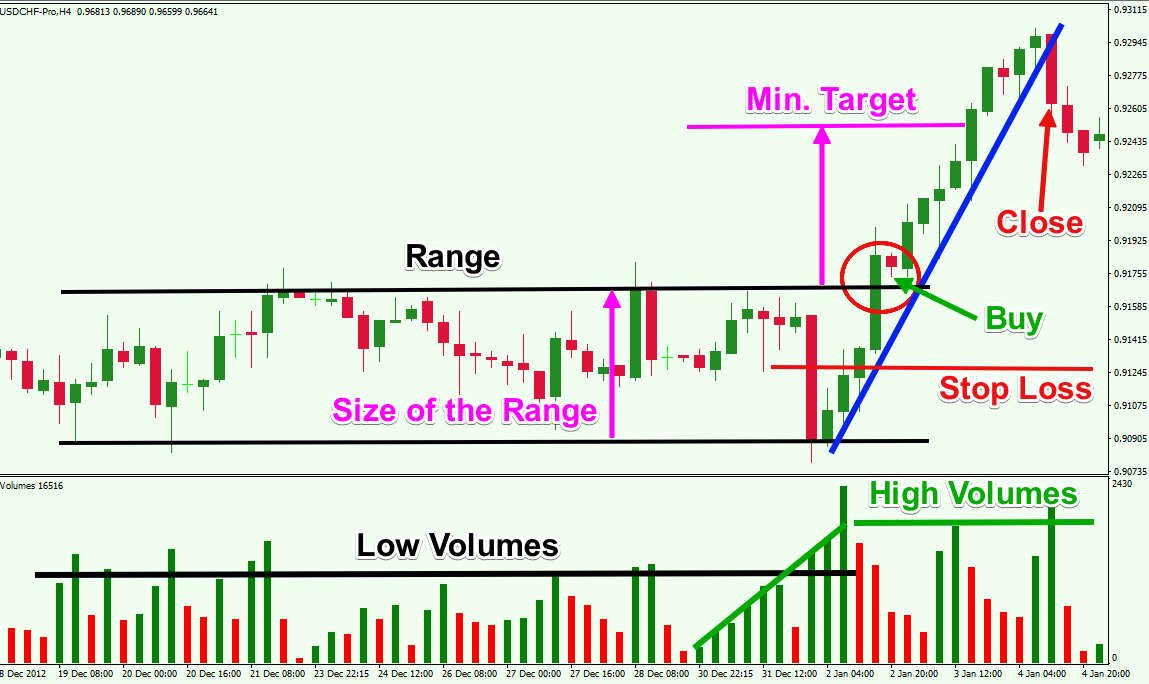

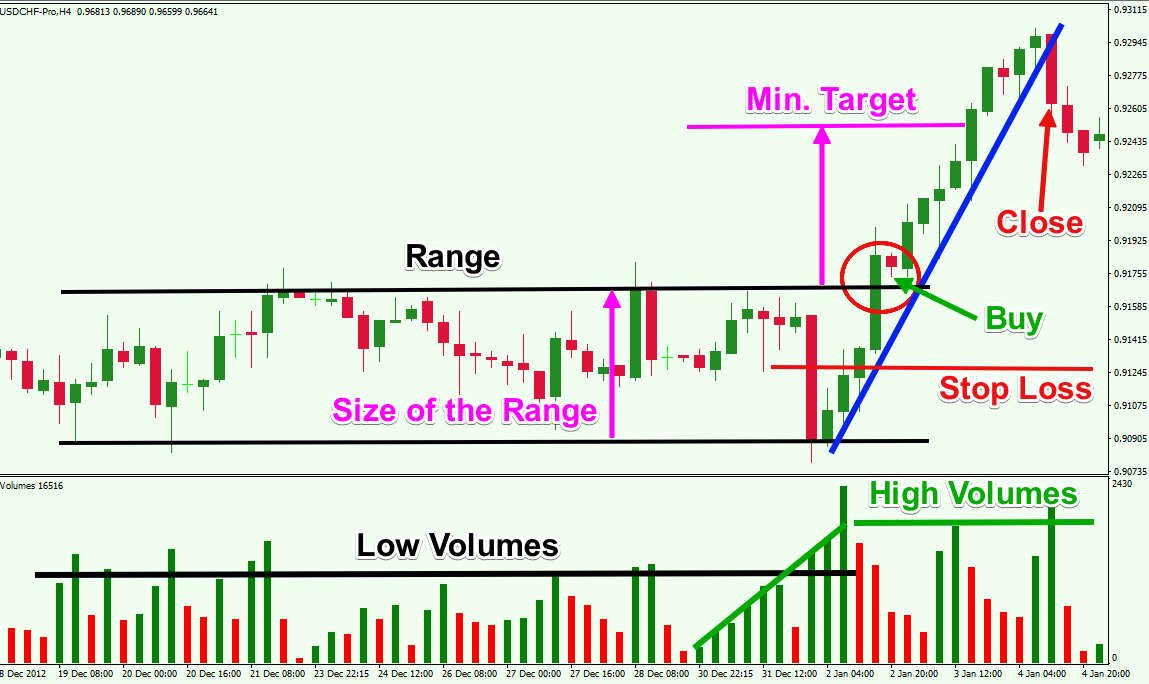

5. Range and Breakout trading

Range Trading: When yen to CAD is moving sideways, traders can buy at support and sell at resistance.

Breakout Trading: Enter trades when the pair breaks out of established ranges, often following major news or economic releases.

Example: If the pair breaks above 0.0098 after a strong Canadian jobs report, a breakout strategy could capture the upside momentum.

6. Volatility and Options Strategies

With heightened volatility in 2025, options-based strategies such as straddles or volatility swaps can be attractive. These allow traders to profit from large moves in either direction, regardless of trend.

7. Risk Management: Protecting Your Capital

No strategy is complete without robust risk management:

Position Sizing: Only risk a small percentage of your trading capital on each trade.

Stop-Loss Orders: Set stops to limit losses if the market moves against you.

Trading plan: Have a clear plan for entry, exit, and risk before each trade.

Maintaining discipline and avoiding emotional decisions are key to long-term success.

Conclusion

The yen to CAD pair presents a rich landscape for active traders, offering opportunities through carry trades, technical and fundamental analysis, and volatility strategies.

By combining these approaches with sound risk management and staying alert to market-moving events, traders can navigate the pair's unique dynamics and capitalise on its swings in 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.