In forex trading, having an edge is crucial. One tool that provides traders with a clear edge—especially in identifying high-probability trade setups—is the Currency Strength Meter.

Often overlooked by beginners, this powerful indicator simplifies the complexity of currency pair dynamics, helping traders make more informed and confident decisions.

This comprehensive guide will explore what a currency strength meter is, how it works, and most importantly, how to use it for better forex trading results.

What Is a Currency Strength Meter?

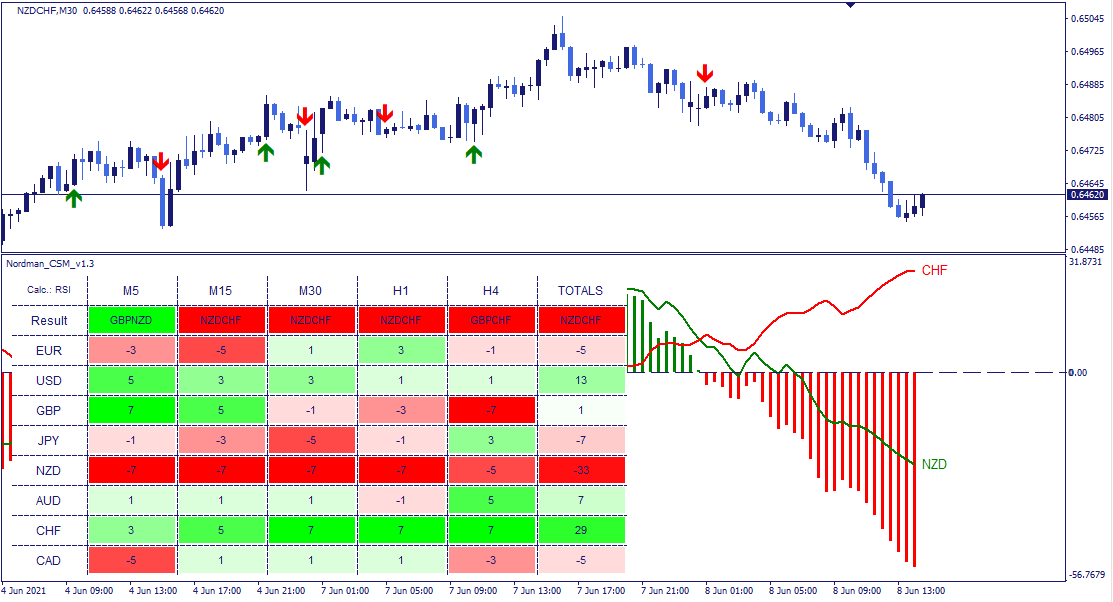

A Currency Strength Meter is a trading tool or indicator that evaluates the relative strength or weakness of individual currencies in real time.

Instead of analysing currency pairs (such as EUR/USD or GBP/JPY), it breaks down each currency's performance across multiple pairs to determine its overall strength.

For example, if the euro is gaining across several pairs (EUR/USD, EUR/JPY, EUR/GBP), the meter will show a high strength score for EUR. If the USD is simultaneously weakening, a long position on EUR/USD becomes a high-probability trade.

How Does it Work?

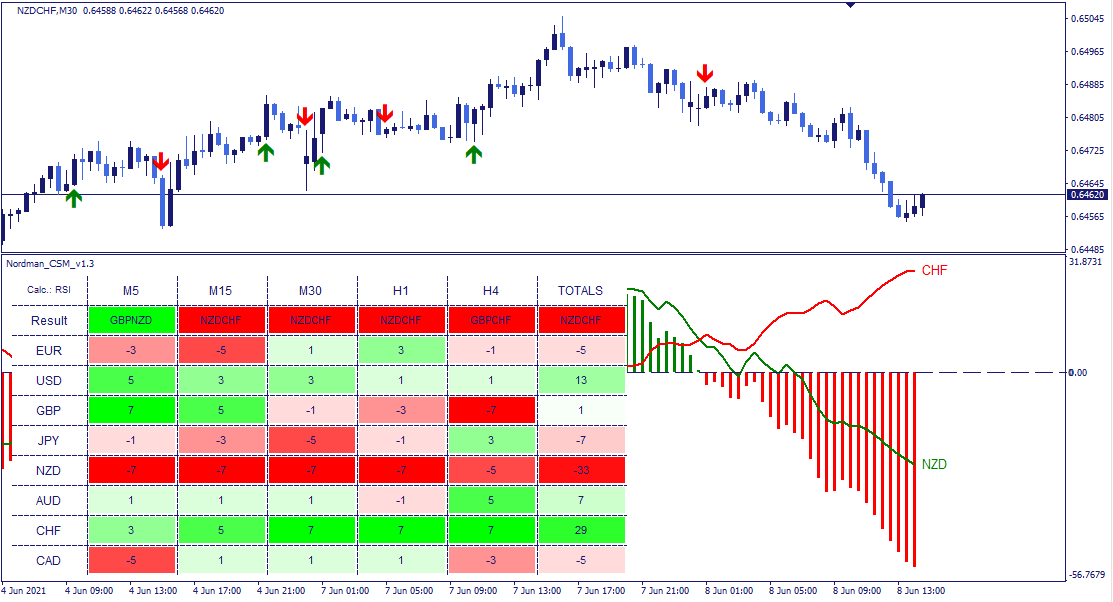

The meter typically uses real-time price data from multiple currency pairs to calculate strength. Some advanced versions apply complex algorithms, but the core idea follows:

