Start by learning the basics of how stocks work, open a brokerage account, practise with small investments or demo trading, and gradually build experience while managing risk.

Understanding the Stock Market

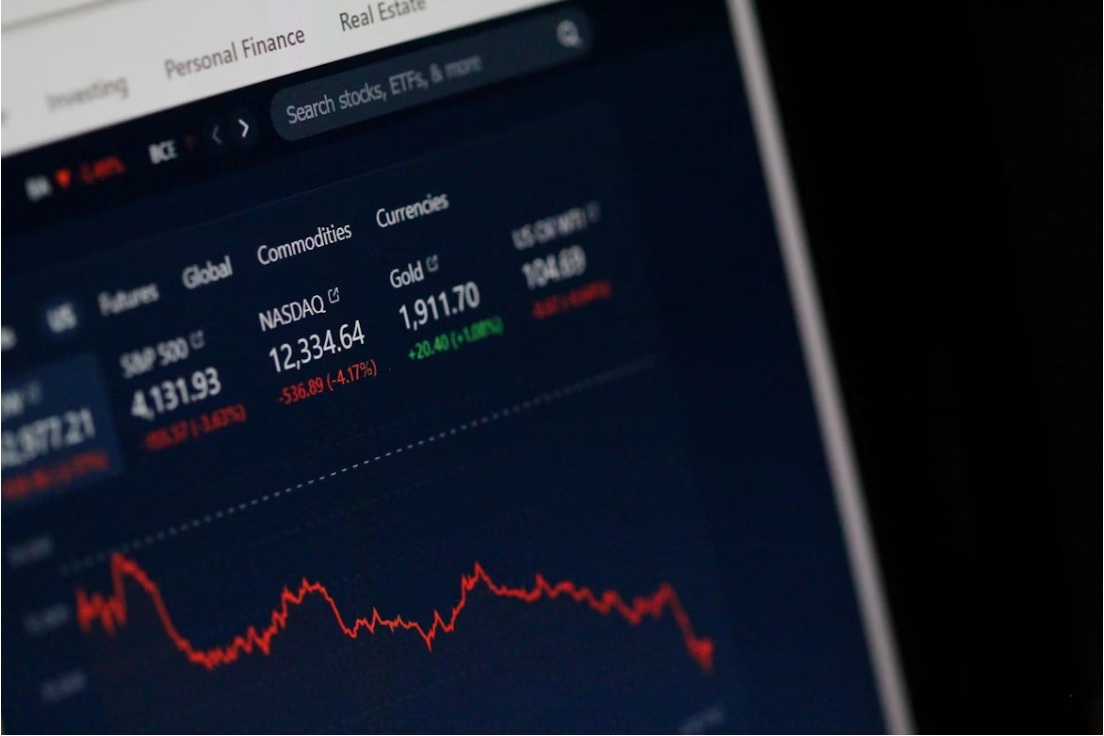

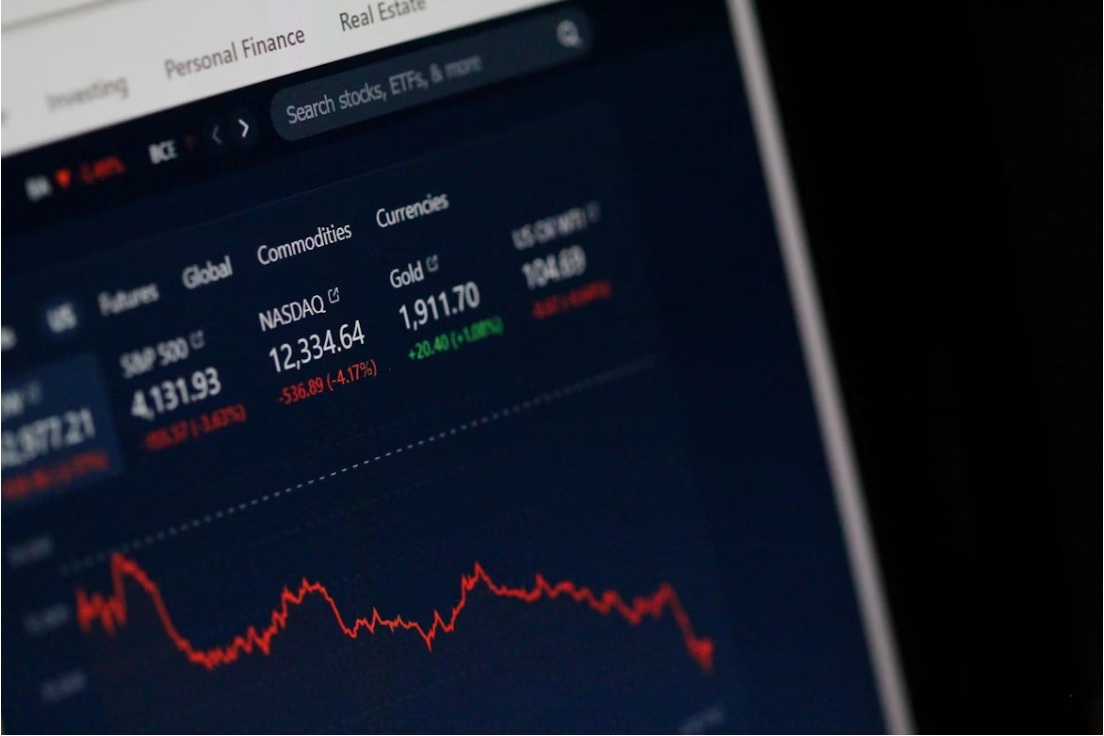

For someone stepping into the world of investing, the stock market may appear complicated, full of charts, tickers, and technical jargon. At its core, however, it is simply a marketplace where buyers and sellers exchange ownership in companies.

