Forex brokers play a central role in the currency market by facilitating trades, providing access to trading platforms, and offering tools that help traders make informed decisions. They can generally be categorised into three main types: A-Book brokers, which send trades directly to the market; B-Book brokers, which may internalise trades; and hybrid (C-Book) brokers, which combine elements of both depending on trade size and market conditions.

Below, we break down each type of forex broker in detail, examining how Market Maker, ECN, STP, and Hybrid brokers operate, their key features, and what traders should consider when selecting a broker. EBC Financial Group provides a useful reference point for understanding these models in practice.

EBC Financial Group: A Modern Example of a Regulated Forex Broker

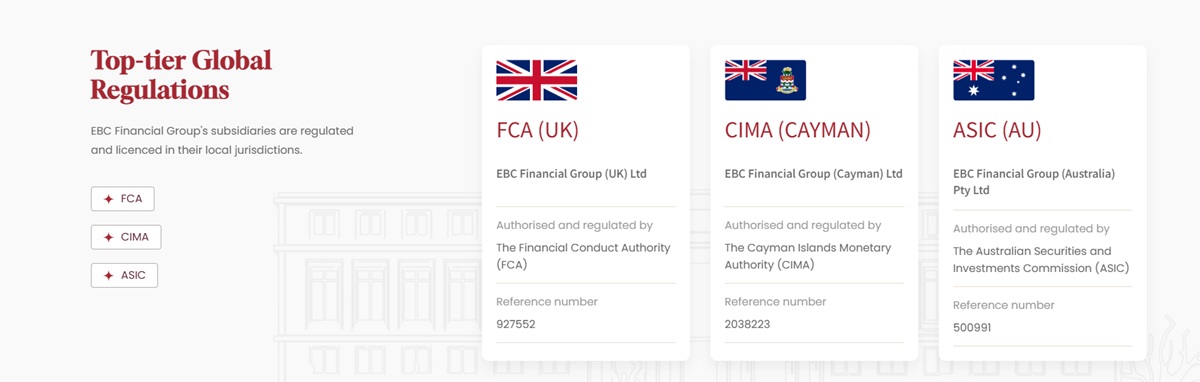

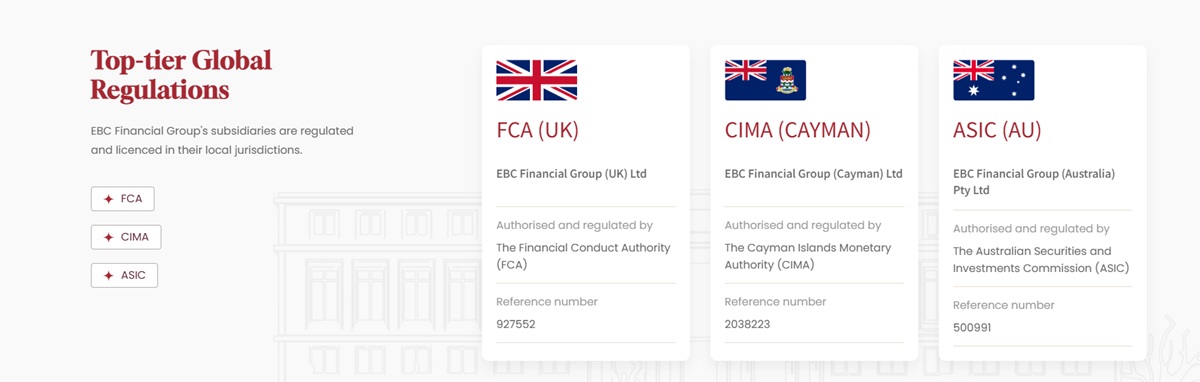

EBC Financial Group is a global financial services provider offering online trading across forex, commodities, indices, and CFDs on shares. Established in 2020 and headquartered in London, the firm operates under reputable regulatory authorities, including the FCA (UK), ASIC (Australia), and CIMA (Cayman Islands), ensuring a secure and transparent trading environment.

The company provides access to MetaTrader 4 and 5 platforms, offering advanced charting, automated trading, and real-time market analysis. Client funds are safeguarded through tier-1 banking institutions and insurance measures, reflecting EBC's commitment to security. With a global presence and strategic partnerships, such as with FC Barcelona, EBC Financial Group provides a useful example of how a modern, regulated forex broker operates.

