The Swiss franc (CHF) is renowned worldwide for its stability and safe-haven status. But what exactly is the CHF currency, and why has it become such a trusted store of value for investors and traders?

This article explores the historic roots of the Swiss franc, its remarkable past performance, and why it remains one of the most stable currencies in the world—plus practical tips for anyone trading CHF today.

What Is CHF Currency and Its History?

The Swiss franc's story begins in the late 18th and early 19th centuries. In 1798, the Helvetic Republic introduced the franc, modelled after the French livre and subdivided into batzen and rappen. However, Switzerland's monetary system remained fragmented for decades, with thousands of coins and notes issued by cantons, cities, and abbeys circulating alongside foreign currencies.

This changed with the Swiss Federal Constitution of 1848, which granted the federal government exclusive rights to issue money. The Federal Coinage Act of 1850 introduced the Swiss franc as the sole legal tender, replacing all previous currencies and pegging it to the French franc. Since then, the CHF has evolved into the official currency of Switzerland and Liechtenstein, and is the only franc still used in Europe.

Why Is the Swiss Franc So Stable?

1. Political Neutrality and Stability

Switzerland's long-standing policy of neutrality, avoiding international conflicts since 1815, has made it a beacon of political stability. This neutrality extends to its financial system, making the CHF a preferred safe haven during global turmoil.

2. A Strong, Diversified Economy

Switzerland boasts a robust economy with world-leading industries in pharmaceuticals, financial services, precision engineering, and more. This diversification reduces dependence on any single sector or trading partner, supporting the franc's resilience.

3. Low Inflation and Conservative Monetary Policy

The Swiss National Bank (SNB) is known for its conservative approach, prioritising low inflation and stable interest rates. This has helped preserve the franc's purchasing power and investor confidence over the decades.

4. A Highly Developed Financial Sector

Swiss banks are renowned for their reliability, strict regulation, and high capital requirements. Even after shocks like the Credit Suisse bankruptcy in 2023, Switzerland's financial sector stabilised quickly, reinforcing trust in the CHF.

5. Safe-Haven Status

During times of global economic or geopolitical uncertainty, investors flock to the CHF for its perceived safety. The franc's value often rises when risk appetite falls, making it a core component of many institutional portfolios.

Past Performance: A Record of Resilience

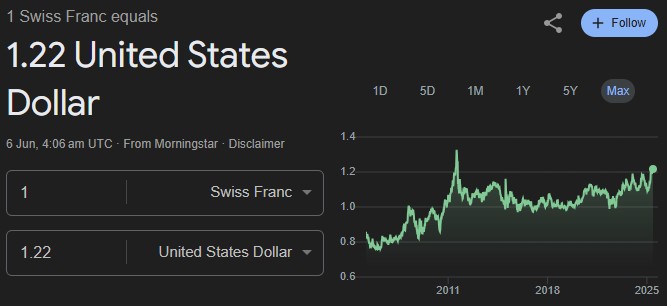

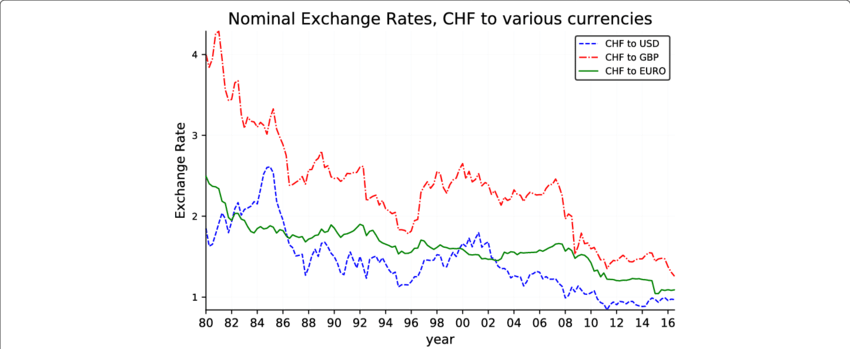

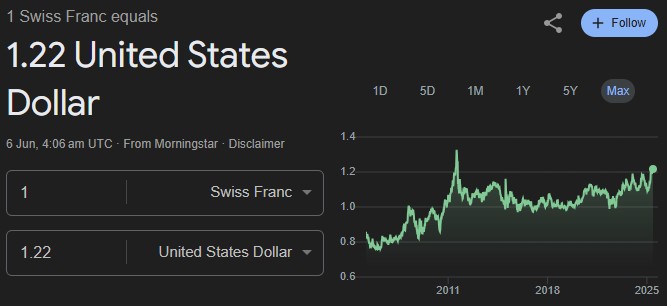

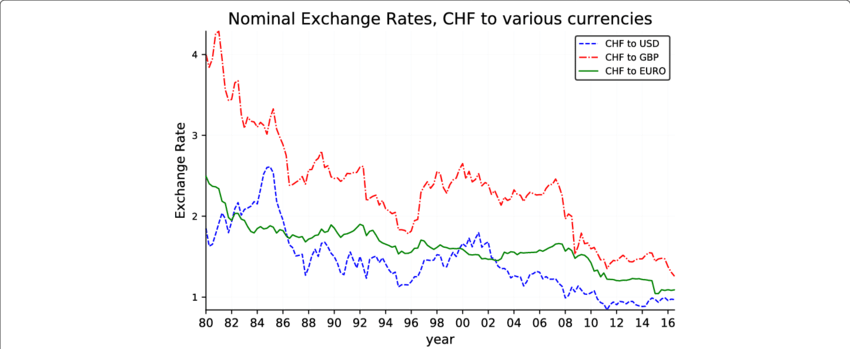

Historically, the CHF has withstood numerous global crises. For example, during the 2008 financial crisis and the European debt crisis, the franc appreciated sharply as investors sought safety.

Even in 2025, the CHF remains strong, trading near 0.84 per US dollar, withstanding pressures from global trade uncertainty and central bank policy shifts. The SNB's readiness to act—whether by cutting rates or intervening in currency markets—has kept the franc stable even amid volatility.

Tips for Trading the Swiss Franc (CHF)

For traders, the CHF offers both opportunity and challenge. Here are essential tips for navigating the Swiss franc in the forex market:

1. Monitor Economic and Geopolitical Events

CHF is sensitive to global risk sentiment. Watch for major economic releases, SNB policy meetings, and geopolitical developments, as these can drive sharp moves in CHF pairs.

2. Use Technical and Fundamental Analysis

Combine technical tools (like moving averages, RSI, and support/resistance levels) with fundamental analysis (such as GDP, inflation, and SNB decisions) to identify trading opportunities.

3. Manage Risk Carefully

CHF pairs can be less volatile than others, but sudden safe-haven flows can cause rapid appreciation. Use stop-loss and take-profit orders, and keep position sizes appropriate to your risk tolerance.

4. Stay Informed on SNB Policy

The SNB occasionally intervenes to prevent excessive CHF strength. Track SNB statements and be ready to adjust your strategy if intervention is hinted or announced.

5. Practise Emotional Discipline

As with all forex trading, avoid emotional decisions. Stick to your Trading plan, review your trades, and use demo accounts to refine your approach before risking real capital.

Conclusion

The Swiss franc (CHF) stands out as one of the world's most stable and trusted currencies, thanks to Switzerland's political neutrality, strong economy, prudent central banking, and world-class financial sector.

Whether you're an investor seeking safety or a trader looking for opportunity, understanding the history and unique qualities of CHF is essential for success in today's global markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.