PDD Holdings Inc. (NASDAQ: PDD), the parent company of Chinese e-commerce platforms Pinduoduo and international marketplace Temu, recently reported its Q2 2025 financial results. The earnings showcased a mix of revenue growth and profitability challenges, prompting investors to reassess the stock's potential. In this article, we delve into the key financial metrics, strategic initiatives, and market reactions to evaluate whether PDD stock is a prudent investment choice.

PDD Q2 2025 Earnings Overview

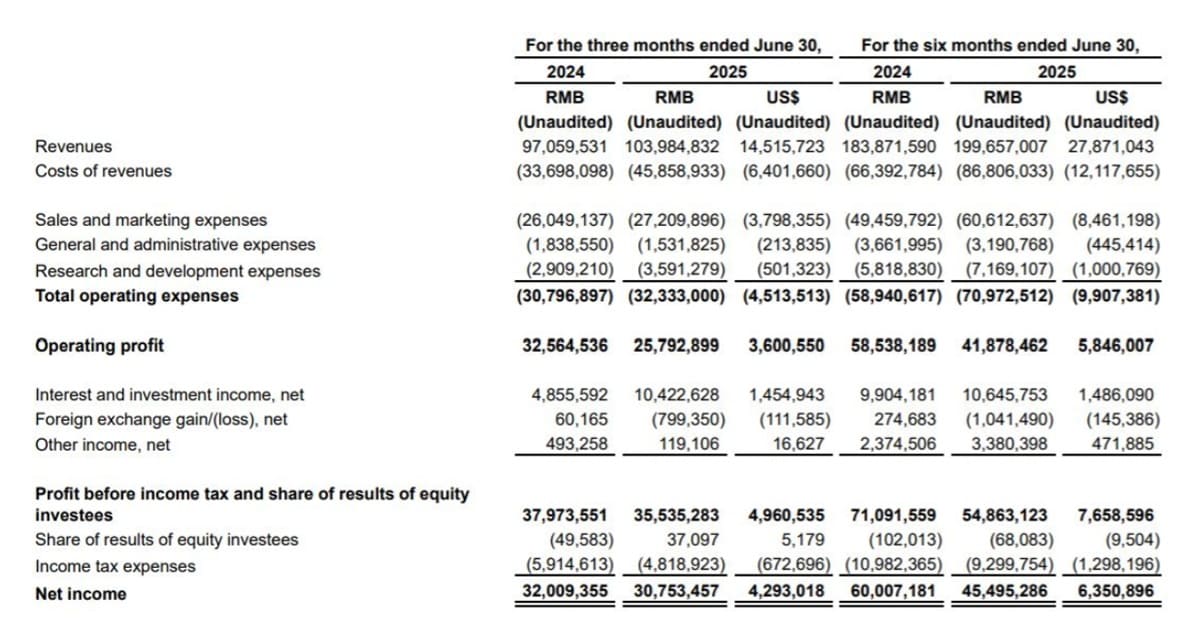

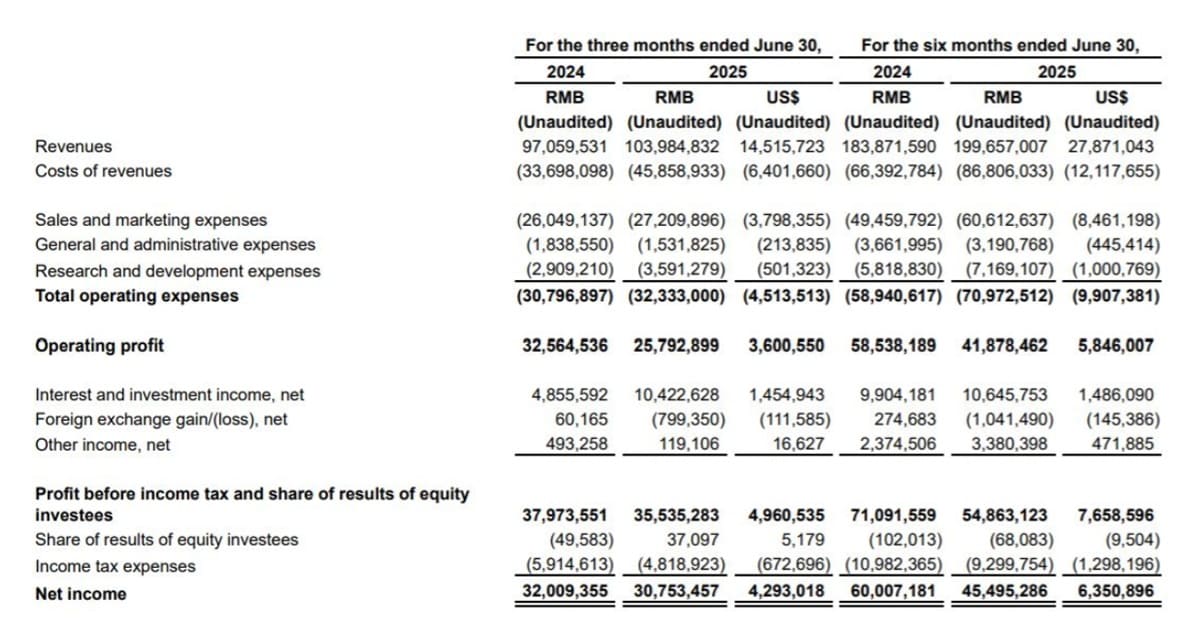

PDD Holdings reported total revenues of ¥103.98 billion (approximately $14.5 billion), marking a 7% year-over-year increase. This growth was primarily driven by a 13% rise in online marketing services revenue, which reached ¥55.7 billion. However, the company's overall revenue growth has moderated compared to previous quarters, reflecting intensified competition in the e-commerce sector .

