The SPDR Dow Jones Industrial Average ETF Trust (DIA ETF) is a staple for investors seeking exposure to the performance of the 30 blue-chip companies in the Dow Jones Industrial Average.

In 2025, EBC Financial Group has introduced DIA ETF Contracts for Difference (CFDs), offering traders and investors new flexibility and strategic opportunities. But what makes the DIA ETF CFD a compelling choice for your portfolio this year?

Here's a detailed look at the main reasons to consider adding this product, along with market forecasts and practical trading insights.

What Is the DIA ETF?

The DIA ETF CFD is a derivative instrument that mirrors the price movements of the SPDR Dow Jones Industrial Average ETF Trust. Rather than owning the underlying ETF, traders enter a contract to exchange the difference in value from the opening to the closing of the position.

This structure allows for leveraged trading, the ability to go both long and short, and access to the Dow Jones index without the need to buy actual shares.

Main Reasons to Add the DIA ETF CFD to Your Portfolio in 2025

1. Diversified Blue-Chip Exposure

The DIA ETF tracks the Dow Jones Industrial Average, which includes 30 of the largest and most established US companies. By trading the DIA ETF CFD, you gain exposure to a diversified basket of sectors—technology, healthcare, finance, and more—all in a single product. This diversification helps manage risk and smooth out volatility compared to trading individual stocks.

2. Leverage and Flexibility

CFDs allow you to control a larger position with a smaller initial margin, amplifying both potential gains and risks. EBC's DIA ETF CFD offering provides flexible leverage options, enabling traders to tailor their exposure according to their risk appetite and capital. This makes it easier to adjust your portfolio or hedge existing positions quickly.

3. Ability to Go Long or Short

Market conditions in 2025 remain uncertain, with ongoing debates over interest rates, inflation, and global growth. The DIA ETF CFD lets you profit from both rising and falling markets by taking long (buy) or short (sell) positions. This two-way trading capability is particularly valuable in volatile or sideways markets, allowing for more dynamic strategies.

4. Efficient Portfolio Diversification

Adding the DIA ETF CFD to your portfolio can enhance overall diversification. It complements positions in other indices, sectors, or asset classes, helping to spread risk and reduce reliance on a single market driver. For investors already trading S&P 500 or NASDAQ-linked products, the Dow Jones offers exposure to a different mix of industry leaders.

5. Cost-Effective Access and No Ownership Hassles

CFDs typically have lower entry costs than purchasing ETF shares outright, as you do not pay for the full value of the underlying asset. There are no custody or management fees, and you avoid the administrative complexities of direct ETF ownership. EBC's platform also offers competitive spreads and efficient order execution, making it cost-effective for both active traders and longer-term investors.

6. Real-Time Trading and Extended Hours

Unlike traditional ETFs, which trade only during exchange hours, DIA ETF CFDs on EBC's platform can often be traded during extended hours. This offers greater flexibility to react to after-hours news, earnings releases, or global market events, which is crucial in today's fast-moving environment.

