Market Context: Energy Against the Broader Equity Tide

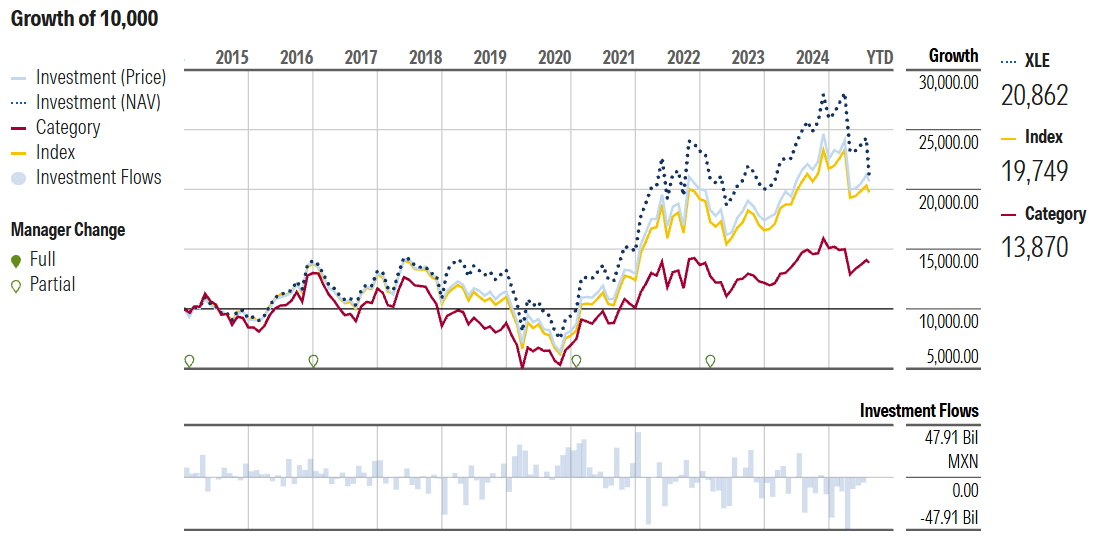

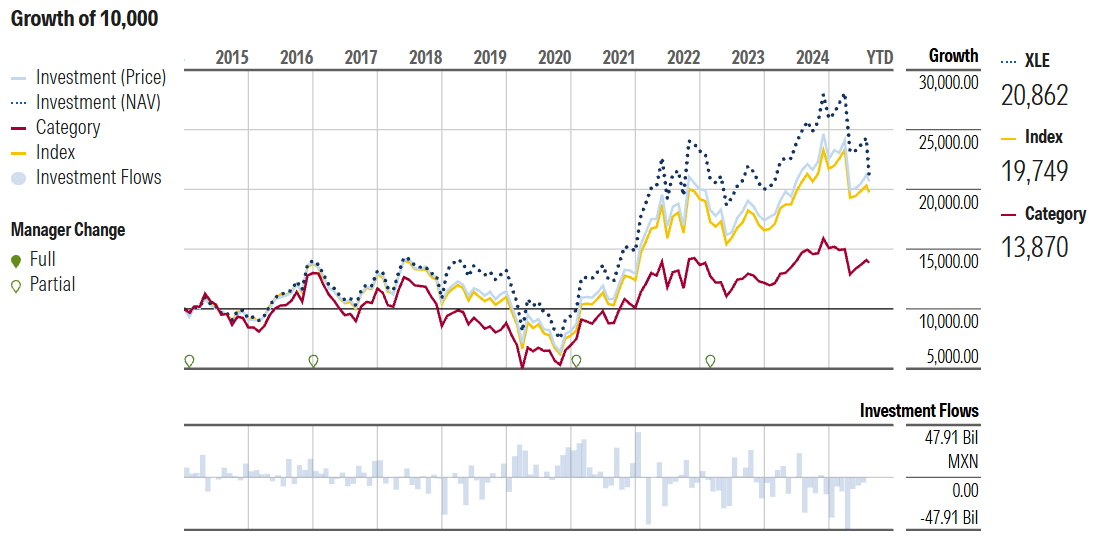

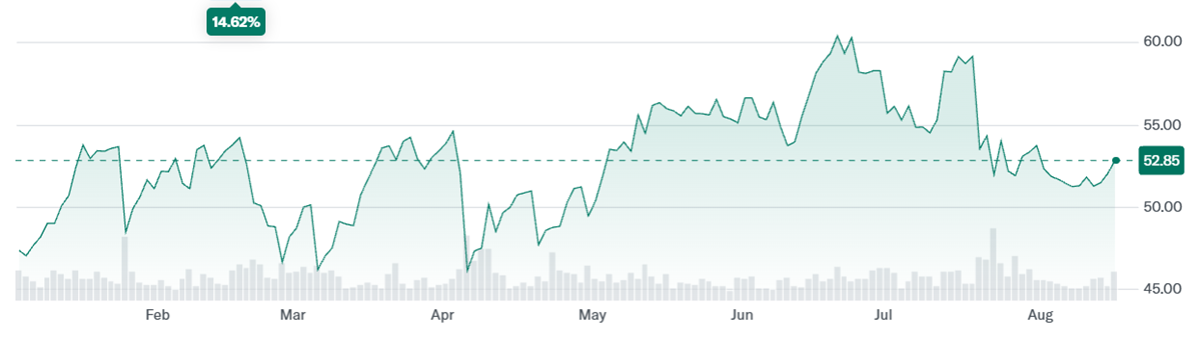

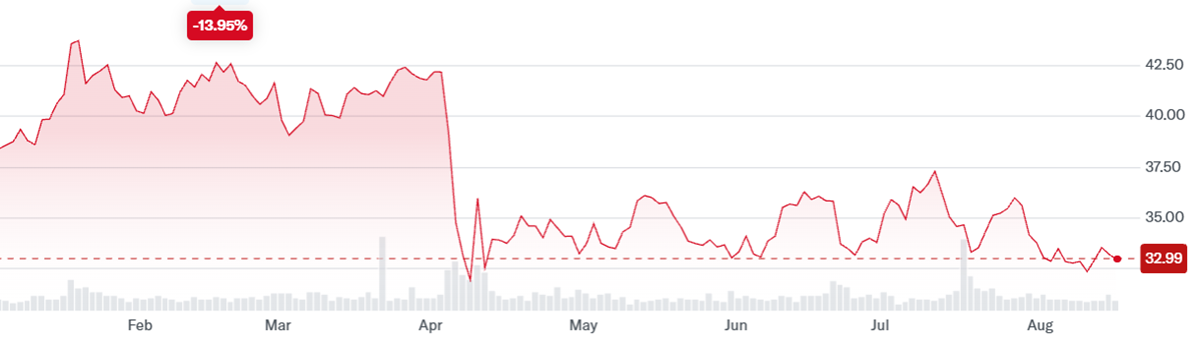

The Energy Select Sector SPDR Fund (XLE) remains the flagship vehicle for investors looking to access U.S. energy giants in one trade. As of 31 July 2025. the fund has returned +3.45% year-to-date, although its one-year performance stands at –3.36%. By comparison, the S&P 500 has gained nearly 10% YTD as of mid-August, underscoring the sector's relative underperformance in a year when technology and growth shares have dominated.

This divergence raises a critical question: if energy stocks are lagging the market, why do institutional and retail investors alike continue to hold XLE in such size (AUM: $26.29 billion)? The answer lies in the fund's role as both a cyclical bet and a defensive anchor.

