Oil and gas ETFs have become a popular way for traders to access the energy markets without the complexities of trading futures or picking individual stocks.

As global energy prices remain volatile and the sector evolves, understanding how these ETFs work and what risks and opportunities they present is crucial for any active trader. Here are seven essential things every trader should know about oil and gas ETFs in 2025.

1. What Are Oil and Gas ETFs?

An oil and gas ETF (exchange-traded fund) is a fund that tracks the performance of oil, gas, or a basket of energy-related assets. These ETFs can invest directly in commodity futures, hold shares of companies involved in exploration and production, or use a mix of both approaches. They trade on major exchanges just like stocks, making them accessible and liquid for traders.

2. Types of Oil and Gas ETFs

Oil and gas ETFs come in several forms, each with unique characteristics:

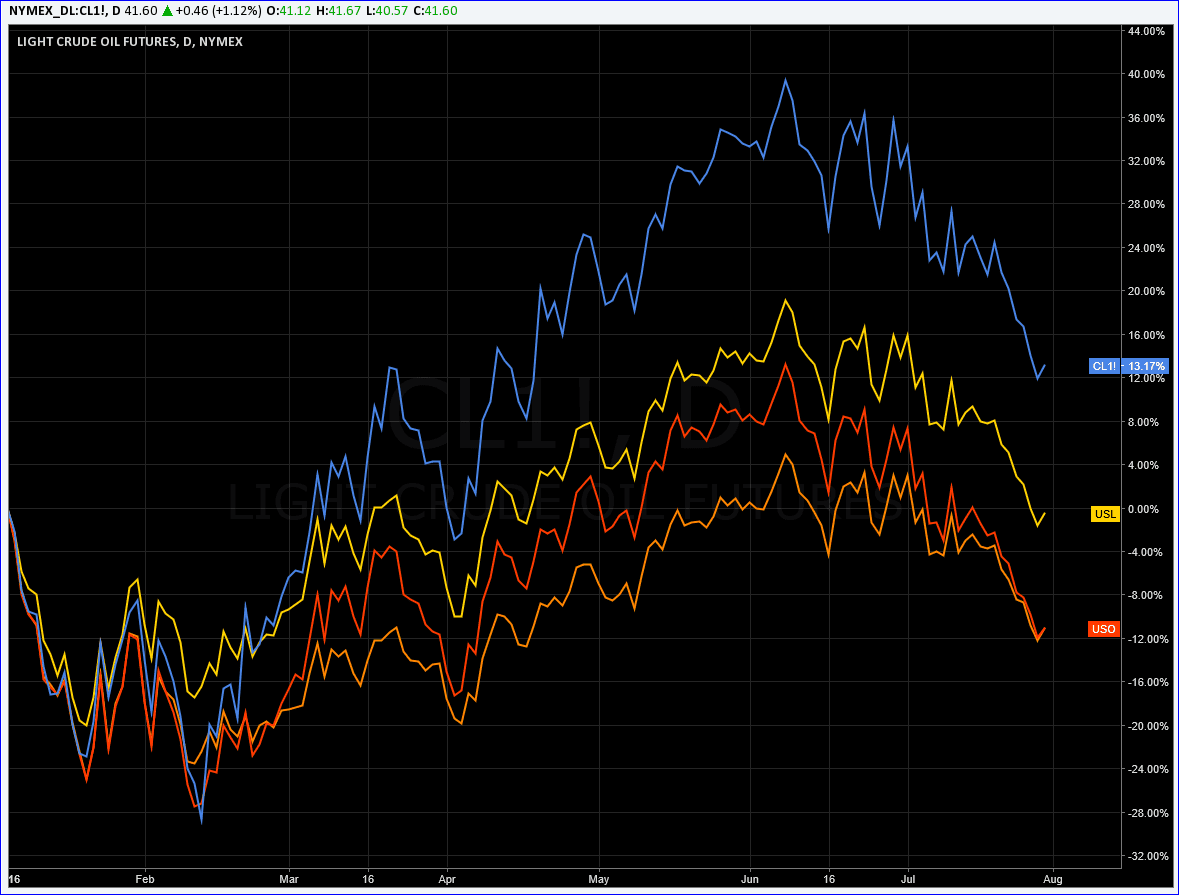

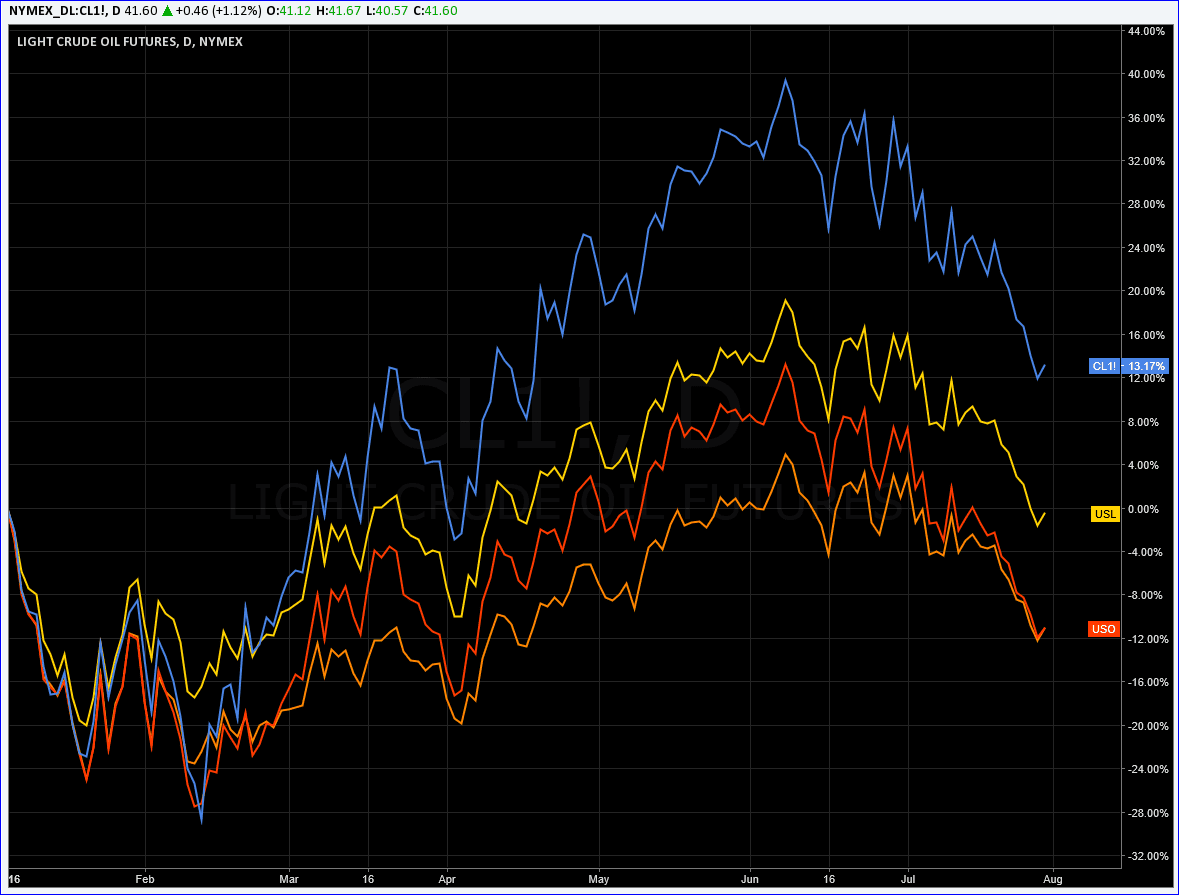

Futures-based ETFs: Track oil or gas prices by holding futures contracts (e.g., USO for oil). These are closely linked to spot prices but are subject to risks like contango and backwardation.

Equity-based ETFs: Invest in shares of oil and gas companies, such as producers, refiners, or service firms (e.g., XLE, VDE, XOP).

Leveraged and Inverse ETFs: Use derivatives to amplify gains or losses, or to profit from falling prices. These are riskier and designed for short-term trading.

3. Volatility and Market Drivers

Oil and gas ETFs are known for their volatility. Prices can swing sharply due to:

Geopolitical events (e.g., conflicts in oil-producing regions)

OPEC+ production decisions

Economic data and global demand shifts

Weather disruptions and natural disasters

This volatility can create trading opportunities but also increases risk.

4. Key Risks: Contango, Decay, and Sector Exposure

Contango and Roll Yield: Futures-based ETFs can suffer losses when future prices are higher than spot prices, as contracts are rolled forward at a premium.

Decay in Leveraged ETFs: Daily resets in leveraged and inverse ETFs can lead to value erosion over time, especially in volatile or sideways markets.

Sector Concentration: Oil and gas ETFs are heavily exposed to the energy sector, which can limit diversification and increase risk if energy prices fall.

