Japanese Finance Minister Shunichi Suzuki said on Tuesday he was concerned

about the negative implications of the current weakness in the yen and its

effect on incentives to increase wages.

"One of our major goals is to achieve wage increases that exceed the rise in

prices," he said. "On the other hand, if prices continue to remain high, it will

be difficult to reach this target even if wages rise."

Yen bears have hit a home run this year, sending the currency to a new

34-year low of 160 in late April. As we predicted in our report for Q3 2023, the

yen is losing its safe haven status.

The sharp depreciation has become a headache for Japanese policymakers as it

hurts consumption and push up import cost. Recent upsurge in commodity prices

adds fuel to the fire.

About 64% of firms surveyed said the yen weakness eroded their profits as

they were unable to pass on rising costs to customers via price increases,

according to a report published by Teikoku Databank.

About half of surveyed companies said a yen trading around 110-120 to the

dollar would be appropriate – unattainable at least in the short run. The report

included both exporters and importers.

The currency is a "big problem," Japan Airlines Co. Chief Executive Officer

Mitsuko Tottori said earlier this month, adding that she would like to see it

retrace back to around 130 per dollar.

Last ditch

Selling pressures re-emerged following suspected interventions during this

month. The yen is languishing around 156, so the BOJ looks like an integral part

of the forthcoming effort to prop up the yen.

The central bank may raise interest rate as many as three more times this

year, with the next move potentially coming as early as June, according to a

former BOJ chief economist Toshitaka Sekine.

"My sense is that there is no problem at all even if they raise rates three

more times this year, provided conditions are sufficiently favourable," he said,

adding "there is nothing pre-determined."

Vanguard Group and PIMCO share his views that are more hawkish than those of

most BOJ watchers, although an increasing number of analysts have flagged the

risk of a July hike.

The BOJ's summary from its April policy gathering indicated more hawkish tilt

among the board, with one member saying the rate path may be higher than what

the market currently expects.

The BOJ is probably thinking a higher rate will be necessary if the yen

disrupts the price trend, given that businesses have started to adapt their

price-setting behaviour to inflation, Toshitaka said.

Key is whether a virtuous wage-price cycle can be clearly seen by the autumn

when economic indicators for July and August reflecting the impact of Shunto are

available, according to Western Asset Management.

Pinch of slowdown

Japan's economy fell faster than expected in Q1 as weak consumption bit,

throwing a fresh challenge to the central bank's push to take interest rates

further away from zero.

Downwardly revised data showed GDP barely grew in Q4 2023 and the

across-the-board declines in all GDP components suggest Japan's economy had no

major growth engine in the last quarter.

"It would be possible that the timing of rate hikes could be pushed back

depending on how the GDP may rebound in the current quarter," said Yoshimasa

Maruyama, chief market economist at SMBC Nikko Securities.

Economists are hopeful the recession will prove temporary and expect the drag

to growth from an earthquake in the Noto area and the suspension of operations

at Toyota's Daihatsu unit to dissipate.

