Target (NYSE: TGT) has consistently been a cornerstone of American retail, merging affordability with style and accessibility. Yet in recent years, the retailer's stock has faced persistent pressure, dropping more than 60% from its peak.

In 2025, the trend continues, and many investors are asking the same question: why is Target stock falling despite its strong brand recognition?

The answer lies in a combination of leadership changes, weakening sales trends, cost pressures, fierce competition and more. Below, we break down the six key reasons Target's stock is struggling today, and what it means for the company's future.

Target Stock's History and Current Financial Status

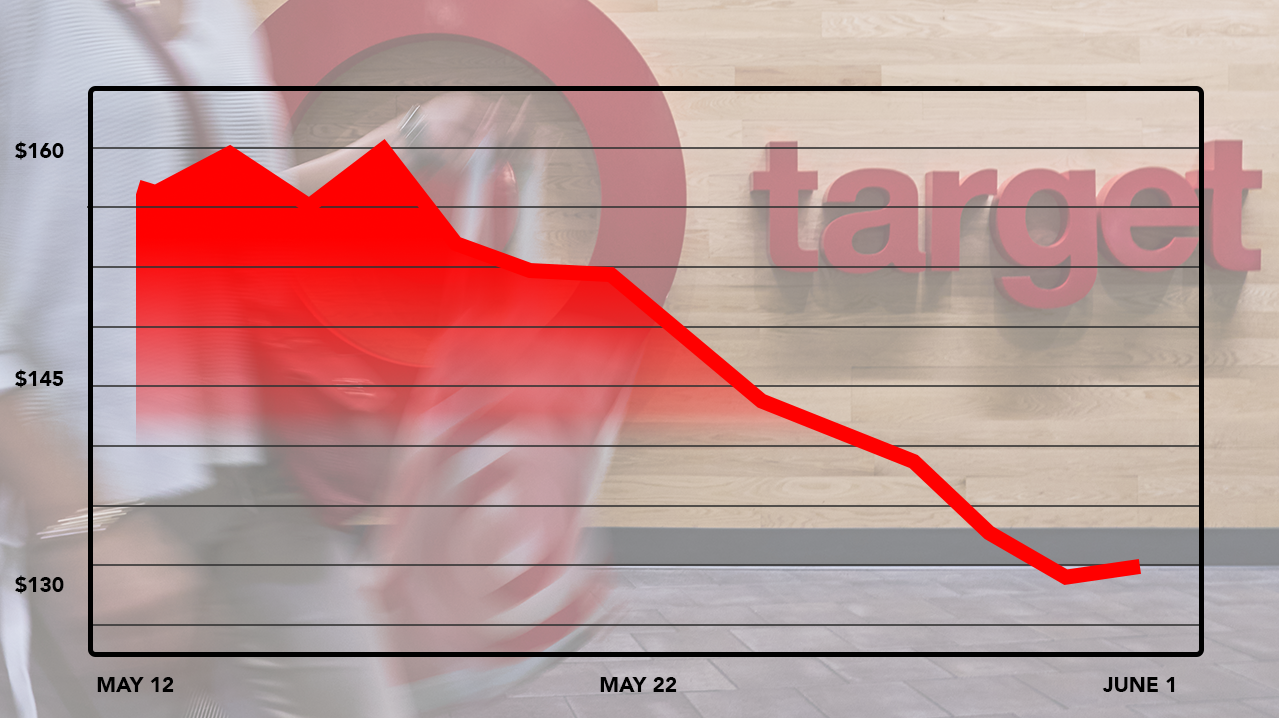

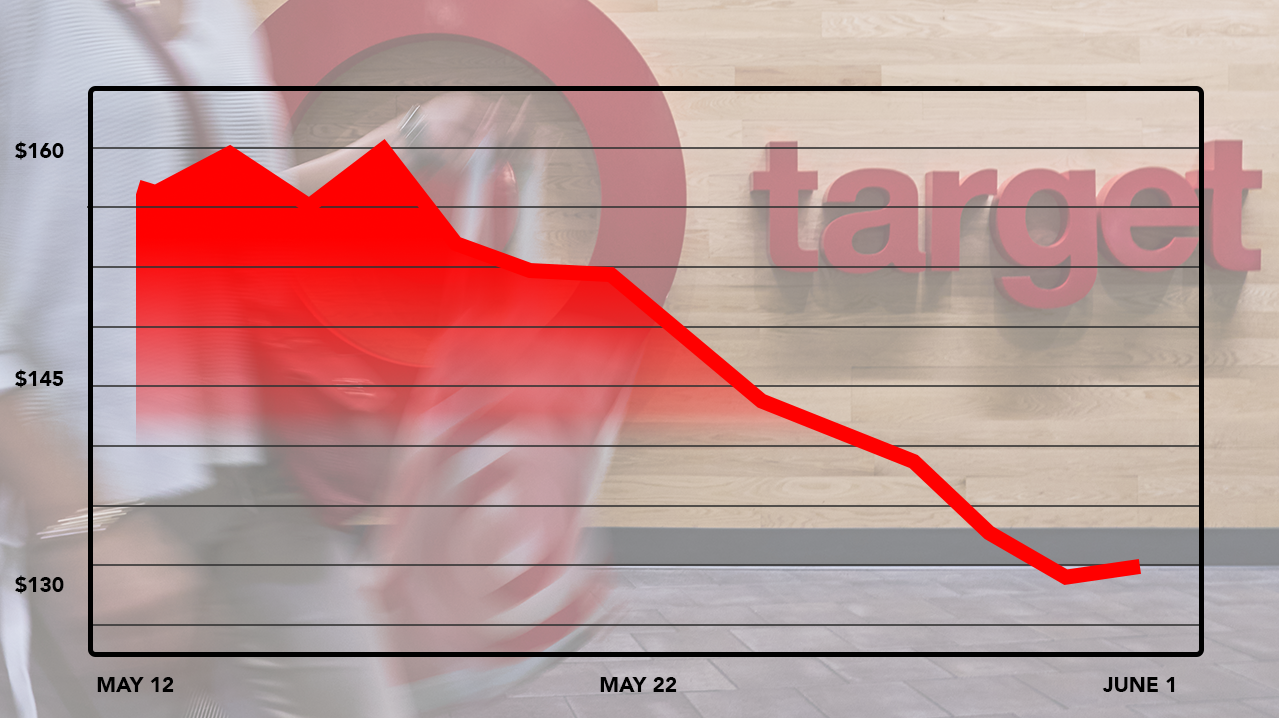

Target's stock has seen dramatic shifts over recent years, reflecting swings in consumer demand, economic conditions, and strategic performance:

All-Time High: Target reached its all-time closing high of $238.01 on November 16, 2021, driven by strong pandemic-era performance and retail sentiment.

Year-End Closing Prices:

2022: $135.98 (–34.2% YoY)

2023: $134.14 (–1.3% YoY)

2024: $131.10 (–2.3% YoY)

As of mid-August 2025, Target shares are priced at approximately $98.69, indicating a year-to-date decline of roughly 24.7%. This drop reflects unstable leadership uncertainty, slowing same-store sales, tariff effects, lower digital engagement and more.

Why Is Target Stock Falling? 6 Factors Explored (Updated August 2025)

1. Leadership Shake-Up: CEO Transition and Market Reaction

In August 2025, Target announced that long-time CEO Brian Cornell would step down in February 2026, to be succeeded by internal executive Michael Fiddelke. While smooth leadership succession often reassures investors, this news triggered an immediate stock plunge of nearly 10%.

Why? Many investors had hoped for an external hire to bring new energy and strategy. Instead, the promotion of an insider raised concerns that Target may stay the course instead of making bold changes.

This leadership uncertainty, combined with already weak performance, has added another layer of pressure on Target's share price.

2. Consumer Backlash and Brand Challenges

One major factor behind Target's struggles has been consumer perception. The company's shifting stance on social and political topics, including DEI initiatives and subsequent rollbacks, sparked both support and criticism. It left Target vulnerable to boycotts and online backlash, weighing on its sales and brand reputation.

