The BSV ETF, or Vanguard Short-Term Bond Index Fund ETF, is designed to provide investors with exposure to short-term, investment-grade US bonds. Many investors turn to the BSV ETF for its promise of stability, lower interest rate sensitivity and consistent income.

Despite its popularity, several misconceptions surround this fund, which can sometimes deter potential investors or lead to unrealistic expectations.

5 Misconceptions About the BSV ETF

Misconception 1: The BSV ETF Is Just a Savings Account Alternative

Some investors believe that because the BSV ETF invests in short-term bonds, it is essentially the same as a savings account. While both aim to preserve capital and offer liquidity, the BSV ETF provides returns that typically exceed those of standard savings accounts.

Unlike savings accounts, the BSV ETF is subject to market fluctuations, so its value can vary. However, its bond holdings generally offer a balance of income and relative safety.

Misconception 2: The BSV ETF Is Risk-Free

No investment is entirely without risk, and the BSV ETF is no exception. While it carries less interest rate risk than longer-term bond funds, it is still subject to credit risk, interest rate changes and market volatility.

The short-term nature of its holdings helps mitigate these risks, but investors should be aware that losses are possible, especially during periods of rising interest rates.

Misconception 3: The BSV ETF Offers High Returns

Because the BSV ETF focuses on short-term bonds, its returns are generally more modest compared to long-term bonds or equity investments. Its primary appeal is stability rather than high yield. Investors seeking rapid capital growth may find the BSV ETF less suitable for their goals.

Misconception 4: The BSV ETF Is Only for Conservative Investors

While the BSV ETF is favoured by conservative investors, it can also serve as a strategic tool in more diversified portfolios. It is often used to reduce overall portfolio volatility or provide a stable income component alongside equities. Even investors with a higher risk tolerance may find a place for the BSV ETF in managing interest rate risk or as a defensive allocation.

Misconception 5: The BSV ETF Does Not Respond to Market Changes

Some think that short-term bond funds like the BSV ETF are immune to economic shifts or interest rate changes. In reality, the BSV ETF's value can fluctuate with market conditions. However, its short maturity profile means price swings are usually less severe than in longer-duration bond funds, providing a buffer against rapid market moves.

How to Invest in the BSV ETF Wisely

To make the most of the BSV ETF, investors should consider their investment horizon, risk tolerance and income needs. It is an excellent choice for those looking for a relatively safe, income-generating asset with less sensitivity to interest rates. However, it is essential to combine the BSV ETF with other asset classes to build a well-rounded portfolio.

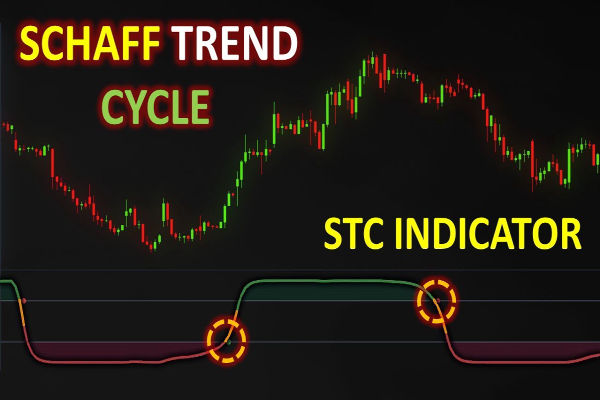

Regularly reviewing the fund's performance and adjusting allocations based on changing market conditions will help investors maintain the desired risk-return balance. Using the BSV ETF alongside other fixed income or equity funds can help manage overall portfolio risk and improve stability.

Conclusion

The BSV ETF offers a practical solution for investors seeking short-term bond exposure with relatively lower risk. By debunking common misconceptions, investors can better understand its role and benefits within a diversified portfolio.

It is neither risk-free nor a high-return vehicle but serves as a valuable tool for capital preservation and steady income.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.