Starting your forex trading journey without a clear plan is like setting sail without a map. A well-constructed Trading plan is essential for beginners who want to trade with discipline, manage risk, and build long-term success.

This guide will walk you through the key steps to building a forex trading plan, helping you avoid common pitfalls and approach the markets with confidence.

Why a Trading Plan Matters

A trading plan is your personal roadmap for navigating the forex market. It outlines your goals, risk tolerance, trading strategies, and rules for entering and exiting trades. By following a plan, you remove emotion from your decisions, stay consistent, and increase your chances of long-term profitability.

Remember, successful traders treat trading as a business, not a gamble.

Forex Trading for Beginners: Step-by-Step Guide

Step 1: Define Your Motivation and Goals

Begin by clarifying why you want to trade forex. Are you looking for extra income, building wealth, or seeking a new challenge? Set specific, measurable, and realistic goals for your trading—such as aiming for a certain percentage return over the next year or learning a new trading strategy each month.

Step 2: Assess Your Risk Tolerance

Every trader has a different comfort level with risk. Decide how much of your capital you are willing to risk on each trade (commonly 1–2%) and set a maximum drawdown limit for your account. Being honest about your risk tolerance will help you avoid emotional decisions and stick to your plan during volatile periods.

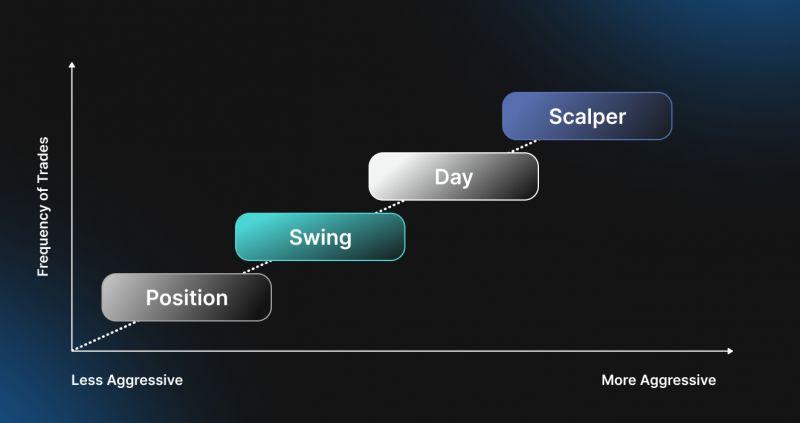

Step 3: Choose Your Trading Style

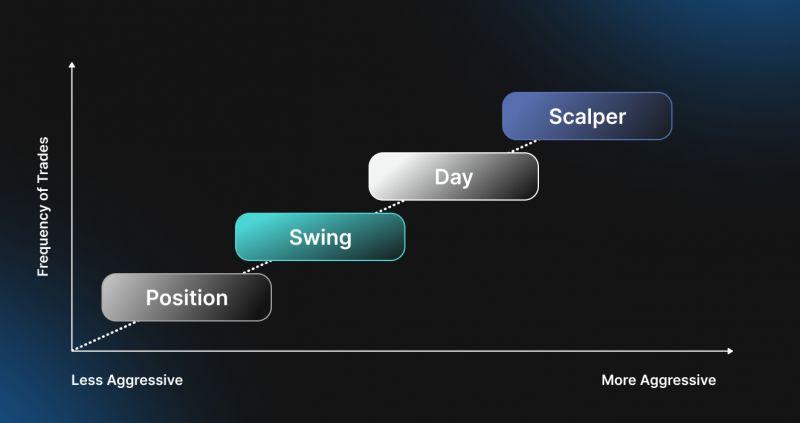

Your trading style should match your personality, time commitment, and goals. Common styles include:

Day trading: Multiple trades within a day, requiring constant attention.

Swing trading: Holding positions for several days to capture short- to medium-term moves.

Position trading: Long-term trades based on major trends.

Scalping: Frequent, small trades for quick profits.

Pick a style that fits your schedule and temperament.

Step 4: Select Your Markets and Currency Pairs

As a beginner, focus on a few major currency pairs like EUR/USD or GBP/USD. These pairs are highly liquid and have lower spreads, making them easier to trade and understand. As you gain experience, you can explore minors and exotics.

Step 5: Develop Your Trading Strategy

Your strategy should define how you enter and exit trades, including:

Technical analysis (using charts and indicators)

Fundamental analysis (economic news and data)

Entry and exit rules (specific signals or patterns)

