An increase of 30% in gold prices overshadows that of other traditional safe

havens such as the Japanese yen, Swiss franc, and Treasurys in the face of

fiscal sustainability concerns and looming wars.

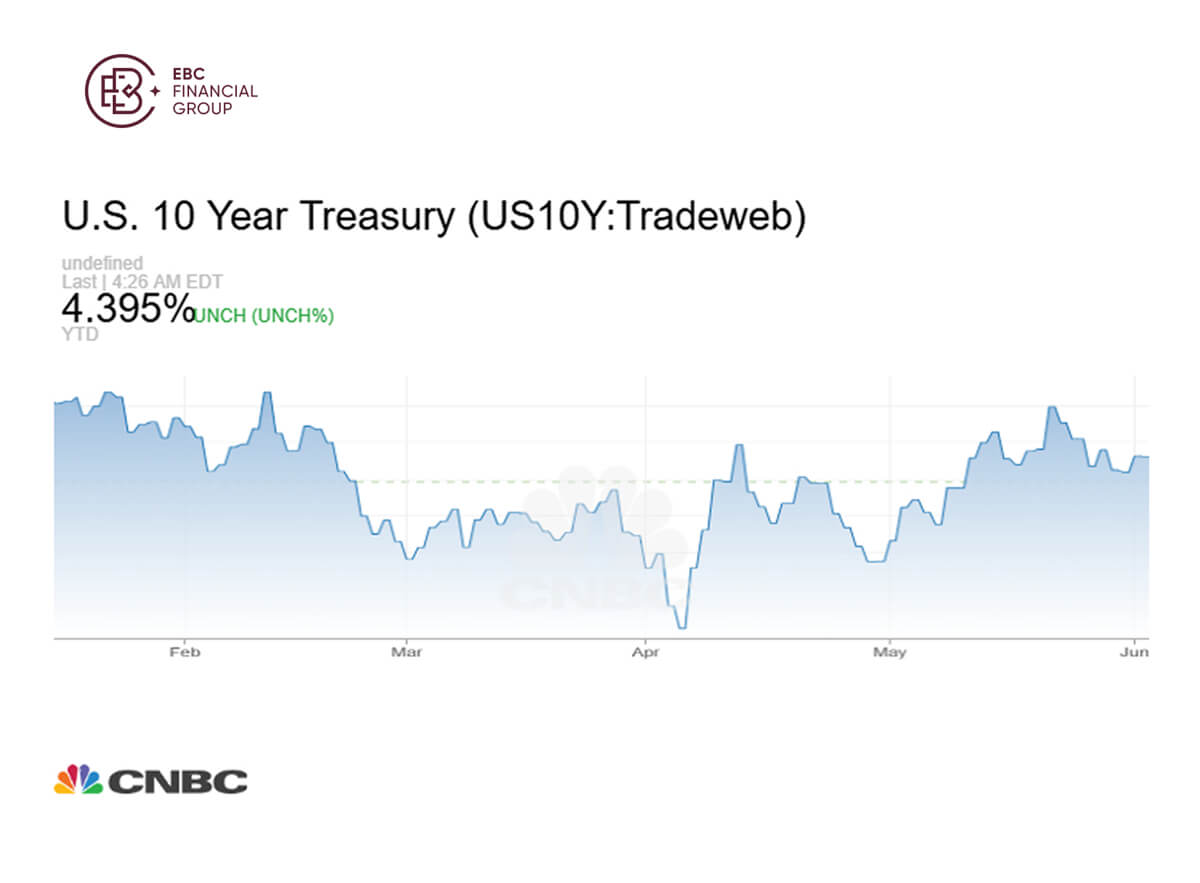

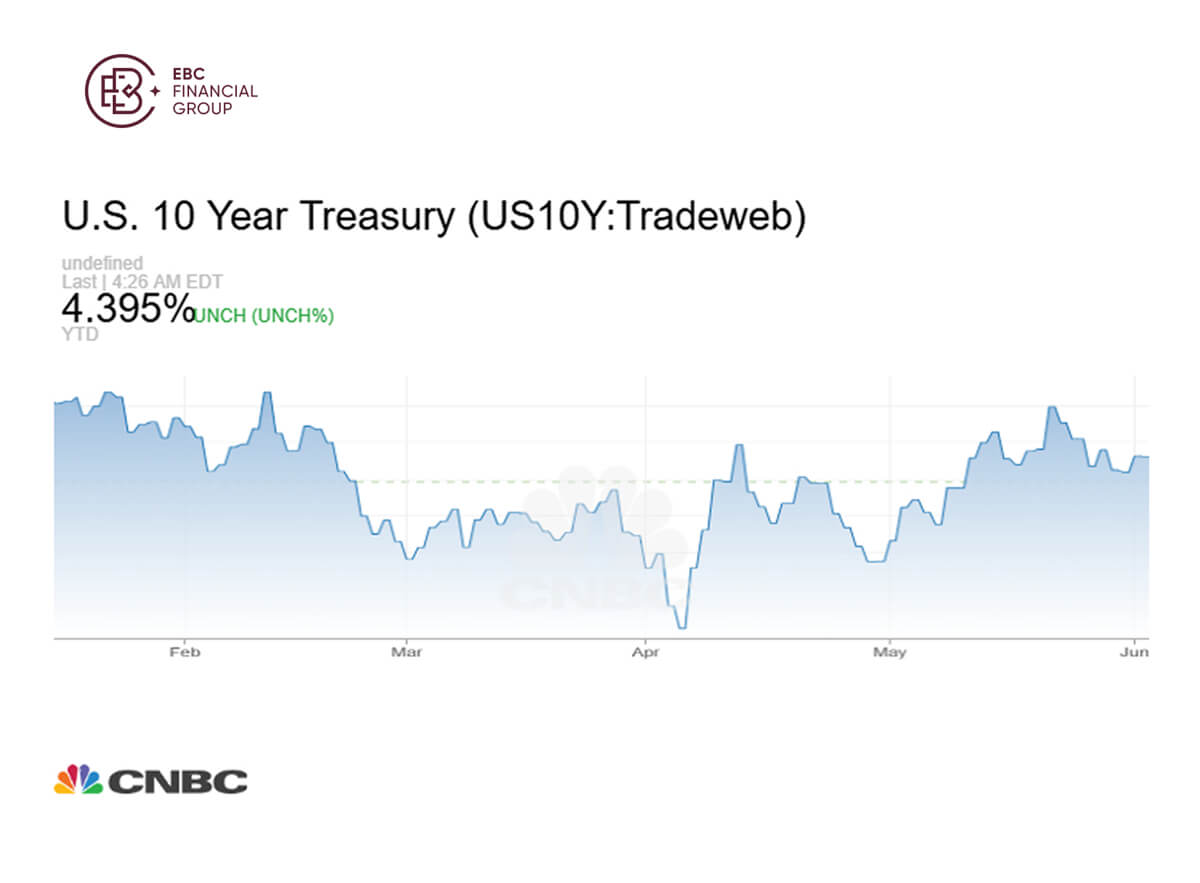

Yields on the benchmark 10-year US government bond is hovered around 4.3 –

4.4%, broadly unchanged so far this year. US credit downgrade and sweeping

tariffs have dented its appeal.

In contrast, gold has been consistently notching fresh highs for months on

demand propelled by an atmosphere of instability and uncertainty, particularly

trade tensions and Iran-Israel conflict.

The Treasury rout in May was accompanied by a sell-off from other key markets

as well. JGBs are among the worst hit as Tokyo did not make headway in clinching

a trade deal with Washington.

Despite taper tantrum underway, the country's debt remains twice the size of

economy. With interest rates heading higher, concerns about debt-serving ability

could cap yen's upside room.

The SNB on Thursday cut interest rates by a further 25 basis points to 0% and

a return to negative rates looks likely. The country had been haunted by years

of weak inflation before the Covid-19 like Japan.