In retail, perception matters, and Target's brand turbulence created headwinds at a time when competitors like Walmart and Amazon were maintaining a steadier image.

3. Declining Foot Traffic and Sales

Target's same-store sales dropped 1.9% year-over-year in Q2 2025, even as it delivered an earnings beat on paper. While some categories, such as beauty and essentials, remain resilient, discretionary spending on apparel and home goods continues to lag.

This drop in sales indicates weakening consumer demand amid inflation, particularly among middle-income families. Foot traffic has also weakened, with shoppers increasingly shifting purchases to online competitors.

4. Economic Pressures and Tariffs

The broader U.S. economy is also not helping Target. With tariffs increasing on imported goods, Target faces higher sourcing costs compared to rivals.

Analysts estimate Target may need to raise prices by up to 8% to offset tariffs, almost double the level expected for Walmart.

It places Target at a disadvantage, as consumers may pivot to cheaper alternatives, and the company risks losing its value-oriented positioning.

5. Rising Competition in Retail

Target functions within one of the most challenging sectors of retail, as Walmart continues to dominate with low prices and expanding online sales, and Amazon leads in e-commerce and delivery convenience.

Moreover, discount stores such as Dollar General and Aldi are appealing to budget-minded consumers. Target, situated between affordability and fashion, is struggling to maintain its market position.

6. Digital Struggles in a Competitive Landscape

While Walmart and Amazon are accelerating digital adoption, Target's digital engagement is slipping. In mid-2025, Target's app usage fell 4.1% year-over-year, while Walmart's surged.

It signals that Target is losing ground with online shoppers, a critical market segment for long-term growth. Without strong digital traction, Target risks missing future consumer trends.

What's Next for Target? Future Growth and Investor Outlook

In March 2025, Target unveiled an ambitious strategy to generate over $15 billion in profitable sales growth by 2030. This vision includes revitalising merchandising categories such as gaming, sports, and toys, doubling the reach of its Target Plus marketplace, scaling its Roundel retail media business, and launching a personalised omnichannel experience through AI and supply chain enhancements.

In its Q2 2025 earnings report, Target delivered improved results, including:

Adjusted EPS: ~$2.05, slightly above expectations.

Net sales: ~$25.2 billion (−0.9% YoY), with digital sales up 4.3%, while in-store comparable sales fell 3.2%.

Guidance: Maintained full-year outlook of a "low-single-digit decline" in sales and an adjusted EPS forecast between $7.00 and $9.00, revised down from earlier estimates of $8.80–$9.80.

However, the company's leadership transition cast a shadow over Target's stock. The announcement that long-time CEO Brian Cornell would step down in February 2026, to be succeeded by internal executive Michael Fiddelke, triggered a ~7–8% drop, as some investors had been hoping for a fresh external perspective.

Analyst sentiment remains mixed. Most maintain a "Hold" stance, with sentiment leaning cautious due to ongoing margin pressures, tariff headwinds, and modest growth expectations despite strategic investments.

Frequently Asked Questions

Q1. Why Is Target Stock Falling in 2025?

Shrinking sales, tariff pressures, brand image challenges, leadership uncertainty, and stiff competition from Walmart and Amazon drive Target's stock decline.

Q2. Is Target Stock a Buy Right Now?

While some analysts see value at current levels, most recommend caution until the company shows signs of sustained growth and digital recovery.

Q3. Will Tariffs Continue to Hurt Target's Profits?

Yes, higher tariffs are forcing Target to raise prices more aggressively than Walmart, potentially reducing its competitiveness with budget-conscious shoppers.

Conclusion

In conclusion, target's stock is falling not because of a single event, but due to a convergence of challenges: brand image issues, slowing sales, tariff pressures, fierce competition, and most recently, leadership uncertainty.

For long-term investors, the key question is whether the company can reinvent itself under new leadership and regain its competitive edge in both physical and digital retail. Until then, caution remains warranted.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.