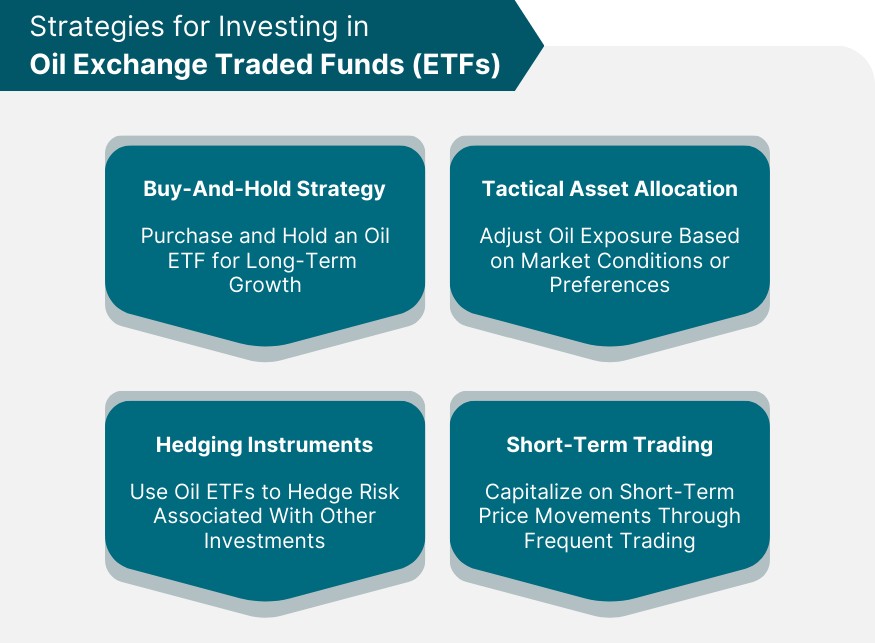

5. Strategies for Trading Oil and Gas ETFs

Short-term trading: Take advantage of volatility with futures-based or leveraged ETFs, but monitor positions closely.

Buy-and-hold: Consider equity-based ETFs for longer-term exposure to the energy sector, but be aware of sector cycles and regulatory changes.

Hedging: Use inverse ETFs or combine positions to hedge against price declines or portfolio risk.