The Structure of XLE: Concentrated Yet Powerful

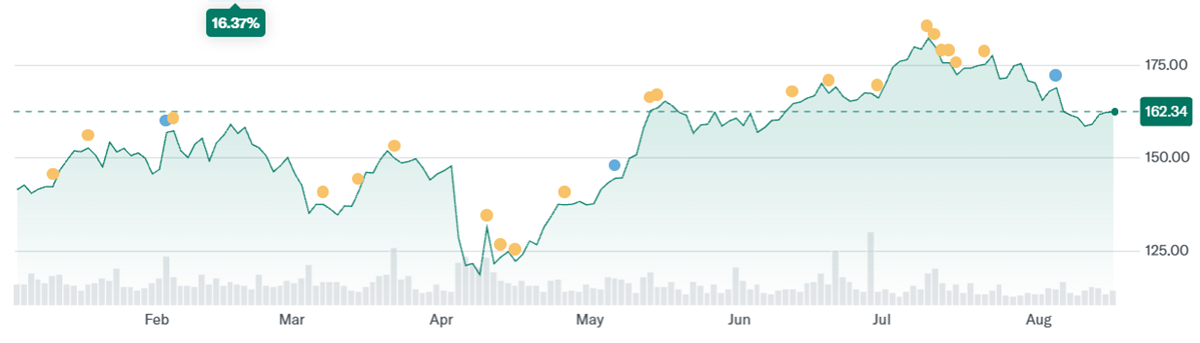

XLE holds just 22 stocks, an unusually small number for a sector ETF, and this creates meaningful concentration risk. As of 14 August 2025. the top three holdings—Exxon Mobil (22.39%), Chevron (18.87%), and ConocoPhillips (7.66%)—together account for nearly half of the fund's weight. This concentration ensures that XLE's fortunes are tied closely to the earnings cycles and strategic decisions of a handful of integrated energy companies.

From an industry standpoint, the ETF is overwhelmingly tilted towards Oil, Gas & Consumable Fuels (91.7%), with only a modest allocation to Energy Equipment & Services (8.3%). In other words, XLE is not a diversified “all-energy” fund but rather a focused exposure to the U.S. oil and gas majors.

The appeal here is cost efficiency: with an expense ratio of 0.08%, XLE delivers highly liquid, broad-based exposure to the U.S. energy sector at a fraction of the cost of active funds.

