Oil prices firmed on Friday and was on course for a big weekly gain, on news

that the Washington and Beijing agreed to more trade talks following a phone

call between Trump and Xi.

Russia launched drones and ballistic missiles at multiple targets across

Ukraine, Kyiv authorities said on Friday. It came after the two countries failed

to reach a ceasefire deal in Istanbul.

Meanwhile, Iran was set to reject a US nuclear deal proposal that would be

key to easing sanctions on the major oil producer. The two OPEC+ members risk

facing tougher sanctions.

saudi arabia was purportedly considering additional significant output hikes

in a bid for market share. The kingdom has cut oil prices to Asia as demand

faltered amid increased tariffs.

In Canada, wildfires burning in Alberta have affected more than 344,000 bpd

of oil sands production, or about 7% of the country's overall crude output,

according to Reuters calculations.

US crude inventories fell much more than expected last week, while fuel

inventories rose, EIA data showed. Local refiners ramped up production with the

start of the summer driving season.

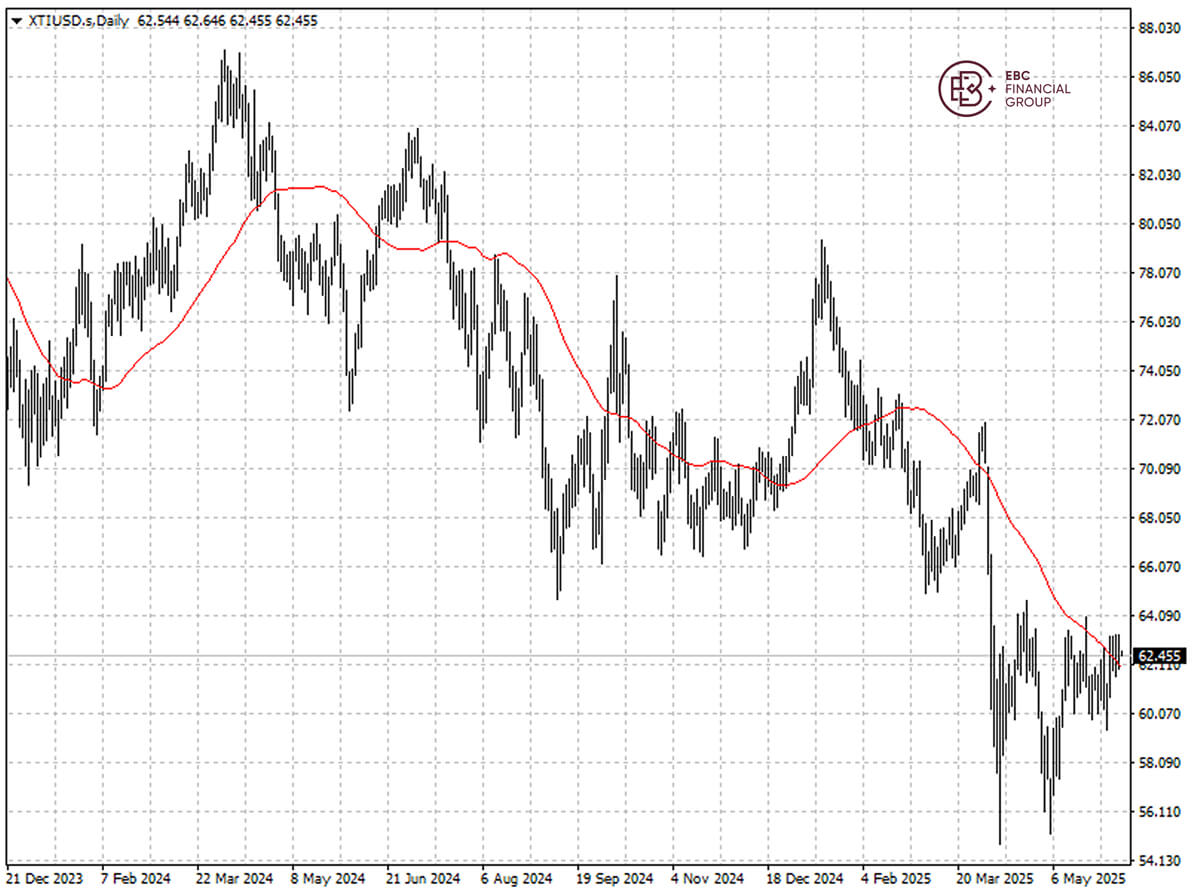

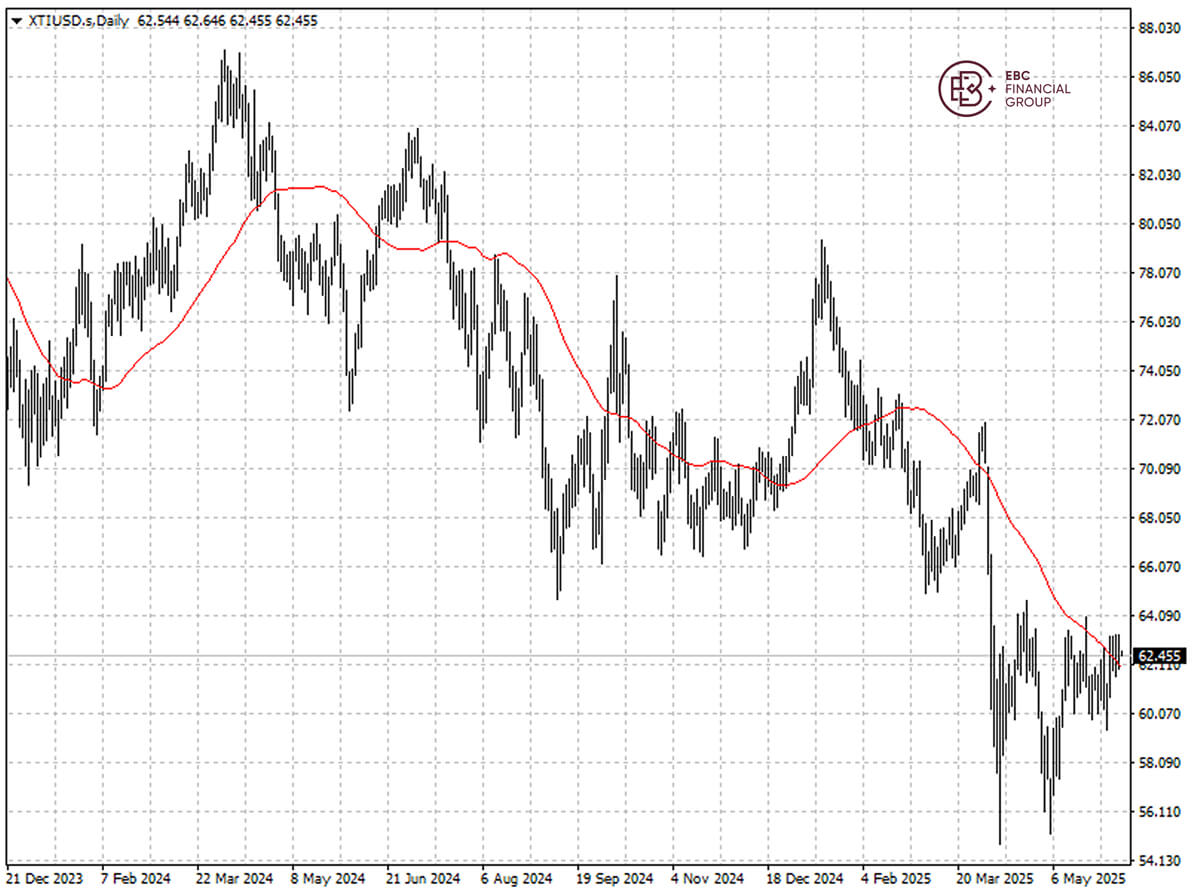

WTI crude is very close to its 50 SMA and the recent trading range remain

intact. We expect it to lose around one dollar in the upcoming sessions.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.