Trading in the forex market is exciting, but without a firm grasp of risk management, it can quickly turn into a costly endeavour. One of the most important tools a trader can use is the forex lot size calculator.

Designed to help calculate the appropriate trade size based on account balance, risk tolerance, and market conditions, this simple yet powerful tool has become essential for both new and experienced traders.

What Is a Forex Lot Size Calculator?

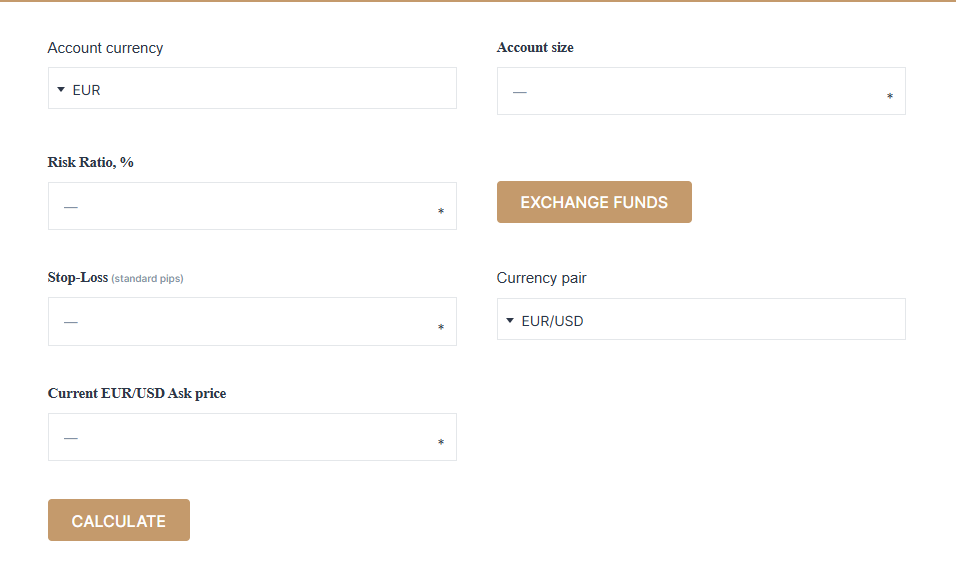

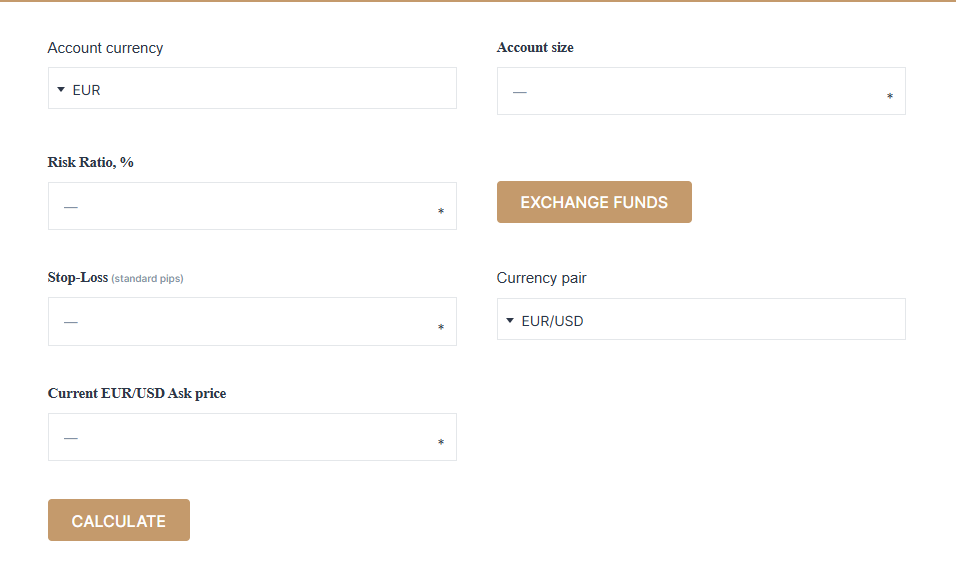

A forex lot size calculator is a tool that determines the correct position size for a trade, ensuring that you do not risk more than a predetermined percentage of your trading capital. It takes into account your account currency, the currency pair you are trading, the size of your stop loss, and your risk percentage.

Without this calculator, many traders make the mistake of choosing arbitrary lot sizes, which often leads to overexposure, inconsistent risk, and potentially devastating losses. The forex lot size calculator removes the guesswork from position sizing, providing clarity and consistency in your trading routine.