Relative performance over a set period (e.g., 1 hour, 4 hours, 1 day)

Weighted averages of price changes across key pairs

Normalisation so all currency strengths are compared on the same scale (usually 0–10 or 0–100)

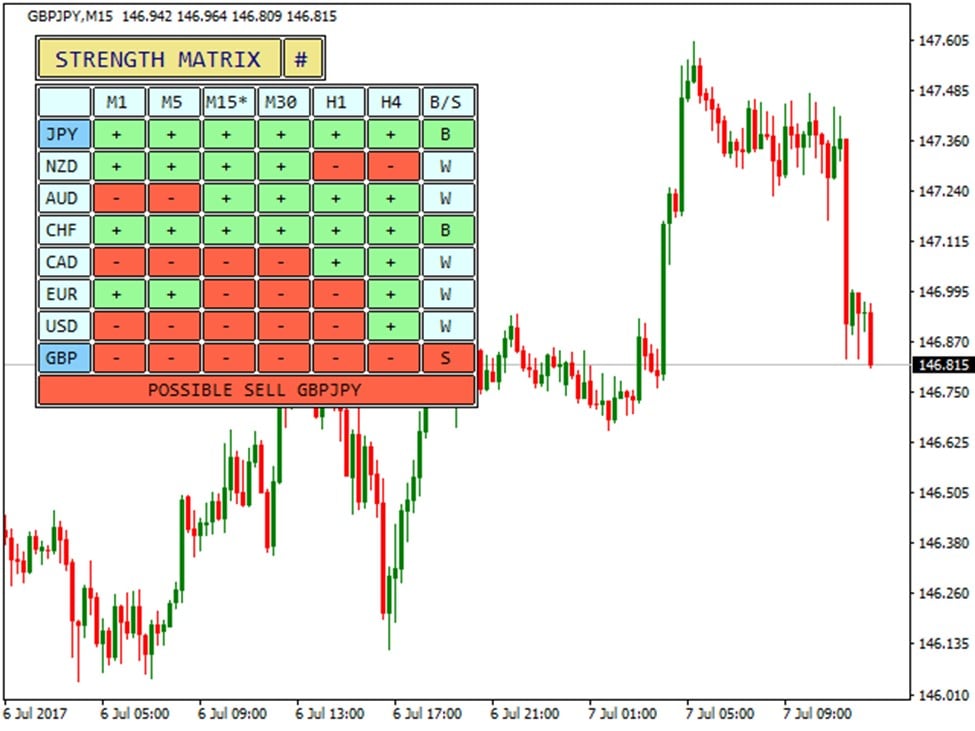

The output will display as such:

A bar graph or line chart ranking currencies from strongest to weakest

A matrix showing individual pair strengths

Or a dashboard with numeric strength values

The tool works best when viewed in combination with price action or trend-following indicators.

How to Read a Currency Strength Meter

Reading the meter depends on how it's displayed, but the basic interpretation remains consistent:

A high strength score (e.g., 9/10 or 80/100) means the currency is strong.

A low score (e.g., 1/10 or 20/100) signals weakness.

Scores in the middle range often indicate neutrality or consolidation.

Example:

| Currency |

Strength Score (0–10) |

| USD |

2.1 |

| EUR |

7.9 |

| GBP |

5.0 |

| JPY |

6.5 |

| AUD |

3.3 |

| NZD |

8.1 |

In this scenario, EUR/NZD or EUR/USD may offer good long setups, while USD/NZD could be a short candidate.

Why FX Traders Use the Currency Strength Meter for Trading?

Forex is traded in pairs, meaning one currency is bought while the other is sold. Success in Forex often comes from understanding which currency is the strongest and which is the weakest.

Using a currency strength meter helps you:

1. Identify the Best Pairs to Trade

Instead of randomly picking pairs, you can focus on pairs that combine a strong currency with a weak one, maximising momentum and potential for profit.

2. Avoid Trading in Choppy or Range-Bound Markets

If both currencies in a pair are equally strong or weak, the market is likely to be indecisive. A strength meter helps filter out those situations.

3. Spot Reversals or Trend Continuations

Fluctuations in currency strength can indicate a trend reversal or support an ongoing trend, depending on relative movements.

4. Refine Entry and Exit Points

Combined with technical indicators such as moving averages, RSI, or MACD, strength meters add confirmation to your trades.

How to Implement Currency Strength Meter in Your Strategy

Integrating a strength meter into your Trading plan doesn't require abandoning your current strategy. Instead, use it to filter trades and boost accuracy.

