If you've ever heard of leveraged ETFs but found yourself a bit unsure about what they actually are or how they work, you're not alone. Leveraged exchange-traded funds (ETFs) might sound complex at first, but once you break them down, they become much easier to understand. Essentially, a leveraged ETF is a type of investment fund that uses financial derivatives and debt to amplify the returns of a specific index or asset. It offers traders the chance to make higher profits, but it also comes with increased risks.

What Is a Leveraged ETF?

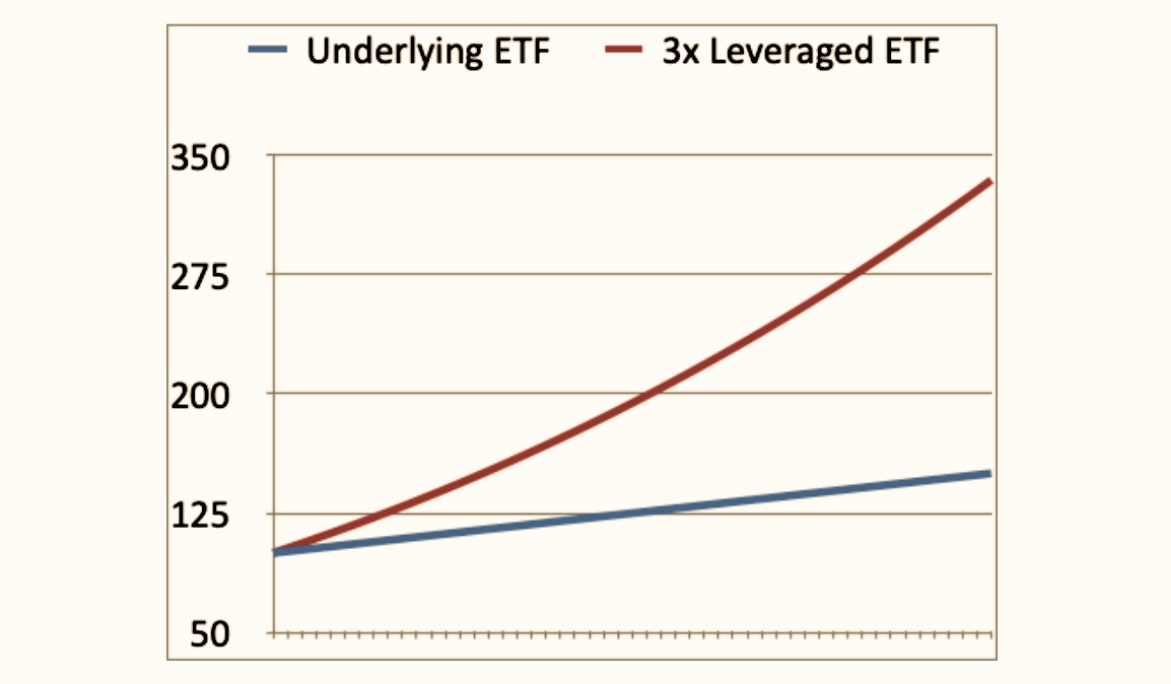

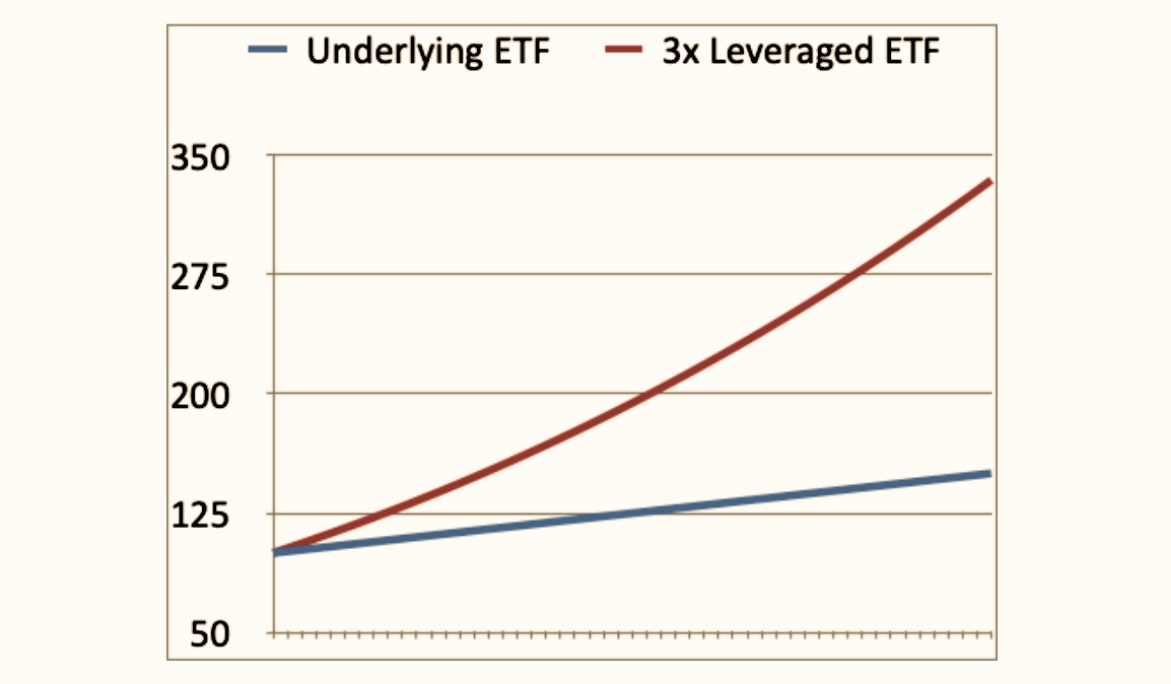

At its core, a leveraged ETF is a fund designed to amplify the returns of an underlying index. These funds use a combination of financial instruments like futures contracts and options to achieve this. The aim is simple: to produce a multiple of the daily return of the index it tracks. For example, a 2x leveraged ETF seeks to return twice the daily performance of the underlying index, while a 3x leveraged ETF aims for three times that return.

This use of leverage is what sets these ETFs apart from standard, unleveraged ETFs, which simply track the performance of an index without attempting to amplify it. While a regular ETF will closely mirror the returns of its benchmark, a leveraged ETF aims to magnify those returns — for better or for worse.

How Do Leveraged ETFs Work?

The way leveraged ETFs work is closely tied to the use of leverage, which involves borrowing capital to increase the size of an investment position. A typical leveraged ETF will borrow money or use financial derivatives (such as futures and swaps) to achieve its goal of amplifying returns. So, instead of just tracking an index's performance, the fund will employ these tools to attempt to deliver 2x or 3x the daily performance.

