The yen was on solid a footing Monday as data showed Japan's economy

contracted at a slower pace than initially estimated inQ1. Trade deficit remains

a drag on the country's revival.

The BOJ should continue to proceed with monetary tightening, which would

support ease yen's long-term weakness against the greenback and rebalancing of

bilateral trade, the US Treasury Department said last week.

Governor Kazuo Ueda said the central bank will only raise interest rates

after economic and price growth re-accelerate clearly. But stubbornly high

prices are complicating its decision.

Japanese real wages fell for a fourth consecutive month in April, adding to

concerns about Japan's growth outlook. It seems uncertain whether the pay hike

major Japan firms agreed on in March will stem the decline.

For the first half of the fiscal year ending at the end of March, Japanese

life insurance companies' hedging protection against the appreciation of the yen

against overseas assets fell to the lowest level in 14 years.

In March, indicators measuring the strength of the yen against the currencies

of major trading partners hit a half-year high largely due to the general

weakening of the US dollar.

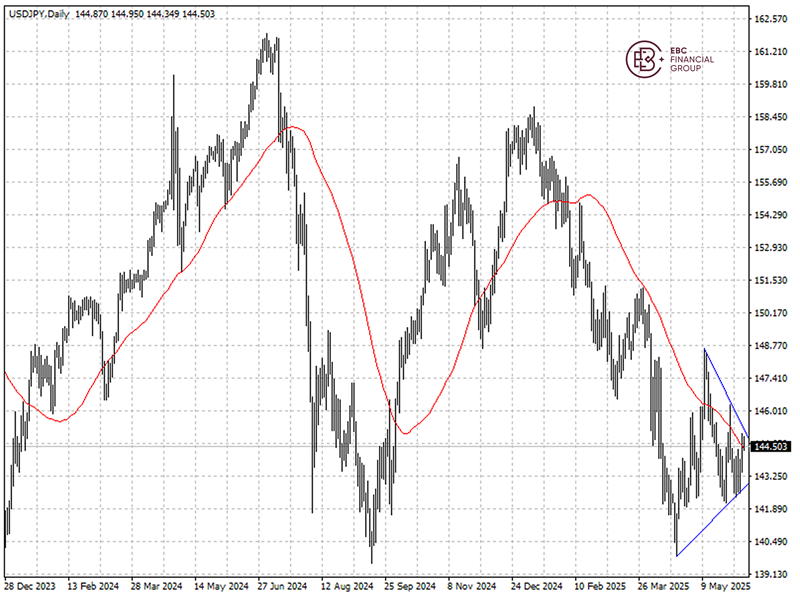

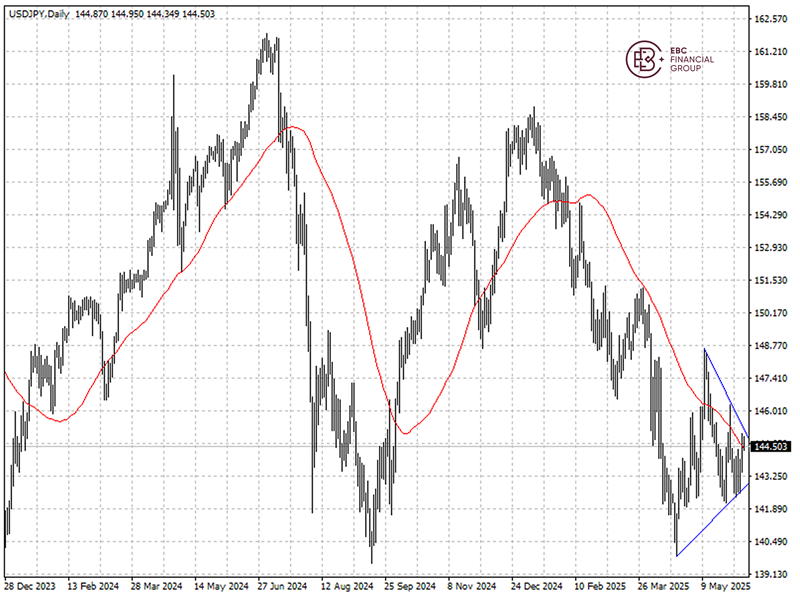

The yen continues to hover around 50 SMA, and a Wedge Pattern is shaping up –

a sign of major breakout in the short run. For now, it looks neutral.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.