Performance Drivers: Winners and Laggards Within the Energy Landscape

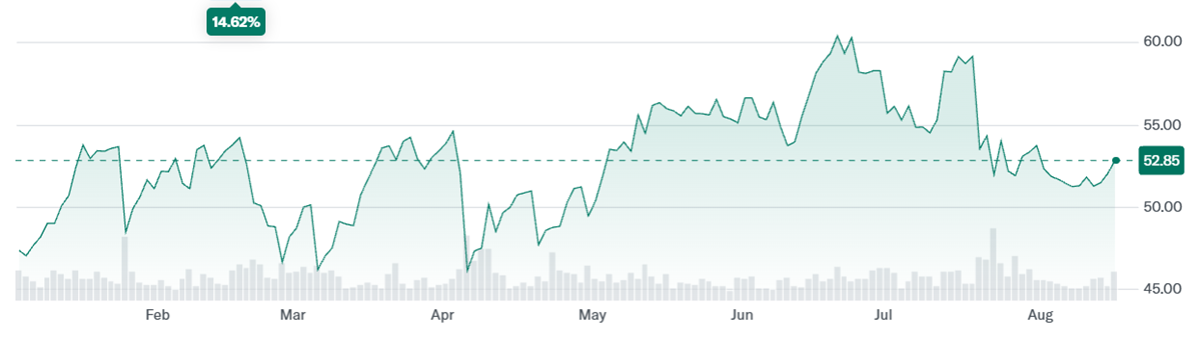

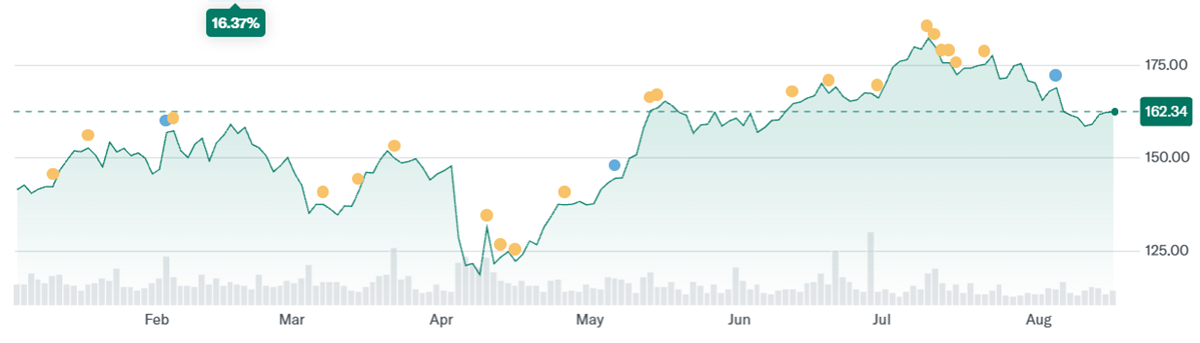

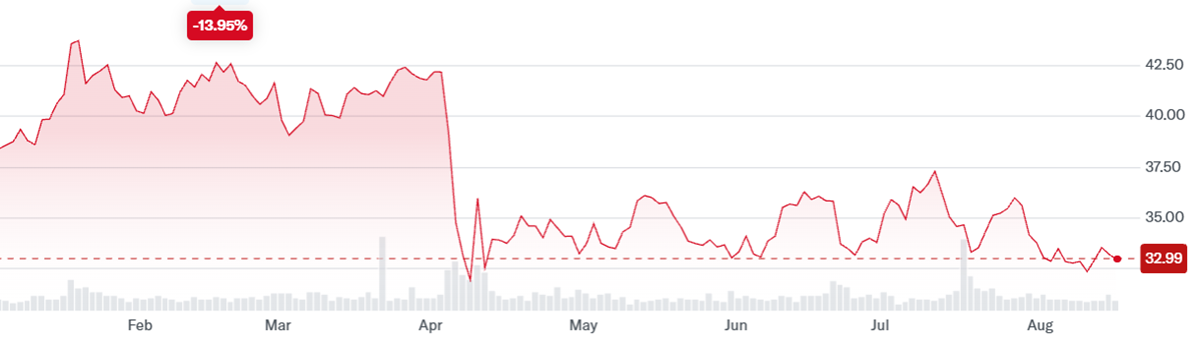

While XLE's headline numbers are modest, its components reveal stark differences in performance during 2025:

Oilfield services firms such as Schlumberger and Halliburton, by contrast, have struggled, reflecting a slowdown in upstream capital expenditure.

What this shows is that energy is far from monolithic: subsector performance diverges widely depending on commodity dynamics, investment cycles, and geopolitical developments. Yet because XLE leans heavily on integrated oil and gas, it delivers a smoother ride than owning pure-play refiners or gas producers.

Stability in Volatile Times: Energy as a Defensive Play

A striking example of XLE's defensive role came in June 2025. during a spike in Middle Eastern tensions. On 13 June, when equity markets broadly wobbled, XLE rose by ~1.74% in a single session, highlighting energy's role as a hedge when geopolitical risks threaten global supply chains.

This defensive quality is not new. Historically, energy stocks have shown resilience in inflationary periods: as oil and gas prices rise, revenues for integrated producers tend to expand, helping offset broader cost pressures that erode returns in other sectors. For investors worried about persistent inflation, energy exposure through XLE provides a valuable counterbalance.

Strategic Role in Portfolios

XLE serves several distinct functions in portfolio construction:

Tactical Exposure: For investors seeking to capture cyclical upswings in commodity prices, XLE provides a low-cost, liquid way to play rising oil and gas markets.

Inflation Hedge: Energy equities often outperform when inflation accelerates, providing diversification when fixed income and growth stocks falter.

Crisis Buffer: As demonstrated in 2025. XLE can rally in moments of geopolitical stress, offsetting declines in the broader market.

Liquidity & Simplicity: With over $26 billion in assets and deep daily trading volume, XLE offers institutional-grade liquidity for both hedging and long-term allocation.

A Thought-Provoking Consideration: Is Concentration a Weakness or a Strength?

The fund's concentration in Exxon and Chevron raises an important debate. On one hand, it means that investors are not getting a broad exposure to the entire energy ecosystem, especially renewables and mid-cap innovators. On the other, it means the ETF reflects the financial and operational strength of companies with the balance sheets to weather downturns, pay dividends, and buy back shares.

In this sense, XLE represents a conservative form of energy exposure—less volatile than niche ETFs, yet still capable of delivering cyclical upside. For investors who see energy as a necessary ballast in diversified portfolios, this concentration may be more feature than flaw.

Conclusion: Energy Beyond the Numbers

At first glance, XLE's recent returns appear underwhelming relative to the S&P 500. Yet beneath the surface, the ETF embodies something more significant: a strategic tool that blends cyclical opportunity with defensive resilience. In a world where inflation remains sticky, geopolitical risks flare without warning, and global energy demand continues to evolve, XLE's role extends well beyond short-term performance charts.

For investors willing to look past the headline figures, XLE is not just an energy ETF—it is a hedge against uncertainty, a counterweight to growth-driven portfolios, and a reminder that energy remains the lifeblood of the global economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.