Therefore, the currency's advantage is diminishing over bullion that bears no

interests. The metal carries no counterparty risks and stands out from other

safe haven assets that are issued by and tied to government owners.

Governmental choice

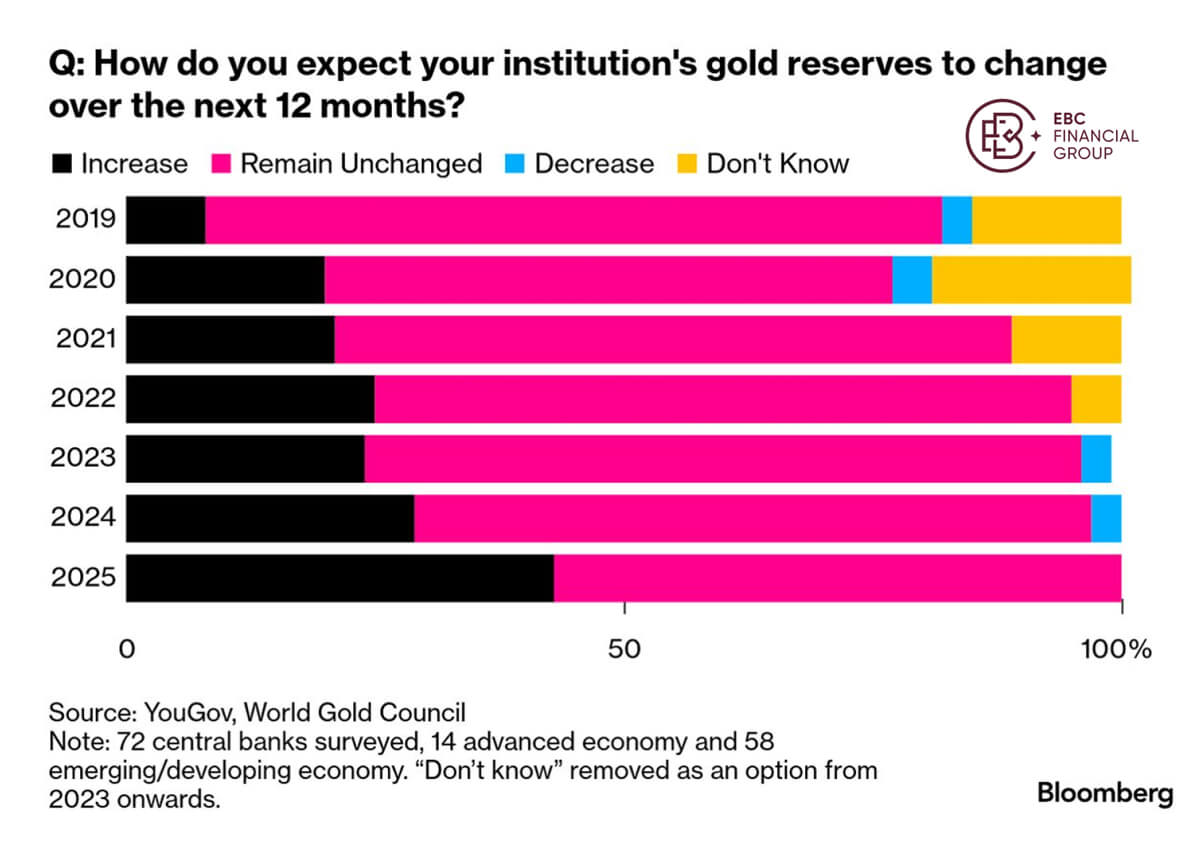

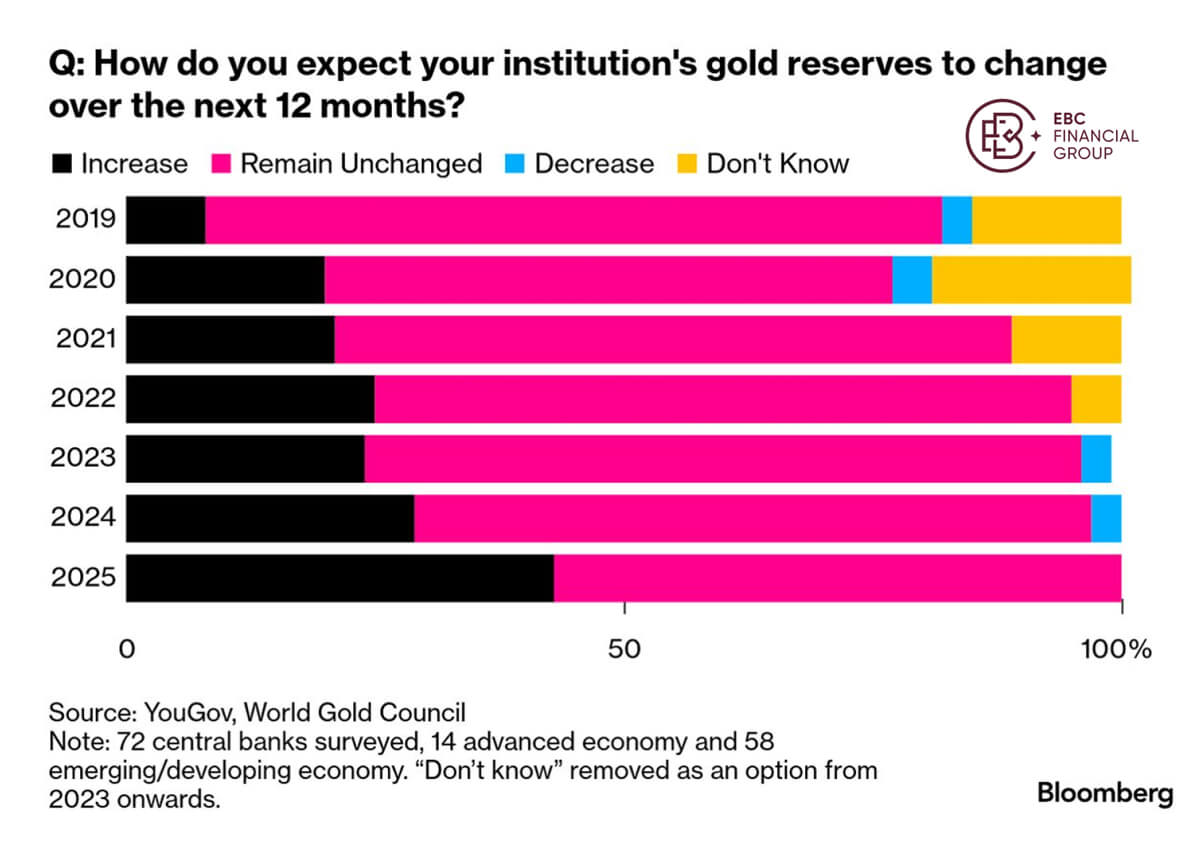

A record share of the world's central banks plans to accumulate more gold

over the next 12 months, drawn by bullion's strong performance during times of

crisis and hedge against inflation.

In a survey of 72 monetary authorities, 43% said they expected their gold

reserves to increase, up from 29% a year earlier and the highest figure in eight

years of data collected by the WGC and YouGov.

"Western countries have stopped selling and emerging market countries have

started buying, they're catching up and building more gold reserves," said

Shaokai Fan, global head of central banks for the WGC.

China's central bank added gold to its reserves in May for the seventh

straight month, official data showed, reflecting Beijing's desire to diversify

its foreign currency reserves even at higher costs.

The Fed kept interest rates steady amid expectations of higher inflation and

lower economic growth ahead, and still pointed to two reductions later this year

– a boon to bullion.

Flare-up in the Middle East adds another wild card to the policy mix, with

prospects of higher energy prices a potential additional factor in keeping the

central bank from cutting.

Trump said Thursday he wouldecide on whether to strike Iran "within two

weeks," according to the White House though the president voiced approved of

attack plans for Iran earlier.

A topsy-turvy world

Gold is expected to consolidate above 3,000 over the next quarter and return

to about $2,500 to $2,700 an ounce by the second half of 2026, according to

Citigroup's base case.