There are two primary markets to be aware of:

Primary market – where new shares are issued to the public, usually through an Initial Public Offering (IPO).

Secondary market – where those shares are bought and sold between investors on stock exchanges such as the London Stock Exchange or the New York Stock Exchange.

Stock prices move according to supply and demand, which in turn are shaped by economic conditions, company performance, and investor sentiment. For beginners, appreciating this dynamic helps demystify what otherwise feels like random fluctuations.

Setting Up Your Stock Trading Foundation

To trade stocks, you first need a brokerage account. This account acts as your gateway to the market. Choosing the right broker is essential—factors such as fees, research tools, customer support, and whether the platform is beginner-friendly all matter.

Most brokers today offer two key account types:

Cash accounts, where you can only trade with the money you deposit.

Margin accounts, which allow you to borrow funds from the broker to increase your buying power. Beginners are strongly advised to start with a cash account, as margin trading carries significant risk.

Practising with a demo or paper trading account is also highly recommended. It allows you to learn the mechanics of trading without risking real money, helping you gain confidence before you commit capital.

Stock Market Terminology & Key Concepts

To trade effectively, you must understand the basic language of the markets. Some essential terms include:

Market capitalisation: The total value of a company's shares, calculated as share price × number of outstanding shares.

Dividend: A portion of company profits paid to shareholders.

Bull market: A period when stock prices are rising.

Bear market: A period when stock prices are falling.

Liquidity: How easily a stock can be bought or sold without affecting its price.

Price-to-Earnings (P/E) ratio: A common valuation metric comparing share price to company earnings per share.

Mastering this terminology equips beginners to interpret financial news, broker platforms, and research reports.

Choosing Your Investment Method in Stock Trading

There are multiple ways to participate in the stock market, each with different levels of involvement and risk.

Individual stocks – Buying shares directly in specific companies. While potentially rewarding, this requires careful research and carries higher risk.

Exchange-Traded Funds (ETFs) – Funds that hold a basket of stocks, allowing instant diversification at relatively low cost.

Mutual or index funds – Professionally managed pools of investments, often designed to track a market index.

For beginners, starting with ETFs or index funds provides diversification and reduces the risks associated with relying on a single company's performance. As you gain confidence, you can gradually add individual shares to your portfolio.

Fundamental & Technical in Stock Trading

To decide which shares to buy or sell, traders and investors use two broad approaches:

Fundamental analysis focuses on a company's financial health—analysing revenue, profits, debt, and growth potential. If a company's fundamentals look strong but the share price is low, it may present a buying opportunity.

Technical analysis studies price charts and patterns. Tools such as moving averages, candlestick charts, and volume analysis help traders identify trends and potential entry or exit points.

Most beginners benefit from learning a combination of both methods. Fundamentals provide long-term conviction, while technicals can guide short-term timing.

Risk Management & Trading Psychology in Stock Trading

Perhaps the most important lesson for any beginner is that trading is not just about making profits—it is about protecting capital. Key risk management principles include:

Diversification: Spread your investments across industries and asset types to reduce risk.

Stop-loss orders: Automated instructions to sell a stock if it falls below a set price, limiting potential losses.

Position sizing: Never risk too much on a single trade—many beginners follow the rule of risking no more than 1–2% of their portfolio per trade.

Just as vital is trading psychology. Fear, greed, and impatience can cause poor decision-making. The most successful traders follow a clear plan and remain disciplined, even during market turbulence.

Conclusion

Stock trading for beginners need not be overwhelming. By understanding how the market works, setting up the right foundation, learning essential terms, choosing suitable investment vehicles, and practising risk management, you can enter the world of investing with confidence.

Remember, no one masters the market overnight. Success comes from continuous learning, patience, and discipline. The journey may start small, but with steady steps, it can become a powerful path to long-term wealth building.

Frequently Asked Questions

Q1. How much money do I need to start stock trading?

You can begin with small amounts, often as little as £100–£500. depending on your broker. Many platforms now allow fractional share purchases.

Q2. Is stock trading risky for beginners?

Yes, all investing carries risk. Beginners should start small, diversify, and use risk management strategies like stop-loss orders.

Q3. Should I trade stocks or invest for the long term?

For most beginners, long-term investing through ETFs or index funds is safer. Active trading requires more skill, research, and emotional discipline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.