The healthcare sector rarely dominates headlines like tech or energy, but when volatility strikes or markets shift defensive, capital tends to flow into names like Eli Lilly, Johnson & Johnson, and UnitedHealth. For traders looking to capitalise on sector moves without managing dozens of individual tickers, the XLV ETF offers a high-liquidity, large-cap vehicle that reflects the pulse of U.S. healthcare giants. Whether you're hedging macro risk, trading policy news, or rotating into a low-beta sector, XLV deserves close attention on your watchlist.

Overview of XLV ETF

The Health Care Select Sector SPDR Fund (ticker: XLV) is a passively managed ETF designed to track the Health Care Select Sector Index, a sub-index of the S&P 500. This fund is one of the original sector ETFs introduced by State Street Global Advisors, launched in December 1998. and has since grown into a liquid, high-volume trading instrument.

XLV includes companies involved in pharmaceuticals, biotechnology, healthcare equipment, providers, and services. As of mid-2025. the fund holds around 65 constituents, with large-cap heavyweights like Eli Lilly, UnitedHealth Group, Johnson & Johnson, and Merck & Co. commanding significant weights.

For traders, this ETF provides a broad, liquid vehicle to express directional views or hedge sector-specific exposure within the broader equity market.

Fund Structure & Index Tracked

XLV tracks the Health Care Select Sector Index, which is essentially the healthcare component of the S&P 500 Index. This means all holdings in XLV are large-cap U.S. healthcare companies, and it does not include mid or small-cap firms, nor does it touch non-U.S. stocks.

