FXAIX is a popular index fund that tracks the performance of the S&P 500, providing investors with exposure to 500 of the largest companies in the United States.

Managed by Fidelity Investments, FXAIX is a low-cost, passively managed fund, making it an attractive option for those looking to invest in a diversified portfolio that reflects the performance of the U.S. stock market.

In this comprehensive guide, we will take a closer look at what FXAIX is, how it works, and why it may be the right choice for your investment strategy.

What Is FXAIX?

FXAIX stands for Fidelity 500 Index Fund, and it's designed to replicate the performance of the S&P 500 Index. The S&P 500 consists of 500 of the largest publicly traded companies in the U.S., representing a wide range of industries, including technology, finance, healthcare, and consumer goods. The fund seeks to mirror the performance of the S&P 500 by holding the same stocks in the same proportions.

As an index fund, FXAIX does not actively buy or sell stocks based on market predictions or research. Instead, it passively follows the S&P 500, making it a suitable option for investors who want to track the overall performance of the U.S. stock market without taking on the risk of individual stock picking.

Key Features of FXAIX

There are several features that make FXAIX appealing to investors:

Low Expense Ratio: One of the key advantages of FXAIX is its low expense ratio. As of recent data, its expense ratio is just 0.015%. This means that for every $1,000 invested, only 15 cents goes toward fund management fees. This low cost is crucial for long-term investors, as high fees can eat into overall returns over time.

Diversification: FXAIX provides instant diversification by holding shares in the top 500 companies in the U.S. This helps spread risk across various sectors, reducing the impact of poor performance in any one company or sector.

Performance Tracking: FXAIX closely tracks the performance of the S&P 500. This means that the fund typically performs similarly to the index, providing a solid option for investors who believe the S&P 500 will continue to grow over time.

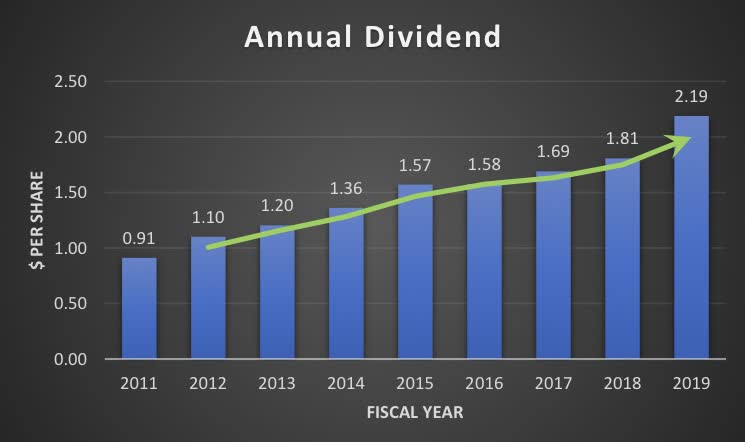

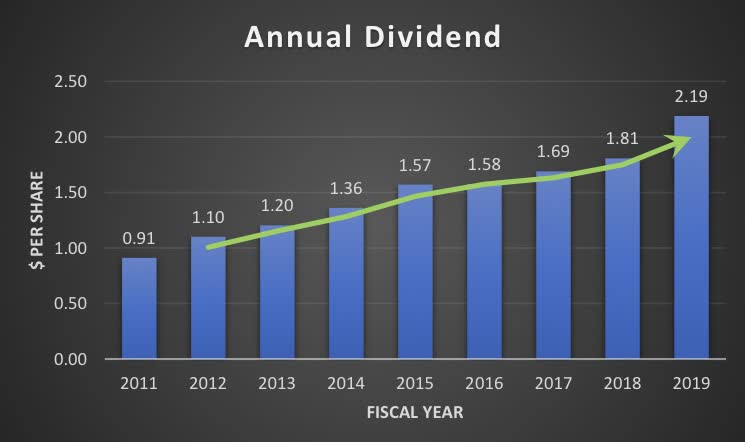

Dividend Payments: FXAIX pays dividends to its investors, typically on a quarterly basis. These dividends are generated from the stocks held in the fund, and they can be reinvested to purchase more shares of the fund or taken as cash.

Why Choose FXAIX?

There are several reasons why investors may choose FXAIX over other investment options:

Long-Term Growth: The S&P 500 has historically provided long-term growth, and FXAIX aims to replicate that performance. For investors seeking to grow their capital over time, FXAIX offers a low-cost, reliable option.

Passive Management: Unlike actively managed funds, FXAIX follows a passive management strategy. This means that the fund does not rely on fund managers making individual stock picks but instead mirrors the performance of the S&P 500. This strategy is particularly appealing to those who want a hands-off investment approach.

Diversification: Investing in a broad market index like the S&P 500 provides exposure to many different industries. This diversification helps reduce the risk of individual companies' performance negatively impacting your portfolio.

Affordability: FXAIX is known for its low expense ratio, making it an affordable option for many investors. Low fees are a critical factor in long-term investing, as even small savings can compound significantly over time.

Performance of FXAIX

Over the years, FXAIX has provided competitive returns for investors. As it tracks the S&P 500, its performance mirrors that of the broader U.S. stock market. While past performance is not always indicative of future results, the S&P 500 has historically produced annualised returns of around 7-10% over the long term, making FXAIX a solid option for investors looking to benefit from U.S. stock market growth.

It's important to remember that the performance of FXAIX is tied to the overall health of the U.S. economy. While it can provide strong returns in times of market growth, it may also suffer losses during market downturns.

Risks of Investing in FXAIX

As with any investment, there are risks associated with FXAIX. Since the fund tracks the S&P 500, its performance is closely tied to the health of the U.S. stock market. This means that in times of economic downturns or market volatility, FXAIX may experience declines in value.

Additionally, while FXAIX provides diversification by investing in 500 companies, it is still primarily focused on large-cap U.S. stocks. This means that investors in FXAIX may not have as much exposure to smaller companies or international markets, potentially limiting growth in certain market conditions.

How to Invest in FXAIX

Investing in FXAIX is relatively straightforward. You can purchase shares through most brokerage accounts or retirement accounts, such as IRAs or 401(k)s. FXAIX is often included in the list of available funds for retirement accounts because of its low cost and potential for long-term growth.

If you're new to investing, you can start with a small amount and gradually increase your investment over time. Since FXAIX tracks the S&P 500, it is generally considered a relatively safe long-term investment.

Final Thoughts

FXAIX can be a great option for investors looking for a low-cost, diversified way to invest in the U.S. stock market. It's particularly appealing for long-term investors who want to take advantage of the historical growth of the S&P 500 without the hassle of picking individual stocks.

However, like any investment, it is important to assess your own risk tolerance and investment goals before deciding whether FXAIX is right for you.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.