Using this as a reference, we can explore the main types of forex brokers and the differences in how they execute trades. Understanding these models is essential for traders who want to choose the right broker and trading environment.

Market Maker Brokers in Forex

Market Maker (MM) brokers, also known as dealing desk brokers, often take the opposite side of their clients' trades. They set prices internally and may provide fixed spreads.

Key points about Market Makers:

They can offer stable spreads, which is useful in volatile markets.

Execution is usually immediate, but prices may not always reflect the wider market.

Some Market Makers operate partially as hybrid brokers, depending on trade size or risk exposure.

Market Makers are suitable for beginners or traders who prefer predictability in spreads but may face potential conflicts of interest since the broker could profit from client losses.

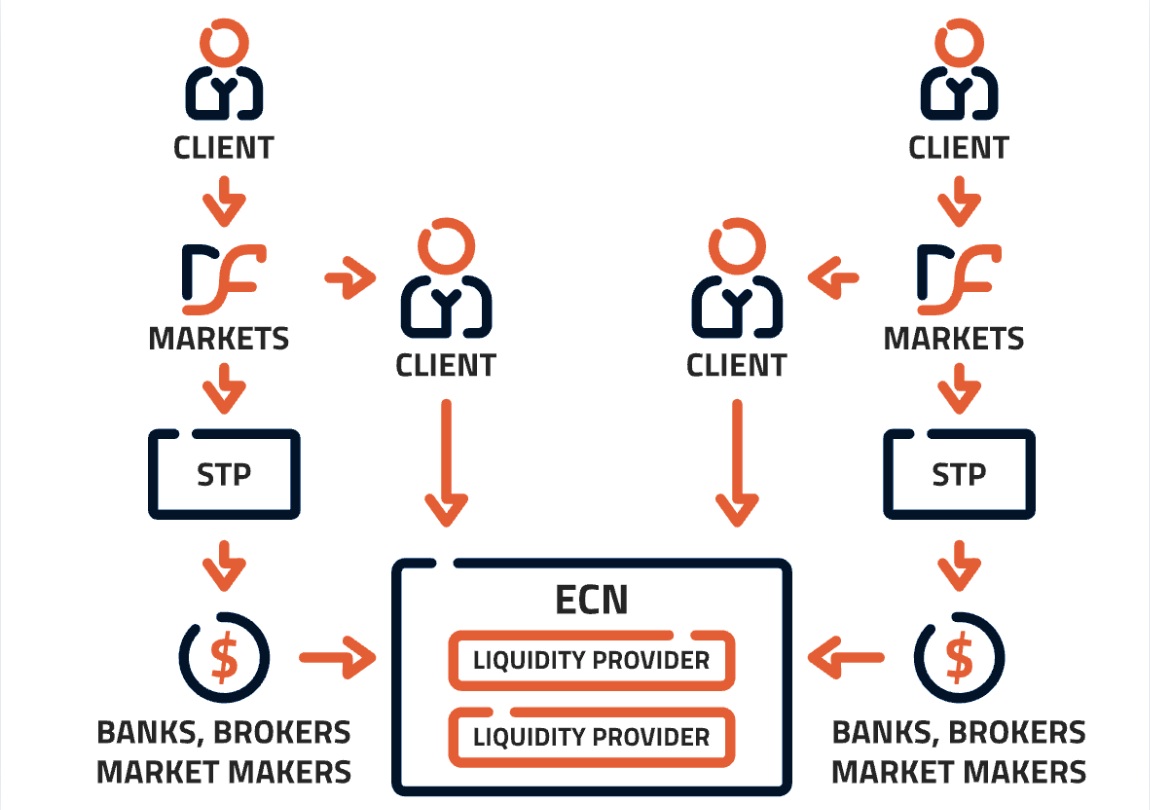

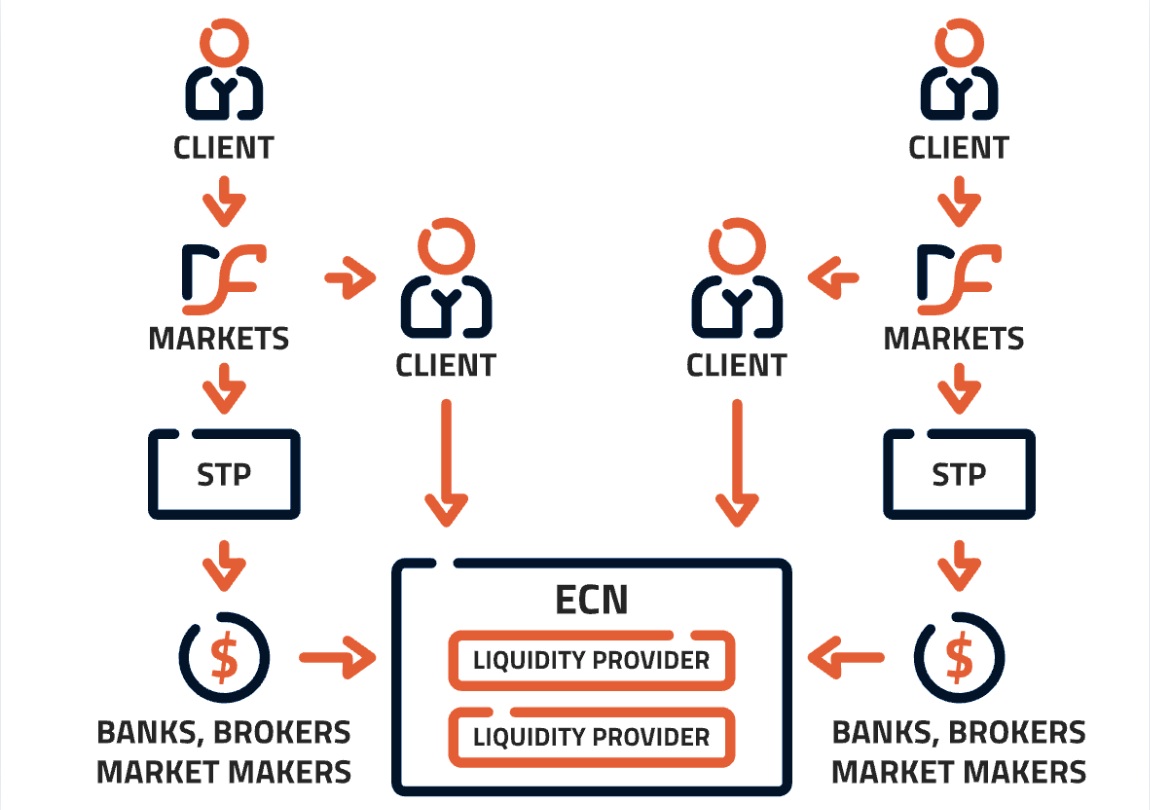

ECN Brokers in Forex

ECN (Electronic Communication Network) brokers send client orders directly to liquidity providers, such as banks or other traders, without interference.

Key points about ECN brokers:

They offer transparent pricing and generally tighter spreads.

Execution is fast and reflects real market conditions.

ECN brokers typically charge a commission per trade instead of marking up spreads.

ECN brokers are ideal for experienced traders who require fast execution and access to real market pricing.