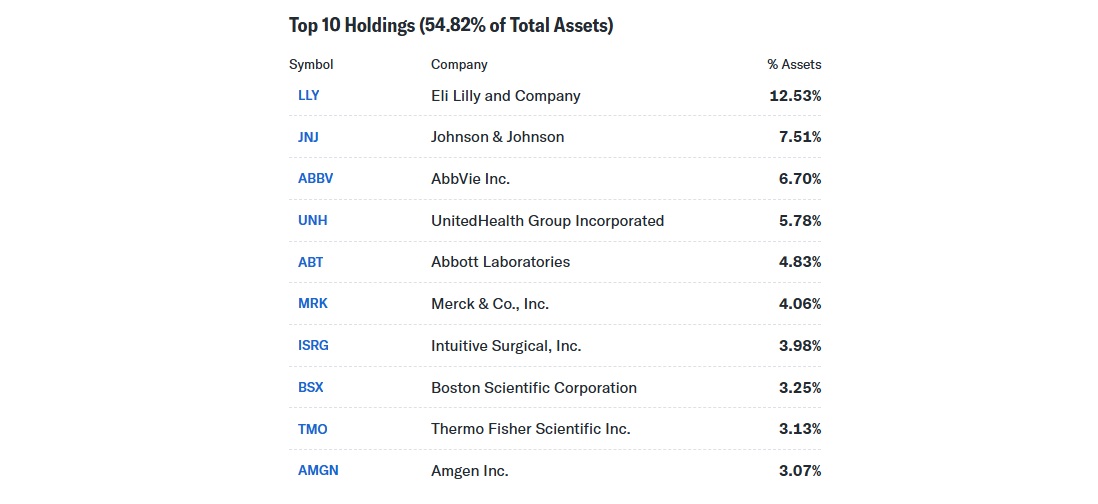

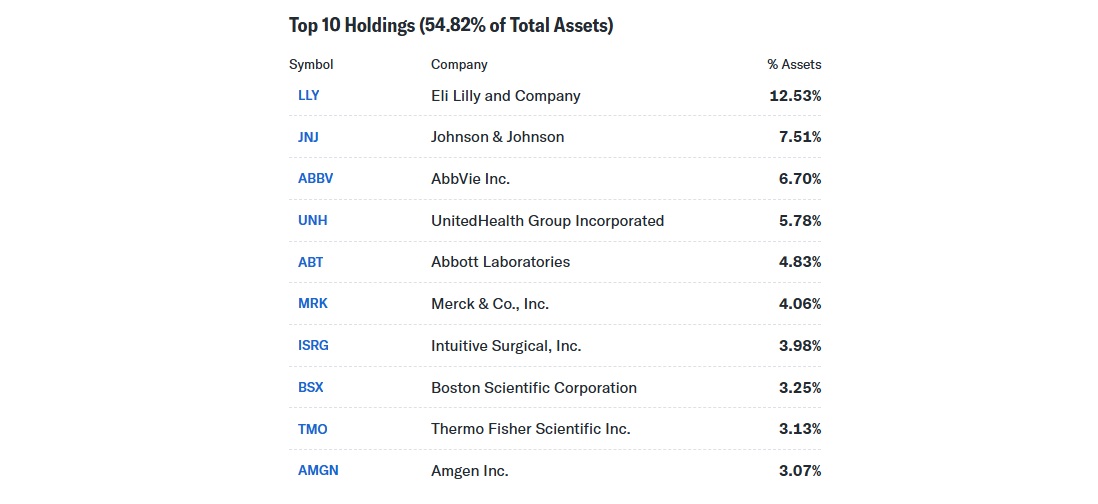

The index is market-cap weighted, causing a concentration in the top five names. In 2025. Eli Lilly alone often comprises 12–13% of the fund, followed by UnitedHealth Group (~9%), and Johnson & Johnson (~8%). This top-heavy structure can significantly affect how XLV moves — which is important for traders looking at intraday volatility triggers or news-driven sector rotations.

Top Holdings & Sector Allocation

The composition of XLV leans heavily toward pharmaceuticals and healthcare providers, which jointly account for over 65% of the portfolio:

Pharmaceuticals: Eli Lilly, Merck, Pfizer

Health Insurance/Providers: UnitedHealth, Cigna, Humana

Medical Devices & Equipment: Abbott, Medtronic, Thermo Fisher

Biotech: Amgen, Vertex Pharmaceuticals

From a trading standpoint, XLV can act as a proxy for drug pricing legislation, clinical trial developments, or even FDA approvals, since single-name catalysts within top holdings often influence ETF price action.

Furthermore, XLV can serve as a hedge or short-term momentum tool during market pullbacks, as healthcare is a traditionally defensive sector.

Expense Ratio & Fees

XLV boasts an expense ratio of just 0.10%, placing it among the most cost-efficient sector ETFs on the market. While this is more relevant to long-term holders, traders will find comfort in knowing that the ETF suffers minimal tracking error and has tight bid-ask spreads, thanks to its high average daily volume and deep options market.

There are also liquid weekly and monthly options chains available, making XLV suitable for derivatives traders looking to implement covered calls, vertical spreads, or protective puts with relatively low slippage.

