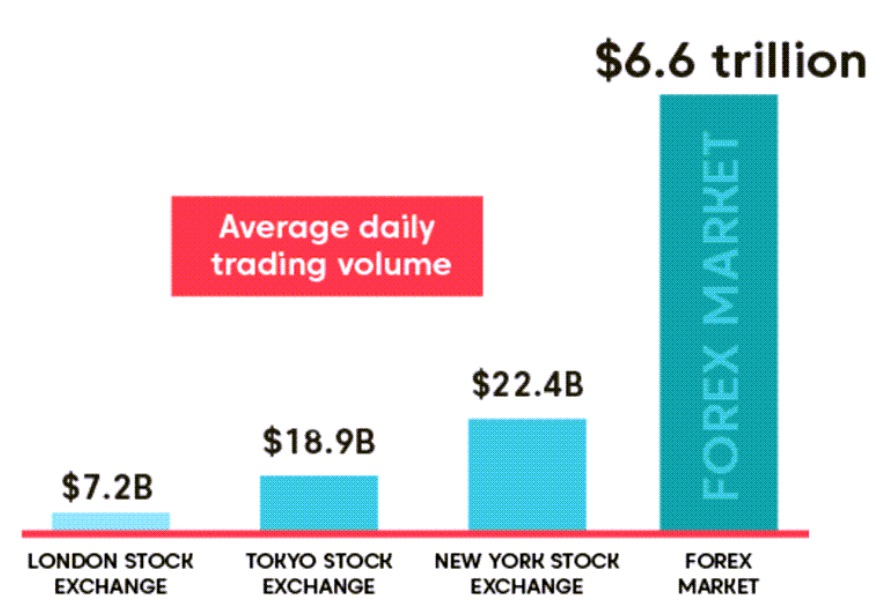

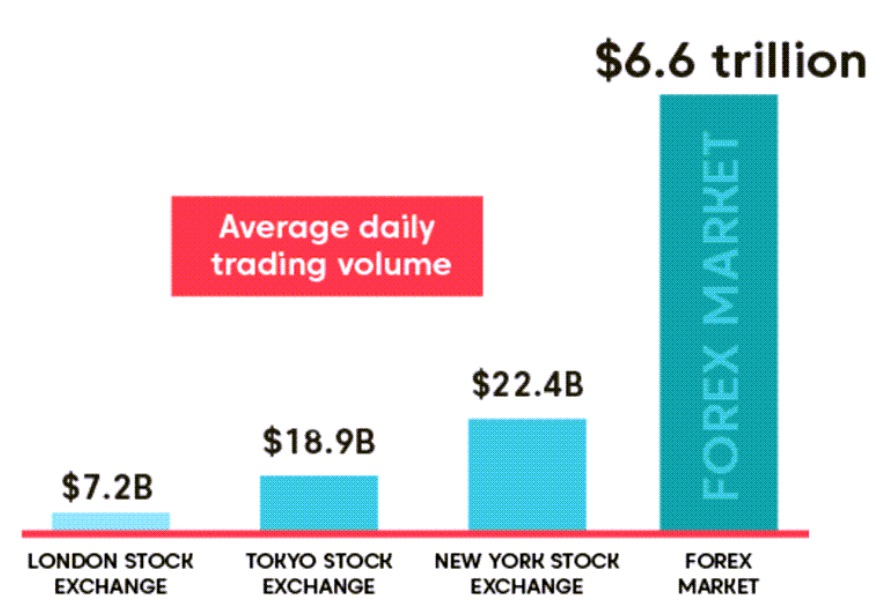

The forex market is the world’s largest financial market. It averaged about $7.5 trillion of daily turnover in April 2022, according to the BIS Triennial Survey. Trading remains concentrated in a handful of global hubs: the UK (London) is still the largest single centre (≈38% of turnover), with major activity also centred in New York, Singapore and Tokyo. These are averages, intraday liquidity, spreads and trading patterns vary widely by currency pair and session.

Should You Trade Forex as a Beginner?

Forex trading seems scary at first, but forex trading is open to anyone who wants to get involved with the financial markets. As a beginner, you need to master the basics and build a strong foundation. Whether you're doing forex trading part-time or as a new investment strategy, learning how to navigate this market can open a whole new world of financial possibilities.

How Does Forex Trading Work?

What Are Currency Pairs?

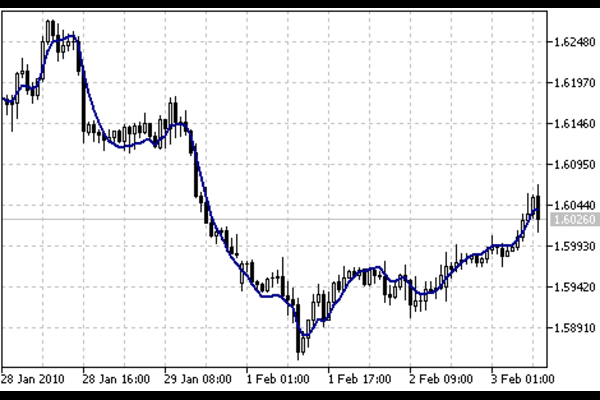

At its core, forex trading involves currency pairs, like the EUR/USD or GBP/USD, where one currency is exchanged for another. Unlike stocks, where you buy shares in a company, in forex, you're trading currencies. For example, if you believe the Euro will strengthen against the US Dollar, you will buy the EUR/USD pair.

