Oil prices in August 2025 have stabilised after a two-week decline, reflecting a finely balanced market where supply discipline, geopolitical risks, and uncertain demand converge. The interplay of cautious OPEC+ production management, ongoing tensions in Eastern Europe, and mixed economic signals from global demand centres has fostered cautious optimism among investors. This article explores these factors, presents the latest data, and highlights the outlook for the coming months.

What's Keeping Oil Prices Stable in August 2025?

-

OPEC+ Production Discipline: OPEC+ countries have maintained production levels near 100-102 million barrels per day. While quotas were increased earlier in the year, several members face challenges in raising output further, stabilising supply conditions.

-

Geopolitical Risk Premium: Continued uncertainty from the Russia-Ukraine conflict sustains a price risk premium, with market participants wary of potential supply shocks from further escalation.

-

US Tariff Uncertainty: The US government's threat to increase tariffs on Indian crude imports has introduced fresh uncertainty into global crude trade, dampening market sentiment and complicating supply flow predictions.

Demand Concerns Offset by Asia Growth: Inflationary pressures and economic slowdowns in developed markets temper demand projections, but growing energy consumption in Asia-Pacific, particularly India and China, counterbalances some of this softness.

How Are Market Sentiments and Prices Behaving?

Investor behaviour reflects uncertainty coexisting with cautious optimism:

-

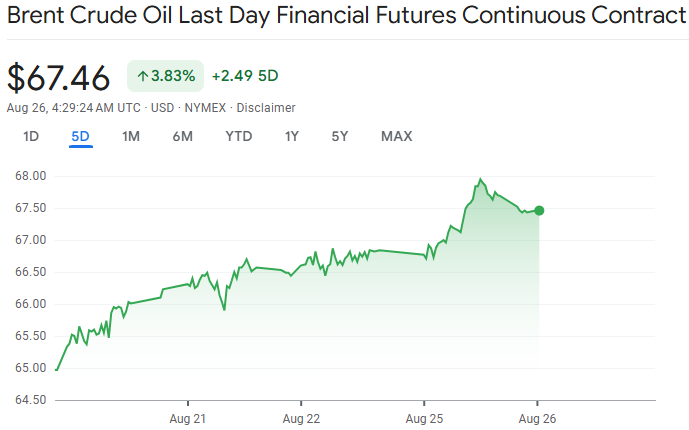

Brent crude prices hovered at about $68.48 per barrel while WTI remained near $67-$69 on 25 August 2025, showing a consolidation of recent losses.

-

Volatility has moderated, suggesting that the market is waiting for fresh cues from OPEC+ decisions, US inventory data, and geopolitical developments before committing to directional bets.

Growth in renewable energy investment, with $386 billion spent globally in the first half of 2025, underscores an emerging long-term shift away from fossil fuel dependency that tempers enthusiasm for sustained high oil prices.

Market Drivers Snapshot

| Factor |

Impact on Prices |

| OPEC+ Production Strategy |

Limits supply and supports price stability |

| Russia-Ukraine Conflict |

Adds volatility and risk premium |

| US Tariffs on Indian Crude |

Raises trade uncertainty |

| Global Economic Slowdown |

Weakens demand forecasts |

| Asia-Pacific Demand Growth |

Provides demand stability |

| Renewable Energy Investment |

Applies structural downward pressure |

Expert Forecasts & Price Outlook

-

The US Energy Information Administration forecasts Brent crude to decline to nearly $58 per barrel by Q4 2025, factoring in inventory builds and reduced demand.

-

J.P. Morgan Research highlights both bearish risk from trade and economic growth concerns and potential supply-side factors that may support prices near mid-2025 levels.

Analysts stress geopolitical dynamics and trade policy as key uncertainties near term, amplifying the potential for market swings.

What To Watch Out For?

-

Outcomes of OPEC+ meetings and compliance with production quotas.

-

Weekly inventory reports from the US Energy Information Administration.

-

Developments in US-India trade policies impacting crude imports.

-

Progress or setbacks in the Russia-Ukraine conflict.

Economic indicators from major consumers, especially in China and India.

Conclusion

Oil prices are maintaining their current levels through August 2025 thanks to a precarious equilibrium set by disciplined supply management, significant geopolitical uncertainty, and mixed demand cues across the global economy. While this balance effectively ended a two-week losing streak, it also sets the stage for renewed volatility, conditional on policy decisions, geopolitical developments, and macroeconomic data. Market participants should maintain vigilance to navigate this complex environment effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.