Despite the revenue uptick, PDD Holdings faced a decline in profitability. Operating profit decreased by 21% to ¥25.8 billion, and net income fell 4% to ¥30.8 billion. The decline in profitability was attributed to a 36% surge in costs, primarily due to increased fulfillment fees, bandwidth and server costs, and payment processing fees .

On a positive note, the company reported adjusted earnings per share (EPS) of ¥22.07 ($3.08), surpassing analyst estimates of ¥15.53. This performance highlights PDD Holdings' ability to maintain earnings strength despite rising costs .

Strategic Initiatives and Long-Term Outlook

PDD Holdings has been investing heavily in merchant support initiatives, including the "100 billion core program," aimed at strengthening its merchant ecosystem. These investments, while impacting short-term profitability, are expected to foster long-term growth by enhancing platform efficiency and competitiveness .

The company faces challenges in its international operations, particularly with Temu, due to the recent elimination of the U.S. de minimis tariff exemption. In response, PDD Holdings has been stockpiling goods in U.S. warehouses and expanding aggressively in markets like Europe and Brazil to mitigate potential obstacles .

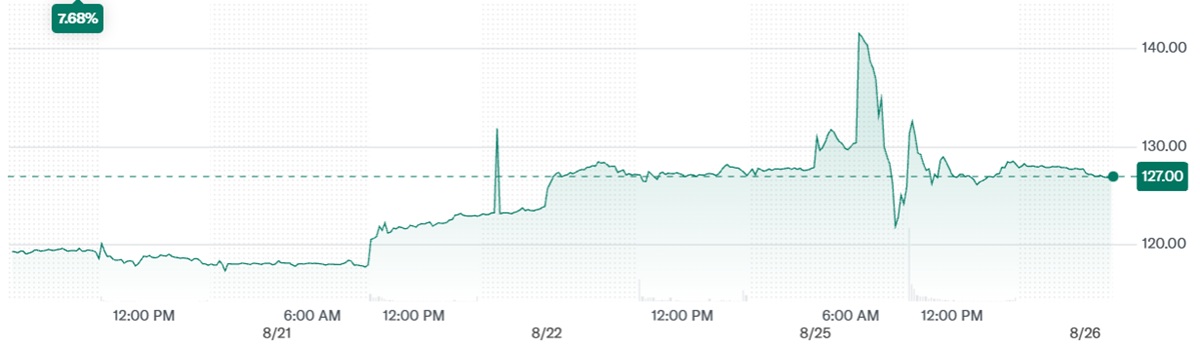

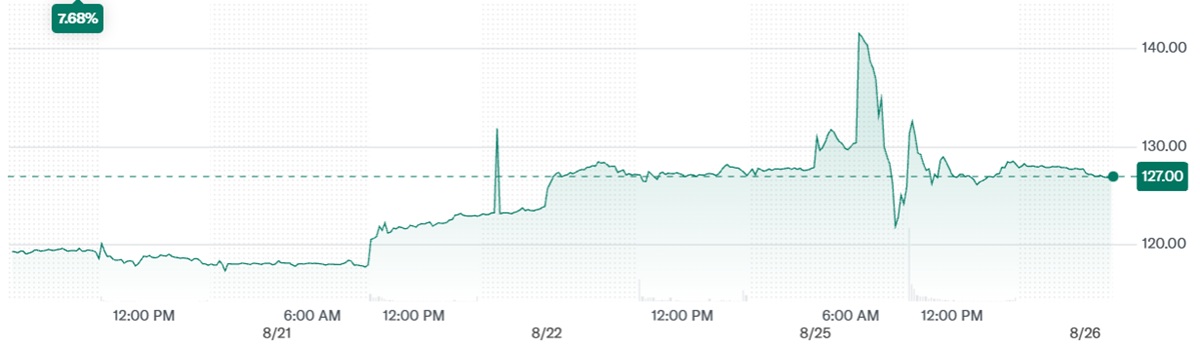

Following the earnings report, PDD Holdings' stock experienced a 12% surge in pre-market trading, reflecting investor optimism. However, the stock price later settled at $128.21. up 1% from the previous close, indicating a mixed market reaction .

Conclusion: Weighing the Investment Decision

PDD Holdings presents a compelling case for long-term investment, driven by its strategic initiatives and strong earnings performance. However, investors should be mindful of the competitive pressures and rising costs that may impact short-term profitability. As with any investment, it's crucial to assess your risk tolerance and investment horizon before making a decision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.