Market Hours & Liquidity

The forex market operates 24 hours a day, five days a week, offering ample opportunity for traders across the globe. But with such accessibility comes volatility. Exchange rates fluctuate due to a variety of factors, from economic reports to geopolitical events. A firm understanding of how these factors influence currency values will help you make informed trading decisions.

How Do I Choose a Forex Broker & Open an Account?

As a beginner in forex, before jumping into trading, you'll need to choose a reliable forex broker. Think of the broker as the gateway to the market—they provide the platform, tools, and resources to execute your trades. However, it’s crucial to select a broker that meets your needs and is regulated by a trusted authority, such as the UK's Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC).

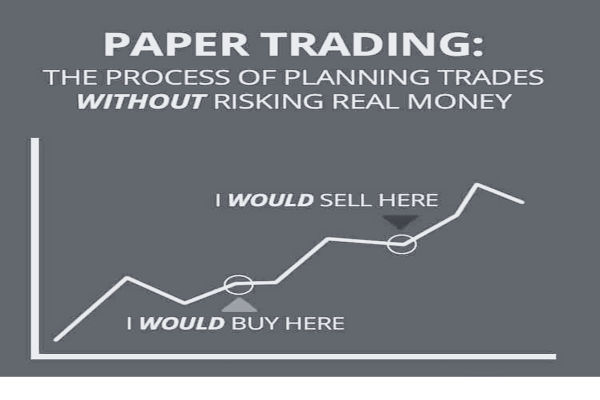

There are plenty of good brokers out there that make trading easy and keep fees reasonable. Regarding to choosing a forex trading platform, beginners should consider how simple it is to use, what it costs, and whether their customer support is reliable. Most brokers also offer demo accounts, which let you practice trading without risking real money. It's a great way to get familiar with the process and build your confidence before starting with actual funds.

Once you're comfortable with a demo account, you can transition to a live account and begin trading with real capital. But remember, start small and use a conservative approach as you gain experience if you are a beginner in forex trading.

Now that you have the right broker and platform, the next step for a beginner in forex trading will be building a strategy. While the thrill of trading can be tempting, successful traders don't rely on hunches, they use tested methods based on research and analysis.

What Technical Tools Should Beginners Learn?

Technical Analysis Basics:

Technical traders use charts and indicators to identify setups. For beginners, focus on: trend identification (moving averages), momentum (RSI), support/resistance and simple candlestick patterns (doji, hammer). Start with one timeframe (e.g., 1-hour or 4-hour) and keep setups rule-based. MetaTrader 4/5 are popular because they make backtesting and indicator use straightforward.

Fundamental Analysis Basics:

Fundamental forex traders watch macro data (interest rates, CPI, employment), central-bank signals and geopolitical shocks. Use an economic calendar to mark high-impact releases and avoid oversized positions around major events (NFP, central-bank rate decisions). Sites like Investing.com and ForexFactory provide event calendars and consensus estimates.

What Fundamental Drivers Matter for Forex?

While technical analysis focuses on charts, fundamental analysis looks at the underlying factors that drive the value of currencies. These can include economic data, interest rates, inflation reports, and geopolitical events. For instance, if the Federal Reserve raises interest rates, the US Dollar might strengthen as higher rates attract investment.

For beginners in forex trading, understanding these factors can give you a broader view of market conditions and help you make informed decisions. Websites like Forex Factory provide economic calendars that list upcoming reports, giving you insight into potential market-moving events.

How Do You Manage Risk in Forex Trading?

Position Size:

limit risk per trade, many pros recommend 1%–2% of account equity to avoid ruin.

Stop-Loss & Take-Profit:

Set stops before entry; use take-profits to lock gains and preserve risk-reward. Consider volatility-based stops (ATR) rather than arbitrary pips.

Leverage:

Starts as a force multiplier, keep leverage low as a beginner and understand margin calls and liquidation risk. Regulatory authorities caution retail traders about high leverage.

Diversify & Size Exposure:

Don’t concentrate capital on one pair or one macro event; manage total portfolio exposure to correlated currencies.

Process & Record:

Keep a trade journal, review setups monthly, and only scale allocation after a documented edge.

Frequently Asked Questions

What is forex trading?

Forex trading is the buying and selling of currencies to profit from changes in exchange rates.

How much money do I need to start trading Forex?

You can start with small amounts using micro/mini lots, but a reasonable beginner account is often $500–$2,000 to allow sensible position sizing and risk control.

How much should I risk per trade?

Many experienced traders risk 1% or less of account equity per trade; conservative retail traders often use up to 2% as an upper bound.

Are demo accounts useful?

Yes, use a demo to test your strategy and the broker’s execution. Transition to live only after consistent demo performance and a tested money management plan.

As markets are constantly evolving, staying updated on economic news, global events, and shifts in market sentiment is also essential for beginners in forex trading. Resources like Investing.com or Bloomberg offer real-time news and expert insights that can give you an edge.

So, take your time, practice with a demo account, and keep refining your skills. The more you learn, the more confident you'll become in your trading decisions—and that's where the real potential for success lies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.