Historic Milestone for Japanese Equities

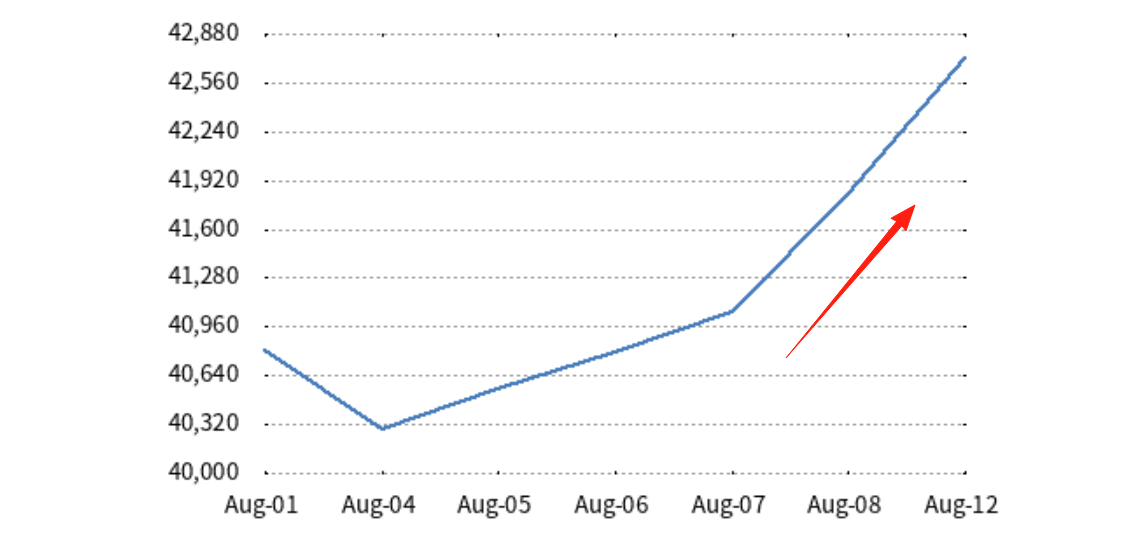

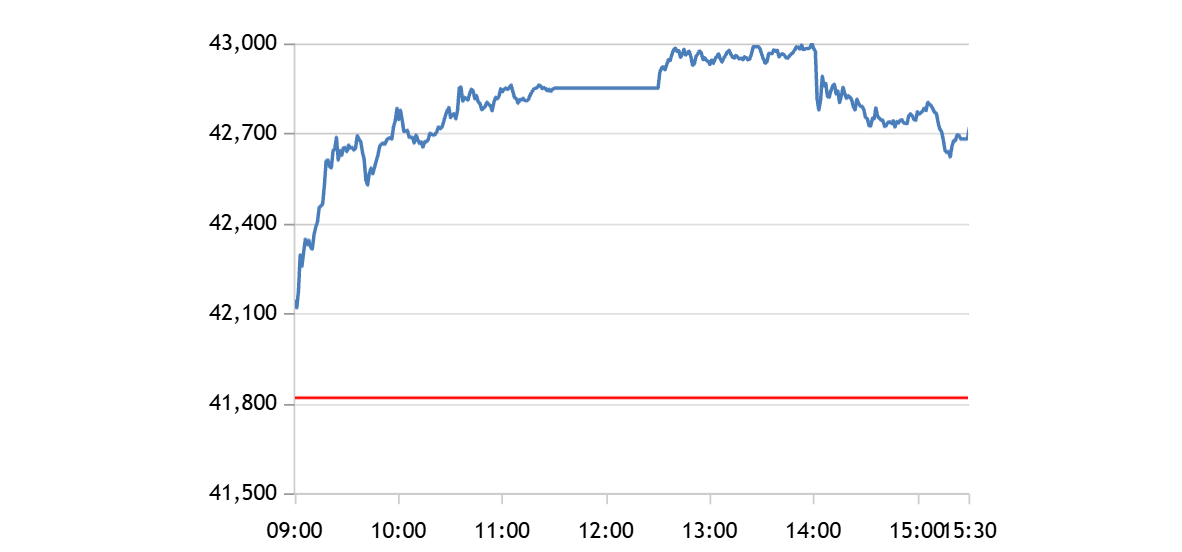

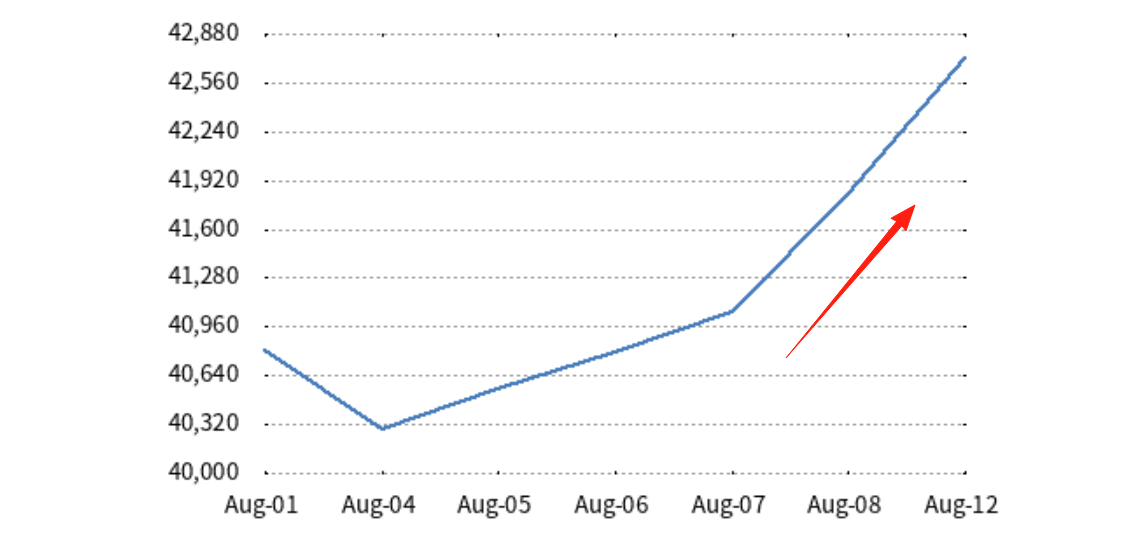

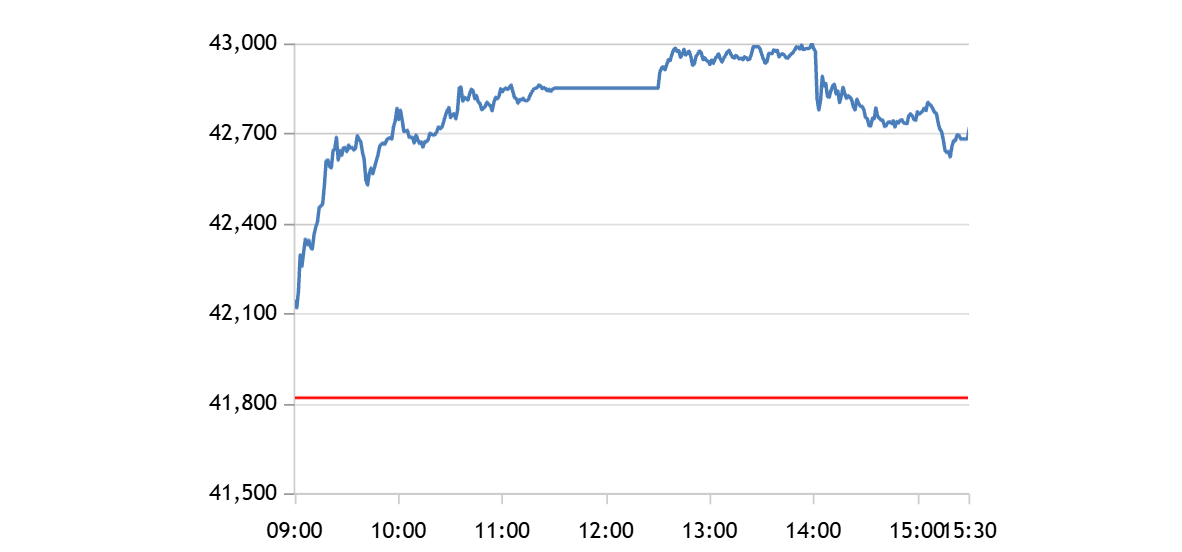

The Nikkei 225 Index surged to a record high on Tuesday, driven by optimism over eased United States tariff policies and a powerful rally in technology shares. The Tokyo Stock Price Index (TOPIX) followed suit, surpassing its previous July 2024 peak and setting its own historic record.

Market Performance and Key Figures

During the day's session, the Nikkei 225 Index jumped by as much as 2.5% to 42.867.69 points. The rally was spearheaded by semiconductor-related stocks, buoyed by two major catalysts:

Micron Technology (US) raised its sales forecast, signalling stronger global demand.

Kioxia Holdings (Japan) posted robust earnings, further lifting market confidence in the memory chip sector.

These developments ignited a wave of buying interest, making technology the day's best-performing sector.

Catalysts Behind the Surge

Tariff Policy Easing

Investor sentiment strengthened after Japan's chief trade negotiator confirmed last week that US officials would suspend the imposition of general tariffs on Japanese goods. The agreement also includes a pledge to cut automobile tariffs from 27.5% to 15%, a significant relief for Japan's export-driven industries.

Broader Trade Relief Measures

In a parallel move, US President Donald Trump announced a 90-day extension to the suspension of high tariffs on Chinese imports. This step helped calm global trade tensions, alleviating a major source of market uncertainty.