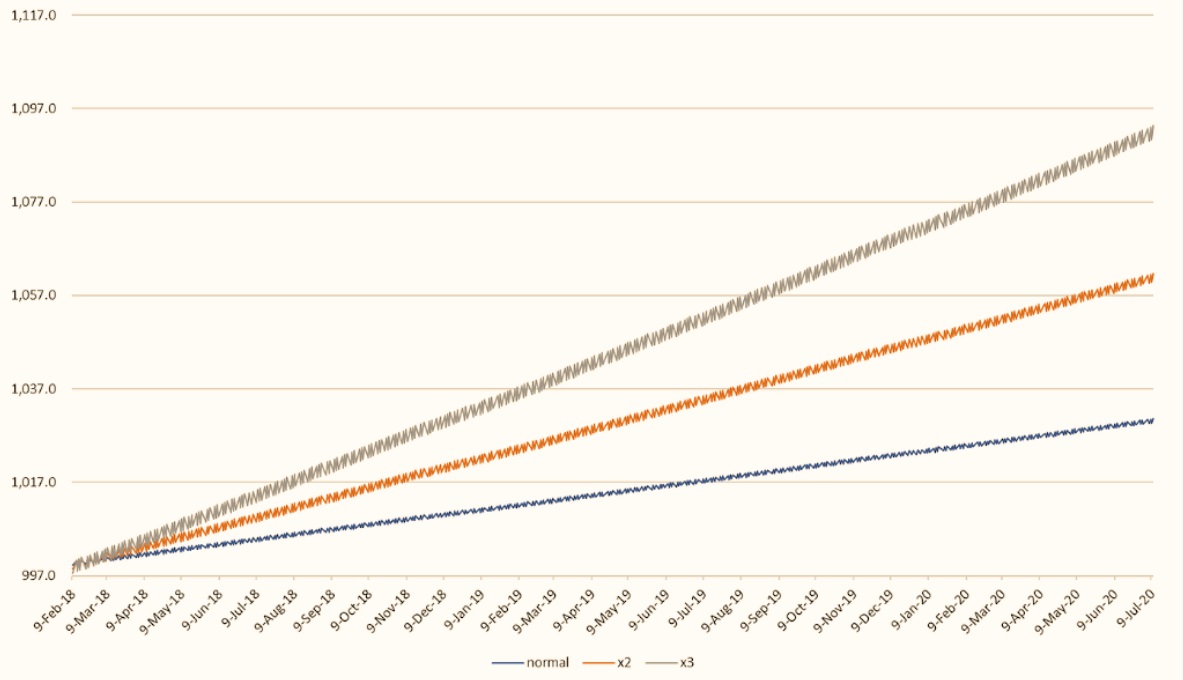

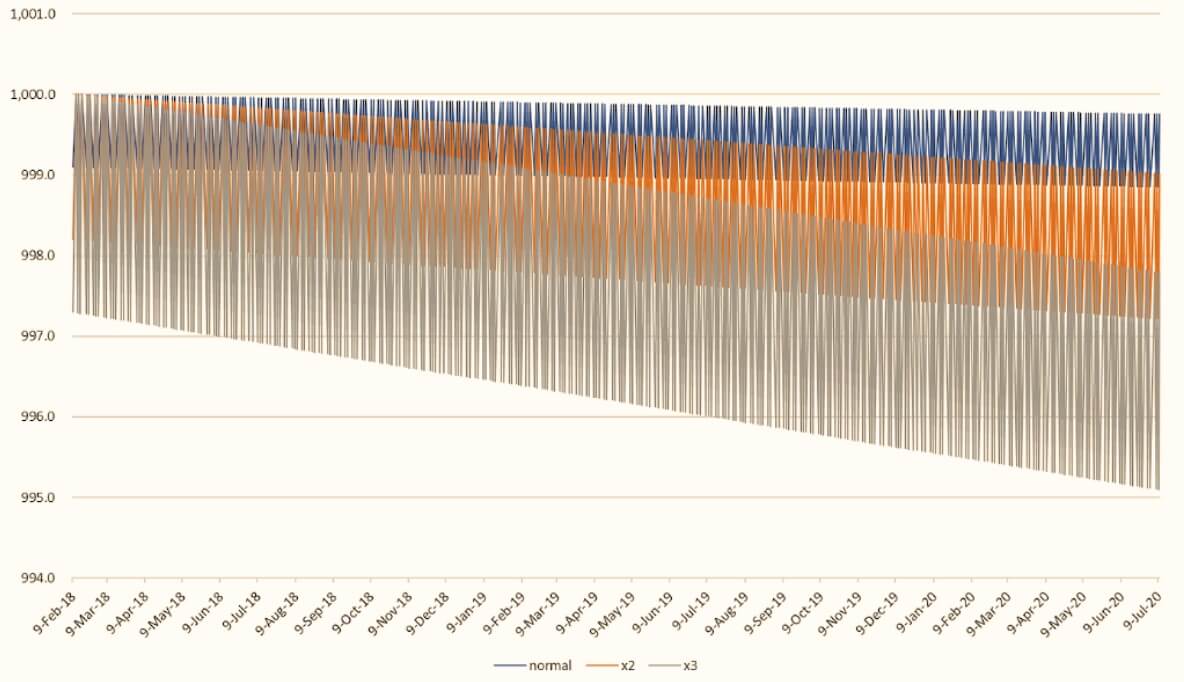

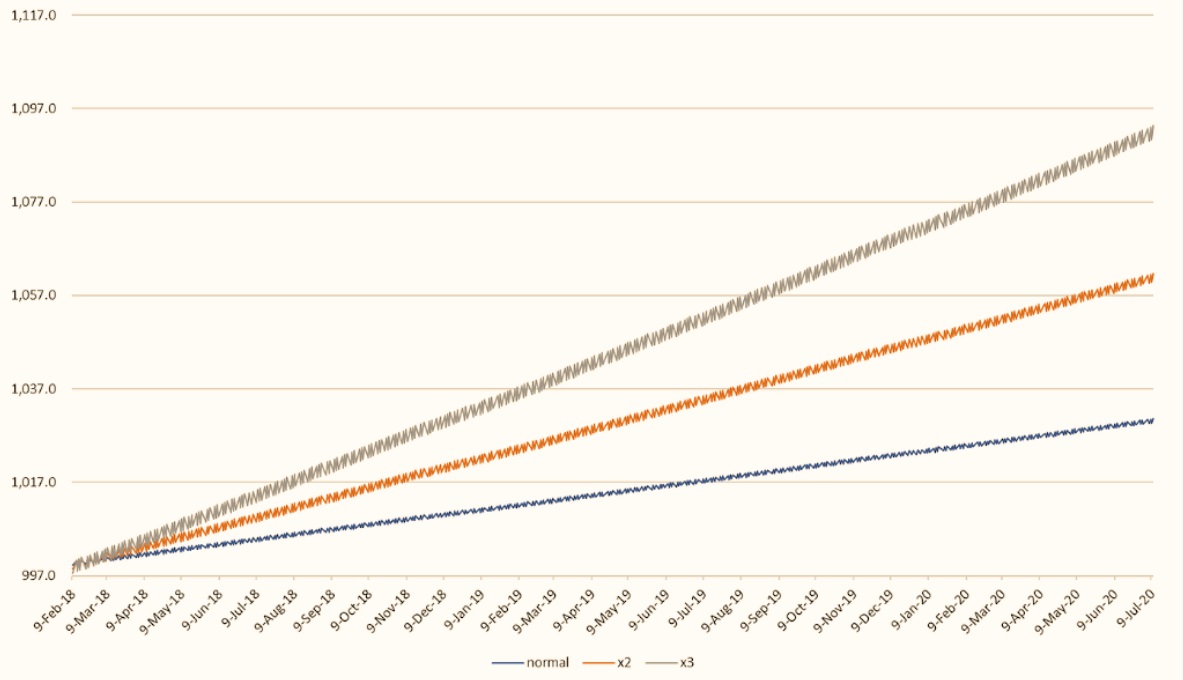

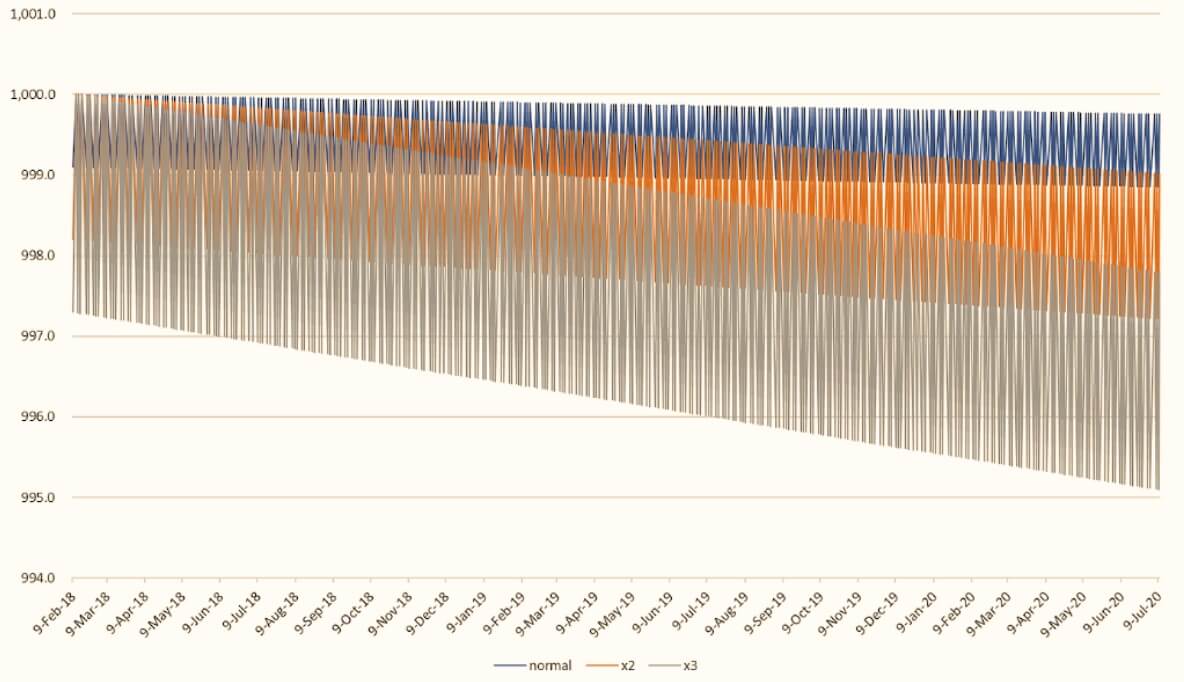

It's important to note that this amplification only applies to the daily returns. Because leveraged ETFs are designed to reset daily, the returns of these funds over longer periods can be significantly different from the expected multiple of the index's performance. This is due to compounding effects and volatility — factors that make these ETFs more suitable for short-term traders, rather than long-term traders.

Types of Leveraged ETFs

When talking about leveraged ETFs, you'll often hear about 2x or 3x funds, which aim to achieve double or triple the return of the underlying index, respectively. These funds are designed to amplify gains in a highly efficient manner, but they can also amplify losses just as quickly if the market moves unfavourably.

In addition to these, there are also inverse leveraged ETFs. These funds are designed to profit from a decline in the value of the underlying index. An inverse leveraged ETF might aim to produce -2x or -3x the daily return of the index, which means that it aims to deliver twice or three times the opposite performance. So, if the underlying index falls, the inverse leveraged ETF is designed to rise, offering a way to profit from falling markets.

