URA ETF can be a compelling play on nuclear energy's revival, but its volatility means it best suits long-term, risk-tolerant investors.

Uranium is regaining attention as nuclear power re-enters the global energy conversation. For investors, the URA ETF has become a popular way to gain exposure to this trend, combining uranium miners, nuclear technology firms, and physical uranium holdings. But is it the right choice for your portfolio? Below, we break down what the URA ETF is, how it works, the opportunities it offers, and the risks you should weigh before investing.

Uranium's Comeback: Why the World is Looking Again at Nuclear Energy

For much of the last decade, uranium was a forgotten corner of the commodities market. Following the Fukushima disaster in 2011. nuclear energy was vilified, reactor projects stalled, and uranium prices languished at historic lows. Investors abandoned the sector, leaving uranium stocks to drift in obscurity.

Fast forward to today, and the narrative has shifted. As governments scramble to meet carbon-neutral goals, nuclear power has returned to the stage as a reliable, carbon-free energy source. Countries from China to France are building new reactors, while innovations in small modular reactors (SMRs) promise to reshape the future of electricity generation. In this context, uranium is once again in demand — and with it, funds like the Global X Uranium ETF (URA) are gaining investor attention.

What is URA ETF and How Does it Work?

Launched by Global X, URA ETF provides a convenient way for investors to gain exposure to the uranium industry. Instead of buying individual mining stocks or attempting to track the volatile uranium spot market, investors can purchase shares of URA to access a diversified basket of companies linked to the uranium value chain.

URA tracks the Solactive Global Uranium & Nuclear Components Total Return Index, which includes uranium miners, refiners, and companies developing nuclear technologies. This structure means URA is not just a pure play on uranium prices; it also reflects the broader nuclear ecosystem. For investors, this makes URA both a thematic and a commodity-linked ETF.