Declining investment demand for gold from Q4 2025 may come from improvement

in global growth confidence as a stimulatory US budget takes effect, and Trump's

policies become less bearish, the bank said.

That came in contrast to other analysts who maintained bullish call. In April

JP Morgan saw gold prices crossing the $4,000 per ounce milestone next year,

citing increased US recession probabilities.

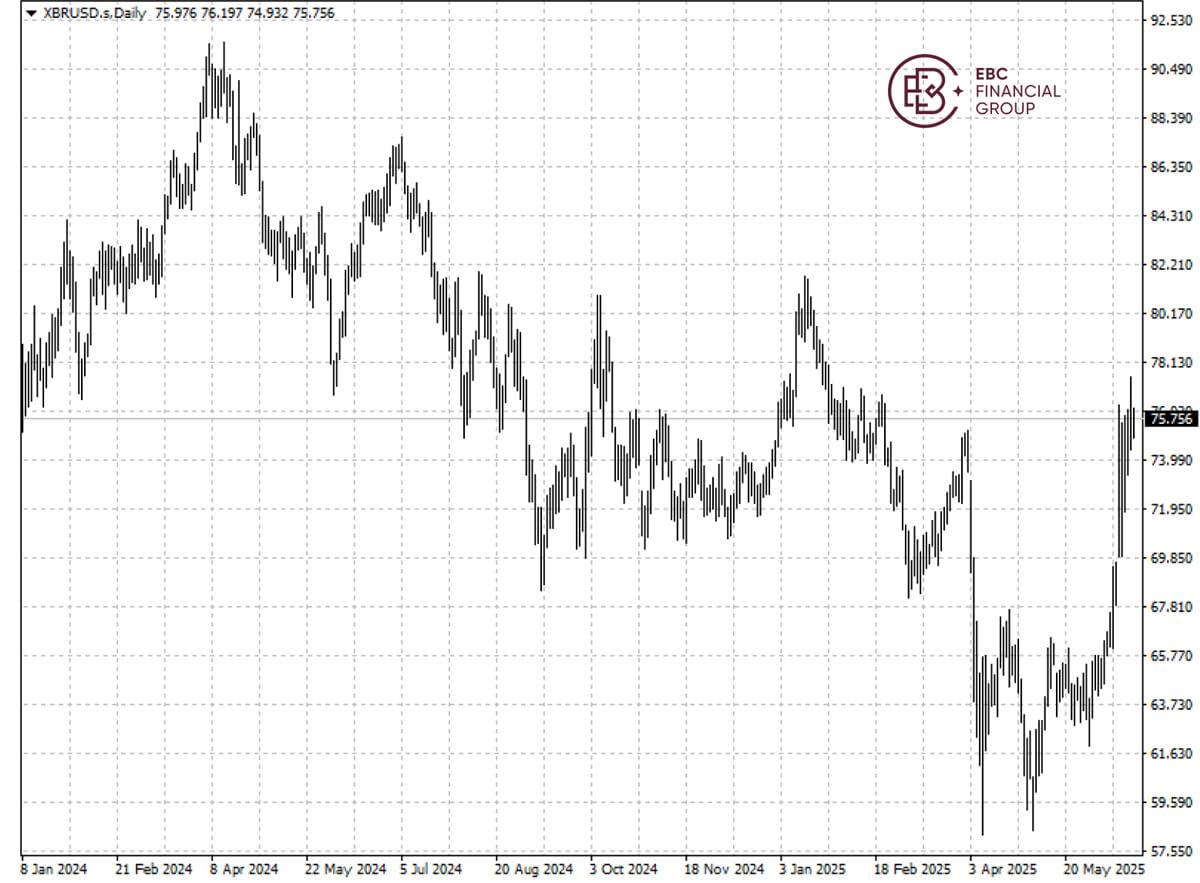

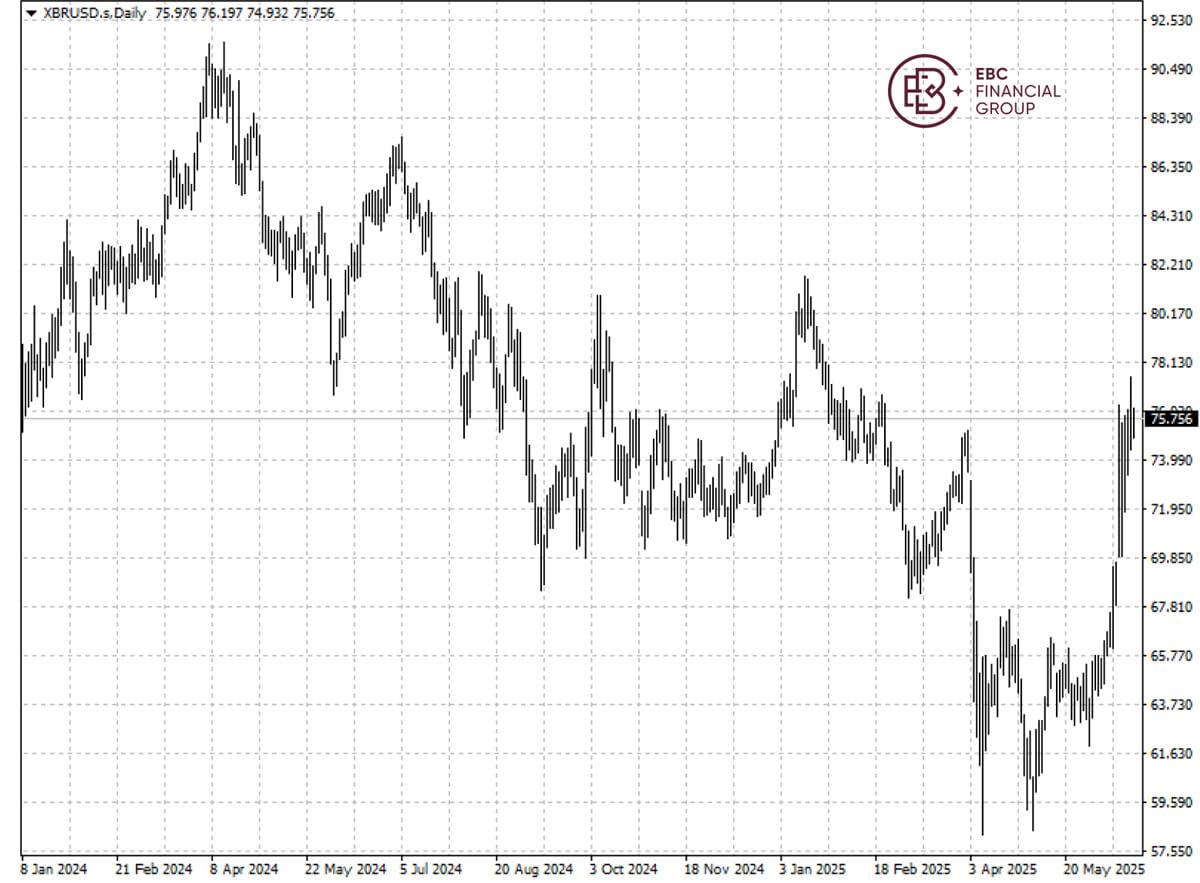

Benchmark oil prices have surged by 23.5% in June, back to its level in

February. Once Trumps loses all his patience in Teheran, the energy market's

continued bull run would exert further upward price pressures.

The confrontation could also ramp up tensions with China. Surging commodity

prices would blunt China's ability to stabilize growth and the fall of the

Iranian regime undermine the Belt and Road Initiative.

Iranian Foreign Minister Abbas Araghchi has said Tehran would not negotiate

with anyone as long as Israeli attacks continue, ahead of a meeting with his

European counterparts in Geneva.

Trump on Tuesday said Japan was being "tough" in trade talks and the EU had

not yet offered what he considered a fair deal. The still-bleak global trade

outlook is helping underpin gold's strength.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.