Forex trading lets you trade currency pairs to profit from exchange rate shifts. Known as foreign exchange, it's the world's largest market, handling over $6 trillion daily.

Whether you're a beginner or seasoned trader, understanding how to trade currency effectively is key. This guide covers the essentials, currency pairs, pips, market hours, and risk management. Ready to dive in?

Let's explore what makes Forex tick and how you can succeed when you trade currency.

What Does It Mean to Trade Currency?

To trade currency means buying one currency while selling another. For example, you might buy GBP/USD, betting the pound will rise against the dollar. If it does, you sell for a profit. Forex operates 24/5, with no central exchange. It's driven by banks, businesses, and traders globally. In 2022, daily turnover hit $7.5 trillion, per the Bank for International Settlements.

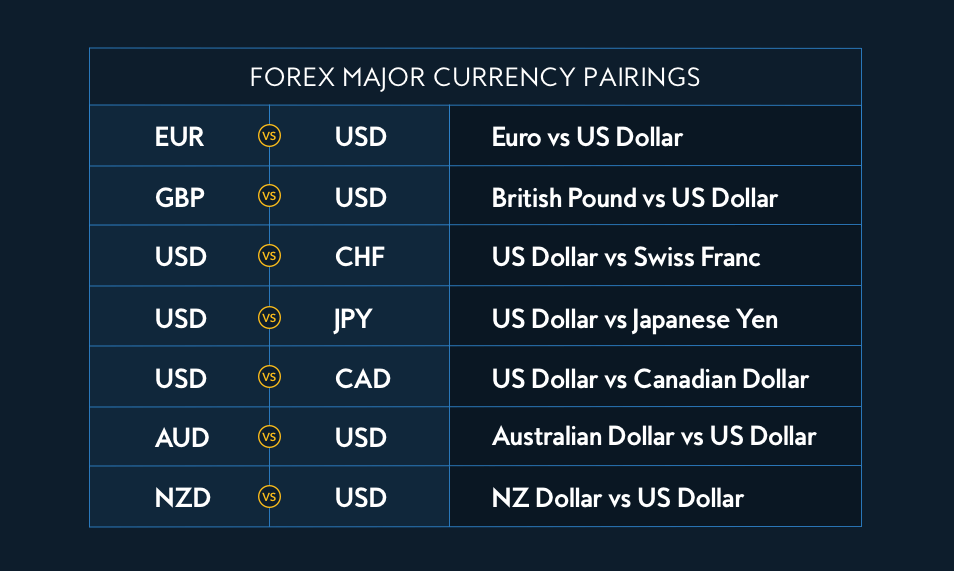

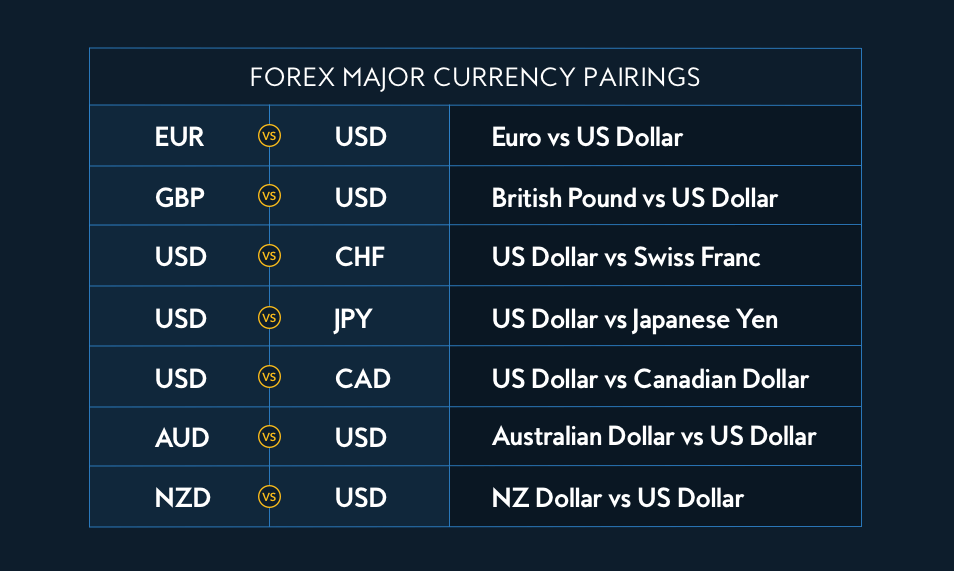

Currency Pairs: The Building Blocks

Currency pairs are the heart of Forex. Each pair has a base currency and a quote currency. GBP/USD at 1.3000 means £1 equals $1.30. Major pairs like EUR/USD and USD/JPY dominate, making up 80% of trades. They're liquid, with tight spreads. Exotic pairs, like USD/TRY, are riskier due to volatility and wider spreads.