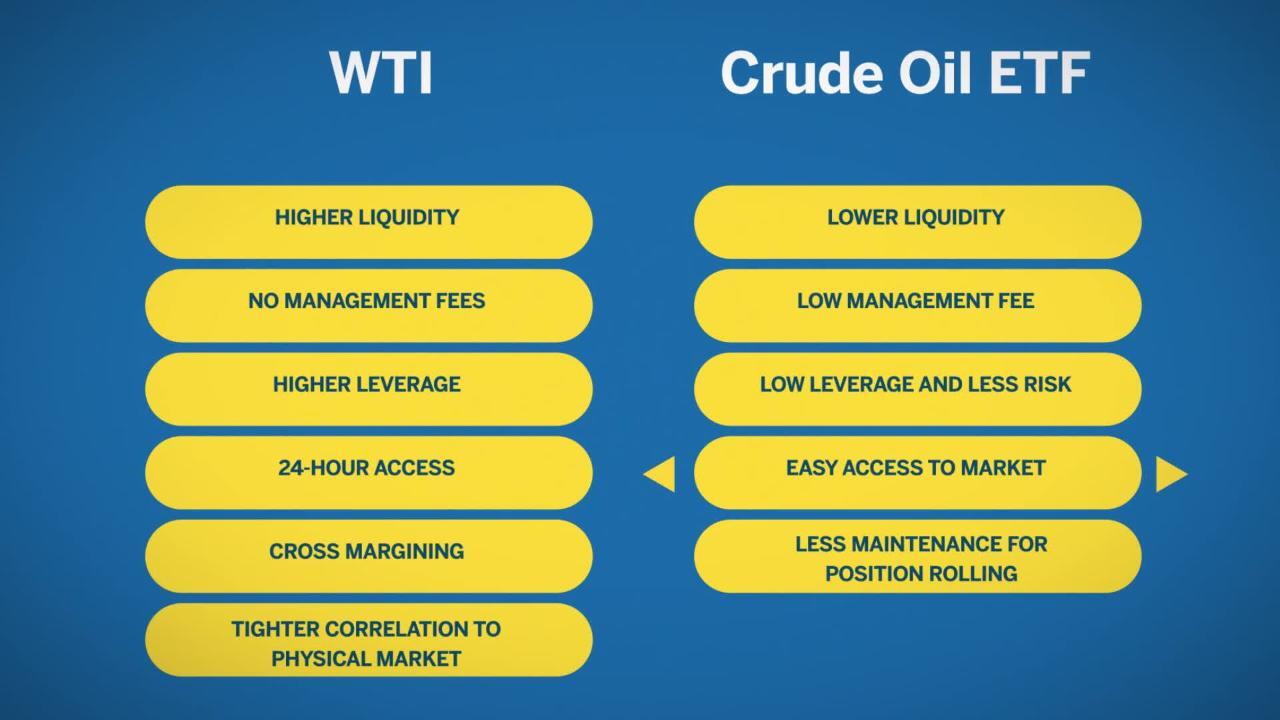

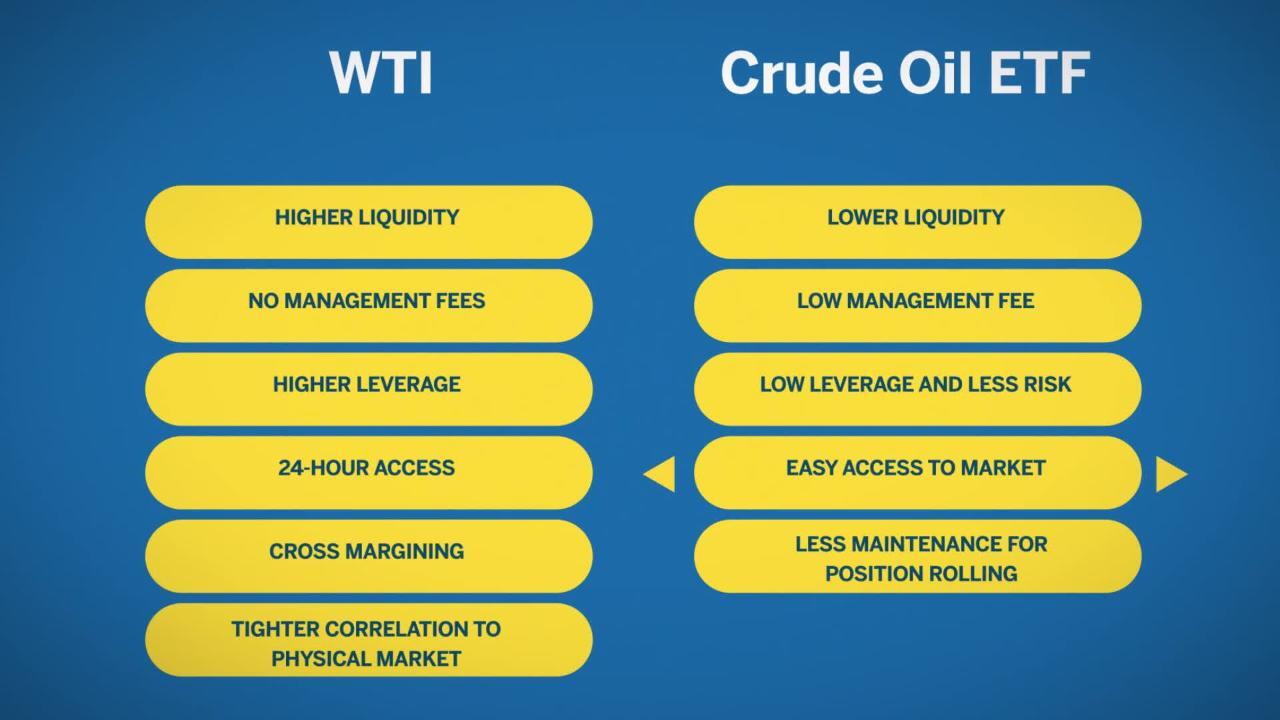

6. Costs and Liquidity

Oil and gas ETFs generally offer lower management fees than actively managed funds and provide high liquidity, allowing traders to enter and exit positions efficiently. However, always review the ETF's expense ratio, trading volume, and bid-ask spread before trading.

7. Regulatory and Environmental Factors

The oil and gas sector is subject to significant regulatory oversight. Changes in government policy, environmental regulations, or shifts towards renewable energy can impact the profitability of oil and gas companies-and, by extension, the ETFs that hold them. Traders should stay informed about global energy trends and policy changes.

Conclusion

Oil and gas ETFs offer traders a flexible, accessible way to participate in the energy markets. By understanding the types of etfs available, the risks of volatility and contango, and the importance of strategy and sector trends, traders can make more informed decisions in this dynamic sector. Always conduct thorough research and consider your risk tolerance before trading oil and gas ETFs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.