A short-lived commodity boom on the heels of the pandemic was largely

unpredictable thanks to the fastest post-recession growth pace in decade, before

inflation fears put a brake on the rally.

But inflation that has peaked globally will likely remain high for years to

come - an environment where commodities usually perform well like base metals

and energy in particular.

That is already evident in a remarkable gain of roughly 6% of the Dow Jones

Commodity Index so far. Meanwhile, two major commodity currencies - the

australian dollar and the canadian dollar both fell around 3%.

An early kick off to easing cycles by most major central banks had been

crowded bets in Q1, but the SNB turns out to be the outlier with a surprising

interest rate cut in March.

A considerable debate has emerged among economists over whether, in the long

run, rates would return to pre-pandemic levels or settle higher. The last mile

of disinflation may be the most difficult one.

In April, the IMF inched up its expectations for global economic growth this

year while warning the outlook remains cautious amid persistent inflation and

geopolitical risks.

A long-lasting commodity bull run is far from certain given the agency's view

that medium-term outlook remains the weakest in decades. Still risk-sensitive

currencies might have scope for more gains.

War beneficiaries

Russia has started preparations for missile drills near Ukraine simulating

the use of tactical nuclear weapons in response to "threats" by Western

officials, Kremlin spokesman Dmitry Peskov said on Monday.

French president Macron repeated that he does not rule out sending troops to

Ukraine, while British Foreign Secretary Cameron said Kyiv's forces will be able

to use British long-range weapons in the war.

Investors have been plagued by possible escalation of ongoing wars in Europe

and the Middle East. Typically, this kind of tail event wreaks havoc on risky

assets, but there are some well-known exceptions.

Oil and gold are undoubtedly among the biggest beneficiaries of a war. Brent

crude climbed above $130 per barrel shortly after Moscow launched a full-scale

invasion of Ukraine two years ago.

Iron ore has proved to be another winner, averaging $135.54 for the 2021-22

financial year. Russia and Ukraine both mine iron ore and manufacture steel and

hence supply disruption jitters.

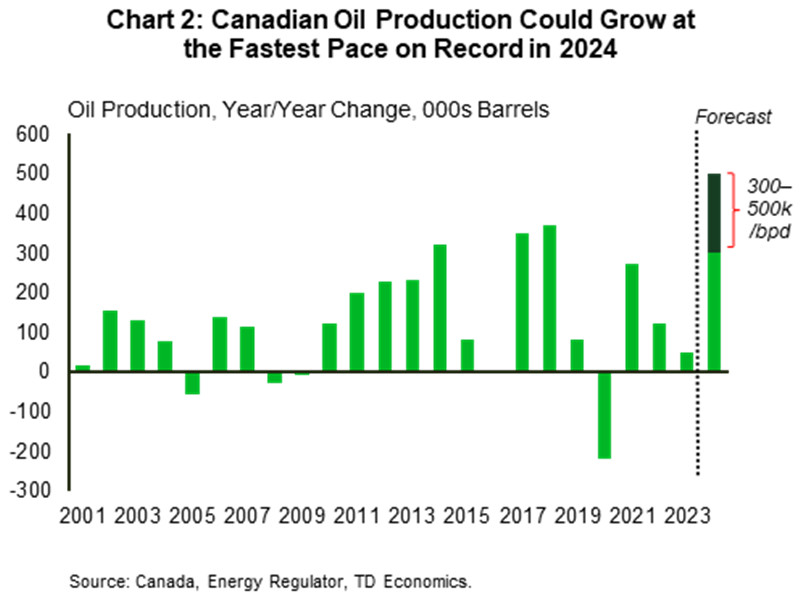

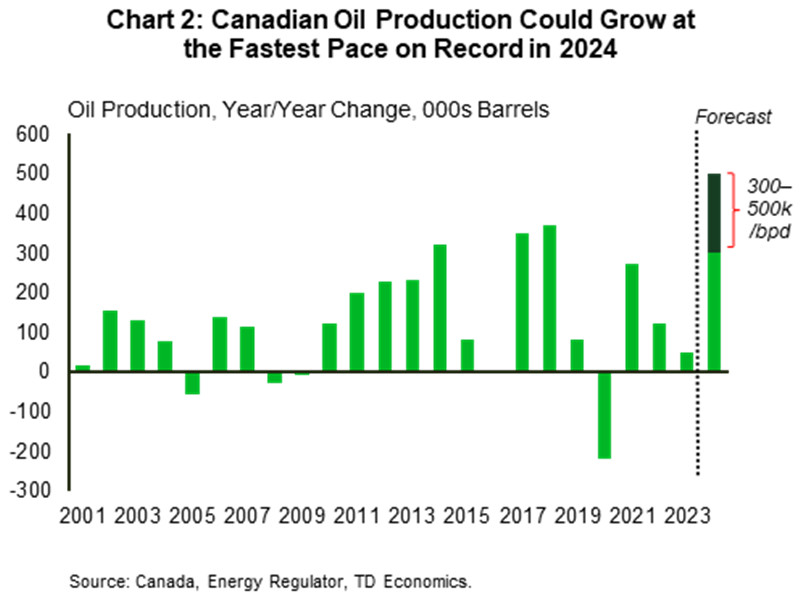

After a relatively weak year for Canada's oil producers, significant output

growth in 2024 could put the nation in the running to be the largest source of

global oil supply growth, according to TD Economics.