Pips and Spreads Explained

Pips measure price changes. For EUR/USD, a move from 1.1000 to 1.1001 is one pip. Spreads are the gap between buy and sell prices—your trading cost. Major pairs often have spreads below one pip, while exotics can exceed 10. Low spreads save money when you trade currency frequently.

Forex Market Hours and Volatility

Forex runs 24 hours across Tokyo, London, and New York sessions. The London-New York overlap (12:00-17:00 GMT) sees peak activity. Volatility spikes during economic releases, like interest rate decisions. In 2023, 65% of traders preferred these hours, per a Forex Factory poll, to trade currency profitably.

Why Trade Currency?

Trading currency offers flexibility. It's accessible with low starting capital—some brokers accept £50. Leverage, often 1:100, boosts buying power but also risk. The market's size ensures liquidity, unlike stocks. Plus, you can profit in rising or falling markets, unlike traditional investments.

How to Start Trading Currency

Beginners can trade currency with these steps:

Pick a broker regulated by the FCA.

Open a demo account to practice risk-free.

Start with $100-$200 on a live account.

Learn basics via free resources like forex basics.

-

Trade small lots to test strategies.

Risk Management Essentials

Risk management is critical when you trade currency. Use stop losses to cap losses at, say, 2% of your account. Aim for a 1:3 Risk-Reward Ratio. Diversify across pairs like EUR/USD and AUD/USD. In 2023, traders using stop losses cut losses by 30%, per TradingView data.

Top Strategies to Trade Currency

Strategies boost success. Try these:

Scalping: Quick trades for small gains, ideal for volatile hours.

Swing Trading: Hold positions for days, using trends.

Breakout trading: Enter when prices break key levels.

Tools like RSI and Bollinger Bands help time entries.

Major Currency Pairs

Pair

|

Daily Volume Share |

Average Spread |

| EUR/USD |

28%

|

0.6 pips |

USD/JPY

|

17% |

0.8 pips |

| GBP/USD |

12% |

1.0 pips |

| AUD/USD |

7% |

1.2 pips |

Common Pitfalls to Avoid

Newbies often stumble. Overtrading racks up fees. Ignoring news—like a 2022 Bank of England rate hike, can blindside you. No stop losses? A 10% drop could wipe out $1,000. Emotional trades after losses hurt too. Stick to a plan to trade currency wisely.

Leverage: Double-Edged Sword

Leverage amplifies gains and losses. At 1:50, $100 controls $5,000. A 1% move earns $50—or loses it. In 2024, 40% of UK traders lost money due to high leverage, per FCA stats. Use it sparingly when you trade currency.

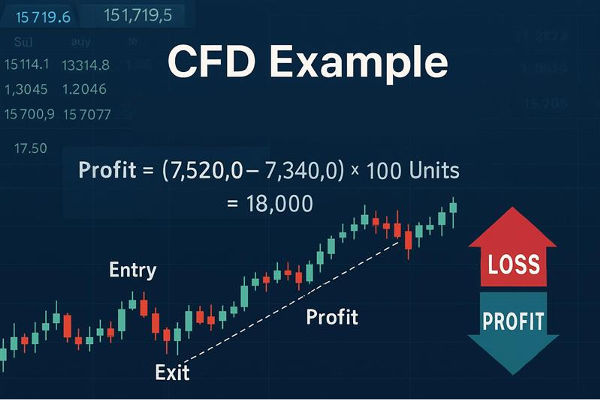

Real Example: Trading GBP/USD

Say GBP/USD is 1.3100. You buy 1 lot ($100,000) with $1,000 margin. It rises to 1.3150—50 pips. You earn $500. But a drop to 1.3050 loses $500. This shows why timing matters when you trade currency.

Actionable Tips to Succeed

Want to trade currency well? Follow these:

Study charts daily for trends.

Set alerts for economic events.

Test strategies on demo accounts first.

Keep a journal of every trade.

Limit risk to 1-2% per trade.

Conclusion

In conclusion, Forex offers high rewards, top traders earn 20% annually, but risks are real. In 2023, 70% of retail traders lost money, per FCA reports. Success hinges on education and practice to trade currency effectively.

Forex is thrilling yet challenging. Mastering pairs, pips, and risk lets you trade currency with confidence. Start small, learn daily, and adapt. The market's open 24/5, plenty of chances to refine your skills. Ready to trade currency? Your journey starts now.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.