Role of Domestic Economic Expectations

Japanese markets reopened after the Obon holiday to renewed speculation that the government might introduce fresh stimulus measures. Such expectations provided an additional lift to equities, reinforcing the bullish momentum.

Analyst Insights

"Japan has successfully avoided the worst-case scenario," observed Toshiya Matsunami, Chief Analyst at Nissay Asset Management. "While tariffs are not a long-term positive, their immediate impact is far less severe than the market once feared."

Tim Waterer, Chief Market Analyst at KCM Trade, added: "Greater certainty on Japa's tariff position has become a key driver. The agreement with the US offers investors crucial confidence, which is fuelling sustained inflows into Japanese stocks."

Trading Volume and Market Sentiment

Despite being in the middle of the Obon holiday season, trading activity was robust. The day's volume was more than 40% higher than the 20-day average, reflecting heightened investor enthusiasm and confidence in the Nikkei 225 Index's upward trajectory.

Conclusion: A Turning Point for the Nikkei 225 Index

The record-setting performance of the Nikkei 225 Index illustrates the rapid impact of policy shifts and sector-specific catalysts on market sentiment. With tariff relief easing external pressures and technology stocks leading the charge, Japan's equity market is in a strong position to attract further investment. However, the sustainability of these gains will depend on domestic policy actions and the global trade environment in the months ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.