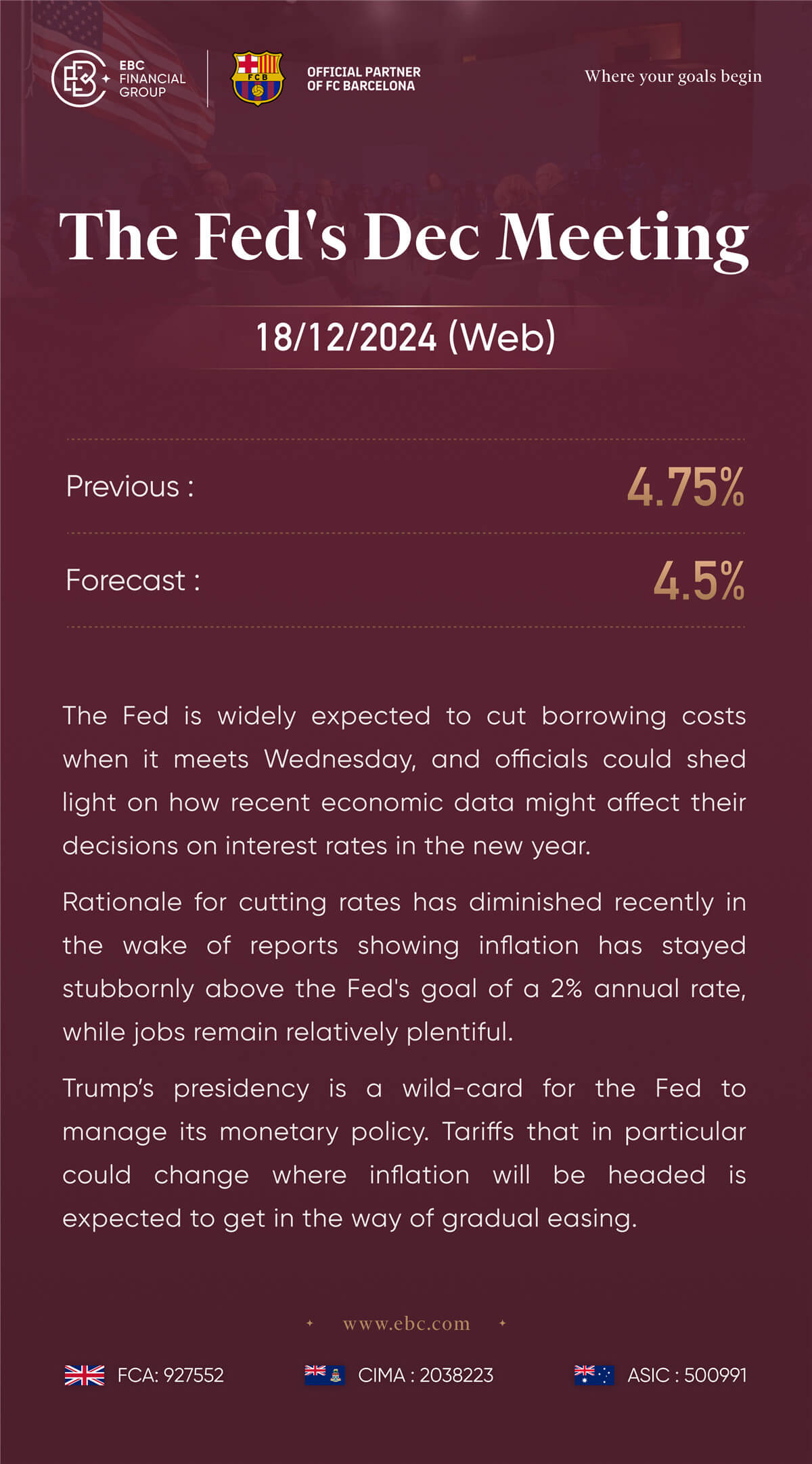

The Fed's Dec meeting

18/12/2024 (Wed)

Previous(Nov): 4.75% Forecast: 4.5%

The Fed is widely expected to cut borrowing costs when it meets Wednesday,

and officials could shed light on how recent economic data might affect their

decisions on interest rates in the new year.

Rationale for cutting rates has diminished recently in the wake of reports

showing inflation has stayed stubbornly above the Fed's goal of a 2% annual

rate, while jobs remain relatively plentiful.

Trump's presidency is a wild-card for the Fed to manage its monetary policy.

Tariffs that in particular could change where inflation will be headed is

expected to get in the way of gradual easing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.