The iShares Russell 1000 ETF (IWB) stands as one of the most comprehensive ways to gain exposure to the largest US companies, offering traders and investors access to 1,000 of America's most significant corporations through a single, liquid instrument.

With over $41 billion in assets under management and a track record spanning more than two decades, IWB provides an efficient gateway to the broad US equity market for both institutional and retail investors.

What Is IWB ETF?

IWB is an exchange-traded fund that tracks the Russell 1000 Index, which comprises the 1,000 largest publicly traded companies in the United States by market capitalisation. Launched on 15 May 2000 by BlackRock, IWB represents a subset of the broader Russell 3000 Index, focusing specifically on large- and mid-capitalisation companies that form the backbone of the American economy.

The ETF employs a market-cap-weighted approach, meaning larger companies have greater influence on the fund's performance. This methodology ensures that IWB closely mirrors the movements of the US equity market's most significant players whilst maintaining broad diversification across sectors and industries.

IWB Holdings and Sector Allocation

As of recent data, IWB holds 1,019 individual stocks, with its top 10 holdings representing 32.9% of the total portfolio. The fund's largest positions include:

Technology companies dominate the fund's allocation, reflecting the sector's prominence in the US market. The fund also provides significant exposure to consumer cyclical stocks, communication services, and financial services, ensuring diversification across the economic spectrum.

Performance and Returns

IWB has delivered solid long-term performance, with annualised returns of 12.03% over the past 10 years and 7.54% since inception. The fund's performance closely tracks its benchmark, the Russell 1000 Index, with minimal tracking error due to its comprehensive replication strategy.

Recent performance metrics show:

The fund has demonstrated resilience through various market cycles, including the 2008 financial crisis and the COVID-19 pandemic, making it a reliable choice for long-term wealth building.

