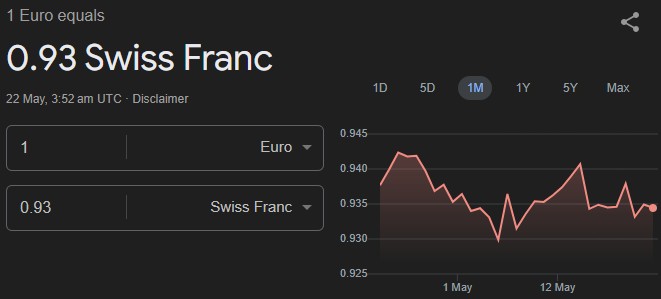

The euro to Swiss franc (EUR/CHF) currency pair is a favourite among active forex traders for its liquidity, stability, and unique relationship with other major pairs. Yet, many overlook one of the most powerful tools for trading this cross: correlation analysis.

Understanding how EUR/CHF moves in relation to other currency pairs—especially EUR/USD and USD/CHF—can help traders confirm setups, spot divergences, and manage risk more effectively.

Why Correlation Matters in EUR/CHF Trading

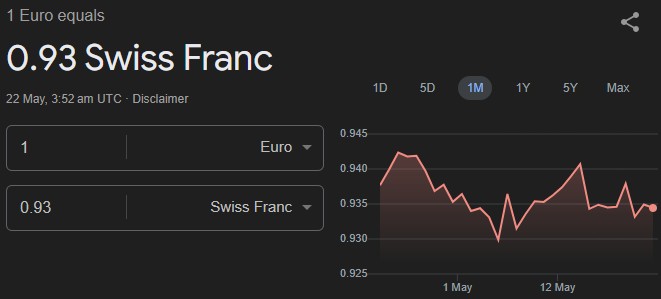

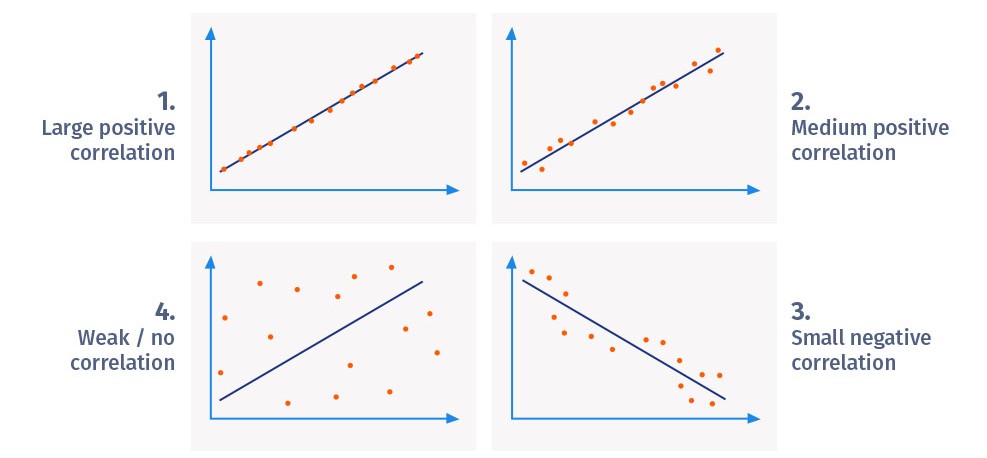

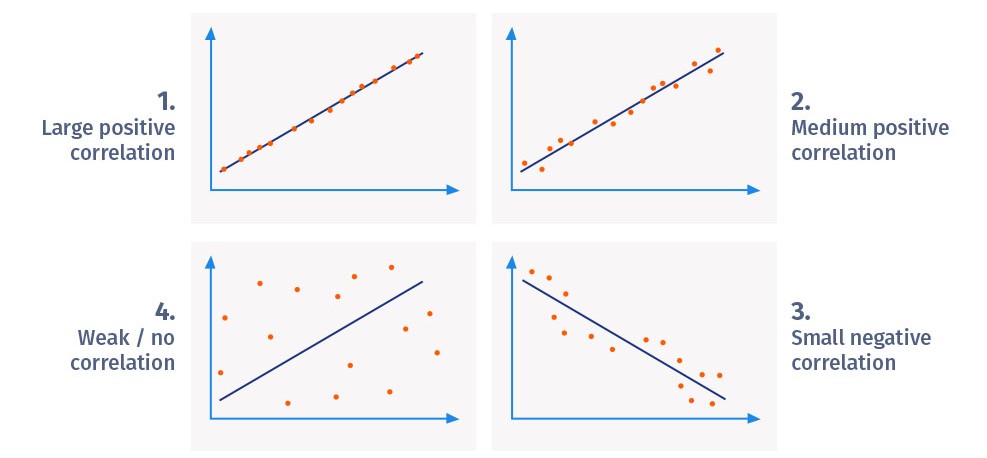

Currency correlation measures how two currency pairs move in relation to each other. In forex, correlations are expressed as coefficients between -1 and +1. A correlation close to +1 means the pairs move together, while -1 indicates they move in opposite directions. A correlation near zero means the pairs are largely independent.

The EUR/CHF pair is particularly interesting because it is closely tied to both EUR/USD and USD/CHF. In fact, EUR/USD and USD/CHF typically show a strong negative correlation, often between -0.85 and -1.0. This means when EUR/USD rises, USD/CHF tends to fall, and vice versa—a relationship driven by the US dollar's central role in both pairs.

The Triangular Relationship: EUR/CHF, EUR/USD, and USD/CHF

The EUR/CHF pair's behaviour is heavily influenced by the interplay between EUR/USD and USD/CHF. The correlation between these two is so strong that traders often use their movements to anticipate EUR/CHF trends.

When EUR/USD rises and USD/CHF falls: This typically signals euro strength and Swiss franc weakness, supporting a bullish EUR/CHF move.

When EUR/USD falls and USD/CHF rises: This often points to euro weakness and Swiss franc strength, putting downward pressure on EUR/CHF.

This triangular relationship is underpinned by the close economic and political ties between the eurozone and Switzerland, as well as the safe-haven status of the Swiss franc.

How to Use Correlation in Your Trading Strategy

1. Confirming Trade Setups

Use correlation to confirm signals. For example, if your technical analysis suggests a EUR/CHF breakout, check if EUR/USD and USD/CHF are moving in the expected directions. If EUR/USD is rallying and USD/CHF is dropping, this adds confidence to a long EUR/CHF trade.