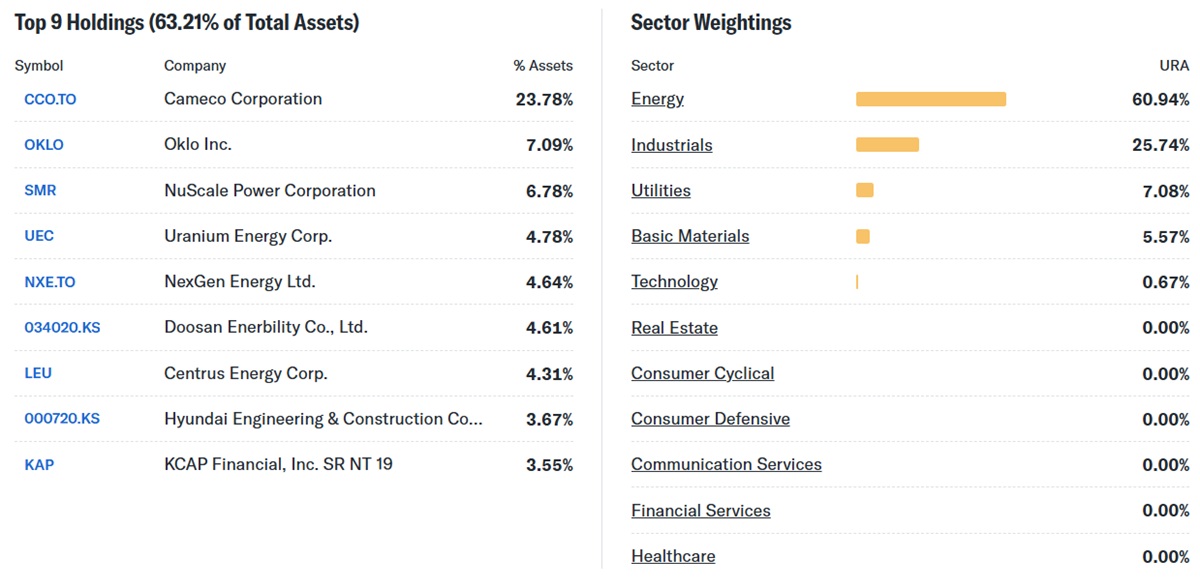

Inside the Portfolio: Giants, Innovators, and Physical Uranium

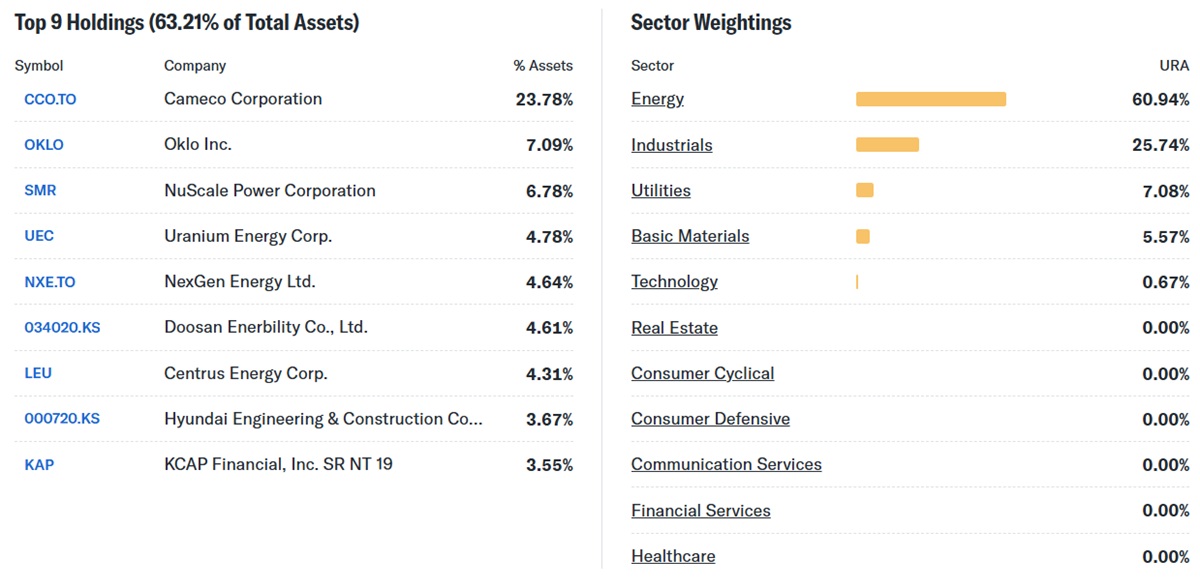

One of URA's appeals is its carefully curated portfolio. The ETF invests in both industry giants and smaller innovators, providing a balanced view of the uranium market.

Mining Giants – Companies like Cameco (Canada) and Kazatomprom (Kazakhstan) dominate production and serve as bellwethers for the sector.

Explorers and Developers – Firms such as NexGen Energy and Denison Mines are exploring new reserves and preparing for future production, offering potential growth.

Physical Exposure – Through holdings in the Sprott Physical Uranium Trust, URA indirectly owns physical uranium, giving investors a more direct link to spot prices.

Nuclear Technology Firms – Beyond mining, URA also includes companies involved in reactor design and components, broadening its thematic reach.

This combination makes URA distinct from other commodity ETFs: it offers exposure not only to the raw material but also to the technologies and infrastructure that rely on it.

Market Forces that Drive URA: Price, Policy, and Geopolitics

The value of URA is tied closely to a mix of market forces:

Uranium Prices – Spot prices of uranium are notoriously cyclical. A sharp rise in uranium prices often translates into higher valuations for miners, and by extension, URA's performance.

Policy Shifts – Government support for nuclear energy — such as France's reactor expansion or Japan's reactor restarts — boosts sentiment. Similarly, policy backing for SMRs could accelerate uranium demand.

Geopolitics – Kazakhstan, which supplies over 40% of global uranium, remains a geopolitical wildcard. Supply disruptions or trade restrictions can quickly alter the market balance.

Energy Security – In a world increasingly concerned about dependence on fossil fuels and geopolitical tensions over gas and oil, nuclear energy is being reframed as a stable, sovereign energy solution.

URA's sensitivity to these drivers makes it both compelling and volatile — attractive for those who believe in the uranium story but risky for the faint-hearted.

Risk and Reward: Why URA Can Shine or Struggle

Investing in URA comes with both opportunity and peril. On the reward side, a long-term shift towards nuclear power could send uranium demand soaring, potentially lifting miners and the ETF with it. Technological advances in SMRs and international climate commitments add further tailwinds.

Yet risks are unavoidable. URA is highly concentrated — with a handful of top holdings making up the bulk of its portfolio. It is also tightly linked to uranium spot prices, which are notoriously volatile and influenced by unpredictable events such as accidents, regulatory changes, or geopolitical tensions. Investors must also consider the cyclical nature of commodities; bull runs in uranium are often followed by extended downturns.

The Road Ahead: Can URA Power Long-Term Portfolios?

As the world navigates the energy transition, the question is not whether nuclear energy will play a role, but how large a role it will assume. If uranium demand accelerates due to reactor builds and SMR deployment, URA could benefit significantly.

For investors, URA represents a thematic satellite holding — not a core portfolio staple, but a potential growth driver for those willing to tolerate risk. Its exposure to miners, nuclear innovators, and physical uranium makes it a unique vehicle to participate in the nuclear revival story.

In short, URA ETF is both a bet on uranium's resurgence and a play on the broader energy transition. For those who believe nuclear energy will be central to a cleaner future, URA offers an accessible and diversified way to capture that theme.

Frequently Asked Questions (FAQ) – URA ETF

Q1: What is URA ETF?

A: URA ETF is the Global X Uranium ETF, designed to track companies involved in uranium mining, nuclear technology, and physical uranium holdings. It provides investors with diversified exposure to the uranium and nuclear energy sector.

Q2: How does URA ETF perform?

A: URA's performance is tied to uranium prices, mining company results, and nuclear policy trends. It can offer strong gains during uranium upcycles but is also highly cyclical and volatile.

Q3: Is URA ETF a suitable investment?

A: URA is best suited for long-term, risk-tolerant investors interested in the nuclear energy theme. While it offers growth potential, it carries higher volatility and sector-specific risks compared to broad-market ETFs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.