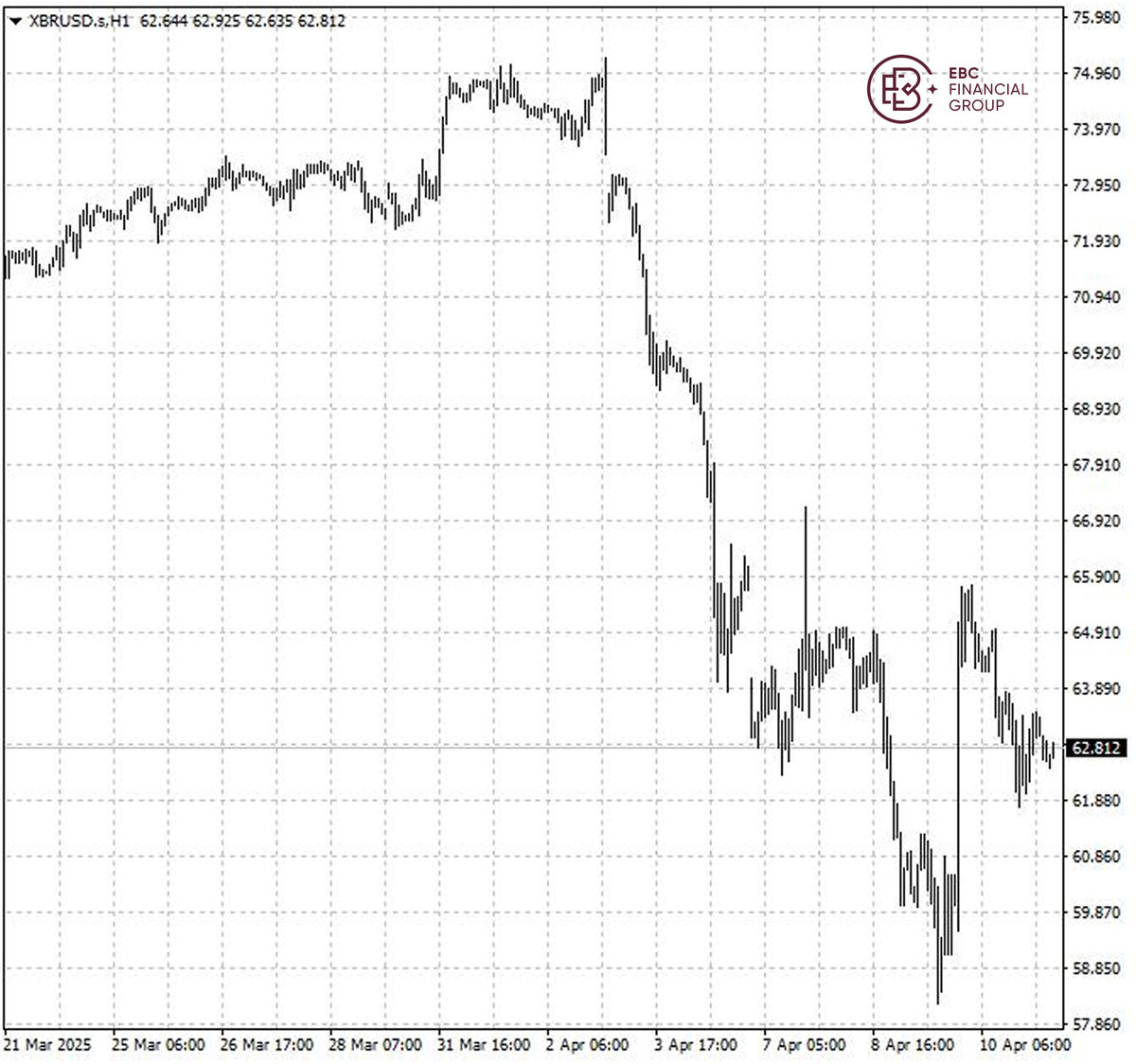

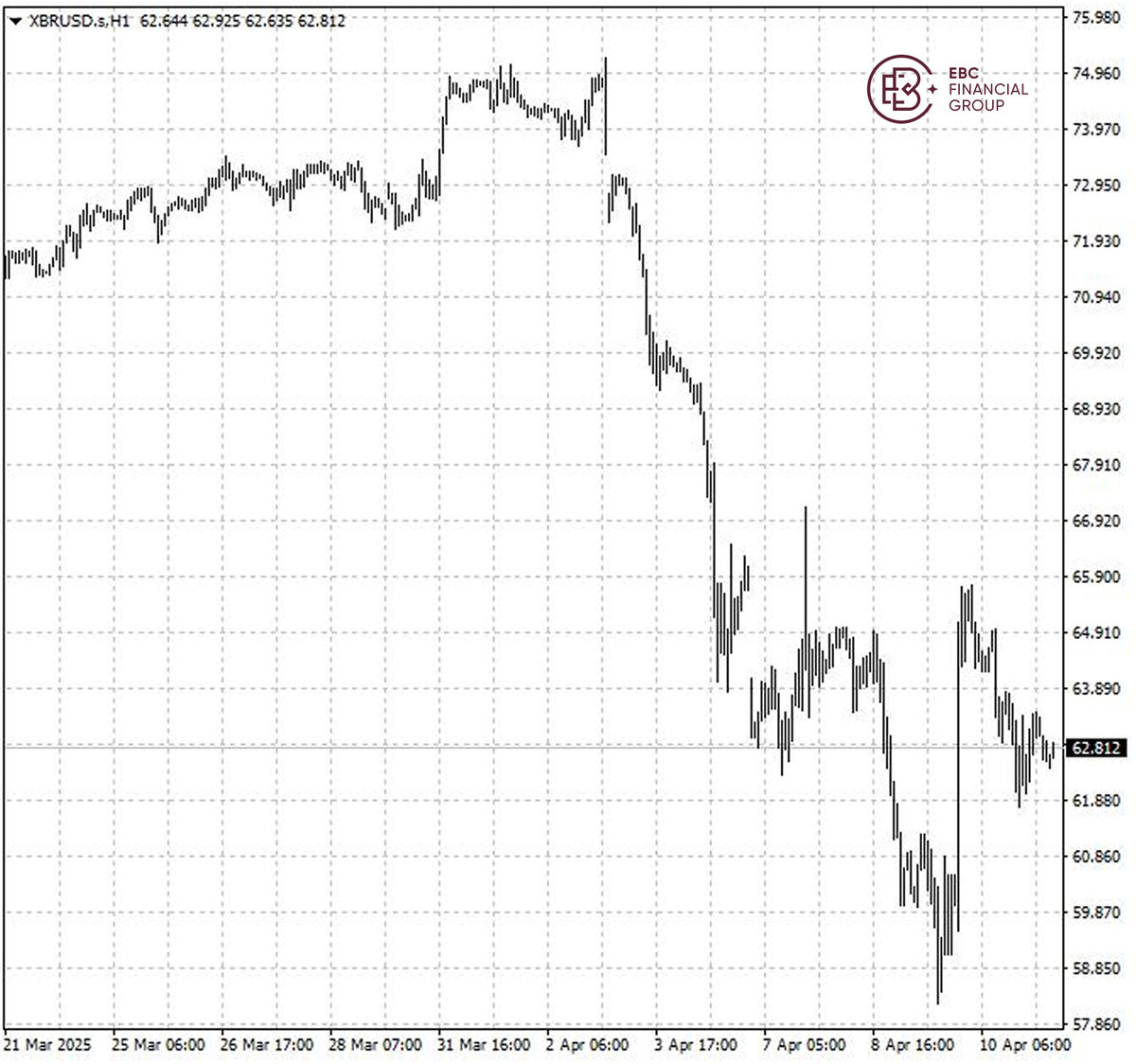

Oil prices fell on Friday and were set to drop for a second week on concerns

prolonged trade war between the US and China, the world's largest economies,

will crush crude consumption.

Brent is set to fall 4% this week, adding to an 11% drop in the prior week,

while WTI is set to decline 3.8%, after also falling 11% in the previous week.

Risk sentiment is souring on uncertainties around supply chain.

An all-out trade war could have large repercussions for producers like China,

which have to seek new markets in the face of weak domestic consumption.

Slower growth and hotter inflation will leave some governments struggling

even more to pay down the world's record $318 trillion debt load and find money

for budget priorities such as defence, climate action and welfare.

The EIA on Thursday lowered its global economic growth forecasts and warned

that tariffs could weigh heavily on oil prices, as it slashed its US and global

oil demand forecasts for this year and next.

In the US, crude inventories rose by 2.6 million barrels last week, the

agency said, compared with analysts' expectations in a Reuters poll for a

1.4-million-barrel rise.

Brent Crude has shown a bearish Pennant Pattern, suggesting there could be

more pains ahead. As such we see it retest $62 in the upcoming sessions.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.