2. Spotting Divergences

Sometimes, EUR/USD and USD/CHF will decouple or move out of sync. Such divergences can signal a potential correction or reversal in EUR/CHF. For instance, if EUR/USD is rising but USD/CHF is flat or rising, it may indicate a weakening of the usual correlation and a possible turning point.

3. Managing Risk and Exposure

Correlation helps you avoid overexposing your portfolio to the same risk. If you're long EUR/CHF and also long EUR/USD, you're effectively doubling your euro exposure. By understanding these relationships, you can diversify more effectively and manage your risk.

4. Timing Entries and Exits

Correlation analysis can improve your timing. If EUR/CHF is approaching a key technical level, but EUR/USD and USD/CHF are not confirming the move, it might be wise to wait for further confirmation before entering a trade.

Practical Example: Correlation in Action

Suppose the European Central Bank (ECB) announces a surprise rate hike, boosting the euro. You notice EUR/USD surges while USD/CHF drops sharply. This classic inverse correlation suggests strong euro momentum and Swiss franc weakness, making a bullish EUR/CHF trade more compelling. If, however, USD/CHF does not respond as expected, it may signal caution or a potential reversal ahead.

Tips for Effective Correlation Trading

Monitor correlation coefficients regularly: Correlations can shift over time, especially during periods of economic or political uncertainty.

Combine correlation with technical analysis: Always confirm correlation signals with price action, support/resistance, or candlestick patterns.

Be mindful of news events: Major announcements from the ECB, Swiss National Bank (SNB), or Federal Reserve can disrupt normal correlations.

Diversify your trades: Avoid taking multiple positions that are highly correlated, as this can amplify risk.

Final Thoughts

Incorporating correlation into your EUR/CHF trading strategy can help you make more informed decisions, confirm trade setups, and manage risk more effectively. By understanding how EUR/CHF interacts with EUR/USD and USD/CHF, you can anticipate market moves and avoid common pitfalls.

Stay alert to shifts in correlation, use it alongside your technical and fundamental analysis, and you'll be better equipped to trade the euro to Swiss franc pair with confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.