TradingView features a special function called Magnet Mode.

Simply put, when drawing lines, if Magnet Mode is enabled, TradingView automatically snaps to key points, making your lines far more accurate.

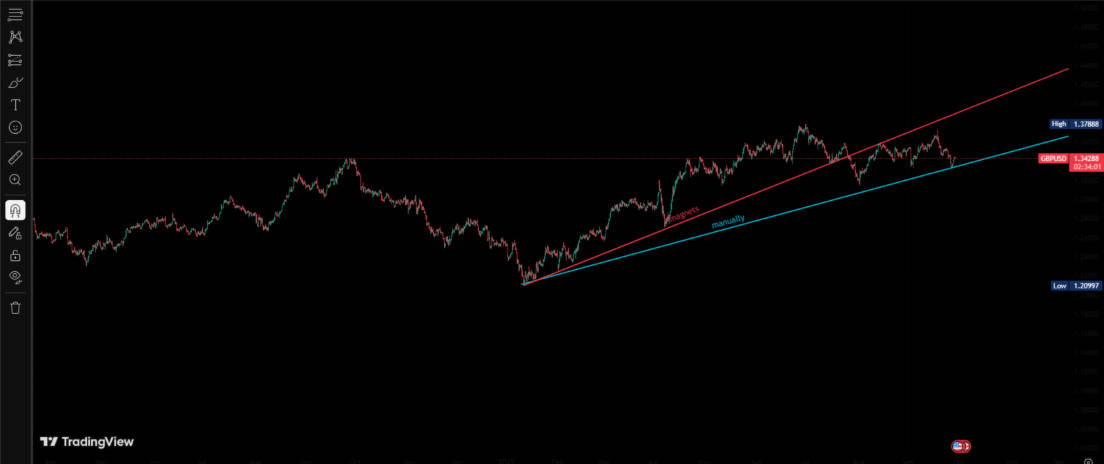

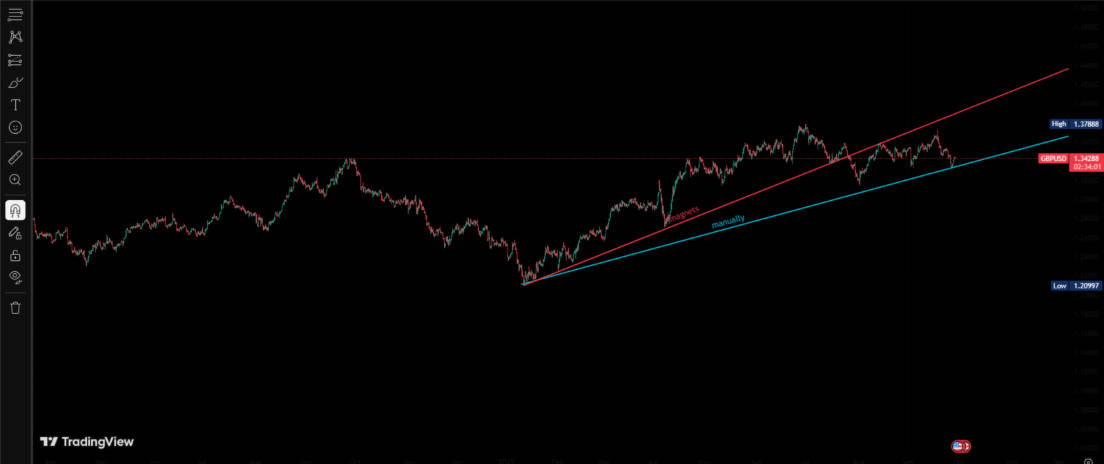

For example, in the chart below, there is some support at the lower region, and you could roughly draw a trendline manually.

However, with Magnet Mode enabled, TradingView precisely connects several lows, producing a more accurate support or resistance line.

Although the difference may appear slight, in the current chart, a manually drawn line suggests an upward trend, whereas the Magnet Mode line shows that the price has already broken the trendline. If the rebound fails, the market is likely to continue downward.

In technical analysis, a trend is only confirmed with three points to define a line, and manual drawing often results in inaccuracies. Magnet Mode greatly improves line precision and reduces the subjectivity of manual placement.