Performance History & Return Metrics

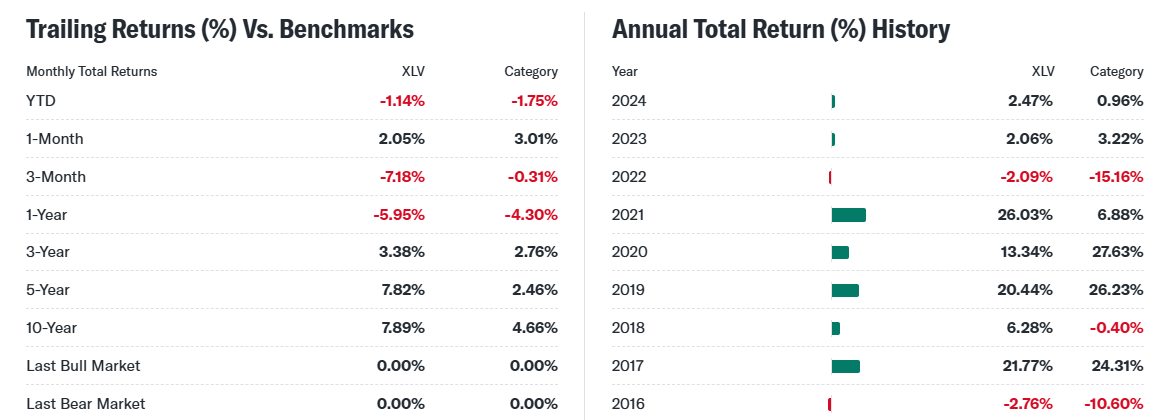

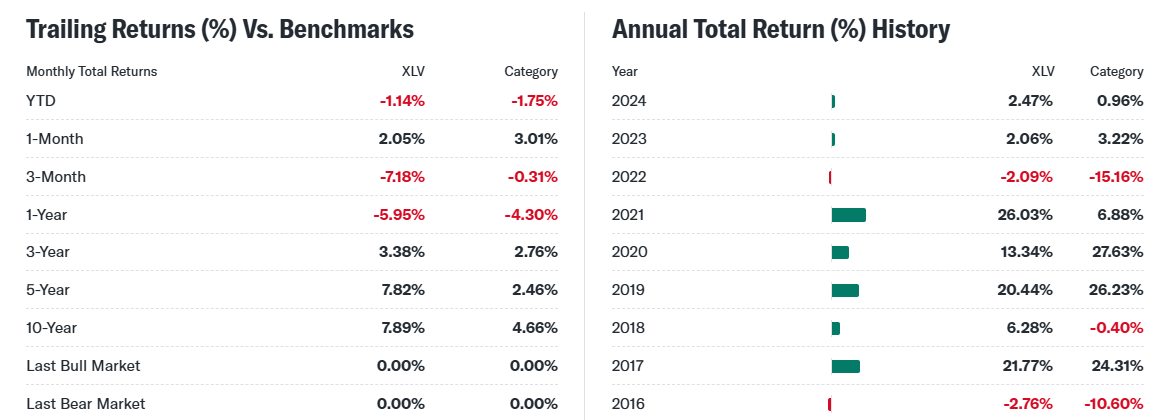

Over the last 5–10 years, XLV has offered consistent, if unspectacular, returns—annualising between 7–10%, depending on the timeframe. But what really matters to traders is relative performance and volatility profile.

Notably:

XLV tends to outperform during risk-off periods, thanks to its defensive nature.

During bull markets, it typically lags tech-heavy ETFs like XLK but shows lower drawdowns.

The ETF has beta ~0.75 vs. S&P 500. indicating it is less volatile than the broader market.

Its 30-day historical volatility hovers between 12–16%, with occasional spikes during major political or regulatory announcements.

In 2025. XLV is largely flat year-to-date, underperforming the broader market but outperforming financials and real estate. This sideways movement makes it ideal for mean reversion strategies, range trading, or volatility breakouts.

Risks & Considerations for Traders

Despite its defensiveness, XLV isn't immune to risks — especially those unique to the healthcare industry. Traders must stay alert to several key catalysts:

Government Policy: Drug pricing caps, Medicare expansions, or regulatory overhauls often trigger abrupt moves in XLV and its top holdings.

Earnings Surprises: Given the weight of its top five stocks, a single earnings beat or miss can pull the entire ETF in either direction.

GLP-1 Volatility: With Eli Lilly and Novo Nordisk (via ADRs and industry exposure) dominating attention due to weight-loss drugs, XLV is often a side-bet on GLP-1 news.

Rotation Risk: XLV may underperform during aggressive risk-on periods when capital flows into cyclical or growth sectors.

In addition, traders should watch for healthcare M&A activity, FDA approvals, and macro data affecting healthcare costs, such as CPI medical care sub-index or PCE healthcare inflation components.

Final Thoughts

XLV offers an exceptional combination of liquidity, low costs, and focused sector exposure, making it a staple for tactical traders looking to exploit short-term healthcare themes or hedge broader exposure.

Its concentration in large, stable U.S. names makes it a safer sector ETF to trade intraday or overnight, but it still reacts sensitively to news and policy events. Whether you're trading earnings season rotations, playing a sector bounce, or hedging risk-off scenarios, XLV provides the instruments — from ETF shares to deep option chains — to meet your tactical needs.

Traders who take the time to understand the underlying index, weightings, and sector dynamics will be best positioned to take advantage of XLV's subtle but tradeable moves.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.