Elsewhere Australia happens be the world's second largest gold producer and

have the largest gold mine reserves worldwide. And it is also the top iron ore

producer and exporter.

Academic Heresy

The greenback's resurgence has come on the back of a slew of signs that the

US economy swerved the slowdown many anticipated. Another tailwind for the

dollar is its role as an unrivalled sanctuary.

The dollar smile theory suggests the dollar rises when the US economy is

either booming or in a deep slump. Some economists even argue rate hikes have

helped spur the recovery due to exploding US budget deficits.

They believe the jump in benchmark rates is providing Americans with a

significant stream of income from their bond investments and savings accounts

for the first time in two decades.

Therefore, the additional spending is more than enough to offset the drop in

demand from those who stop borrowing money, which made the rate-hiking cycle

simulative.

Mark Zandi, chief economist at Moody's Analytics, called the new theory

simply "off base". But he acknowledges that "higher rates are doing less

economic damage than in times past."

US Treasury Secretary Janet Yellen said it's "unlikely" that interest rates

will return to levels that prevailed before the Covid-19 pandemic triggered a

wave of inflation and higher yields.

The 10-year Treasury yield is now level with that of comparable AGBs and is

nearly 90 bps higher than its Canadian peer's. The rate differential could have

helped push the Aussie dollar higher than loonie.

A close game

The IMF lately raised its Asia growth forecast to 4.5% for 2024, reflecting

upgrades for China. It also remained optimistic on India where "public

investment remains an important driver."

The Asian Development Bank struck a similar tone, saying China will remain

the largest growth engine for the world economy in spite of its slowdown while

India's economy is undoubtedly a "bright spot."

The forecast put the Australian dollar in a good position to outperform the

Canadian dollar though China's property sector is posing a dire risk to Asia's demand.

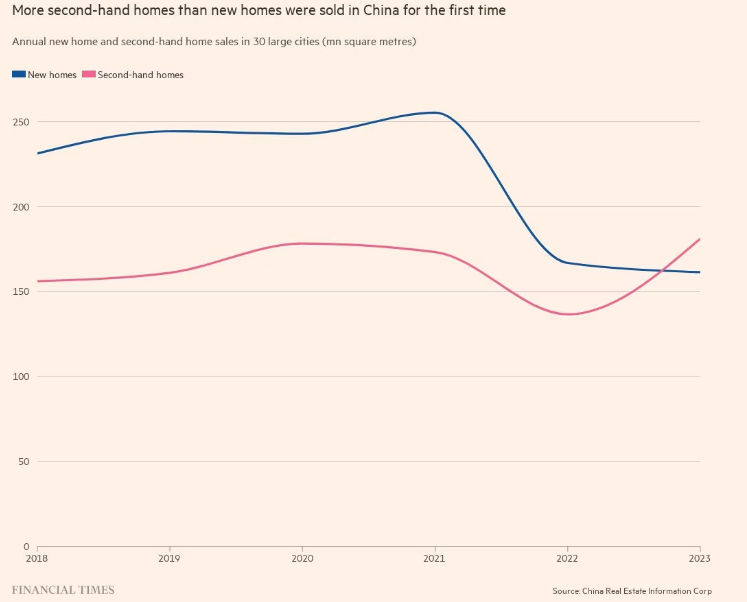

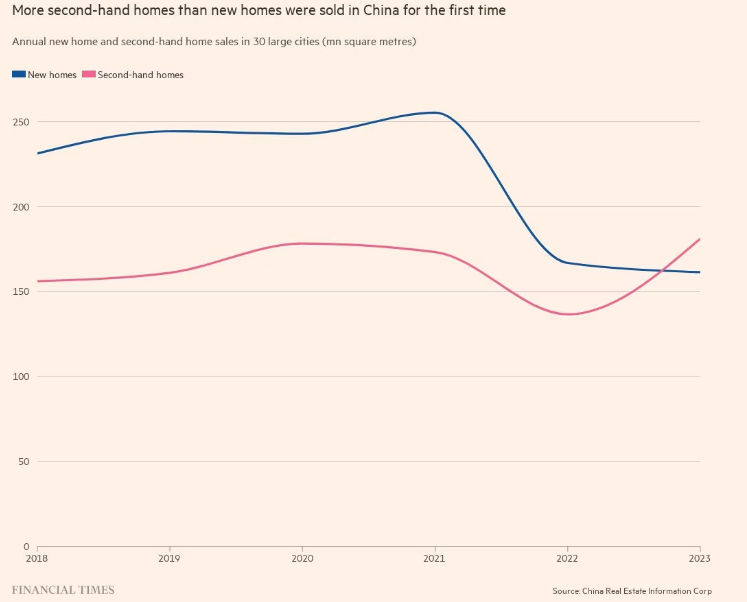

Second-hand home sales in China surpassed those of new homes by floor space

last year for the first time since 1990s, presaging continued weakness in the

construction activity.

President Joe Biden has called for a tripling of tariffs on some steel from

China in April, but economists largely see the threat as more of a political

tool than an economic one.

High tariffs can have unintended economic consequences that end up penalising

American importers and consumers more than they do the intended Chinese

exporters.

In a nutshell, the Canadian dollar and the Australian dollar will likely

extend their rally against the US dollar from early May in the short-term with

slightly better prospects for the latter.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.