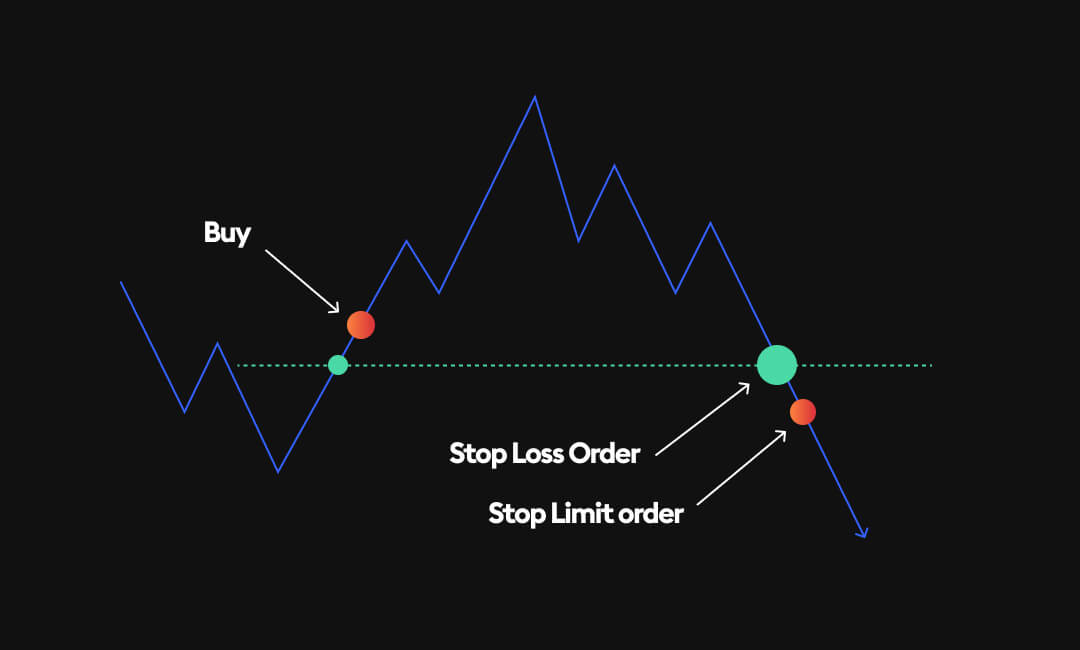

Stop-loss and take-profit levels

Test your strategy on a demo account before risking real money.

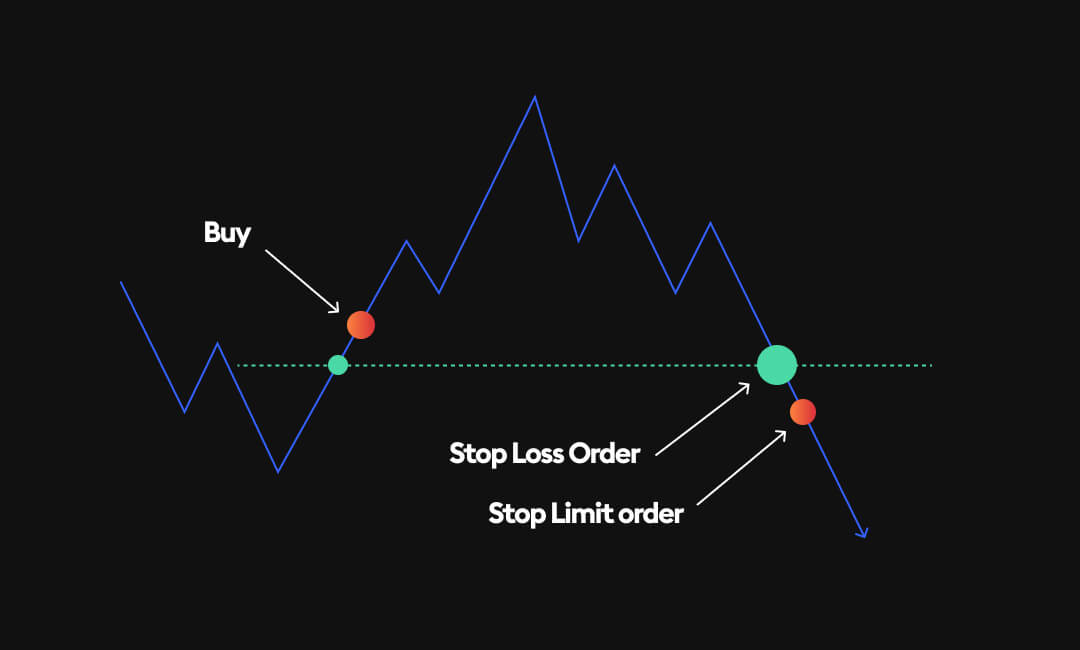

Step 6: Set Clear Risk Management Rules

Risk management is the backbone of any trading plan. Always use stop-loss orders to limit potential losses and take-profit orders to lock in gains. Decide on your position size based on your risk tolerance and account size. Never risk more than you can afford to lose.

Step 7: Plan Your Trading Routine

Decide when you will trade based on your availability and the most active market hours for your chosen currency pairs. Build a routine that includes market analysis, trade execution, and post-trade review. Consistency is key to developing discipline and improving your skills.

Step 8: Keep a Trading Diary

Maintain a detailed trading diary to record every trade, including entry and exit points, the reasoning behind each trade, and your emotional state. Reviewing your diary regularly will help you identify strengths, weaknesses, and areas for improvement.

Step 9: Review and Adjust Your Plan

Markets evolve, and so should your trading plan. Set regular intervals to review your performance and adjust your plan based on what you learn. Flexibility and continuous learning are vital for long-term success.

Final Thoughts

Building a solid trading plan is the foundation of every successful forex trader's journey. By defining your goals, managing risk, and sticking to a disciplined routine, you give yourself the best chance of thriving in the forex market.

For beginners seeking a secure and regulated environment, EBC Financial Group offers award-winning platforms, transparent pricing, and robust support—making it one of the best choices for new forex traders.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.