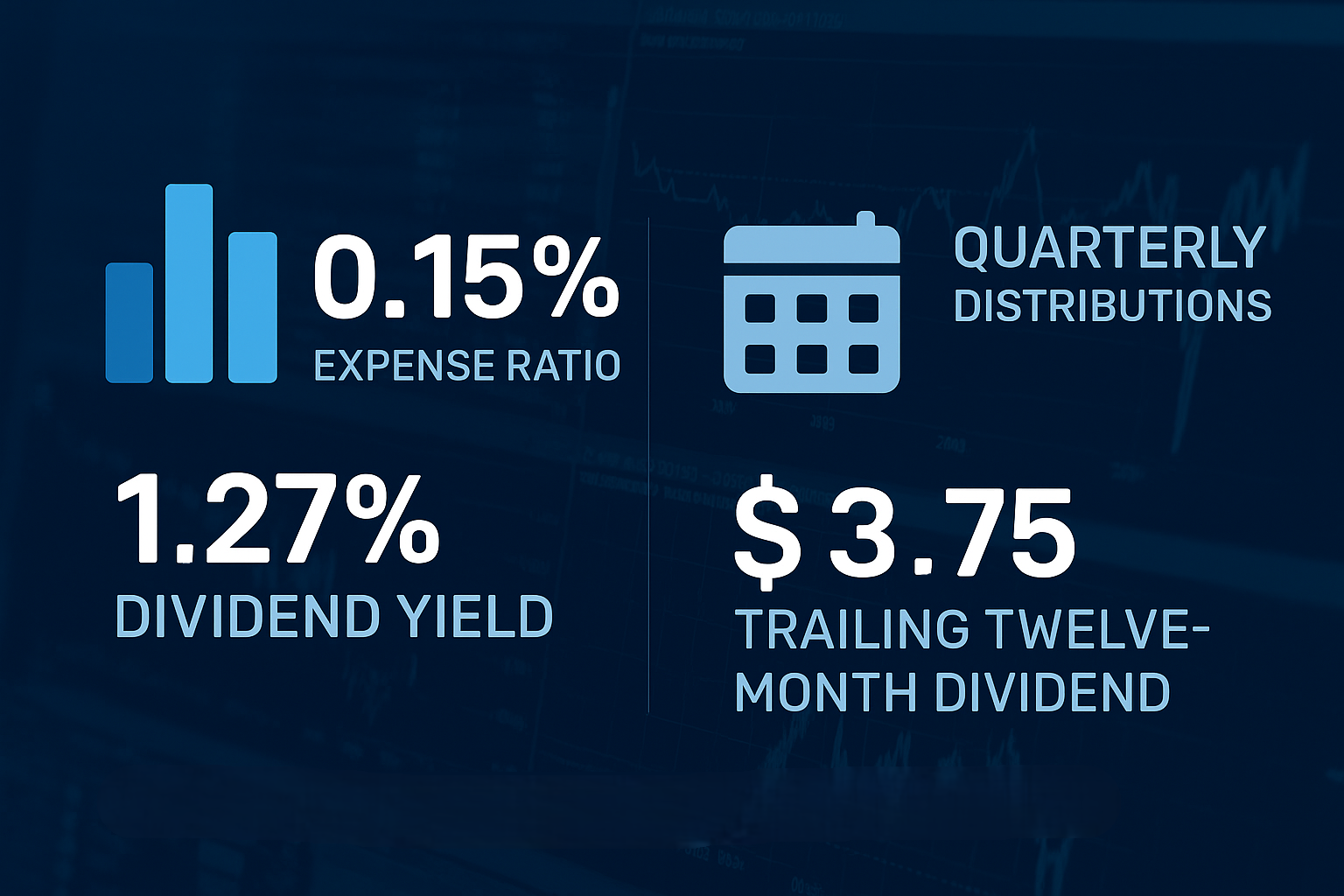

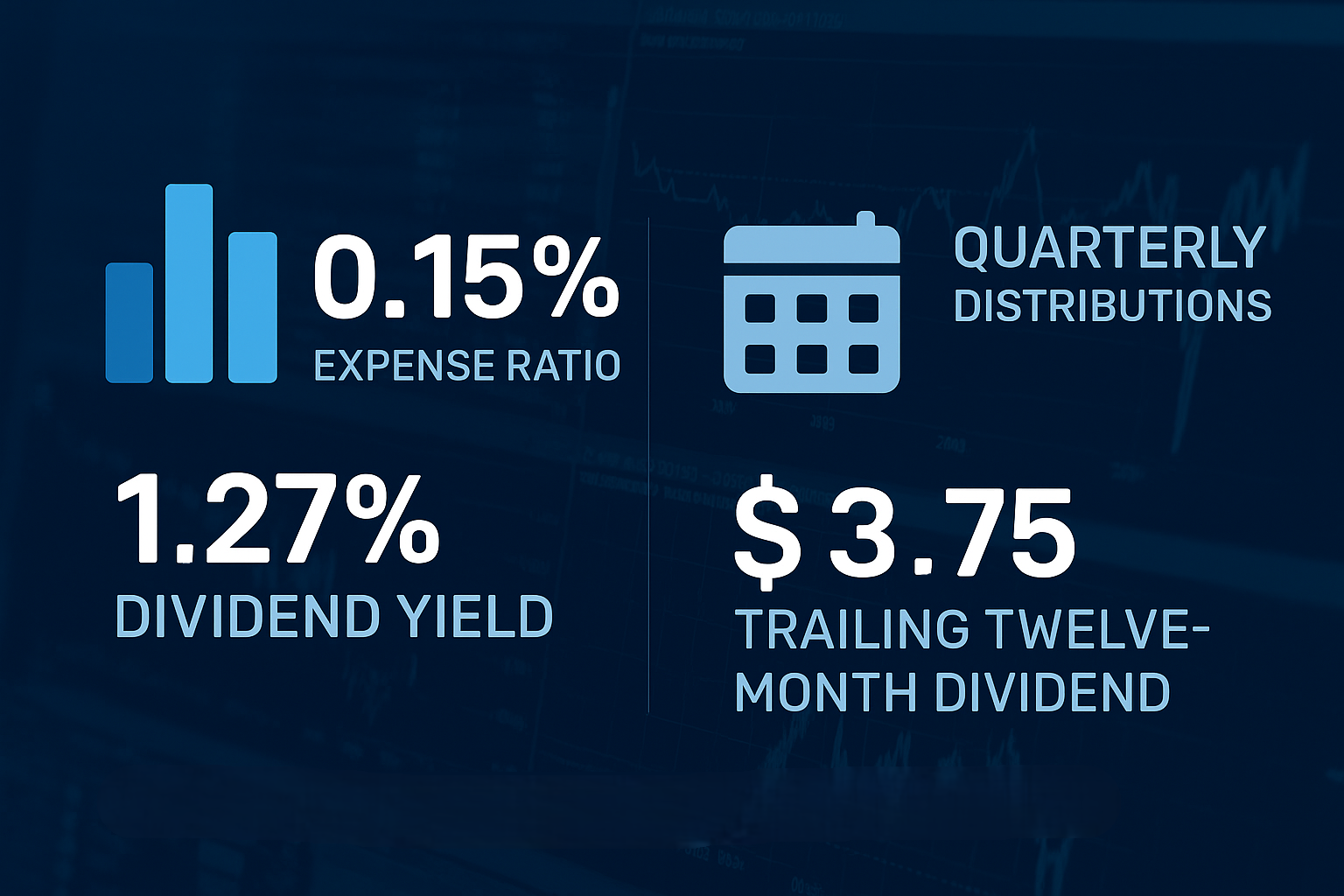

Cost Structure and Efficiency

One of IWB's most attractive features is its low expense ratio of just 0.15%, making it a cost-effective way to gain broad market exposure. This competitive fee structure means that more of investors' returns stay in their pockets rather than being eroded by management costs.

The fund also offers a dividend yield of approximately 1.27%, with quarterly distributions that reflect the dividend payments of its underlying holdings. The most recent ex-dividend date was 16 June 2025, with a trailing twelve-month dividend of $3.75 per share.

Why Traders Choose IWB ETF

Broad Market Exposure: IWB provides instant diversification across 1,000 of the largest US companies, reducing single-stock risk whilst maintaining growth potential.

High Liquidity: With average daily trading volumes exceeding 900,000 shares, IWB offers excellent liquidity for both small and large trades.

Transparency: The fund's holdings are published daily, allowing traders to understand exactly what they own and how their investment is allocated.

Low Tracking Error: IWB's full replication strategy ensures it closely follows the Russell 1000 Index, providing predictable performance relative to its benchmark.

IWB vs Other Large-Cap ETFs

When compared to other popular large-cap ETFs like SPY (S&P 500) or VTI (Total stock market), IWB offers a middle ground. It provides broader exposure than the S&P 500's 500 companies whilst maintaining focus on large-cap stocks, unlike VTI's inclusion of small and mid-cap companies.

This positioning makes IWB particularly suitable for traders who want comprehensive large-cap exposure without the added volatility that can come from smaller companies.

Trading Strategies with IWB

Core Holding Strategy: Many traders use IWB as a core portfolio holding, representing 30-50% of their equity allocation whilst adding satellite positions in specific sectors or themes.

