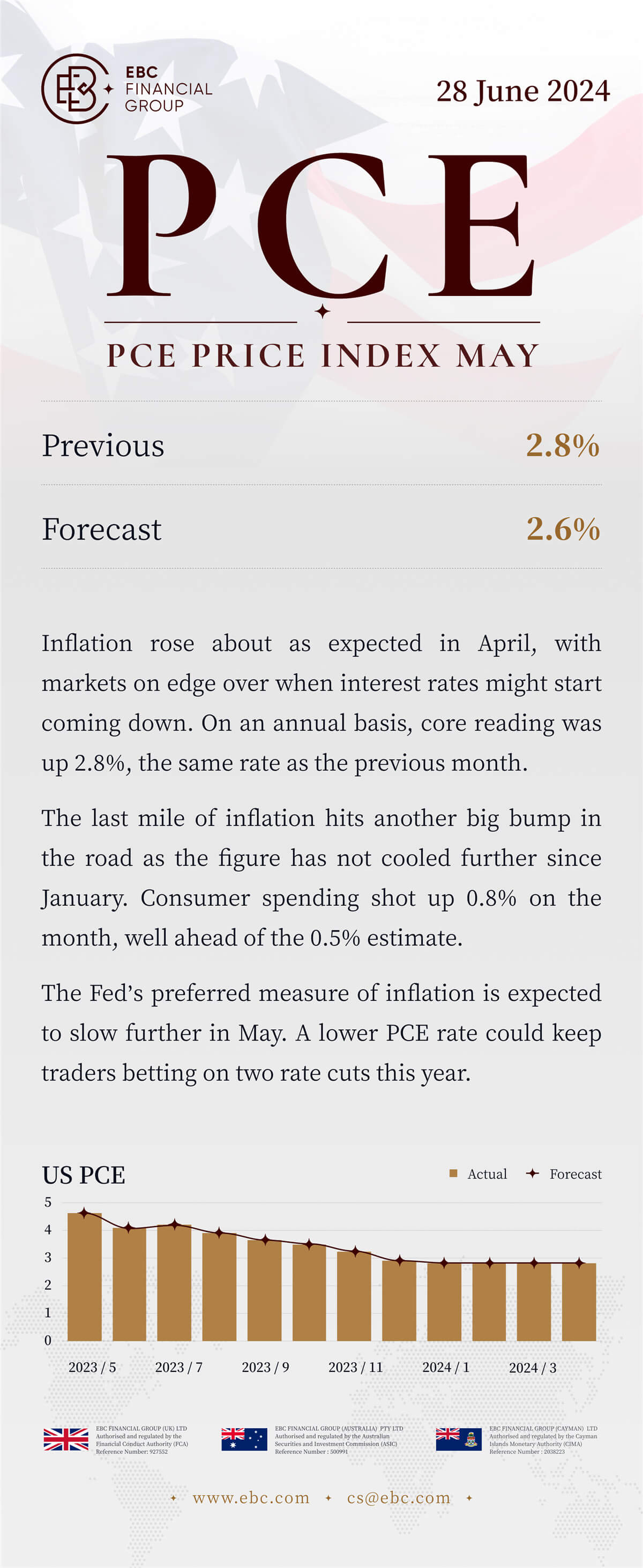

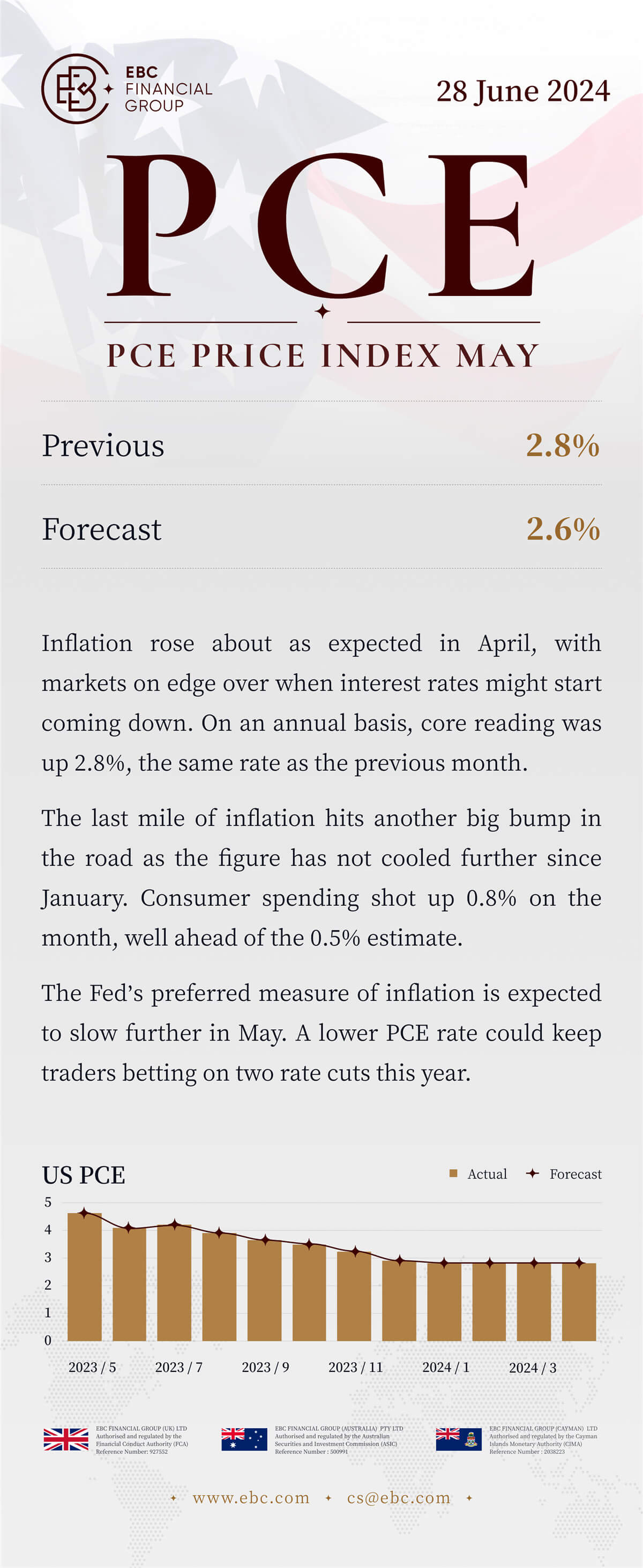

PCE Price Index May

28/6/2024 (Fri)

Previous: 2.6% Forecast: 2.8%

Inflation rose about as expected in April, with markets on edge over when

interest rates might start coming down. On an annual basis, core reading was up

2.8%, the same rate as the previous month.

The last mile of inflation hits another big bump in the road as the figure

has not cooled further since January. Consumer spending shot up 0.8% on the

month, well ahead of the 0.5% estimate.

The Fed’s preferred measure of inflation is expected to slow further in May.

A lower PCE rate could keep traders betting on two rate cuts this year.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.