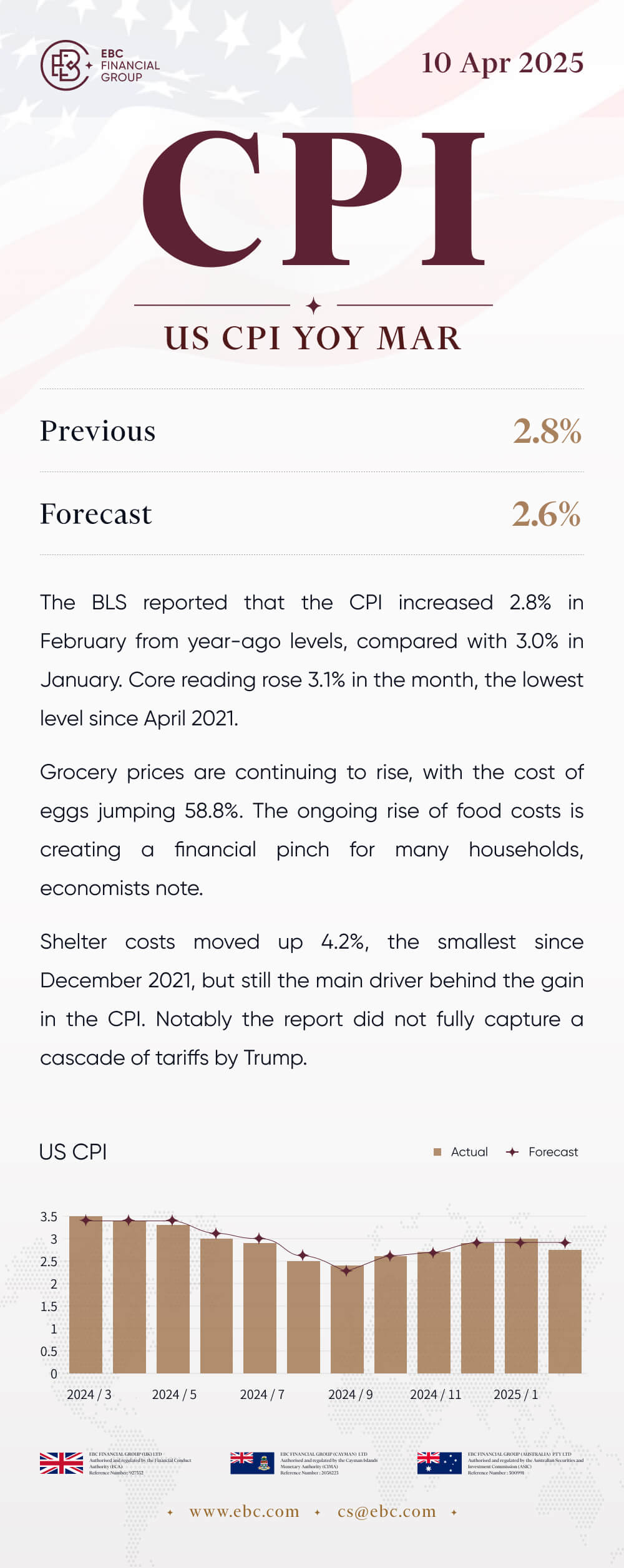

US CPI Mar

10/4/2025 (Thu)

Previous: 2.8% Forecast: 2.6%

The BLS reported that the CPI increased 2.8% in February from year-ago

levels, compared with 3.0% in January. Core reading rose 3.1% in the month, the

lowest level since April 2021.

Grocery prices are continuing to rise, with the cost of eggs jumping 58.8%.

The ongoing rise of food costs is creating a financial pinch for many

households, economists note.

Shelter costs moved up 4.2%, the smallest since December 2021, but still the

main driver behind the gain in the CPI. Notably the report did not fully capture

a cascade of tariffs by Trump.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.