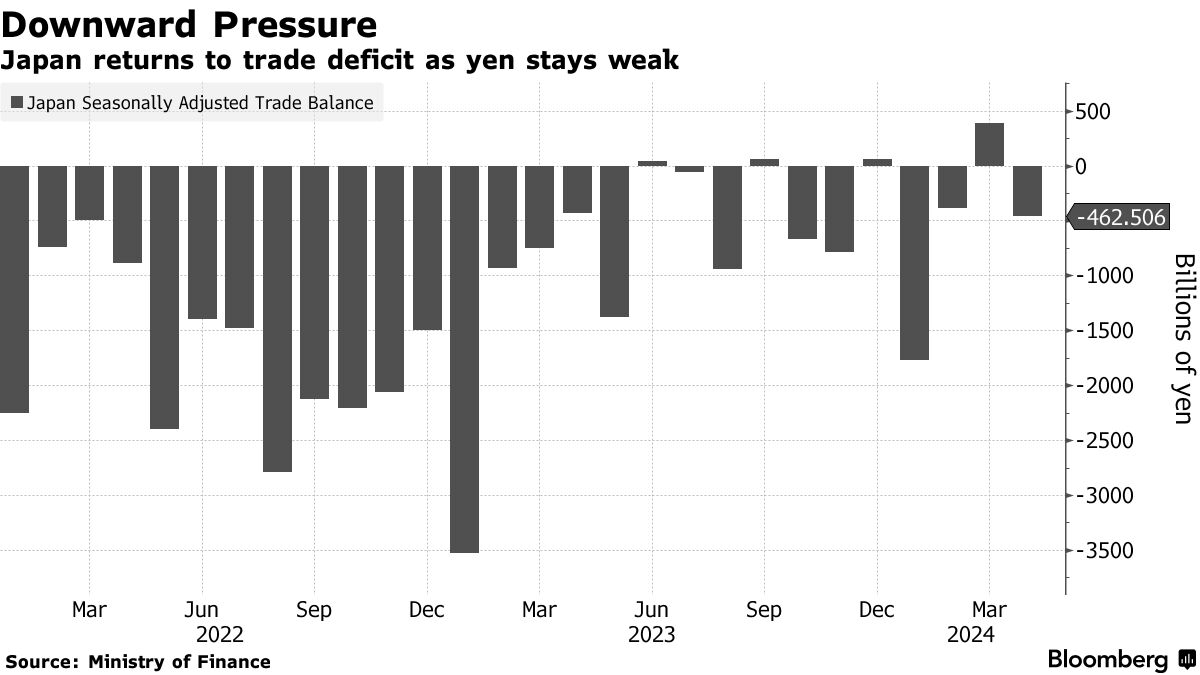

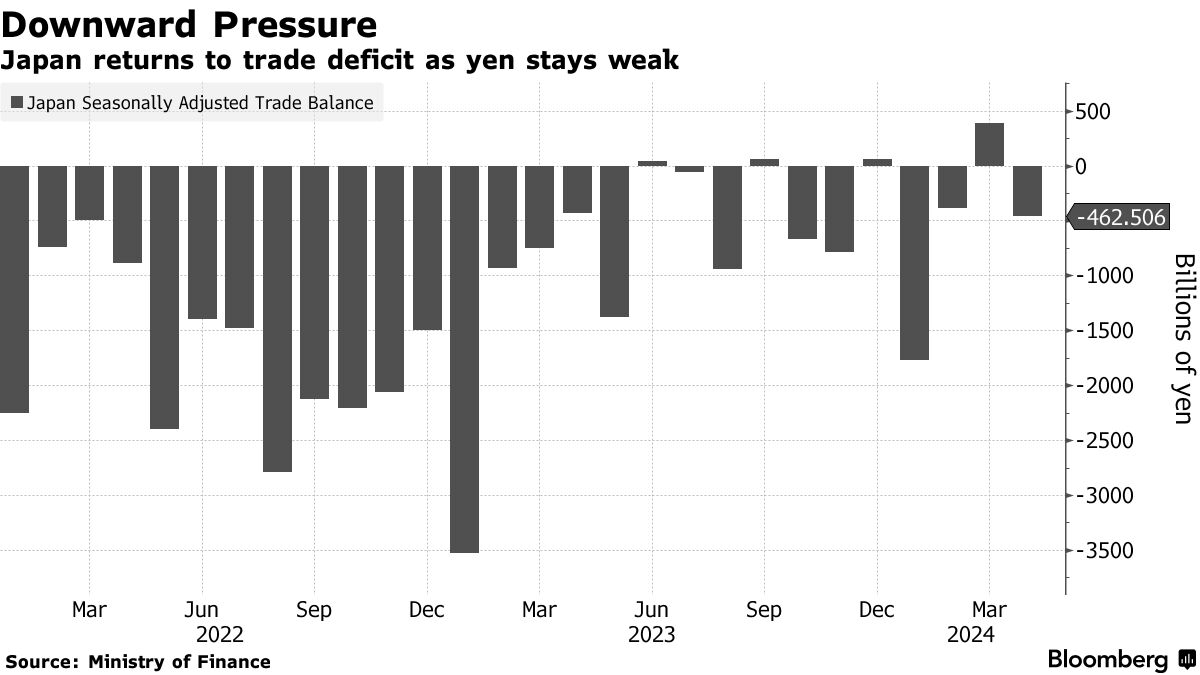

Japan’s imports rebounded in April, pushing the nation’s trade balance into

deficit. The negative factor for GDP reflects the growing pain associated with a

falling local currency.

Exports to the US rose 8.8%. Strong demand in overseas markets signals that

the economy could return to growth in Q2 while underscoring positive outlook on

the US growth.

Japan's core consumer inflation probably slowed for a second straight month

to 2.2% from 2.6% in March in April from a year earlier, a Reuters poll showed,

leaving policymakers in a worse predicament.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.