Thursday is the last settlement day of the week ahead of the Easter holidays

and trade volumes were thin. For the week, both Brent and WTI gained about 5%,

their first weekly gain in three weeks.

They settled more than 3% higher on Thursday, supported by hopes for a trade

deal between the US and the EU and new sanctions to curb Iranian oil exports,

which continued to elevate supply concerns.

Trump and Italian PM Giorgia Meloni met in Washington and expressed optimism

about resolving trade tensions. Vice-President JD Vance said earlier there was a

"good chance" of a deal with the UK.

The US president touted "big progress" in tariff talks with Japan on

Wednesday, in one of the first rounds of face-to-face negotiations. He also said

he expected to make a trade deal with China.

Crude inventories rose by 515,000 barrels the week ended 11 April, the EIA

said, compared with analysts' expectations for a 507,000-barrel rise. Meanwhile,

crude exports hit the highest in about a year.

"In the next four years we'll almost certainly see lower average energy

prices than we saw in the last four years of the previous administration," said

US Energy Secretary Chris Wright last week.

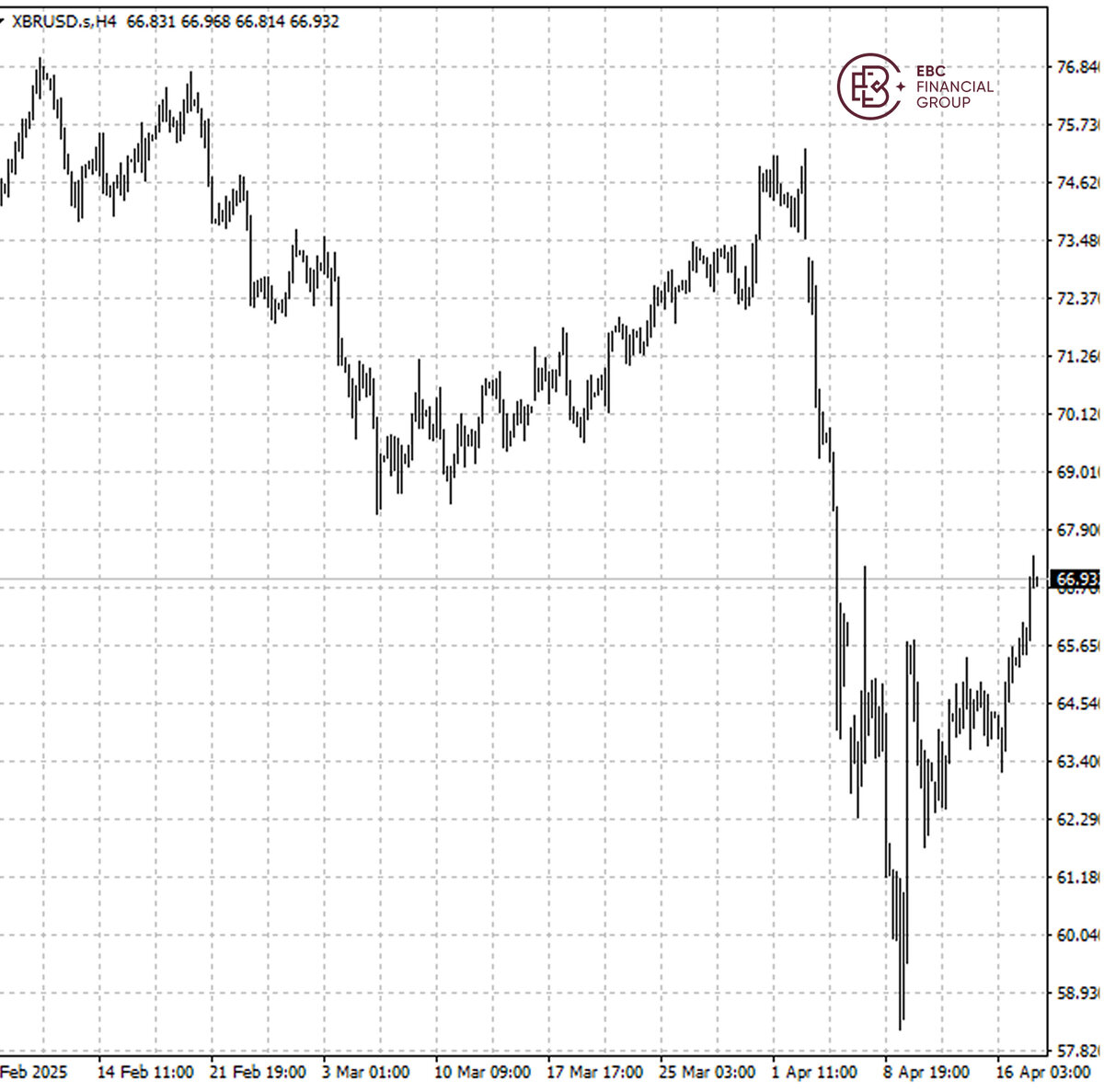

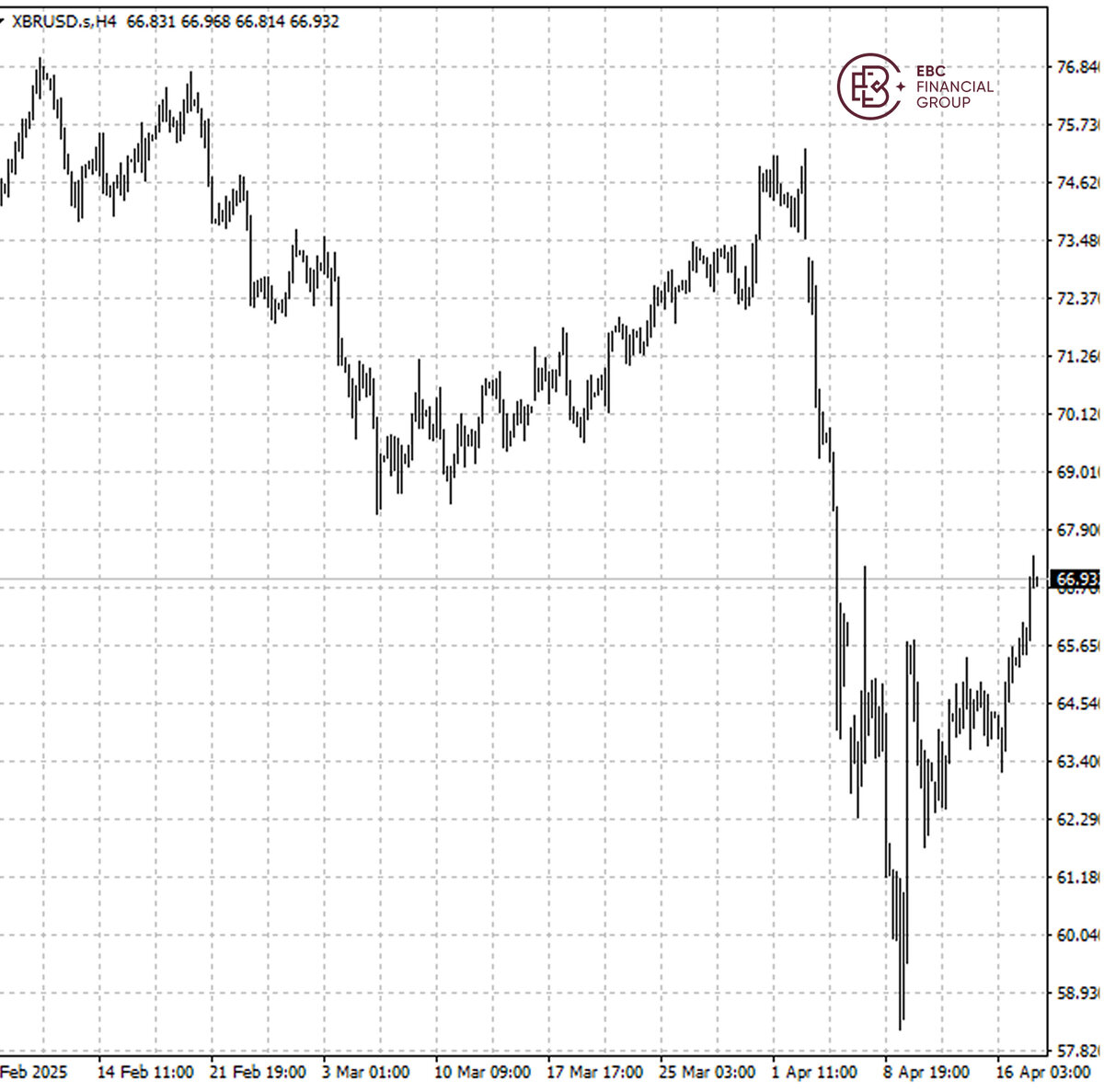

Brent Crude extended it rally amid improving market sentiment and the risk

remains skewed towards the upside. The next major hurdle could be the previous

support around $68.2.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.