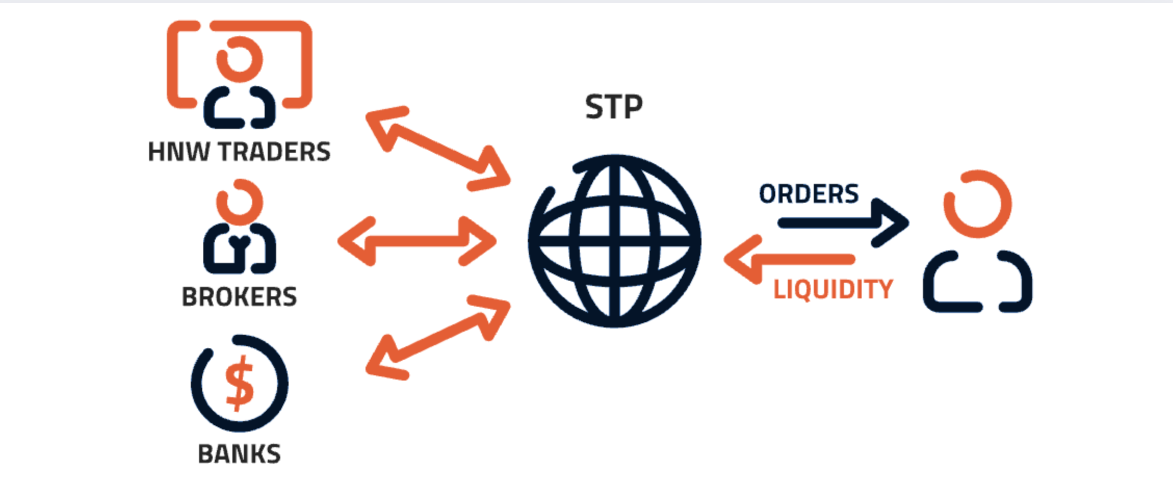

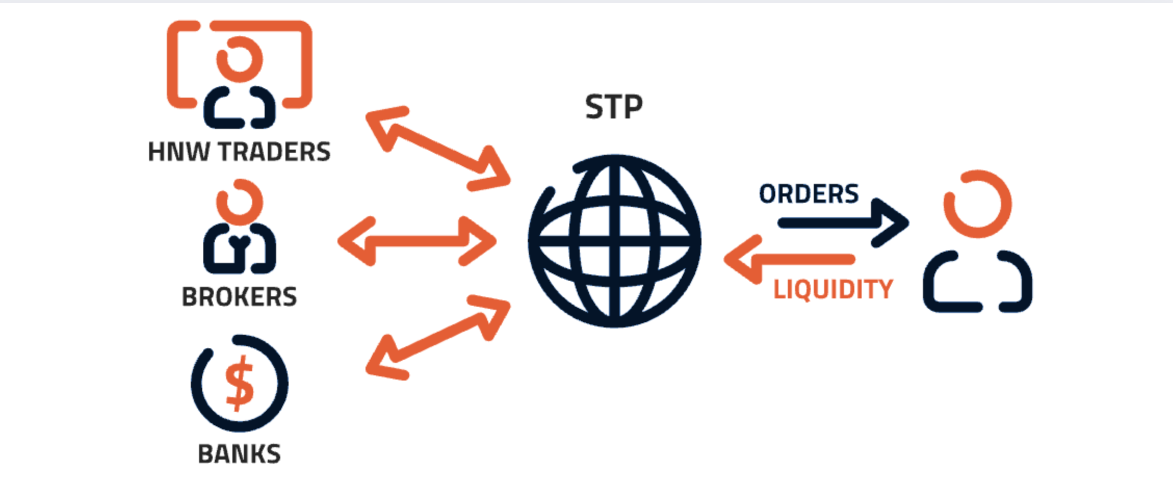

STP Brokers in Forex

STP (Straight Through Processing) brokers process orders through their systems and send them to liquidity providers, sometimes via a bridging network.

Key points about STP brokers:

Traders often see variable spreads that reflect market conditions.

Orders are processed automatically, usually without re-quotes.

STP brokers can provide a balance between Market Maker and ECN models, offering competitive spreads and relatively fast execution.

STP brokers suit traders who want more direct access to the market while still benefiting from some broker-managed infrastructure.

Hybrid Brokers in Forex

Hybrid brokers combine elements of Market Maker and ECN/STP models, adapting their execution method depending on trade size, account type, or market conditions.

Key points about Hybrid brokers:

They can offer both tight spreads and transparent execution.

Execution may vary based on internal risk management.

Hybrid brokers provide flexibility for brokers and traders alike.

Hybrid brokers are useful for traders seeking a mix of speed, transparency, and cost-effectiveness.

Choosing the Right Broker in Forex

Selecting a forex broker is crucial for a successful trading experience. Key considerations include:

Regulation: Ensure the broker is licensed by a reputable authority, such as the FCA, ASIC, or CIMA.

Execution model: Identify whether the broker uses an A-Book, B-Book, or hybrid model.

Spreads and commissions: Compare trading costs carefully.

Trading platform: Evaluate the platform's usability and features.

Customer support: Reliable support is essential for resolving issues quickly.

Educational resources: Beginners benefit from brokers that provide tutorials, webinars, and market insights.

By reviewing these factors, traders can choose a broker that aligns with their trading style and goals.

Frequently Asked Questions (FAQ)

1. What are the main types of forex brokers?

The main types are Market Maker, ECN, STP, and Hybrid brokers, each differing in execution, spreads, and pricing models.

2. How does the broker type affect trading?

Broker type affects trade execution speed, spreads, pricing transparency, and potential conflicts of interest.

3. What should I consider when choosing a broker?

Consider regulation, execution model, costs, platform quality, and available educational resources to ensure a secure and suitable trading environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.