Beyond standard line drawing, Magnet Mode works equally well with any indicator.

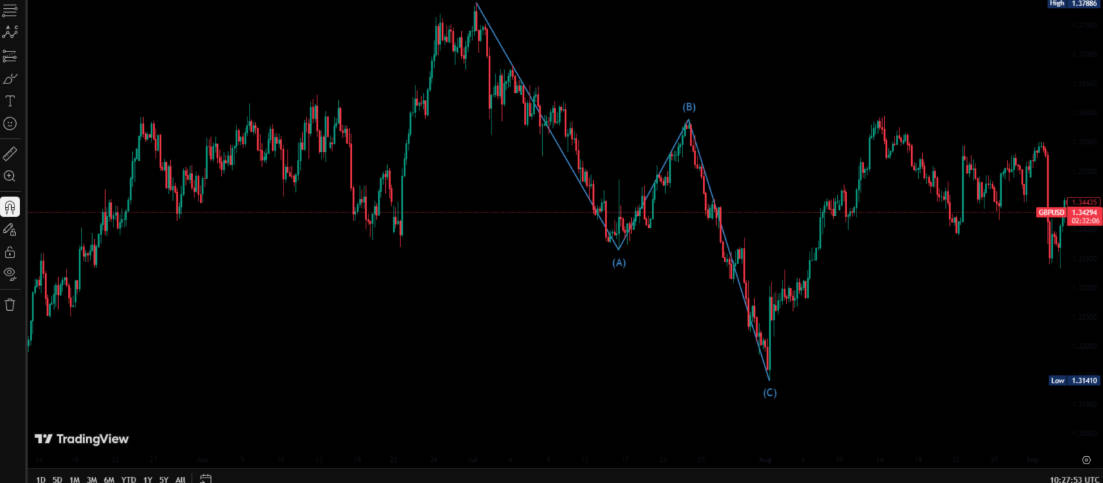

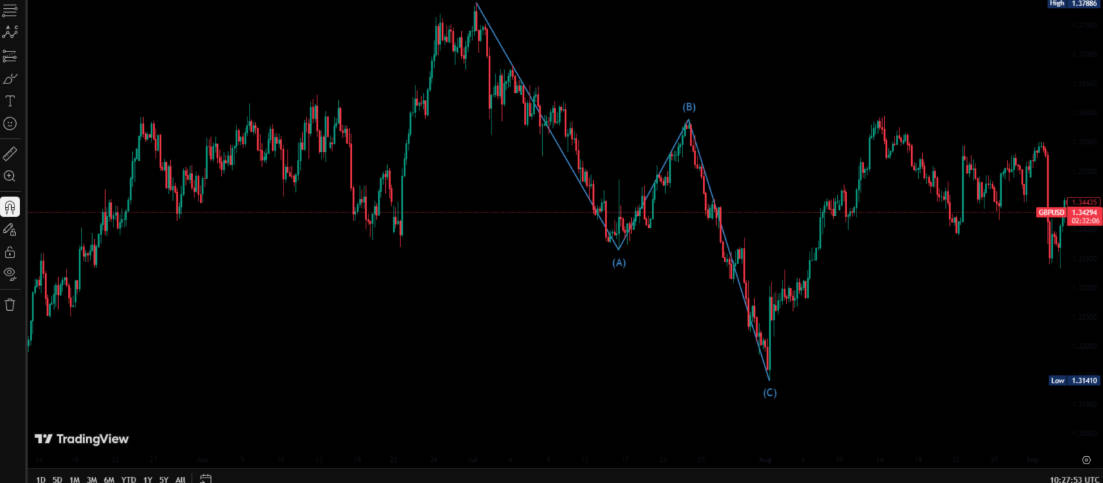

For instance, when identifying a Wave 3 retracement, enabling Magnet Mode ensures lines automatically snap to highs and lows, making your drawing much more precise.