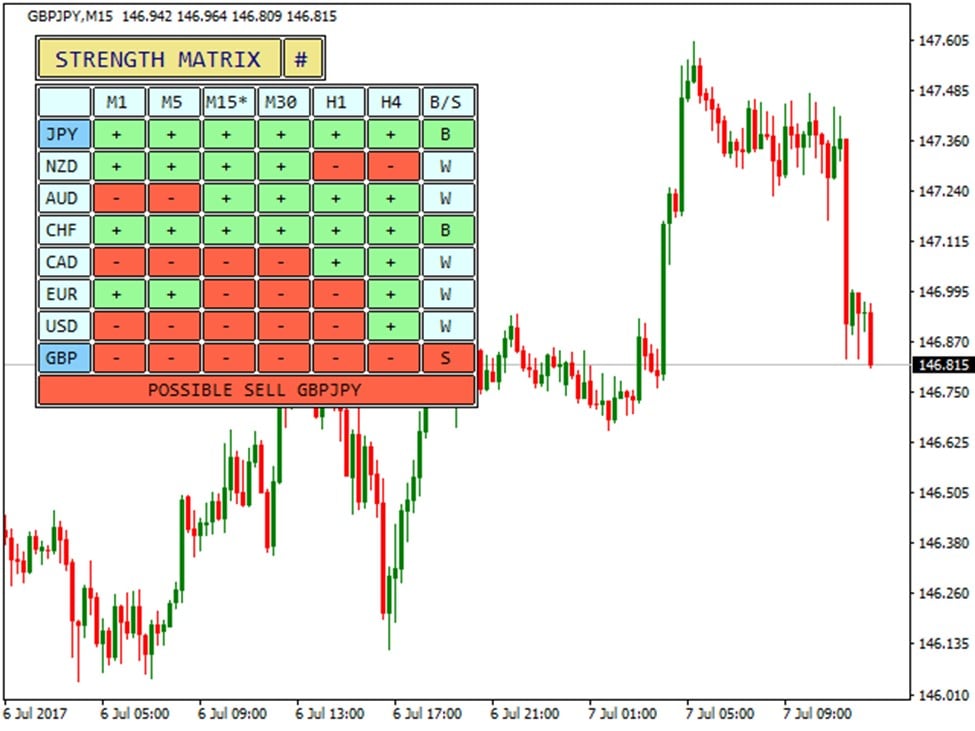

1. Pair Strong with Weak

The most basic method. Trade a strong currency against a weak one. This approach increases your chances of capturing strong trends and minimises chop.

Example: If GBP is strong and JPY is weak, consider long GBP/JPY trades.

2. Use it with Breakout Strategies

Before entering a breakout trade, confirm that the currency being bought is strong and the one being sold is weak. It helps avoid false breakouts.

3. Trade Pullbacks in Strong Trends

During a trend, use strength readings to confirm that momentum persists. Enter on pullbacks when the strength remains steady.

4. Avoid Low-Volatility Trades

If both currencies in a pair have similar strength levels, price action is likely to be flat. Skip these trades to avoid getting stuck in sideways markets.

Example

Picture yourself analysing the Forex market on a Monday morning.

Currency Strength Meter Output:

| Currency |

Strength |

| USD |

2.0 |

| GBP |

7.5 |

| EUR |

6.8 |

| JPY |

4.1 |

| AUD |

5.0 |

Strategy:

With confirmation from:

Trend structure

Technical indicators

Currency strength meter

You enter a long position on GBP/USD, aligning all signals for a high-confidence trade.

Currency Strength Meter vs Technical Indicators

Currency Strength Meters analyses the relative strength of entire currencies, not just one pair.

Technical Indicators (such as RSI, MACD, or Bollinger Bands) analyse price behaviour on one pair.

Using both allows you to:

Identify which pairs to trade (strength meter)

Find when to trade them (technical indicators)

This dual-layer approach significantly enhances decision-making.

Pros and Cons to Understand

| Pros |

Cons |

| Easy to understand, even for beginners |

May lag slightly depending on the time interval |

| Great for identifying strong/weak pairings |

Should not be used as the sole decision tool |

| Complements all trading strategies |

Quality varies across different versions |

| Works across all timeframes |

Needs real-time price feed for best accuracy |

Final Tips for Beginners

1. Start With Higher Timeframes

Daily or 4-hour strength readings offer more reliable signals than lower timeframes, especially if you're a swing or position trader.

2. Always Confirm with Price Action

Don't rely solely on the meter. Check for key support/resistance levels, trendlines, or candlestick patterns before pulling the trigger.

3. Use Demo Accounts for Practice

Platforms offer demo trading environments with access to strength meters. Practice strategies here before going live.

4. Watch for Divergences

If a currency is weakening, but the price is still going up, that's a warning sign that the move may soon reverse.

Conclusion

In conclusion, the currency strength meter is a practical, visual, and effective tool for any forex trader. It removes guesswork by showing which currencies are dominating and which are weakening—helping you make smarter, faster, and more confident decisions.

With tools like this and a solid trading plan, you're on the path to better trades and consistent profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.