Market Timing: Due to its broad market representation, IWB can be used for tactical asset allocation, increasing exposure during bullish periods and reducing it during market uncertainty.

Dollar-Cost Averaging: The fund's stability and long-term growth trajectory make it suitable for systematic investment plans.

Risk Considerations

Whilst IWB offers broad diversification, traders should be aware of certain risks:

Market Risk: As a broad market fund, IWB will decline during general market downturns

Concentration Risk: The fund's top holdings represent a significant portion of assets, meaning performance can be influenced by a relatively small number of companies

Sector Bias: The heavy weighting towards technology stocks means the fund may be more volatile during tech sector corrections

ETF cfd trading with EBC Financial Group

For traders seeking more flexibility and leverage, EBC Financial Group offers ETF CFD trading on popular funds like IWB. This approach allows traders to:

Access leveraged exposure with lower capital requirements

Trade both long and short positions

Benefit from competitive spreads and fast execution

Avoid traditional fund management fees

EBC's ETF CFD platform provides access to over 100 US-listed ETFs, offering traders the flexibility to implement sophisticated strategies whilst maintaining the diversification benefits of ETF investing.

Conclusion

IWB represents an excellent choice for traders seeking broad exposure to the US large-cap market through a single, cost-effective instrument. Its combination of comprehensive diversification, strong historical performance, and low fees makes it suitable for both core portfolio holdings and tactical trading strategies.

Whether used for long-term wealth building or shorter-term market positioning, IWB provides the foundation for successful equity market participation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.