Understanding the different types of leveraged ETFs is crucial, as they cater to different investment strategies. Regular leveraged ETFs (like 2x and 3x funds) are typically used by traders who want to capitalise on short-term market movements. In contrast, inverse leveraged ETFs are commonly used for hedging or speculating on downward market trends.

Benefits of Leveraged ETFs

There’s no doubt that leveraged ETFs offer some compelling advantages for the right kind of trader. The most obvious benefit is the potential for higher returns. Since these funds are designed to amplify the daily returns of an index, they allow traders to take advantage of short-term price movements with more significant exposure.

For example, if an trader believes that a specific sector is going to perform well over the short term, a leveraged ETF that tracks that sector can provide much higher potential returns compared to a traditional ETF. This ability to capture greater gains in a shorter time frame is what attracts traders who are focused on momentum-based strategies.

Another benefit is that leveraged ETFs are highly liquid, just like traditional ETFs. This makes them easy to buy and sell throughout the day, providing flexibility for traders who need to react quickly to market changes.

Risks and Considerations

While the rewards of leveraged ETFs can be significant, the risks are equally important to consider. The most notable risk is the potential for amplified losses. Just as leveraged ETFs can magnify gains, they can also magnify losses. If the market moves against the direction of your leveraged ETF, you can lose more money than you initially invested.

This makes leveraged ETFs a more risky choice for long-term investing. Due to the way they reset daily, their performance over longer periods may not align with the multiple you might expect based on the index's return. For example, if you invested in a 2x leveraged ETF and the market went up by 10% one day, you'd see a 20% return. But if the market then went down by 10% the next day, you could end up with a loss of 20%, despite the market being roughly even overall.

Additionally, these funds tend to be more volatile, meaning that the price swings can be larger and more frequent, which can make them unsuitable for more conservative traders or anyone with a low tolerance for risk.

Conclusion

Leveraged ETFs offer a unique way to invest, providing the potential for amplified returns through the use of leverage and derivatives. While they can be highly attractive for traders looking to capitalise on short-term market movements, it's crucial to understand both the rewards and the risks involved. These funds are not for the faint-hearted and are typically best suited for those with experience in trading or those who are comfortable with higher risk in exchange for the possibility of higher returns.

If you're considering investing in leveraged ETFs, make sure you fully understand how they work and carefully assess whether they fit with your overall investment strategy and risk tolerance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.