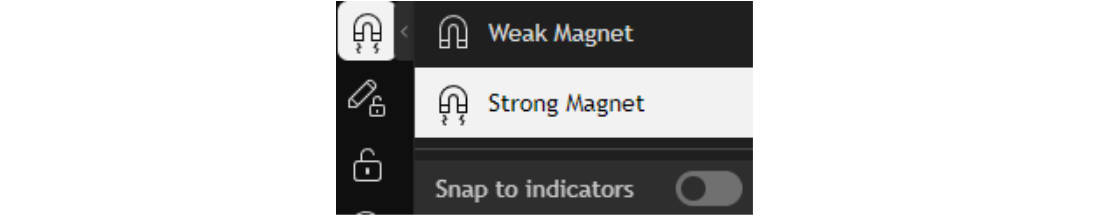

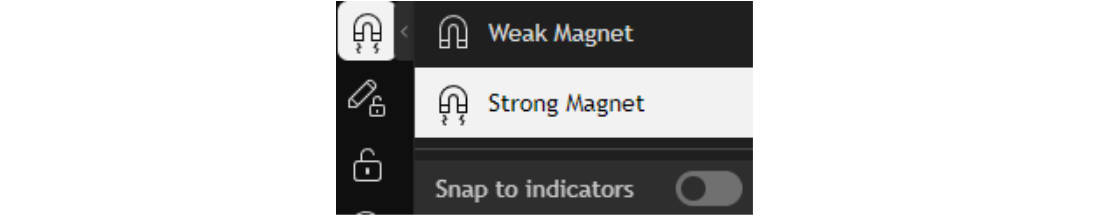

TradingView provides two Magnet Mode options: Strong Magnet and Weak Magnet:

Strong Magnet Mode: Automatically snaps to the highest and lowest prices, strictly following this rule so that each line connects either a high or low point.

Weak Magnet Mode: More flexible, allowing lines to connect open and close prices as well, giving greater freedom in line placement.

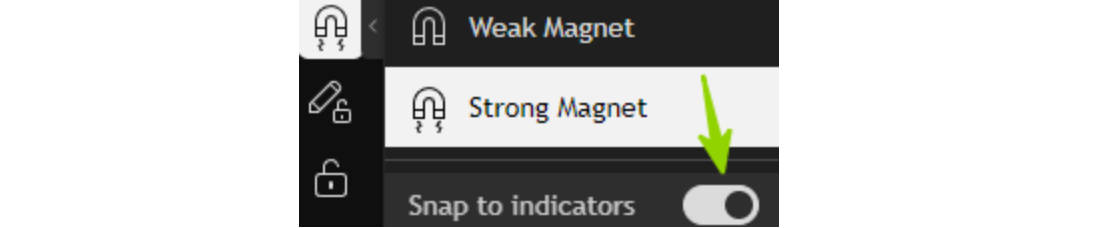

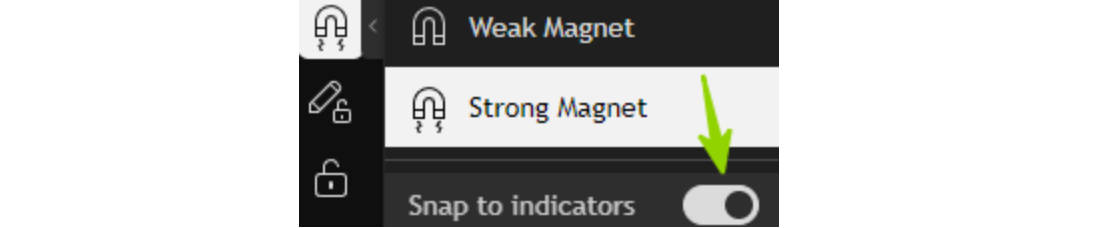

Additionally, TradingView has introduced an Snap to indicators feature.

Previously, Magnet Mode applied mainly to candlesticks, meaning that no matter how you drew a line, both points would always align with candlestick highs or lows.

With Indicator Snap enabled, lines will automatically snap to key points on indicators, allowing you to draw beyond the candlesticks themselves.

In summary, TradingView's Magnet Mode is a highly useful tool that significantly enhances the accuracy of market analysis. Used flexibly, it helps you capture trends with greater precision when drawing lines.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.