Why It Matters for Risk Management

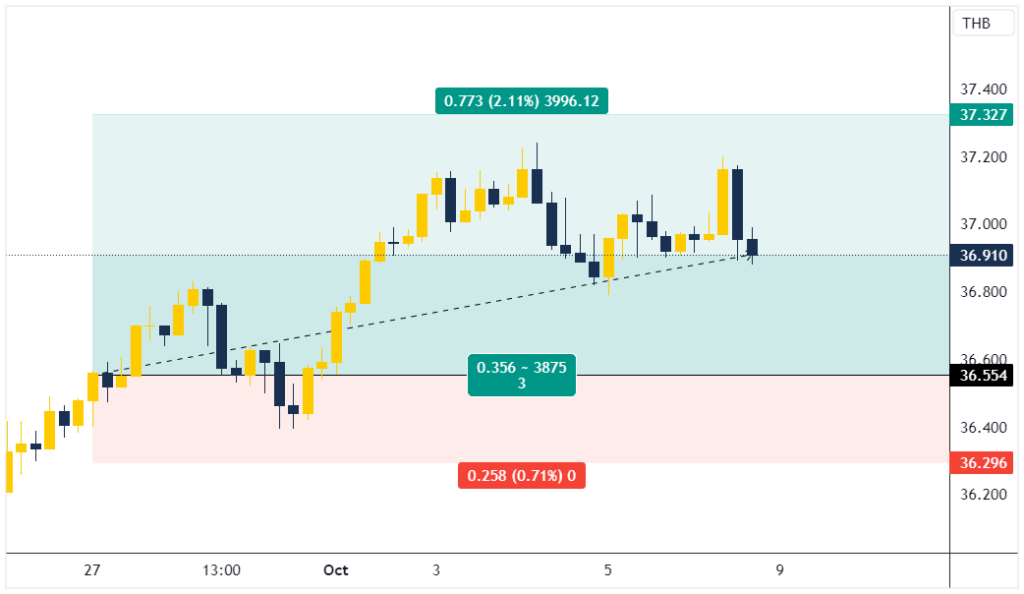

At its core, trading success is not just about strategy but about how you manage risk. Even with a solid Trading plan, poor risk management can wipe out your capital. This is where the forex lot size calculator shines. It allows you to keep your risk per trade consistent, protecting your account from large drawdowns.

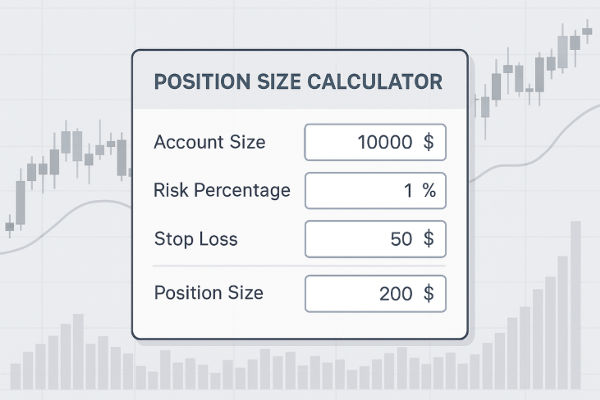

Say you have a Trading Account of $10,000 and you are willing to risk 2 percent on each trade. That means you should not lose more than $200 per position. A forex lot size calculator will take your stop loss distance and calculate exactly how many lots you can trade while staying within that $200 limit.

By making the math easy and instant, this tool ensures traders follow a disciplined approach. Over time, consistent risk sizing improves your ability to survive long losing streaks and remain in the game long enough to benefit from your edge.

How It Works in Practice

Let's say you are trading GBP/USD, and you want to enter a position with a 50-pip stop loss. You have a $5,000 account and plan to risk 1 percent per trade. Instead of estimating and potentially misjudging your lot size, the forex lot size calculator gives you a precise answer. In this case, it might recommend a trade size of 0.10 lots, or one mini lot.

By aligning your position size with the exact risk amount, you avoid risking too much or too little. This level of precision is not only helpful for capital preservation but also boosts trader confidence, knowing that every trade has been planned logically.

Who Should Use a Forex Lot Size Calculator?

Anyone involved in forex trading should use one. Whether you are a day trader, swing trader, or position trader, managing position size correctly is essential. Beginners often underestimate the importance of this and suffer losses due to taking trades that are too large for their account size. Experienced traders use the forex lot size calculator to maintain consistency, reduce emotional decision-making, and streamline their process.

For traders using expert advisors or automated strategies, integrating a forex lot size calculator into the code is common practice to control risk dynamically as account equity changes.

The Psychological Edge It Offers

Emotional control is critical in trading. A large, unplanned position can cause panic when it goes against you. On the other hand, risking too little might lead to missed opportunities. By using a forex lot size calculator, traders predefine their risk. This removes hesitation and regret, helping them focus on execution rather than second-guessing their decisions.

Knowing your trade fits within a calculated risk framework adds psychological comfort, which is often underestimated. This mental clarity enables you to follow your trading plan with greater confidence and avoid impulsive behaviour.

Common Mistakes Without One

Without using a forex lot size calculator, traders often fall into two major traps. First, they might risk too much, leading to oversized losses that are hard to recover from. Second, they might trade too small, limiting their profit potential even when their strategy works.

Another frequent mistake is failing to adjust lot size when account balance changes. For example, after a series of losses, continuing to trade the same size can breach your risk parameters. The forex lot size calculator solves this by adapting your trade size to your current account equity.

Integrating It into Your Strategy

The best way to benefit from a forex lot size calculator is to make it part of your trade setup routine. Before entering any position, calculate your lot size based on your risk rules. Whether you do it manually or through a calculator on a trading platform, it should become a non-negotiable step.

Most platforms now offer integrated lot size calculators, and many brokers provide free tools on their websites. You can also find downloadable apps and online versions that cater to various account currencies and instruments.

Why It Beats Manual Calculation

Manual calculations are prone to errors, especially under pressure. In fast-moving markets, a small mistake in position sizing can make a big impact. A forex lot size calculator ensures accuracy and saves time. It also helps avoid the tendency to round numbers in your favour, a common psychological bias among traders.

Using a calculator reinforces discipline and eliminates subjective decision-making. When everything is pre-calculated and aligned with your trading plan, execution becomes smoother and more professional.

Final Thoughts

The forex lot size calculator might seem like a simple tool, but its impact on trading outcomes is significant. It ensures you protect your capital, standardise your risk, and approach every trade with a clear and objective mindset. As part of your trading toolkit, it plays a vital role in both short-term performance and long-term success.

If you are not already using a forex lot size calculator, now is the time to integrate it into your trading routine. The benefits go beyond numbers. It is a tool for precision, consistency, and peace of mind.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.