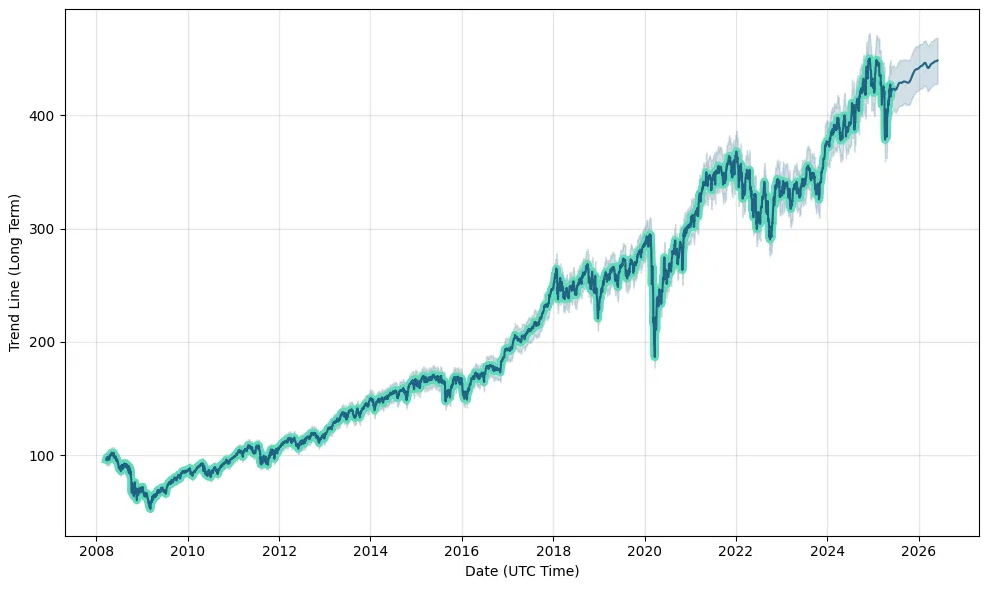

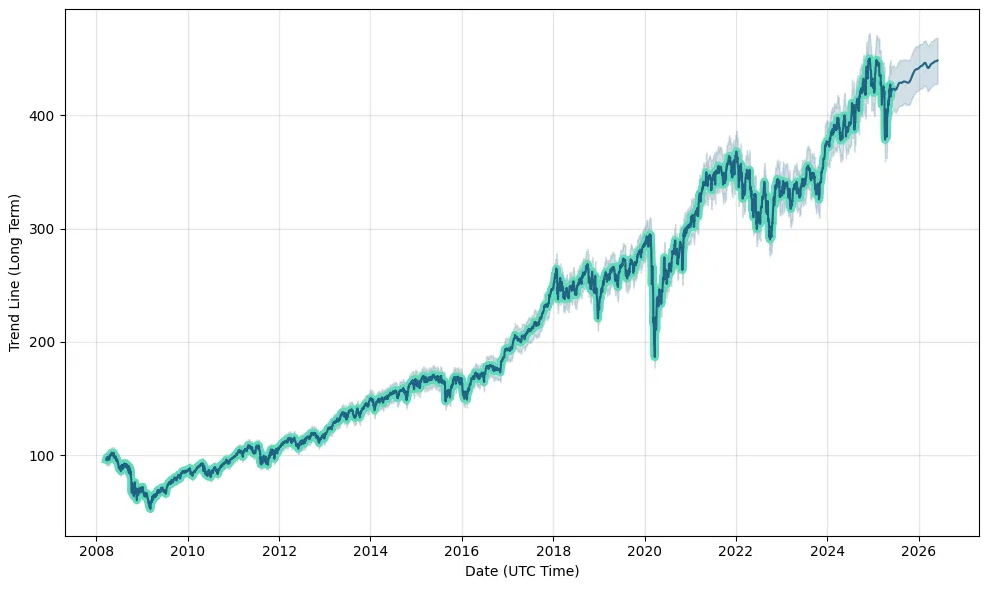

DIA ETF CFD Forecasts and Market Outlook for 2025

Analysts expect the Dow Jones Industrial Average to remain a key barometer for US economic health in 2025. With the Federal Reserve signalling a cautious approach to interest rates and ongoing resilience in blue-chip earnings, the index could see moderate growth, though volatility is likely to persist due to global uncertainties.

Bullish Scenario: If US economic data continues to improve and corporate earnings remain strong, the Dow could test new highs, supporting long positions in DIA ETF CFDs.

Bearish Scenario: Should inflation spike or global risks escalate, the ability to short the DIA ETF CFD allows traders to hedge or profit from potential downturns.

How the DIA ETF CFD Fits in Your Portfolio

For both active traders and long-term investors, the DIA ETF CFD offers a practical way to gain or hedge exposure to the Dow Jones index. It can be used as a core holding for broad market exposure, as a tactical tool for short-term opportunities, or as a hedge against other equity positions.

Example strategies:

Pairing DIA ETF CFDs with S&P 500 or NASDAQ CFDs for balanced US market exposure.

Using short positions to protect gains during market corrections.

Allocating a portion of your portfolio to blue-chip indices for stability alongside higher-growth assets.

Conclusion

EBC Financial Group's advanced trading platform makes it easy to access the DIA ETF CFD, with user-friendly tools, real-time data, and robust risk management features. Whether you're looking to diversify, hedge, or take advantage of market trends, this new product offers the flexibility and control needed for modern trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.